Nasdaq fails to dispel fears of a bear market

By Colin Twiggs

November 14th, 2011 7:00 a.m. ET (10:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

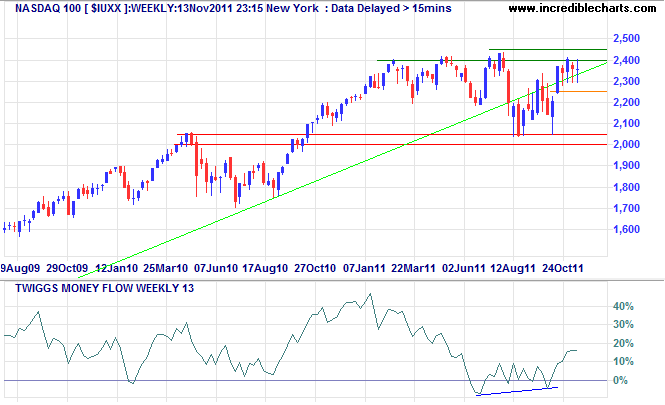

The Nasdaq 100 is consolidating in a narrow band below resistance at 2400 on the weekly chart, suggesting an upward breakout. Follow-through above 2450 would confirm the target of 2800*. 13-Week Twiggs Money Flow continues to signal buying pressure after an earlier bullish divergence.

* Target calculation: 2400 + ( 2400 - 2000 ) = 2800

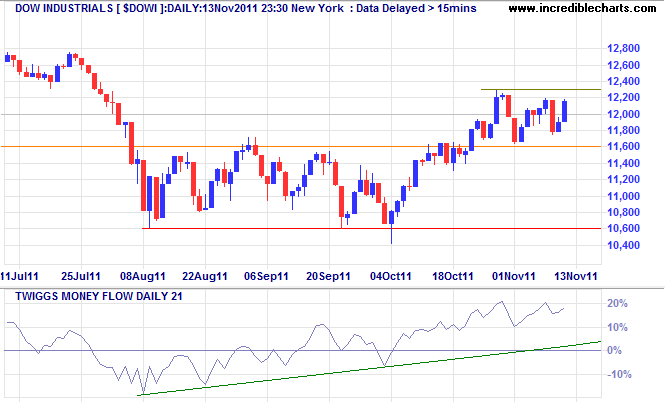

The Dow Industrial Average is consolidating below 12300. Rising 21-day Twiggs Money Flow indicates medium-term buying pressure. Breakout above 12300 would offer a target of 12800*. Failure of support at 11600 is less likely, but would mean another test of primary support at 10600.

* Target calculation: 12200 + ( 12200 - 11600 ) = 12800

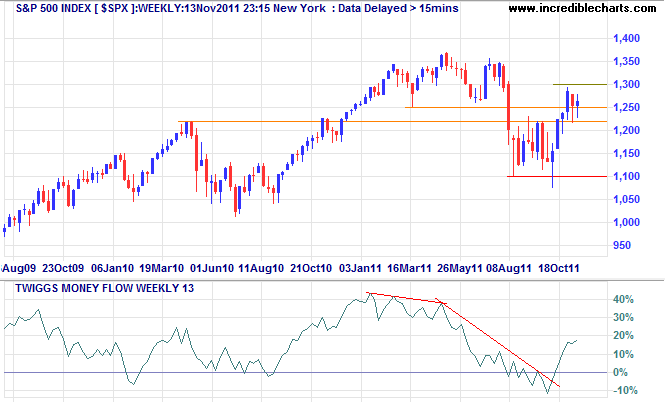

The S&P 500 is similarly consolidating between 1220 and 1300. Expect strong resistance at 1350.

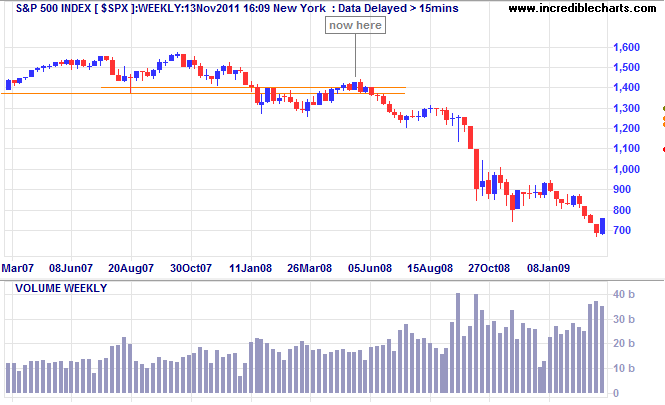

Comparing to early 2008, the S&P500 displays a similar pattern, with the index testing resistance at 1400. We are close to a watershed: reversal below medium-term support (1220) would be a strong bear signal, while follow-through above recent highs would dispel fears of another bear market.

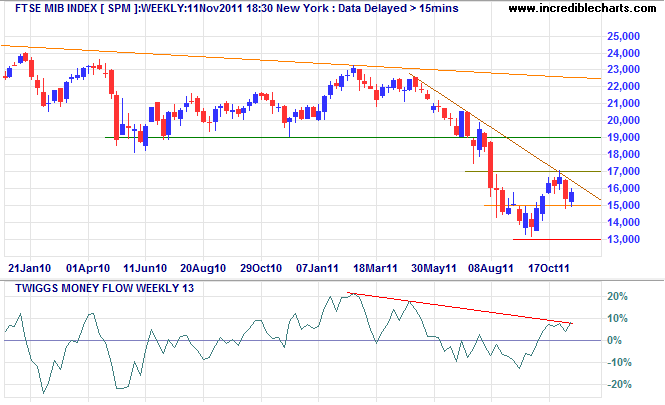

Europe consolidates

The FTSE Italian MIB index found support at 15000. Expect an upsurge in response to news that Mario Monti has been asked to form a new government. Breakout above 17000 would signal a rally to 19000. Rising 13-week Twiggs Money Flow indicates consistent buying pressure over the past few weeks.

* Target calculation: 17 + ( 17 - 15 ) = 19

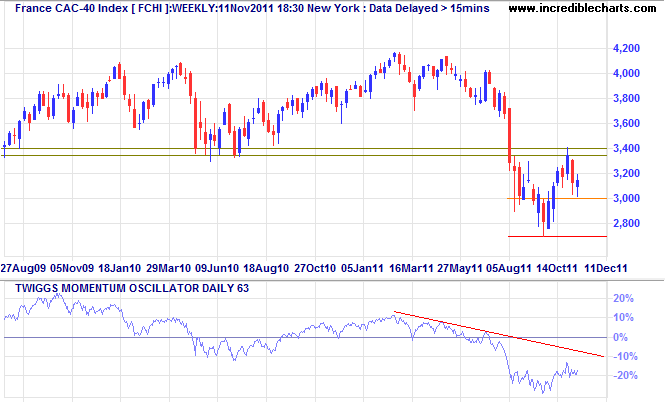

France�s CAC-40 index similarly found support at 3000. Recovery above 3400 would offer a target of 3800, but 63-day Twiggs Momentum, a long way below zero, indicates a primary down-trend.

* Target calculation: 2800 - ( 3400 - 2800 ) = 2200 AND 3400 + ( 3400 - 3000 ) = 3800

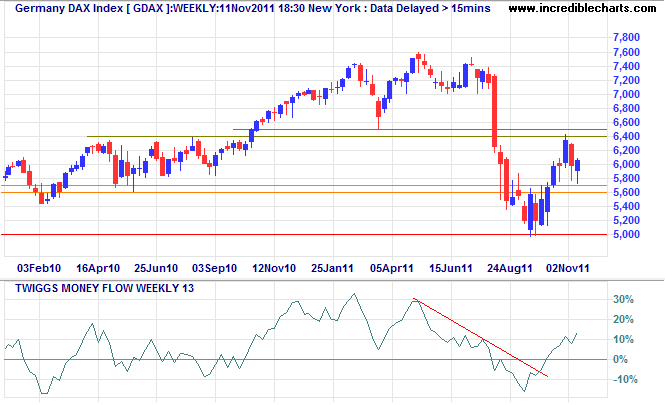

The German DAX found support at 5700. Recovery above 6400 would offer a target of 7100, while failure of support would warn of another test of primary support at 5000.

* Target calculation: 6400 + ( 6400 - 5700 ) = 7100

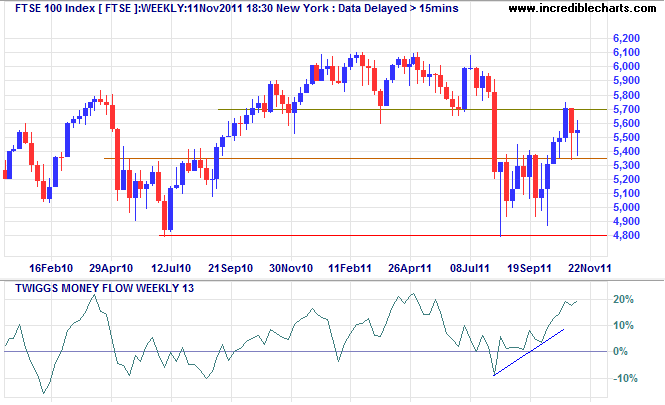

The FTSE 100 is also consolidating above medium-term support — this time at 5350. 13-Week Twiggs Money Flow continues to signal strong buying pressure. Breakout above 5700 would re-test the 2011 highs at 6100. Failure of support is unlikely, but would warn of another test of primary support at 4800.

* Target calculation: 5700 + ( 5700 - 5300 ) = 6100

We need to remember, however, that this is still a bear market. We have seen one or two favorable news headlines but very little substance. And the European economy faces strong headwinds over the next few years.

Courage doesn't always roar. Sometimes courage is the quiet voice at the end of the day saying, "I will try again tomorrow."

~ Mary Anne Radmacher.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.