Shanghai breaks primary support

By Colin Twiggs

December 12th, 2011 4:00 a.m. ET (8:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

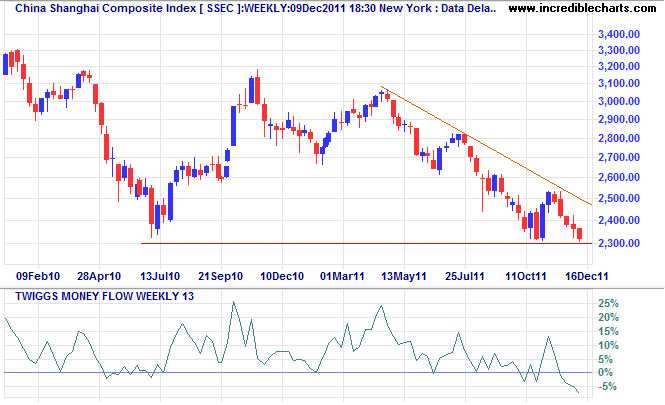

The Shanghai Composite index broke primary support at 2300 Monday, signaling a decline to 2100*. Follow-through on Tuesday would strengthen the signal. The sharp fall on 13-week Twiggs Money Flow warns of strong selling pressure.

* Target calculation: 2300 - ( 2500 - 2300 ) = 2100

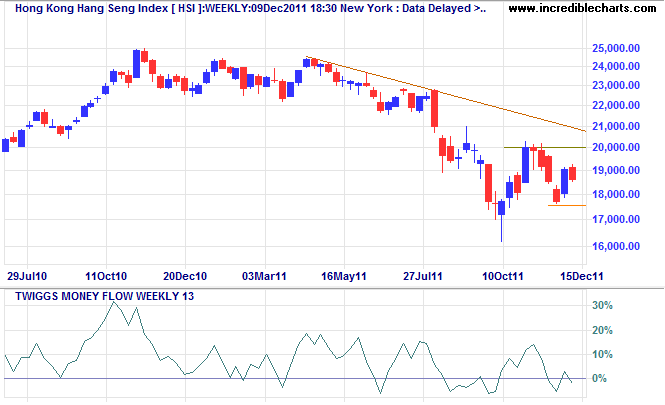

Hong Kong's Hang Seng Index held above 18500 Monday, but another test of medium-term support at 17500 is likely.

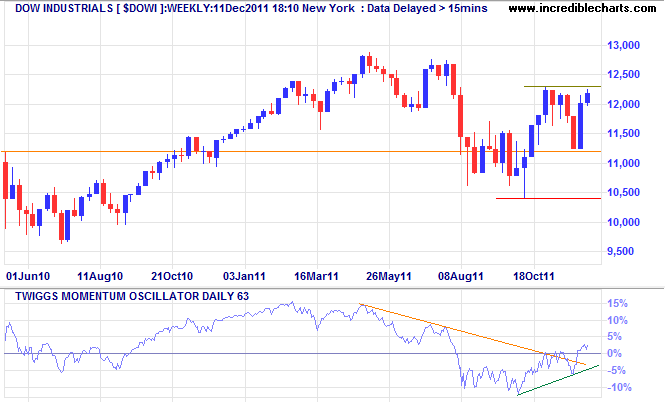

Dow, Nasdaq diverge

Dow Jones Industrial Average is testing resistance at 12300. Breakout would signal a primary advance to 13400 and an end to the bear market. Rising 63-day Twiggs Momentum is encouraging but will only be significant if retracement respects the zero line.

* Target calculation: 12300 + ( 12300 - 11200 ) = 13400

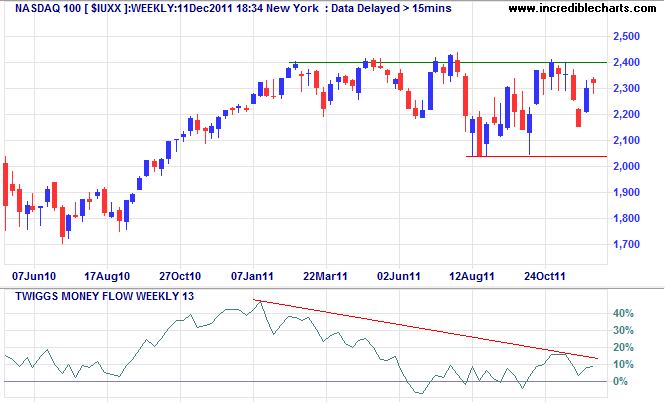

The Nasdaq 100, however, displays a large bearish divergence on 13-week Twiggs Money Flow, warning of selling pressure. Reversal below 2040 would confirm a primary down-trend. Breakout above 2400 is less likely, but would suggest an advance to 2800*.

* Target calculation: 2400 + ( 2400 - 2000 ) = 2800

Never confuse movement with action.

~ Ernest Hemingway

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.