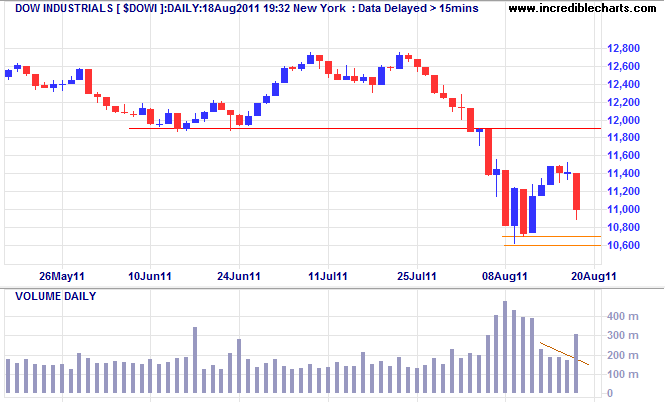

Dow threatens support

By Colin Twiggs

August 18, 2010 9:00 p.m. ET (11:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

The Dow Jones Industrial Average fell sharply on Thursday, accompanied by strong volume. Failure of support at 10700 would complete the dead cat bounce, offering a target of the 2010 low at 9600*.

* Target calculation: 10800 - ( 12000 - 10800 ) = 9600

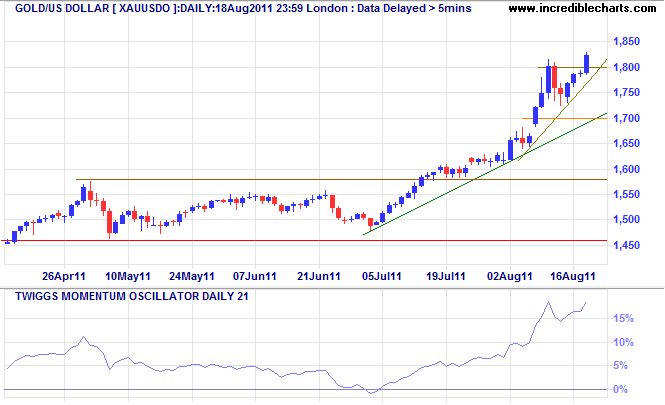

Gold renews drive to $2000/ounce

Spot gold broke through resistance at $1800, signaling an advance to test $2000/ounce in the medium-term. Retracement that respects the new support level would strengthen the signal.

* Target calculation: 1800 + ( 1800 - 1600 ) = 2000

Shrinking debt sounds a warning

Shrinking debt levels warn of a dearth of private capital investment in the UK and Australia — and little job creation as a consequence. Falling household debt in the UK also indicates a weak housing market. But US levels appear to be bottoming.

Forex Updates

Click here for the latest forex updates.

Peace comes from within. Do not seek it without.

~ Buddha

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.