Will Bernanke pull the trigger?

By Colin Twiggs

August 25th, 2011 4:00 a.m. ET (6:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

New Format

Fresh analysis is posted to the Gold, Stocks & Forex trading blog through the day. Existing Trading Diary summaries will continue, but readers can also elect to receive individual posts — or daily/weekly summaries from the trading blog. Thank you for your support and I hope you enjoy the new format.

Will Bernanke pull the trigger?

Rising stocks and a sharp fall on spot gold reflect uncertainty as to whether Ben Bernanke will announce further quantitative easing by the Fed, at Jackson Hole, Wyo. on Friday. Further purchases of Treasurys by the Fed would lift inflation and send investors scrambling for inflation-hedges like gold and blue-chip stocks. Stocks are rising, but gold is falling. Could it be that promise of an end to the conflict in Libya makes the world a safer place — or that a resulting fall in oil prices would reduce inflationary pressures? Brent crude and the CRB Commodities Index are both rising, however, suggesting that the precious metals blow-off is driven by profit-taking — after the sharp surge over the last few weeks and ahead of an uncertain announcement on Friday.

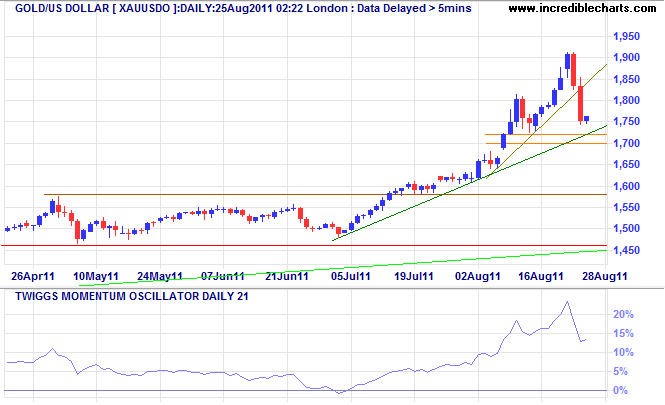

Spot gold is testing its secondary [green] rising trendline at $1700/$1720. Support is likely to hold — especially if there is any hint of QE3 on Friday — but failure would warn of a fall to the long-term trendline around $1500/ounce.

* Target calculation: 1900 + ( 1900 - 1700 ) = 2100

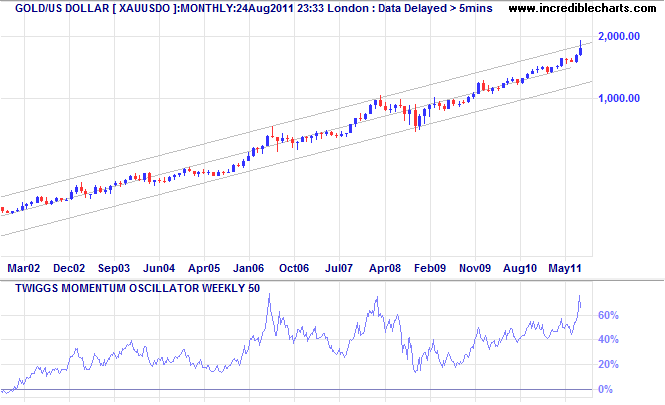

The monthly gold chart shows spot gold testing the upper trend channel of the long-term bull-trend. Correction to the lower channel would result in a substantial fall. A lot depends on what happens Friday.

No Silver lining

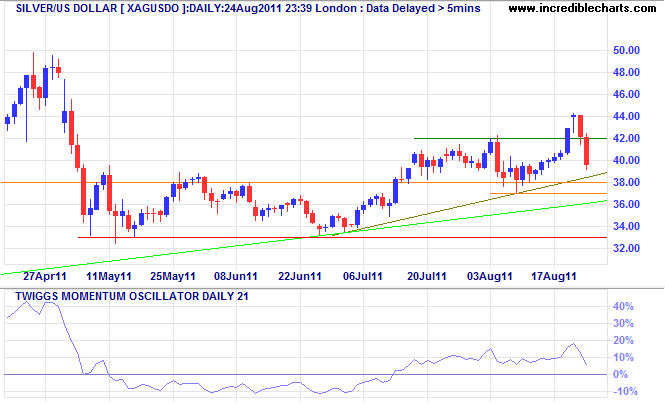

Spot silver followed gold, falling through support at $42/ounce. Respect of support at $37/$38 would indicate that the up-trend is intact; failure is unlikely but would test primary support at $33/ounce.

* Target calculation: 42 + ( 42 - 38 ) = 46

Brent Crude ignores good news

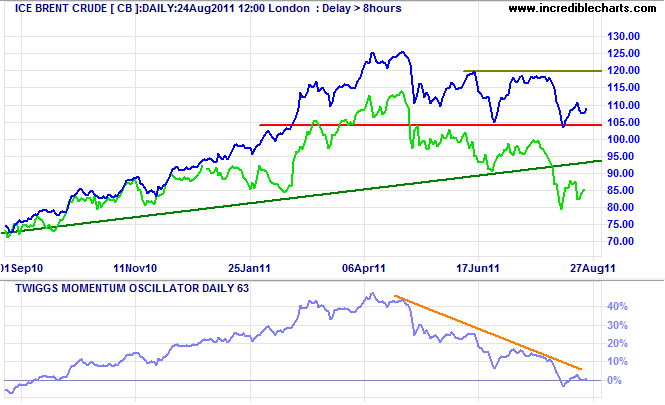

Brent crude is stubbornly holding above support at $104/$105 per barrel despite the promise of an early resolution to the conflict in Libya. Even WTI Light crude [lime] recovered slightly after improved manufacturing orders in the US. But the primary trend is down and failure of support at $104 would offer a target of $90 per barrel.

* Target calculation: 105 - ( 120 - 105 ) = 90

Forex Updates

Click here for the latest forex updates.

There is the plain fool, who does the wrong thing at all times everywhere, but there is also the Wall Street fool, who thinks he must trade all the time. No man can have adequate reasons for buying or selling stocks daily — or sufficient knowledge to make his play an intelligent play.

~ Jesse Livermore in Reminiscences of a Stock Operator by Edwin Lefevre.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.