Reminder: we're in a bear market

By Colin Twiggs

September 1st, 2011 5:00 a.m. ET (7:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

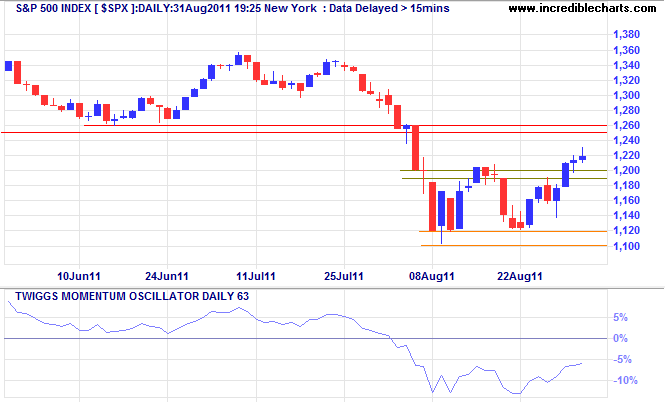

Don't be fooled by month-end froth in the markets into thinking that the bear market is over or that the early August plunge was a false signal. The S&P 500 Index has made little headway since completing a double bottom at 1200 despite normal volumes, indicating the absence of strong selling. 63-Day Momentum peaking below the zero line indicates a primary down-trend. Expect the bear rally to test resistance at 1250/1260 before a retreat to 1100. Breach of 1100 would find support at the 2010 low of 1000, but the calculated target is even lower*.

* Target calculation: 1100 - ( 1250 - 1100 ) = 950

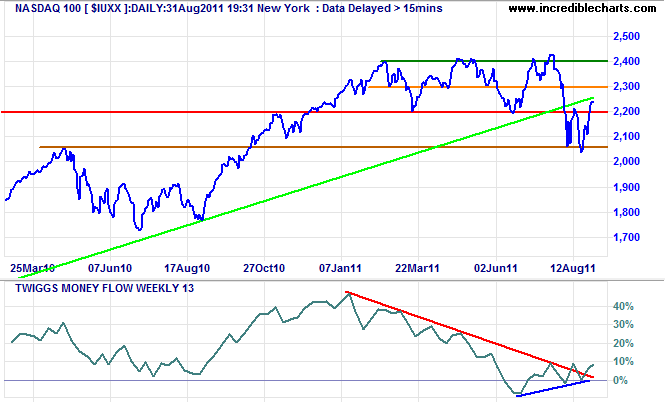

The Nasdaq 100 performed better, clearing 2200 to complete a double bottom with a target of 2350*. Bullish divergence on 13-week Twiggs Money Flow indicates buying pressure. But this is a bear rally in the middle of a bear market, and further falls on the Dow/S&P 500 would drag the Nasdaq lower.

* Target calculation: 2200 + ( 2200 - 2050 ) = 2350

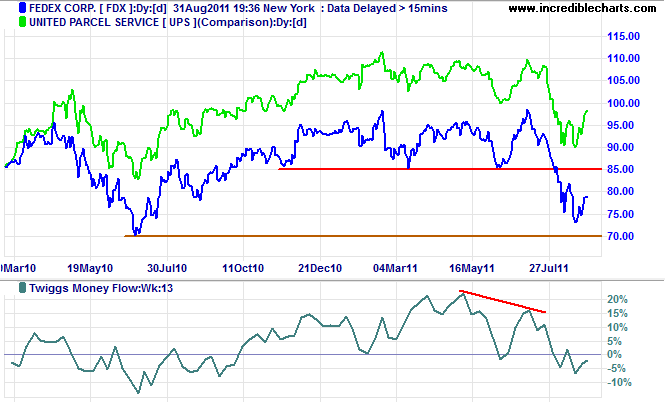

Fedex and UPS remain in a primary down-trend, indicating that economic activity levels remain poor.

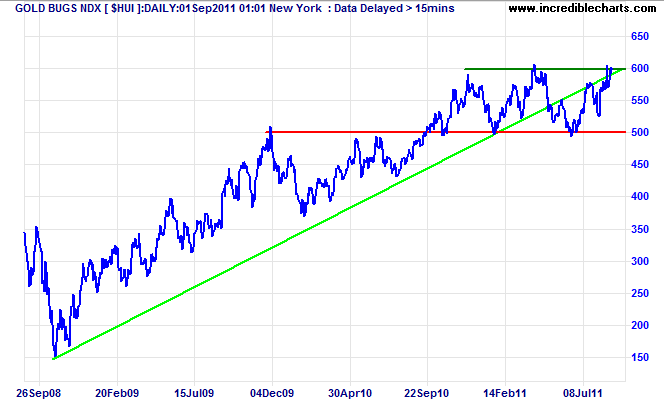

Gold miners threaten breakout

The Gold Bugs Index, representing unhedged gold miners, threatens to break through resistance at 600 which would signal an advance to 700*. Upward breakout would negate the earlier bear signal from penetration of the rising trendline — as well as strengthening prospects of a further advance in the spot price.

* Target calculation: 600 + ( 600 - 500 ) = 700

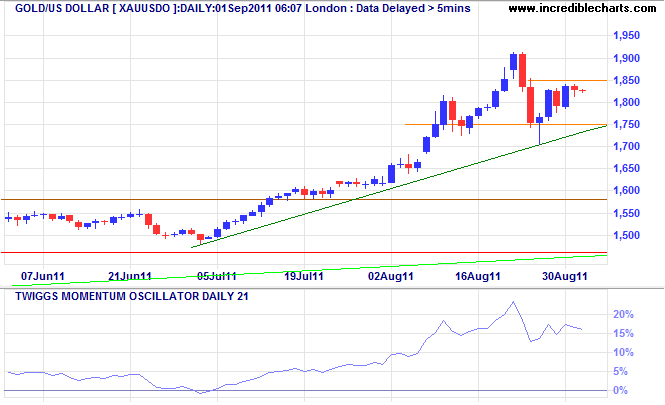

Spot gold has so far respected the secondary trendline and support at $1750. Short retracement from resistance at $1850 would be a bullish sign, suggesting an upward breakout. Recovery above $1900 would test $2000, though the calculated target is even higher*.

* Target calculation: 600 + ( 600 - 500 ) = 700

Upside potential for gold remains strong. Treasury and the Fed are running out of options to revive the economy and further quantitative easing grows ever more inviting despite the inflationary outcome. With presidential elections looming in 2012, the White House will also be doing their best to influence the Fed decision.

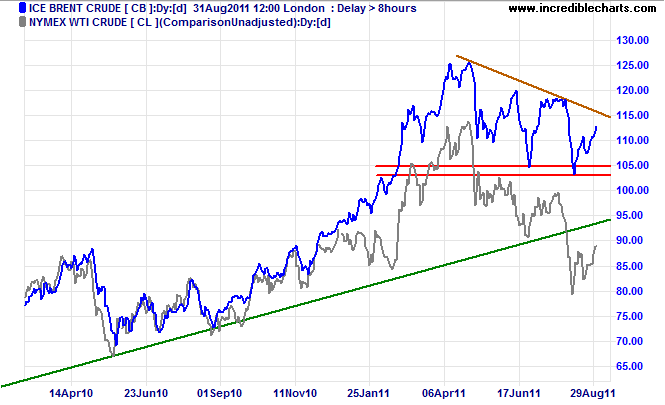

Crude oil divergence continues

The spread between Brent Crude and Nymex WTI Light Crude remains at $24/barrel. Brent is rallying to test the declining trendline, but retreat to medium-term support at $105 is likely. Resolution of the conflict in Libya should take some of the supply pressure off European refineries, easing Brent prices.

We then have to wait and see what Chairman Ben pulls out of his hat at the September 21st FOMC meeting. Further quantitative easing would cause an upward spike in commodity prices, including crude.

* Target calculation: 105 - ( 120 - 105 ) = 90

Forex Updates

Of course, if a man is both wise and lucky, he will not make the same mistake twice. But he will make any one of ten thousand brothers or cousins of the original. The Mistake family is so large that there is always one of them around when you want to see what you can do in the fool-play line.

~ Jesse Livermore in Reminiscences of a Stock Operator by Edwin Lefevre.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.