ASX 200 rally — but it's still a bear market

By Colin Twiggs

October 6th, 2011 3:00 a.m. ET (6:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

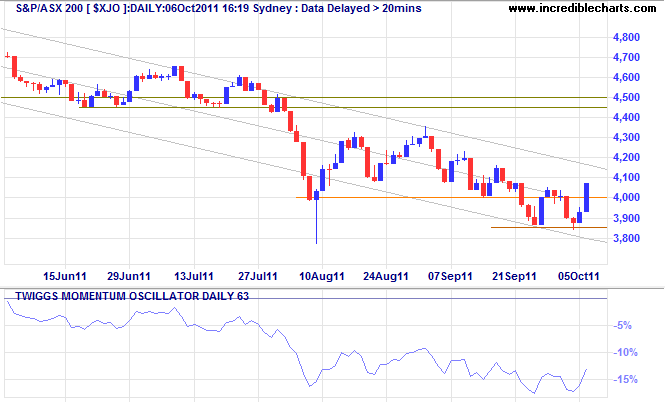

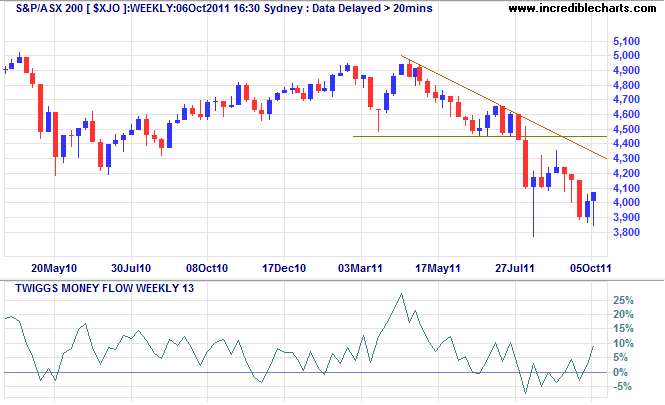

Australia's ASX 200 index rallied strongly Thursday and is headed for a test of the upper trend channel. 63-day Momentum declining below zero reminds that we are in a strong primary down-trend. Respect of the upper channel would warn of another decline — to test the lower channel border.

* Target calculation: 4000 - ( 4500 - 4000 ) = 3500

We are experiencing exceptional volatility at present and risk of false signals is high. It is important in such situations to look for strong confirmation. One step is to wait for signals on the weekly chart to confirm those on the daily chart. As you can see, this bear market is a long way from over.

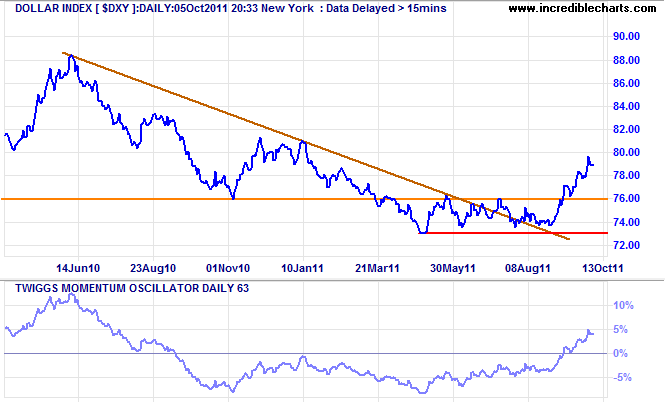

Dollar Index reaches target

The strong advance on the US Dollar Index continues. Now that the index has reached its current target of 79, expect retracement to test the new support level at 76. Respect of support would confirm the primary up-trend and offer a target of 84* for the next advance. A trough above zero on 63-day Momentum would strengthen the signal.

* Target calculation: 80 + ( 80 - 76 ) = 84

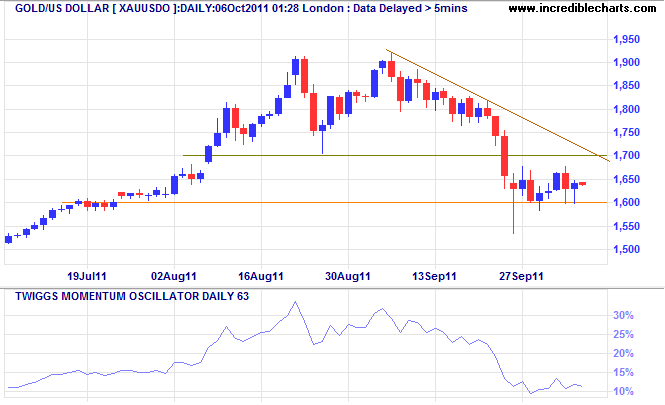

Spot gold correction tests $1600

Spot gold is testing support at $1600/ounce, but the primary trend remains upward. Expect a rally to the declining trendline. Breakout above $1700 would indicate the correction is weakening, while failure of support would test $1500*.

* Target calculation: 1700 - ( 1900 - 1700 ) = 1500

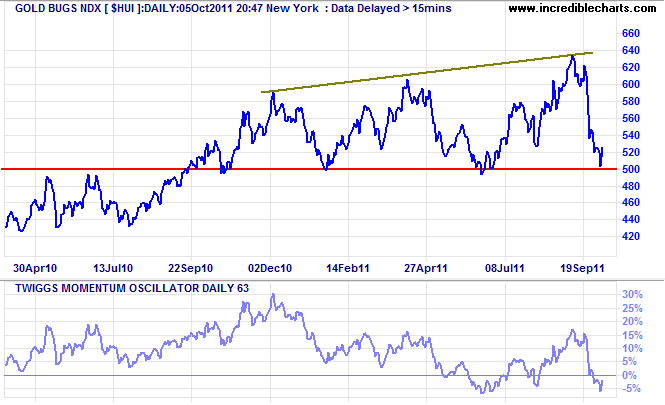

Amex Gold Bugs Index, representing un-hedged gold stocks, is testing primary support at 500. Failure of support would warn of a reversal in the primary trend and would be a bearish sign for spot metal prices.

You know a professional gambler is not looking for long shots, but for sure money.

~ Jesse Livermore in Reminiscences of a Stock Operator by Edwin Lefevre.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.