What's New: Borrowing Inside Your SMSF

By Warrick Hanley and Nathan Baker

July 13, 2011 2:00 p.m. AET

This newsletter is subject to Incredible Charts Terms of Use.

Prior to 1999 super funds commonly used related trusts in which to hold leveraged assets. However, after 1999 funds could no longer establish these trusts, meaning that if the SMSF trustee wished to purchase an asset they needed to have sufficient money within the fund. This was a considerable problem when dealing with particularly large assets such as business real property.

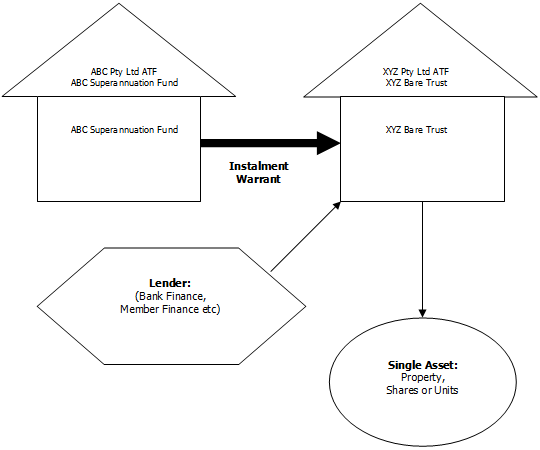

Legislation introduced in 2007 with respect to instalment warrants took the industry by surprise as it once again allowed private borrowing structures provided certain criteria are met. Suddenly buying leveraged assets within a SMSF was once again possible.

The important difference between an SMSF borrowing directly and, for example, investing in an unrelated unit trust which has borrowings, is that within the unit trust arrangement the liability for repayment of that debt is limited to the value of the units purchased. In setting up any future borrowing trust, maintaining this limited liability is of vital importance if the trust arrangement is to comply with the law.

The current government has expressed concern as to whether leverage is appropriate within superannuation and whether there could be a rise in opportunistic marketing on the part of product manufacturers. To date, there has been little evidence of this. However, recent changes have further restricted the use of these structures, and if you are thinking of setting one up, make sure you know the limitations and whether these still suit your purpose.

As it now stands a superannuation fund is permitted to borrow under the following circumstances:

- the borrowing is in the name of the SMSF trustee

- the borrowing is to acquire an asset that the SMSF trustee would normally be allowed to acquire (for example, the SMSF cannot acquire residential property from a member using a borrowing trust, because this would breach the rule concerning acquisition of assets from related parties)

- the asset must be held by a separate trustee (a bare trust)

- the SMSF trustee makes an instalment payment to receive beneficial ownership of the asset

- further payments are required to obtain full legal ownership

- all income such as dividends, rents or interest accrue for the benefit of the SMSF trustee

- the borrowing is limited recourse: the lender's right to recover in the event of default is limited to the primary asset being purchased

- at the end of the loan period the holding trustee transfers full legal ownership

It is very important that you get the structure right or it will cause problems with respect to compliance, which can necessitate a very costly unwinding of the transaction as well as incurring penalties. It can also lead to increased tax and/or stamp duty.

Who Can Be the Lender

Banks: These perhaps remain the most common form of finance. While the banks are warming to this sector the disadvantages can be a relatively low lending ratio and a premium interest rate being charged due to the limited recourse nature of the loan. The banks may also ask for personal guarantees on the part of the trustees and/or members and this is permissible provided the rights of the guarantor are limited in the same way as the lender.

Member Finance: Where the member has sufficient assets or the capacity to borrow against other non-superannuation assets and subsequently extends finance to the super fund. This can overcome many of the problems which arise when financing through third parties.

Limitations of the Borrowing Rules

It is important to remember that the super fund can borrow to purchase an asset or a replacement asset. The borrowing rules do not extend to the situation where you wish to borrow in order to renovate or improve an asset. Nor can the super fund refinance an asset that is currently debt free within the fund or re-leverage the asset that is held within the borrowing trust.

The new laws further restrict this to the purchase of a single asset or group of identical assets. For example, a building or a parcel of BHP shares would be acceptable. The former is a single asset, while the second is a group of identical assets. However, you would not be able to use the trust to purchase a diversified portfolio of different shares. The new rules also significantly limit your ability to change the asset being held. Selling one property and buying another will not be allowed, nor would selling your BHP to buy ANZ. Likewise, you could not partially sell down your BHP to take some profit, as the entire parcel must be treated as a single asset.

ATF = As Trustee For

Apart from the ability of the borrowing trust to accept a replacement asset in limited circumstances, the trust is to effectively be a one transaction vehicle. So each time you wish to purchase a new asset with leverage you will need to establish a new trust. After the recent natural disasters there are also some serious questions being asked about the ability to rebuild an existing asset even where insurance makes this financially viable. The problem is that this would be considered a replacement asset of a type not permitted by the legislation.

The introduction of instalment warrant structures has certainly been a welcome move for SMSFs. It is of course important not to lose sight of the fact that the introduction of debt within your asset pool will increase the level of risk that you face. It still needs to fit within your investment strategy and you need to consider your fund's liquidity and insurance needs if a large asset such as property is to be introduced. Finally, there is a legislative risk here, both in terms of the restrictions that are already enforceable, and the very real chance of future change. Weigh up your opportunities and risks carefully.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.