Gold miners warning

By Colin Twiggs

June 16th, 2011 1:00 a.m. ET (3:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Gold

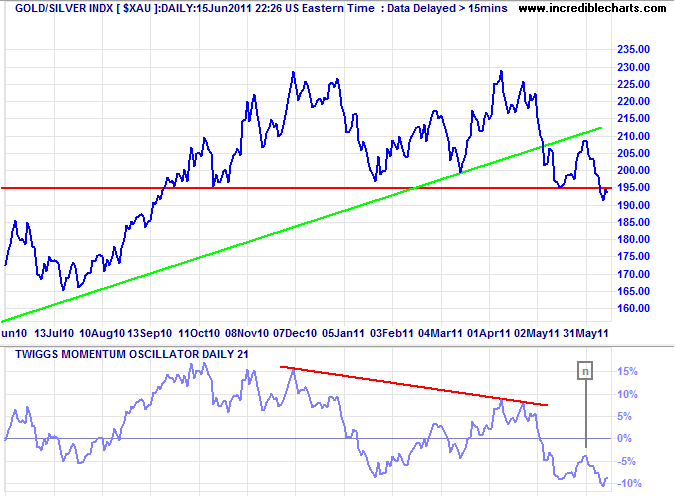

Gold miners are pointing to a weaker gold price. The XAU index broke through primary support at 195 to complete a double-top reversal. Follow-through below 190 would confirm the signal. Traded on the Philadelphia exchange, the XAU index consists of 16 major precious metal miners.

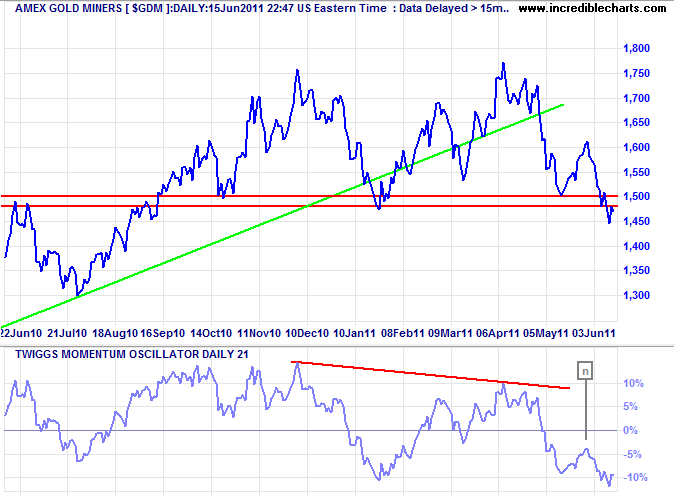

The wider AMEX Gold Miners Index $GDM (tracked by the GDX Gold Miners ETF) similarly broke through support at 1500.

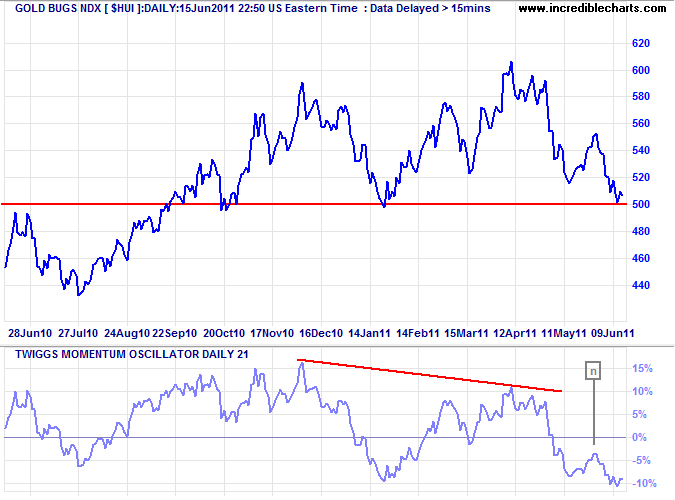

But the Gold Bugs Index $HUI, representing unhedged gold stocks, has yet to follow. Breach of primary support at 500 would confirm. All three indices display a bearish Momentum peak [n] below zero, warning of a down-trend.

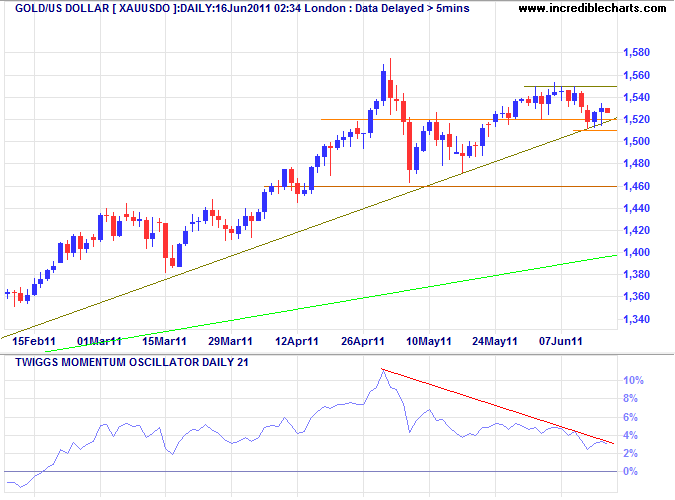

Spot gold retraced to test support at $1520 per ounce. Recovery above $1550 would signal continuation of the advance, but retreat below $1510 would echo the miner's warning, testing support at $1460. A stronger dollar suggests weaker gold prices.

* Target calculation: 1575 + ( 1575 - 1475 ) = 1675

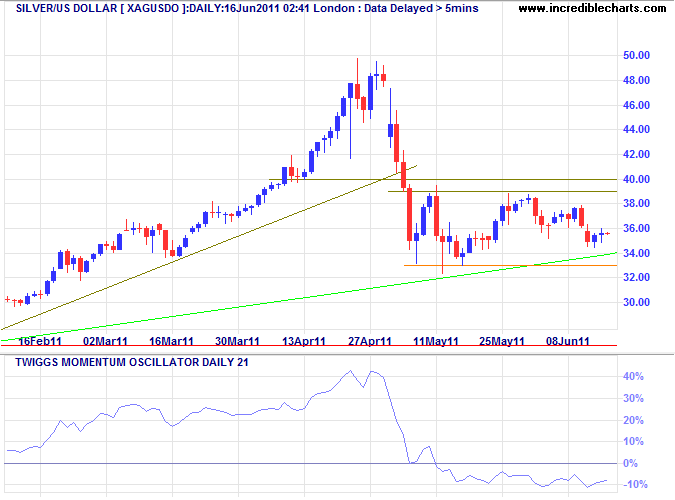

Silver

Failure of support at $33 per ounce for silver would also suggest that gold is likely to weaken. Recovery above $39 is less likely but would indicate another advance.

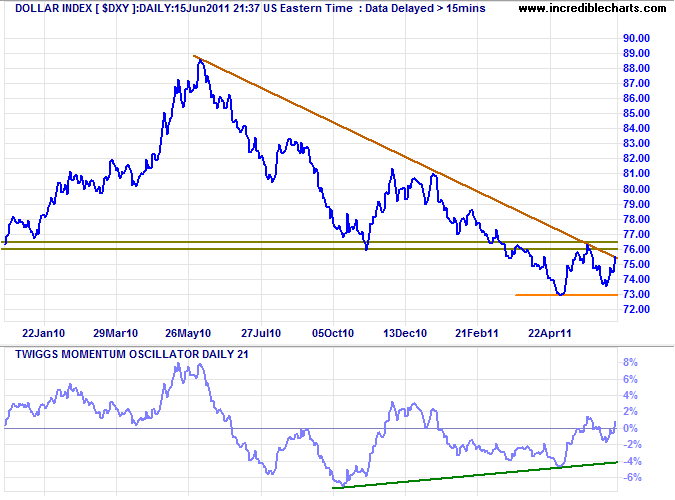

US Dollar Index

The strengthening dollar is responsible for weaker gold and commodity prices. A Dollar Index breakout above 76.50 would signal a primary up-trend. Reversal below primary support at 73, however, would warn of a decline to 70*. Bullish divergence on Twiggs Momentum suggests that the down-trend is weakening.

* Target calculation: 73 - ( 76 - 73 ) = 70

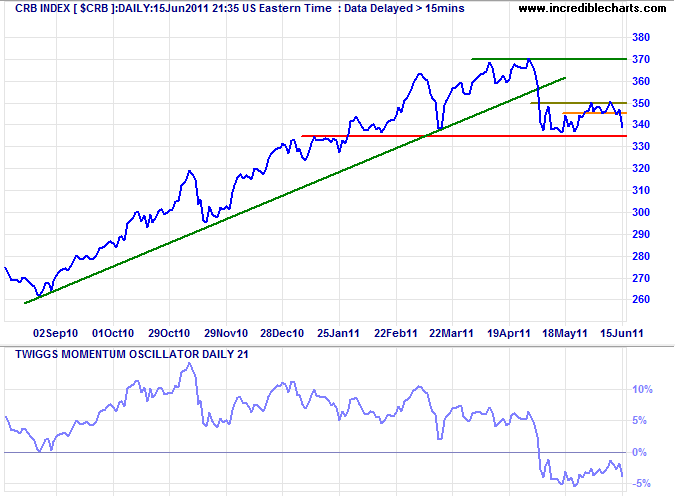

Commodities

The CRB Commodities Index is headed for a test of support at 335. Failure would signal a primary down-trend. Recovery above 350 is unlikely, but would signal another advance. Again, the dollar is likely to have a strong influence.

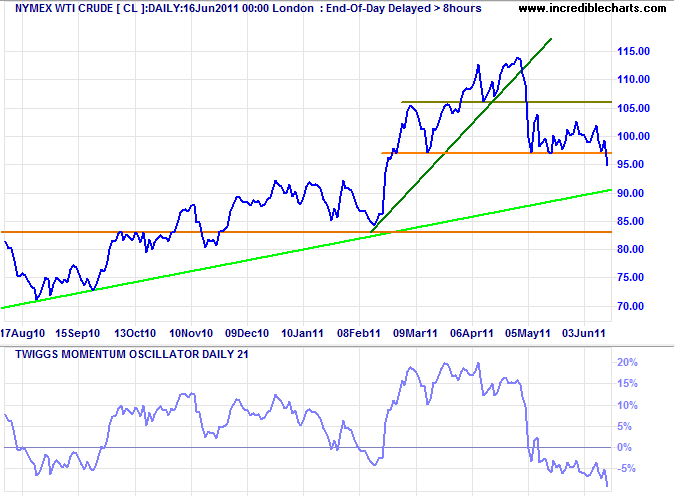

Crude Oil

ICE Brent crude retreated to $114 Wednesday, while Nymex WTI Crude broke support at $97, headed for a test of the long-term ascending trendline and support at $83 per barrel.

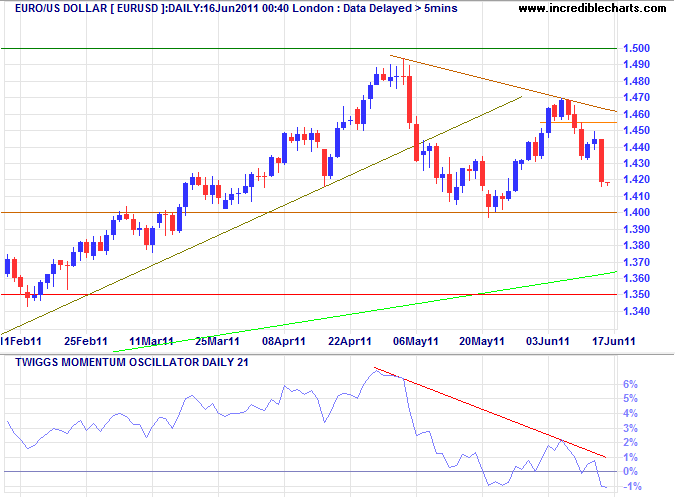

Euro

The euro is retreating for another test of support at $1.40. Failure of support would signal a primary down-trend.

* Target calculation: 1.40 + ( 1.40 - 1.30 ) = 1.50

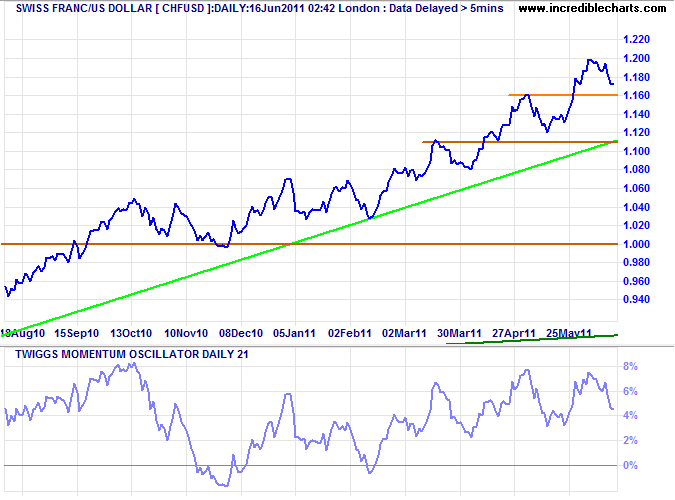

Swiss Franc

The Swiss franc continues in a strong primary up-trend against both the dollar and the euro. Respect of medium-term support at $1.16 would confirm trend strength.

* Target calculation: 1.00 + ( 1.00 - 0.80 ) = 1.20

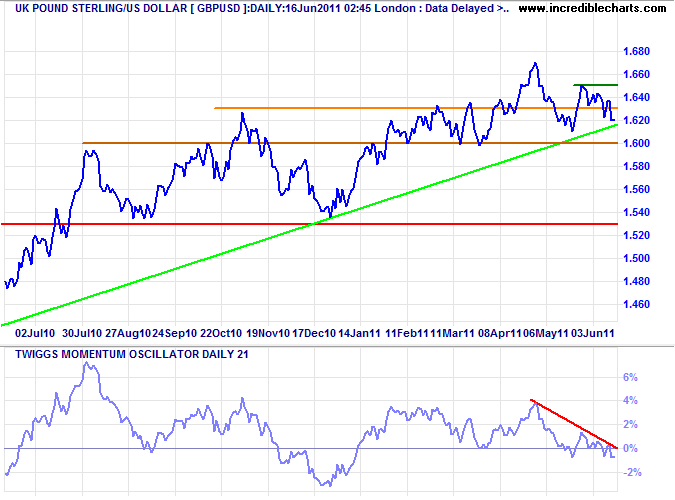

UK Pound Sterling

The pound is retracing to test medium-term support at $1.60. The sharp fall on Twiggs Momentum warns of trend weakness. Failure of support would test primary support at $1.53.

* Target calculation: 1.63 + ( 1.63 - 1.53 ) = 1.73

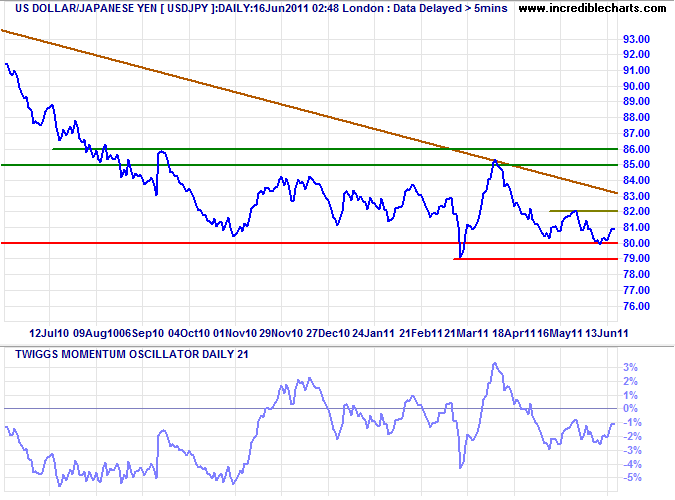

Japanese Yen

The dollar again respected long-term support at ¥80. Twiggs Momentum oscillating below zero indicates continuation of the down-trend. Failure of support would signal a decline to ¥75*, but would most likely spur further BOJ efforts to halt appreciation of the yen.

* Target calculation: 80 - ( 85 - 80 ) = 75

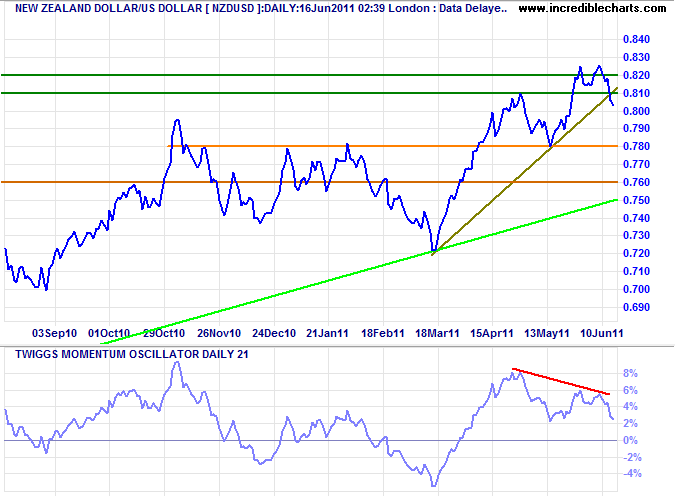

New Zealand Dollar

The kiwi dollar retreated below the rising medium-term trendline to warn of a correction. Bearish divergence on Twiggs Momentum strengthens the signal. Expect a test of the long-term trendline at $0.76.

* Target calculation: 81 + ( 81 - 78 ) = 84

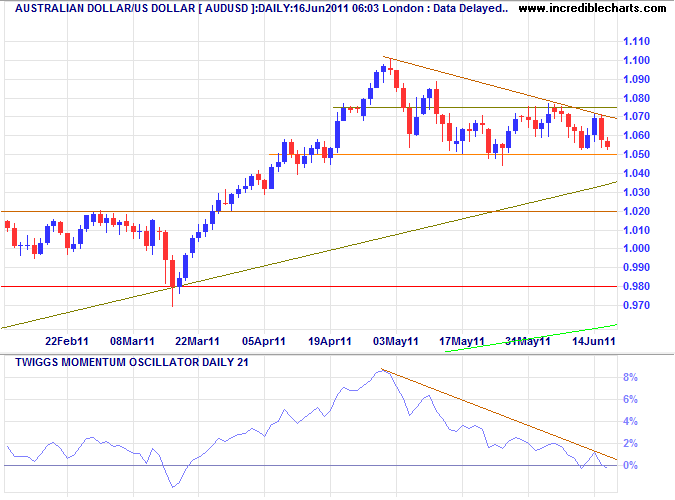

Australian Dollar

Weaker commodity prices are likely to weigh on the Aussie dollar, which is again testing support at $1.05 against the greenback. Failure of support would test $1.02. Recovery above $1.075 is unlikely, but would signal a fresh advance.

* Target calculation: 1.10 + ( 1.10 - 1.05 ) = 1.15

Self-control is the chief element in self-respect,

and self-respect is the chief element in courage.

~ Thucydides (c. 460 BC – c. 400 BC).

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.