Gold back at $1800

By Colin Twiggs

August 18th, 2011 3:00 a.m. ET (5:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

New Format

Fresh analysis is posted to the Gold, Stocks & Forex trading blog through the day. Posts of no more than a few paragraphs are easier to read and the Comments section on each page will hopefully encourage greater interaction with readers. Existing Trading Diary summaries will continue, but readers can also elect to receive individual posts — or daily/weekly summaries from the trading blog.

Thank you for your support and I hope you enjoy the new format.

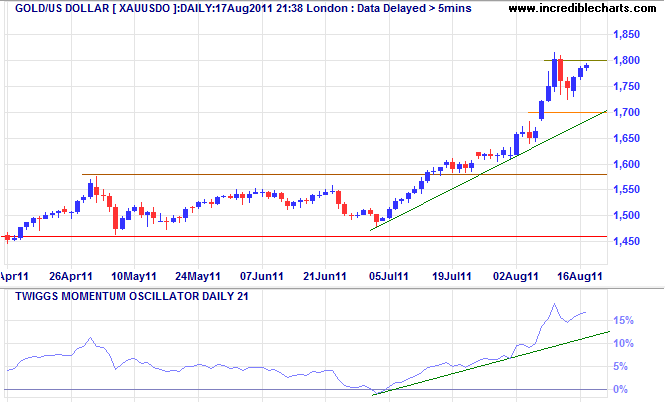

Gold back at $1800/ounce

After a brief but volatile dip, gold is again testing resistance at $1800/ounce. Rising Momentum threatens an exponential up-trend, with rapid gains and short retracements. Breakout would signal an advance to $2000.

* Target calculation: 1800 + ( 1800 - 1600 ) = 2000

Always bear in mind that exponential trends make rapid gains but inevitably lead to a blow-off; and stop losses employed in a normal trend are likely to react too late.

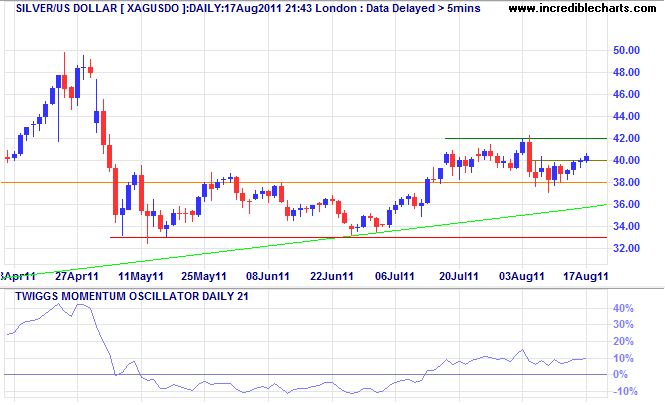

Silver edges higher

Spot silver is headed for another test of $42/ounce after recovering above $40. Breakout above $42 would offer a medium-term target of $46* (long-term $50).

* Target calculation: 42 + ( 42 - 38 ) = 46

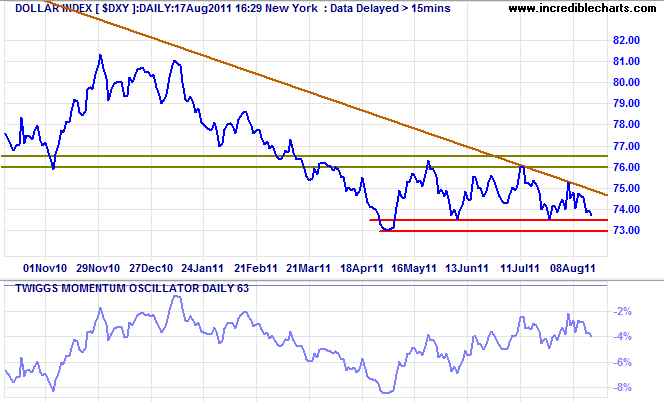

Dollar Index tests support

The Dollar Index has consolidated between 73 and 76.50 for the last 3 months. The recent failed swing, a rally that did not reach 76, indicates weakness and we are now likely to see a test of support at 73. In the long term, with 63-day Twiggs Momentum oscillating below zero, the primary down-trend is likely to continue. Failure of support would offer a target of 70*.

* Target calculation: 73 - ( 76 - 73 ) = 70

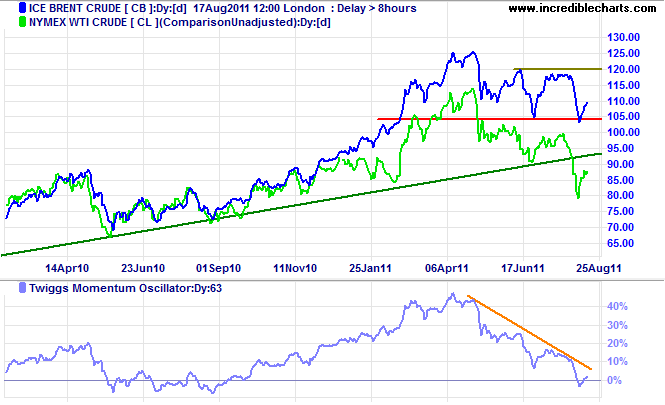

Crude divergence widens

The strength in the Brent reflects the ongoing loss of high quality Libyan crude and fears of its recent replacement Nigerian bonny light�� Royal Dutch Shell declared force majeure on its Nigerian Bonny Light crude oil loadings for June and July. Shell blamed production cutbacks caused by leaks and fires on its Trans-Niger Pipeline.

~ Commodities - Futures Magazine.

The divergence between Brent crude and WTI Light crude has widened to more than $20/barrel. WTI is clearly in a primary down-trend, but there is stubborn support for Brent at $104/105 per barrel. Resolution of the conflict in Libya and/or Nigerian supply fears would see Brent prices soften to within a few dollars of WTI.

* Target calculation: 105 - ( 120 - 105 ) = 90

Click the above heading to view all updates.

A loss never bothers me after I take it. I forget it overnight. But being wrong — not taking the loss — that is what does damage to the pocketbook and to the soul.

~ Jesse Livermore in Reminiscences of a Stock Operator by Edwin Lefevre.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.