Dow not yet out of the woods

By Colin Twiggs

October 25th, 2011 7:00 a.m. ET (10:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

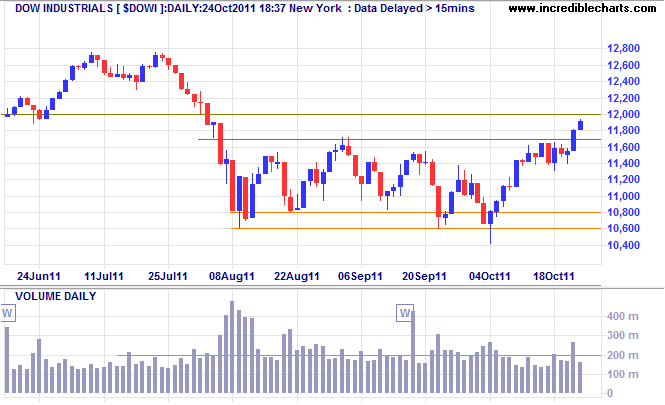

Dow Jones Industrial Average followed through on its breakout above the 10600-11700 trading range but expect some resistance at 12000. The index looks set for a decent rally after narrow consolidation below resistance at 11700. Target for the breakout is 12600*.

* Target calculation: 11600 + ( 11600 - 10600 ) = 12600

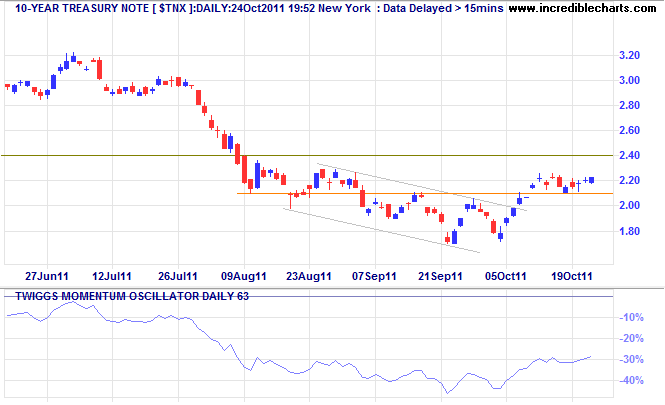

Yields on 10-year Treasury notes also rallied as funds flowed back into stocks, but we are not yet out of the woods.

There is bound to be a relief rally when EU leaders announce details of their rescue package — followed by a pull-back when traders figure out the costs involved. The danger is that Germany and France do an "Ireland" and rescue the banks but put themselves at risk. Both have public debt to GDP ratios close to 80 percent and it would not take much to push them into the danger zone. If they are down-graded then the kids are home alone — there will be no adults left in the room. A down-grade would raise their cost of funding and place their own budgets under pressure.

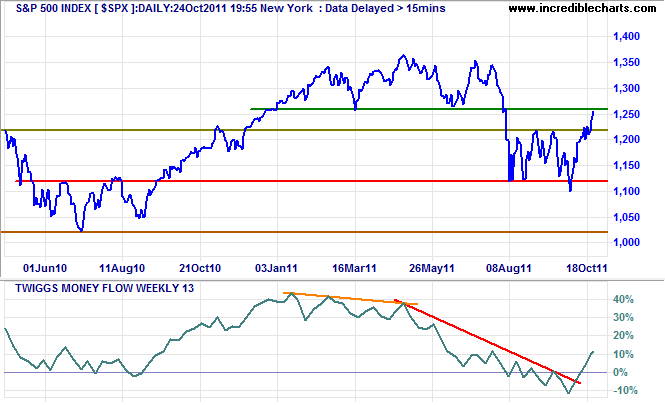

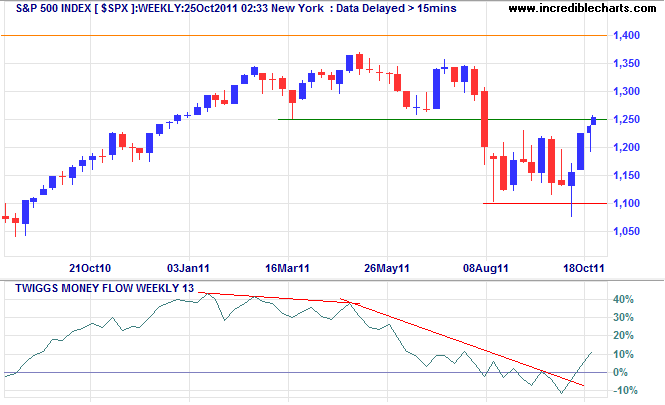

The S&P 500 is also testing resistance at 1260; breakout would confirm a Dow signal. 13-Week Twiggs Money Flow is rising but no bullish divergence means this could be secondary (medium-term) buying pressure.

* Target calculation: 1120 + ( 1220 - 1120 ) = 1320

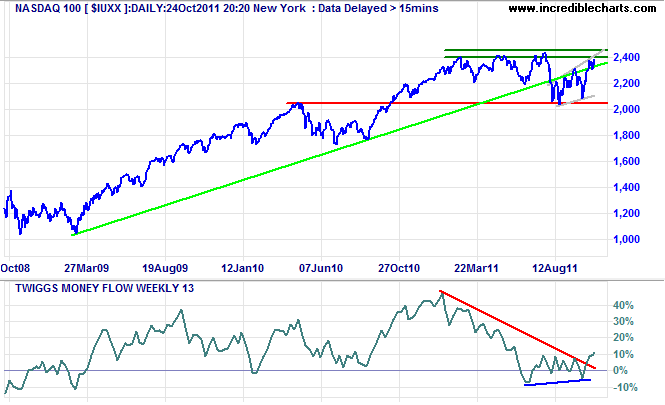

Nasdaq 100 index displays an ascending broadening wedge as it approaches resistance at 2400. The ascending wedge is a bearish pattern: Bulkowski maintains that it breaks out downward 73% of the time. Target would be the base of the pattern at 2000. Bullish divergence on 13-Week Twiggs Money Flow, however, indicates strong buying pressure. Breakout above 2450 would signal a primary advance to 2600*.

* Target calculation: 2400 + ( 2400 - 2200 ) = 2600

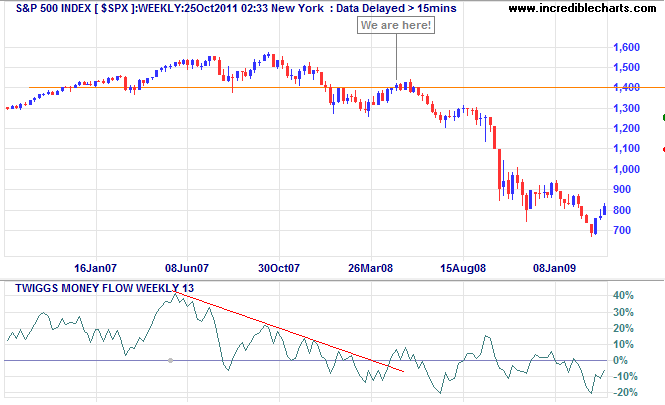

2008 Deja Vu

Early May 2008, the S&P 500 index recovered above resistance at the former primary support level of 1400 on its second attempt. 13-Week Twiggs Money Flow broke back above zero, indicating secondary buying pressure. Breakout was followed by two pull-backs in May. The first made a false break below the new support level; the second followed through, commencing a 50% decline to 700.

We are now at a similar watershed. Expect retracement in the week ahead to test the new support level at 1250. Respect of support would strengthen the signal, but beware of any penetration. Follow-through above 1300 would signal that the (immediate) danger is over. Until then, consider this a bear market.

* Target calculation: 1250 + ( 1250 - 1100 ) = 1400

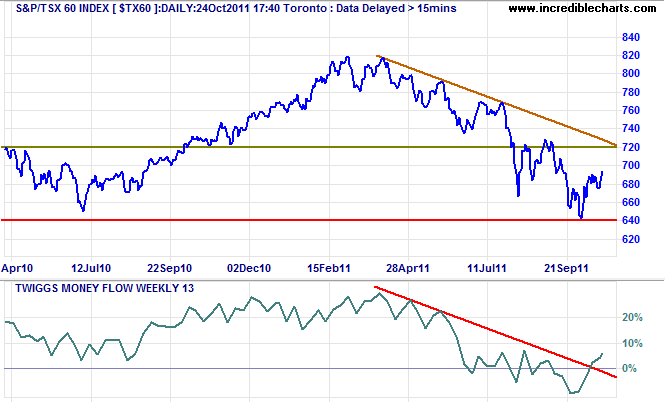

Canada TSX 60

The TSX 60 index also shows a small bullish divergence on 13-week Twiggs Money Flow, suggesting secondary buying pressure. Expect a rally to the descending trendline at 720. Respect would signal another test of primary support at 640. Breakout remains unlikely, but would offer a target of 800*.

* Target calculation: 720 + ( 720 - 640 ) = 800

Apologies. I have run out of time and will cover Asia-Pacific in the morning.

The public, with their eyes fixed on the stock market, saw little — that week. The wise stock operators saw much — that year. That was the difference.

~ Jesse Livermore in Reminiscences of a Stock Operator by Edwin Lefevre.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.