S&P 500 and Nasdaq test resistance

By Colin Twiggs

January 17th, 2012 2:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

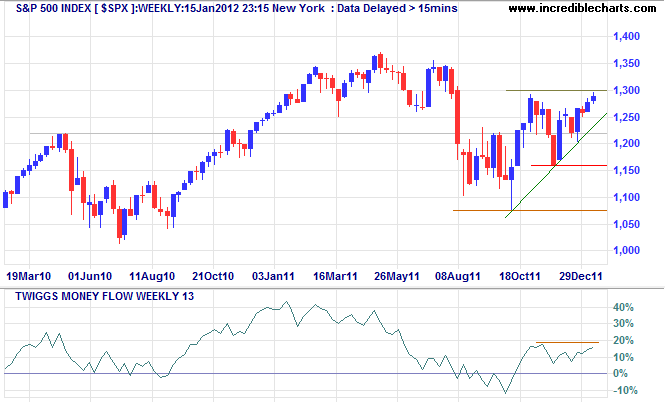

The S&P 500 index is testing resistance at 1300. Breakout would signal a primary up-trend with a target of 1450* for the initial advance. Mild bearish divergence on 13-week Twiggs Money Flow warns of selling pressure, however, and reversal below the rising trendline would indicate another test of primary support at 1160.

* Target calculations: 1300 + ( 1300 - 1150 ) = 1450

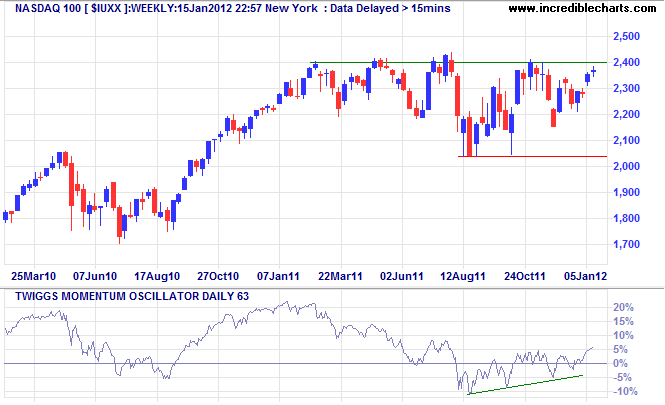

The Nasdaq 100 is also testing resistance, at 2400. Rising 63-day Twiggs Momentum and 13-week Twiggs Money Flow both suggest an upward breakout, which would offer a target of 2800* for the initial advance.

* Target calculations: 2400 + ( 2400 - 2000 ) = 2800

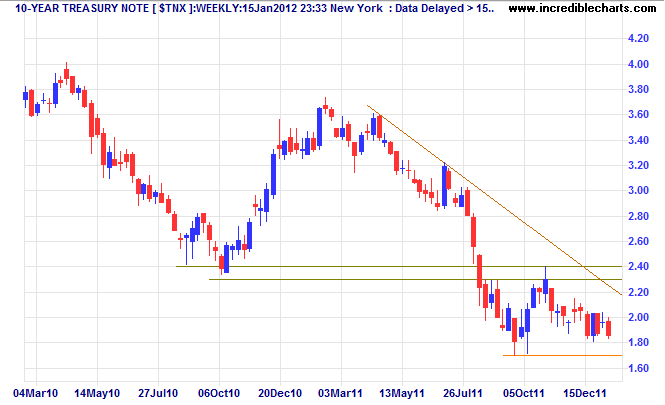

Treasury yields are falling, indicating a flight to safety. Uncertainty in Europe and China is likely to hurt the market and we should only accept bull signals if they have strong confirmation.

Ninety-eight percent of the adults in this country are decent, hard-working, honest Americans. It's the other lousy two percent that get all the publicity. But then — we elected them.

~ Lily Tomlin

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.