Too-big-to-fail is here to stay

By Colin Twiggs

October 13th, 2011 3:00 a.m. ET (6:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Lehman Brothers' collapse in 2008 was intended to intended to teach financial markets that they could not rely on an implicit government guarantee for too-big-to-fail (TBTF) banks. What bondholders learned was the opposite: never again would an institution of that size be allowed to collapse because of the de-stabilizing effect on the entire financial system.

Rescue of Dexia by French, Belgium and Luxembourg governments is the latest example. Bond-holders received 100 cents in the dollar/euro. Markets are just too fragile to consider giving bondholders a haircut. Denmark earlier had to back down from forcing haircuts on bondholders when Danish banks found themselves shut out of funding markets. [WSJ]

Frequent calls for TBTF institutions to be broken up have proved ineffective. Instead the problem has grown even larger with post 2008 rescue/take-overs of Countrywide and Merrill Lynch (BofA), Bear Stearns and WaMu (JPM), Lehman (Barclays), and Wachovia (Wells Fargo) reinforcing Willem Buiters' survival of the fattest observation.

Proposals to reduce systemic risk through adoption of the Volcker Rule, which would prevent banks form trading for their own account, are proving difficult to implement. The 298-page first draft offers few clear definitions of restricted activities, instead calling for suggestions or feedback.[Bloomberg] Drafters should consider turning the rule around, offering a list of approved activities that banks can pursue, rather than attempting to define what they cannot. I have great respect for banks' ability to find loopholes in any restrictive list.

The Rule on its own, however, cannot protect taxpayers from future bailouts. It does not prevent banks from over-lending if there is another bubble. There is only one solution: increase capital ratios — and apply similar ratios to securitized assets. Increases would have to be gradual, as some banks could respond by shrinking assets rather than raising capital — which would have a deflationary effect on the economy. Changes would also have to be sensitive to the economic cycle. The easiest way may be to set a long-term target (e.g. 20% Tier 1 + 2 capital by 2030) and leave implementation to the central bank as part of its monetary policy.

Together with the Volcker Rule, increased capital ratios are our best defense against a recurrence of the GFC.

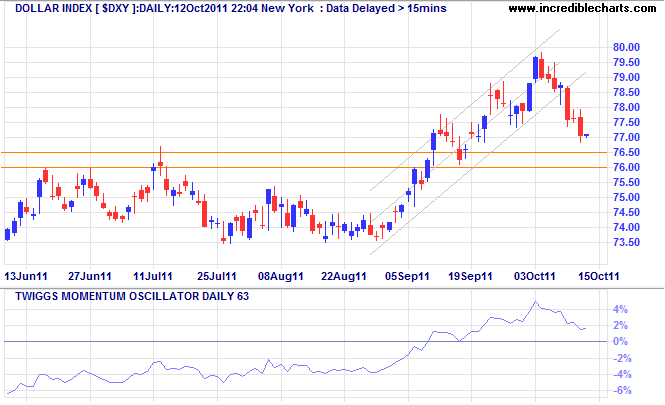

Dollar retreats, gold rises

The US Dollar Index is retracing to test support at 76.00. Respect of support would confirm the primary up-trend and offer a target of 84.00* for the next advance. A 63-day Twiggs Momentum trough above zero would strengthen the signal.

* Target calculation: 80 + ( 80 - 76 ) = 84

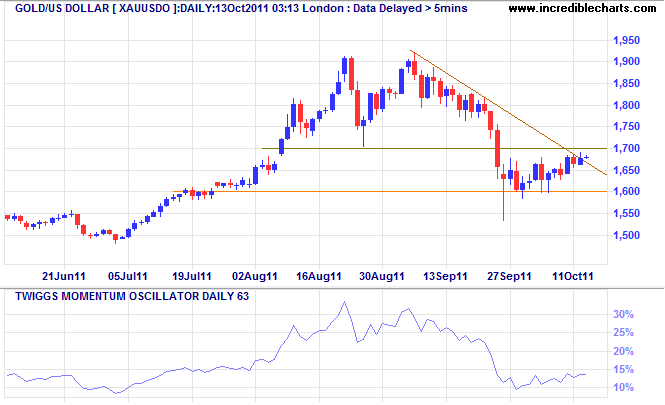

Spot gold is testing the declining trendline and resistance at $1700/ounce. Respect would warn of a decline to test $1500*. The primary trend remains upward and will resume if the Fed introduces further quantitative easing in the months ahead.

* Target calculation: 1700 - ( 1900 - 1700 ) = 1500

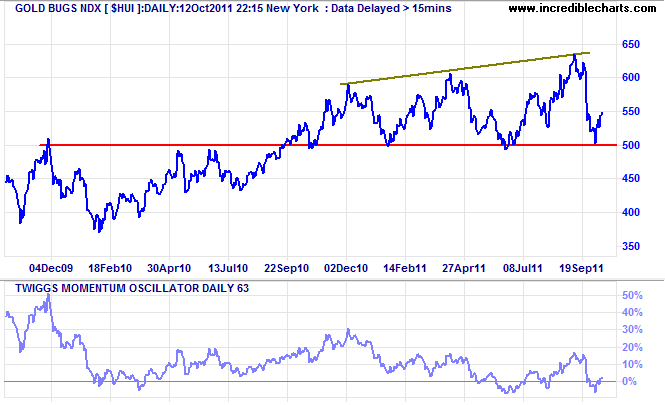

Amex Gold Bugs Index continues in a broadening wedge formation. Downward breakouts occur 66% of the time, according to Thomas Bulkowski. Failure of support at 500 would offer a target of 370*.

Crude and commodities rally

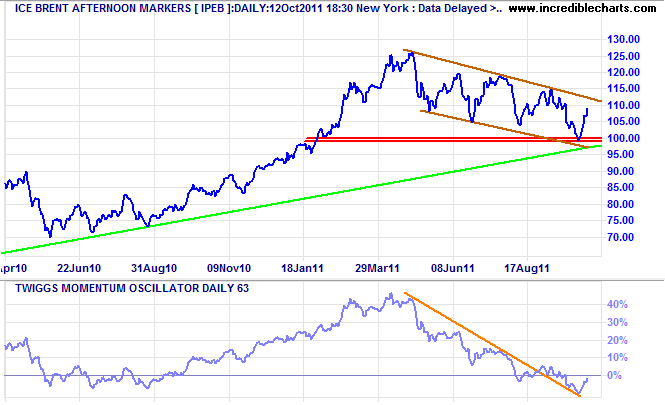

Brent Crude rallied off support at $99/$100 per barrel, headed for a test of the upper trend channel. 63-Day Twiggs Momentum above its descending trendline warns that the down-trend is weakening. Breakout above the upper channel would test the 2011 high of $125/barrel.

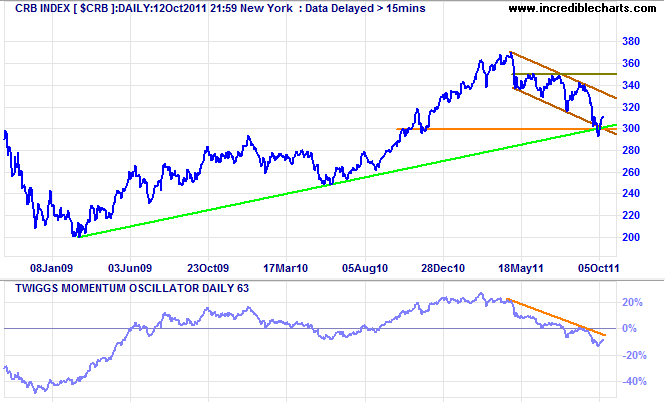

CRB Commodities Index similarly rallied off support at 300. 63-Day Twiggs Momentum is still declining and failure to reach the upper trend channel (on the price chart) would warn of an accelerating down-trend.

The one game of all games that really requires study before making a play is the one he (the average investor) goes into without his usual highly intelligent preliminary and precautionary doubts. He will risk half his fortune in the stock market with less reflection than he devotes to the selection of a medium-priced automobile.

~ Jesse Livermore in Reminiscences of a Stock Operator by Edwin Lefevre.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.