Transport stocks threaten fall

By Colin Twiggs

June 9th, 2011 4:00 a.m. ET (6:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

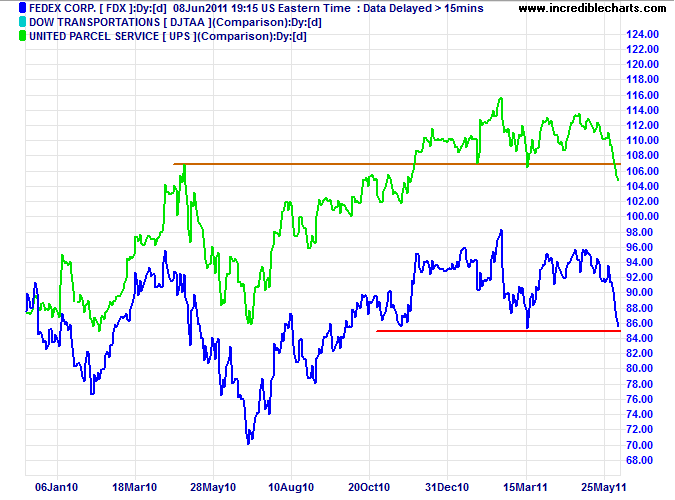

Bellwether transport stock Fedex is threatening primary support at 85. Failure would confirm the reversal signal from UPS — with negative implications for the broader economy.

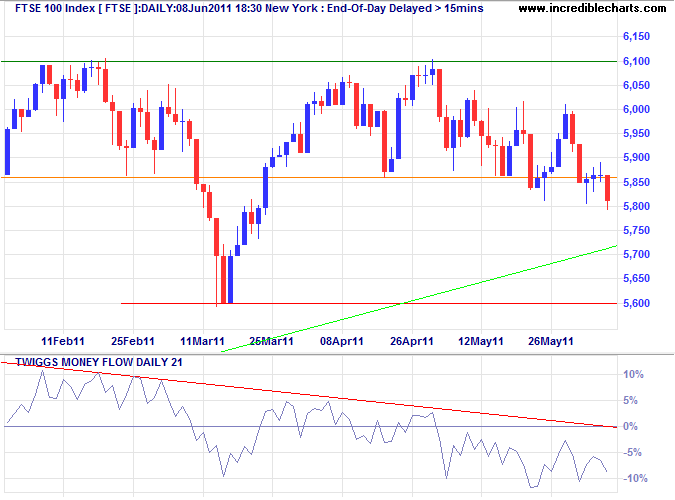

UK stocks fell on Wednesday, with the FTSE 100 signaling a correction to test primary support at 5600. Twiggs Money Flow (21-day) holding below zero warns of strong selling pressure.

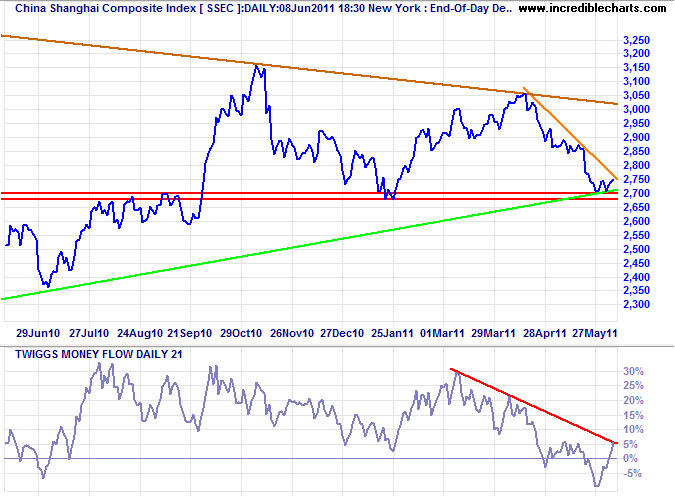

The Shanghai Composite Index recovered above primary support at 2700, but retreated Thursday for another test. Downward breakout would confirm the reversal signal from the Shenzhen Index.

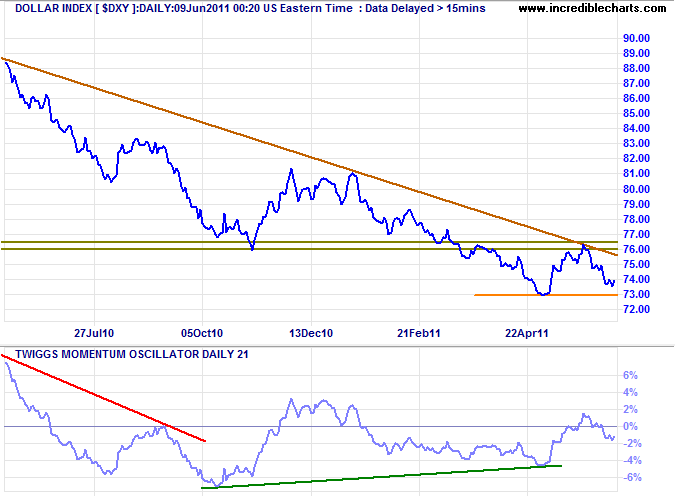

US Dollar Index

The Dollar Index is headed for a test of primary support at 73; failure would warn of a decline to 70*. Bullish divergence on Twiggs Momentum, however, suggests that the down-trend is weakening and recovery above 76.50 would signal a reversal.

* Target calculation: 73 - ( 76 - 73 ) = 70

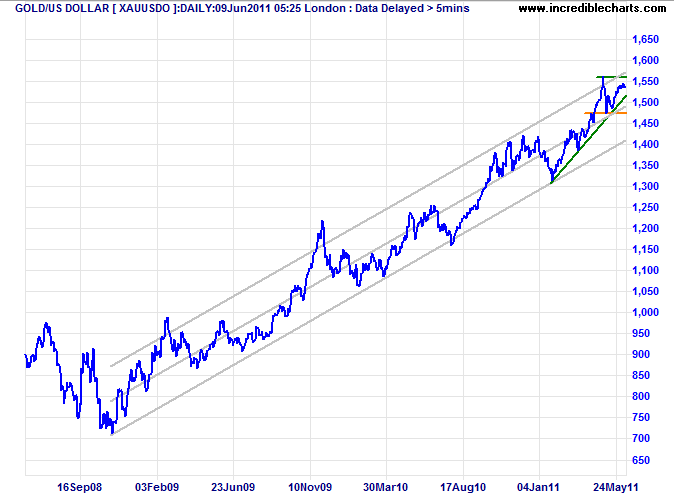

Gold

Gold is testing the upper border of is trend channel. Respect of $1575 would signal a down-swing to the lower channel. Breach of $1475 would confirm. A stronger dollar would weaken gold.

* Target calculation: 1575 + ( 1575 - 1475 ) = 1675

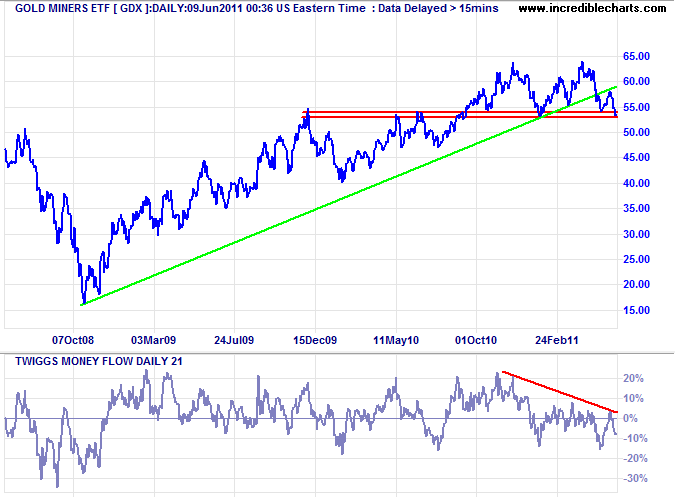

The Gold Miners ETF threatens a double top reversal. Breakout below 53 would complete. Bearish divergence on 21-day Twiggs Money Flow and a fall below zero confirm strong selling pressure. Primary trend reversal on gold miners would warn of a similar reversal on the physical metal.

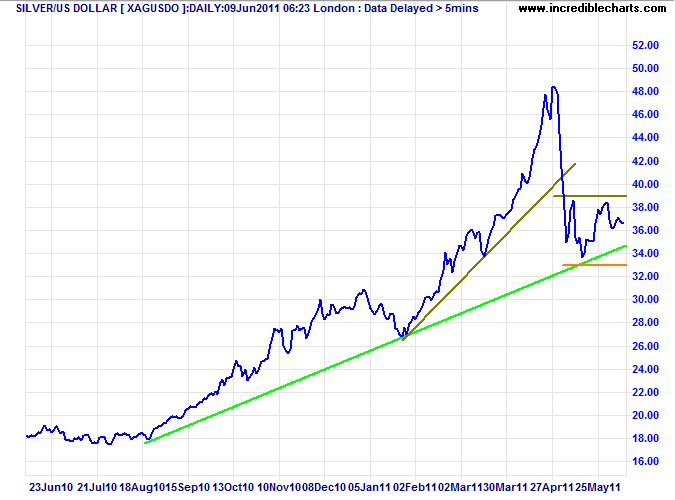

Silver

Silver continues to range between $33 and $39; breakout will indicate future direction. Penetration of the long-term trendline would warn that the primary trend is weakening.

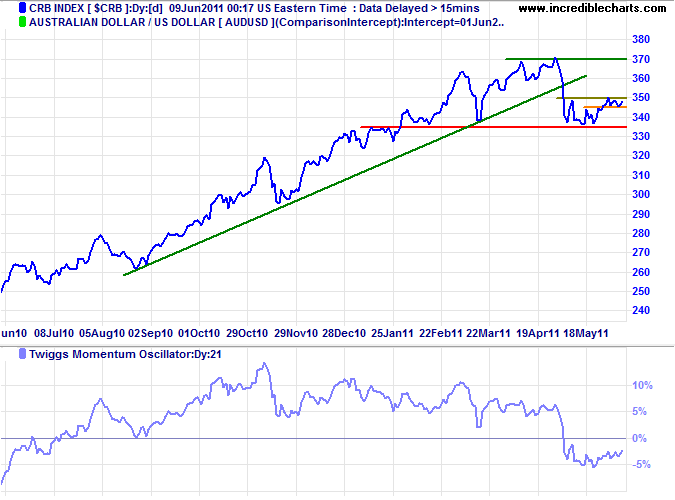

Commodities

The CRB Commodities Index displays a similar pattern, consolidating between 335 and 350. Breakout will indicate future direction. Again, the dollar is likely to have a strong influence.

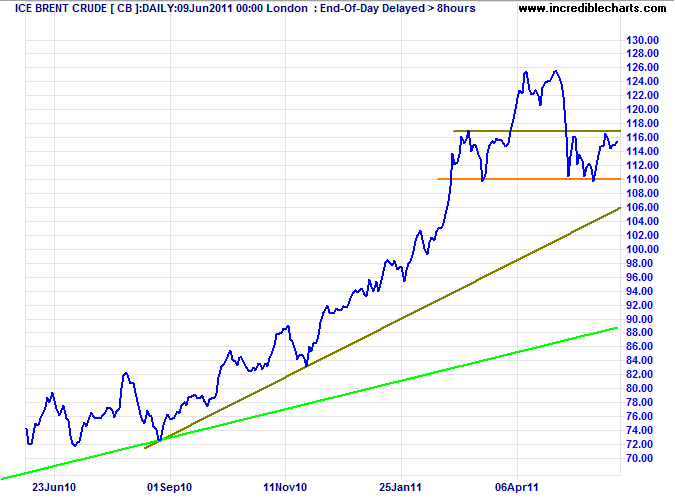

Crude Oil

Brent crude continues to test resistance at $117/barrel. Breakout would signal an advance to $125, while respect would warn of another test of support at $110. A slowing of the global economy, as signaled by declining transport stocks, would weaken demand for crude, making reversion to the long-term trendline at $90 more likely. A stronger dollar would also lower prices.

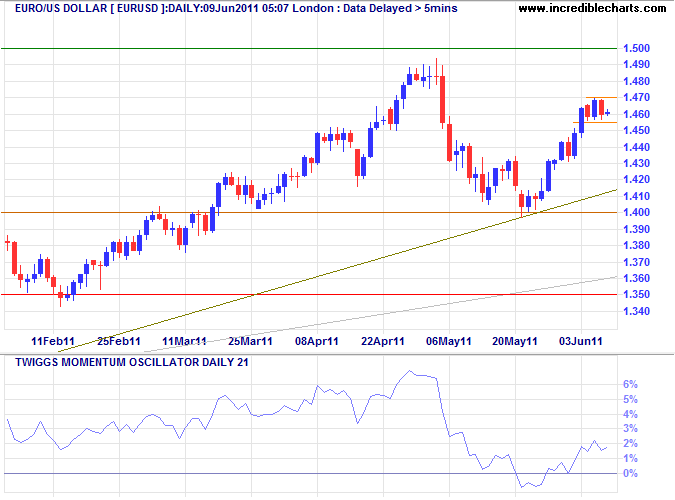

Euro

The euro is consolidating in a narrow band (between $1.455 and $1.47), indicating continuation of the rally to test $1.50*.

* Target calculation: 1.40 + ( 1.40 - 1.30 ) = 1.50

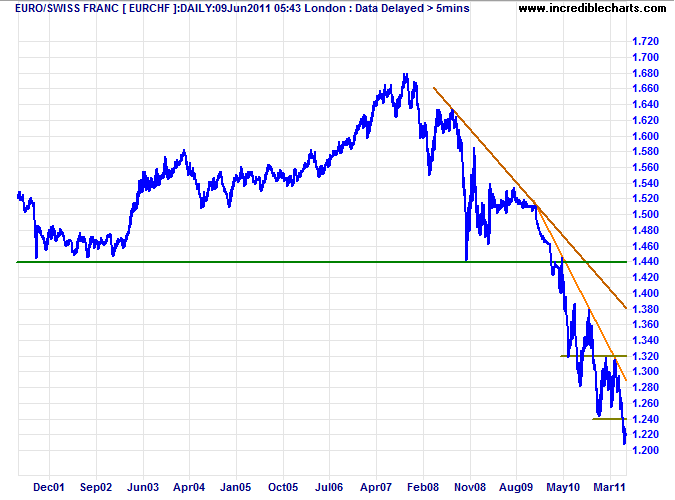

Swiss Franc

The sovereign debt crisis has bedeviled the euro, as indicated by the sharp fall against the Swiss franc since early 2010.

* Target calculation: 1.24 - ( 1.32 - 1.24 ) = 1.16

* Target calculation for CHFUSD: 1.00 + ( 1.00 - 0.80 ) = 1.20

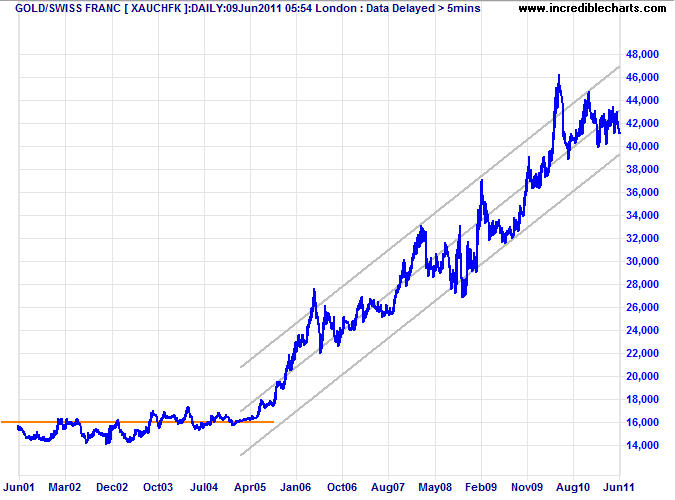

Despite the strength of the Swiss franc, gold has appreciated more than 250% in CHF over the last 6 years, compared to approx. 340% against the USD.

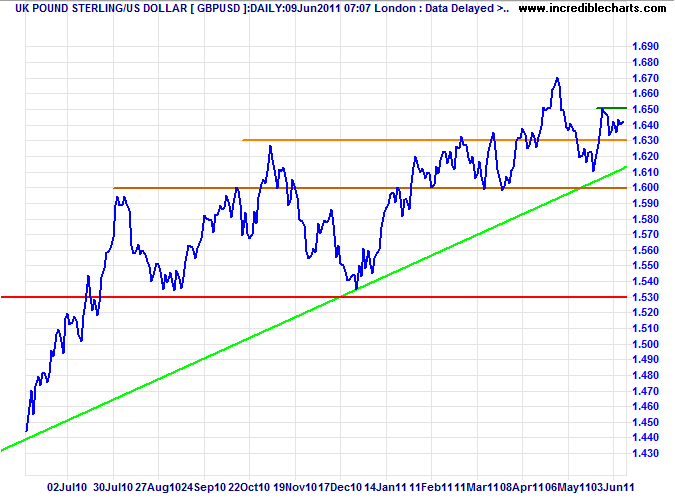

UK Pound Sterling

The pound respected its long-term trendline and is testing short-term resistance at $1.65. Breakout would indicate continuation of the rally to $1.67. Failure of support at $1.60 is unlikely but would warn of a correction to $1.53.

* Target calculation: 1.63 + ( 1.63 - 1.53 ) = 1.73

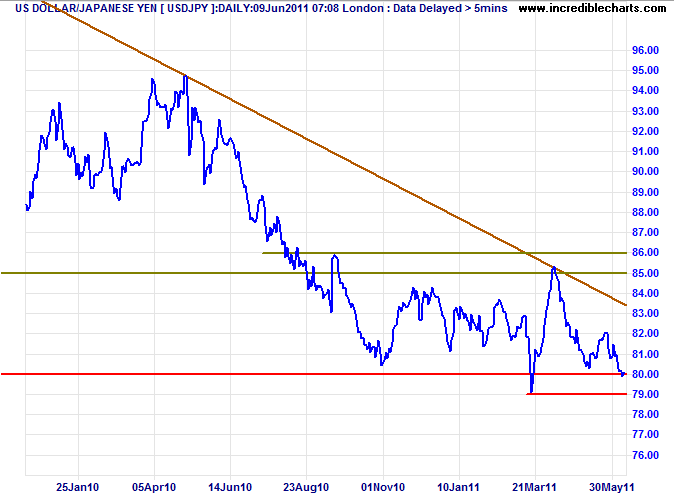

Japanese Yen

The dollar is again testing long-term support at ¥80. Failure would signal a down-swing to ¥75*, but would be likely to spur further efforts by the BOJ to halt appreciation of the yen.

* Target calculation: 80 - ( 85 - 80 ) = 75

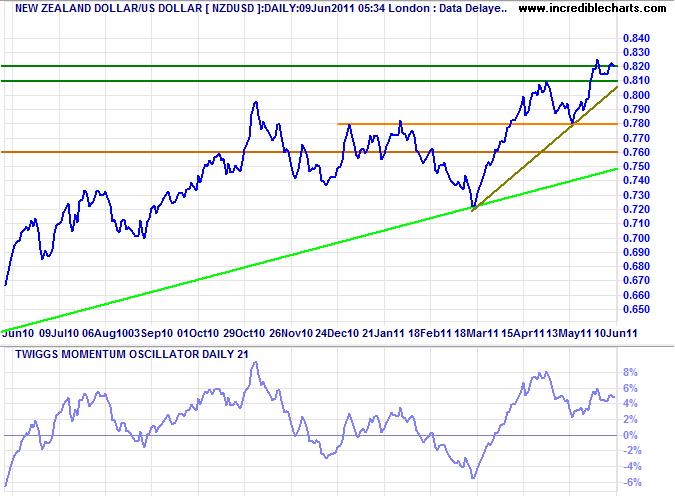

New Zealand Dollar

The kiwi dollar threatens a breakout above $0.82, its 2008 high against the greenback. Follow-through would signal an advance to $0.84*.

* Target calculation: 81 + ( 81 - 78 ) = 84

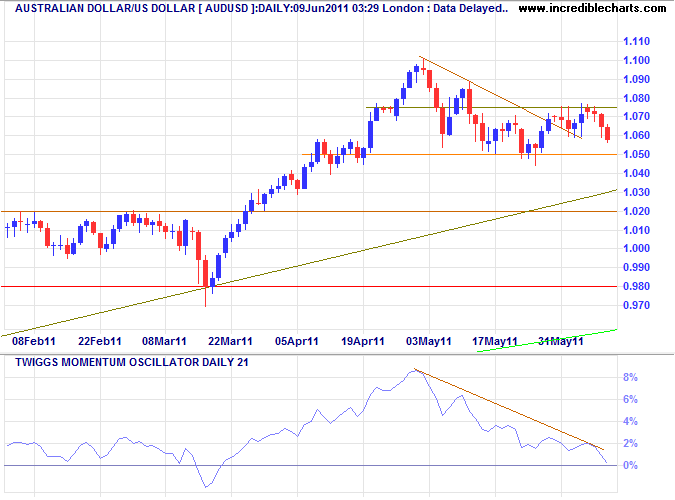

Australian Dollar

The Aussie dollar is retracing for another test of support at $1.05 against the greenback. Failure would test medium-term support at $1.02, while recovery above $1.075 would signal an advance to $1.15*. Declining momentum, however, favors a downward breakout.

* Target calculation: 1.10 + ( 1.10 - 1.05 ) = 1.15

The secret of happiness is freedom,

and the secret of freedom is courage.

~ Thucydides (c. 460 BC - c. 400 BC).

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.