Crude oil sinks hope of early recovery

By Colin Twiggs

August 10th, 2011 6:00 a.m. ET (8:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

New Format

We have changed the format of the Trading Diary to enable faster delivery and shorter, more readable newsletters.

I will post fresh analysis to a trading blog through the day, as various markets open and close. Posts of no more than a few paragraphs are easier to digest and the Comments section on each page will hopefully encourage greater interaction with readers. Praise is welcome but constructive criticism has helped greatly to strengthen my analysis over the years.

Thank you for your support and I hope you enjoy the new format. Your Comments will be appreciated.

Crude Oil

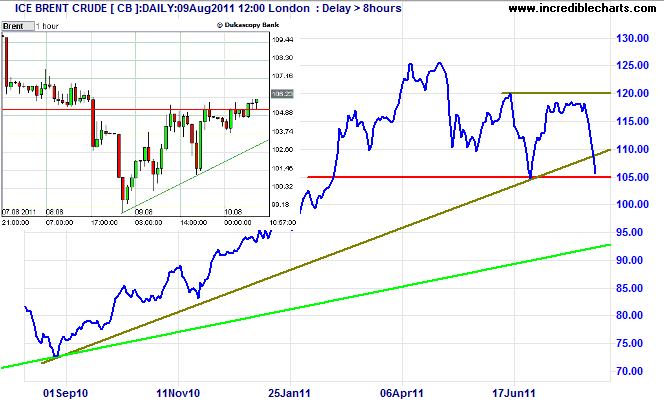

Today's bounce on world markets caused a rally of Brent Crude on the hourly chart, testing the former primary support level at $105/barrel. Institutional buying of stocks does not alter the fundamentals: high crude oil prices will cause a double-dip recession. No action by the Fed can change this. Every crude oil spike in the last 50 years has been followed by a recession.

* Target calculation: 105 - ( 120 - 105 ) = 90

Retreat below resistance at $105 would confirm that Brent Crude has joined Light (WTI) Crude in a primary down-trend. Target for the down-swing is $90*.

We need a major re-adjustment of crude oil prices to set the global economy on a sound footing.

China Faces Lower Growth

China's growth over the past couple of decades was based on large increases in government-directed investment. As a consequence, it had to run large trade surpluses to absorb the resulting excess capacity in manufacturing��. This can't continue.

~ By Michael Pettis - WSJ.com

As Japan and other fast-growing economies in the past have discovered, continued infrastructure spending grows increasingly wasteful and fails to deliver further growth. Subsidizing business through artificially low interest rates may encourage private investment as an alternative, but leads to:

- bloated, inefficient corporations;

- high inflation; and

- massive speculative bubbles.

Options are narrowing and a shift to private consumption as the main driver of future growth is not without its risks:

- low interest rates and high inflation are eroding private savings;

- higher interest rates, however, would unmask business inefficiencies and collapse the speculative property bubble;

- higher wages, on the other hand, will fuel inflation.

This Chinese puzzle may not be easy to solve.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.