Dow and China fall

By Colin Twiggs

June 2nd, 2011 2:00 a.m. ET (4:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

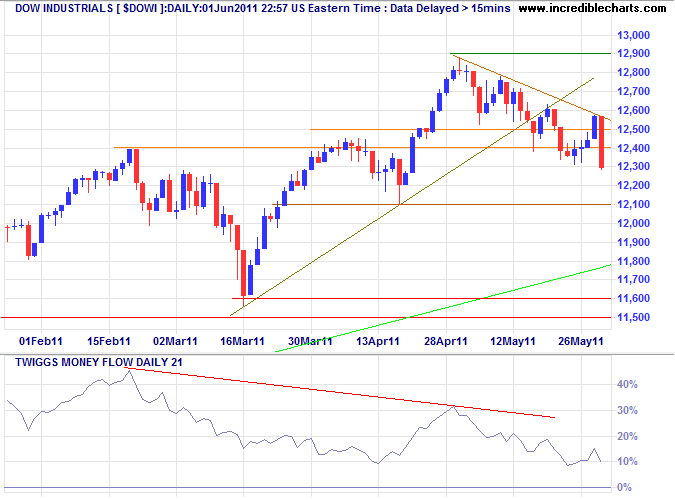

The Dow Jones Industrial Average fell sharply, retreating below medium-term support at 12400 to confirm the correction signaled earlier by the Nasdaq, S&P 500, and the bearish divergence on 21-day Twiggs Money Flow.

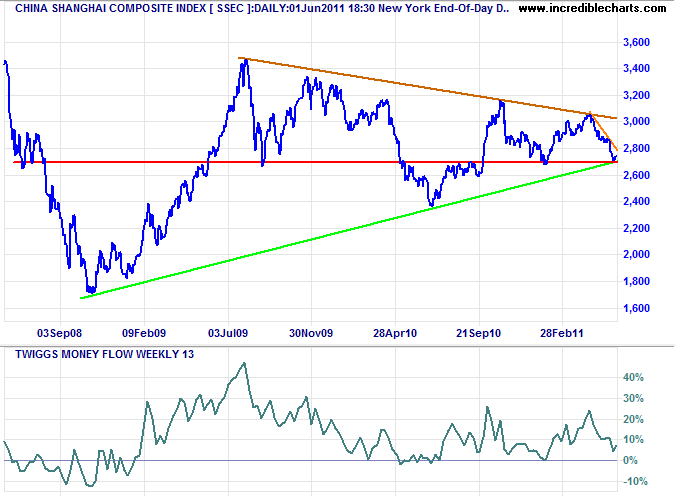

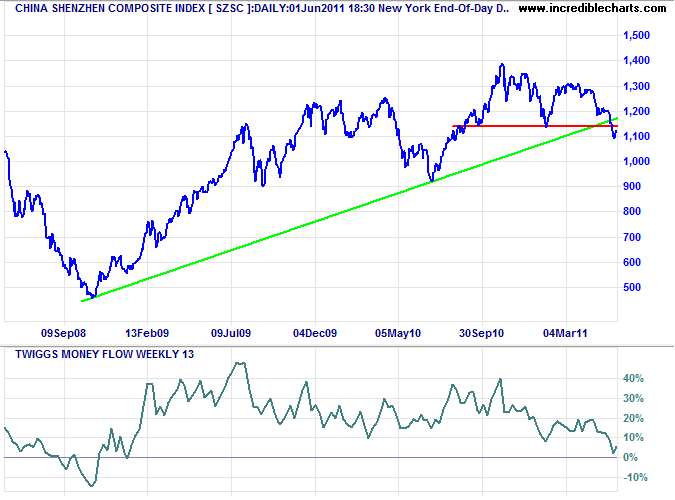

The Shanghai Composite Index followed, breaking support at 2700 Thursday to signal a primary down-trend.

This confirms the warning from the Shenzhen Index and will have negative implications for global markets, particularly resource-rich countries such as Australia, Brazil and South Africa.

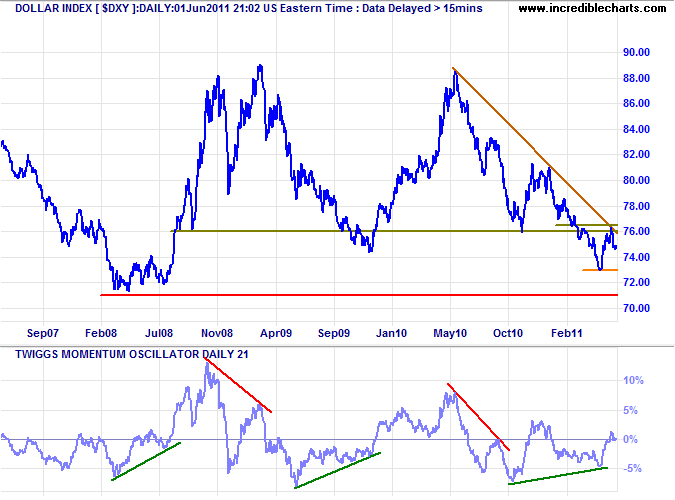

US Dollar Index

The Dollar Index retreated from resistance at 76, but a large bullish divergence on Twiggs Momentum suggests a reversal. Breakout above 76.50 would confirm, while failure of support at 73 would test long-term support at 71.

* Target calculation: 76 - ( 81 - 76 ) = 71

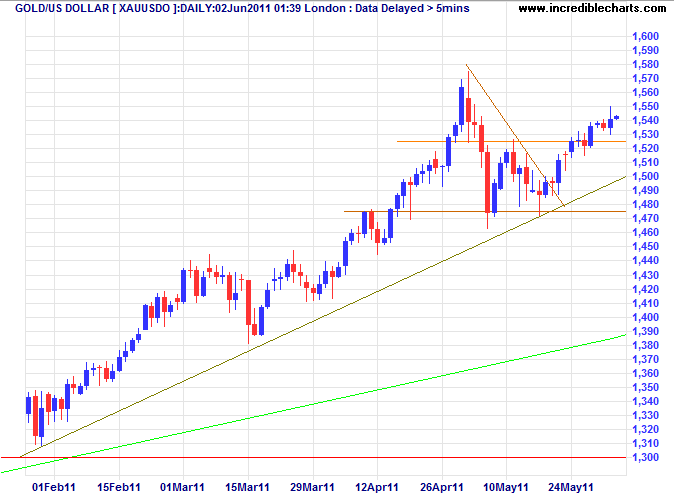

Gold

Gold is holding above $1525. A retracement that respects the new support level would confirm the new advance. Breach of the medium-term trendline, however, would warn of a bull trap and test of the long-term trendline around $1400. Behavior of the dollar will be a major influence.

* Target calculation: 1575 + ( 1575 - 1475 ) = 1675

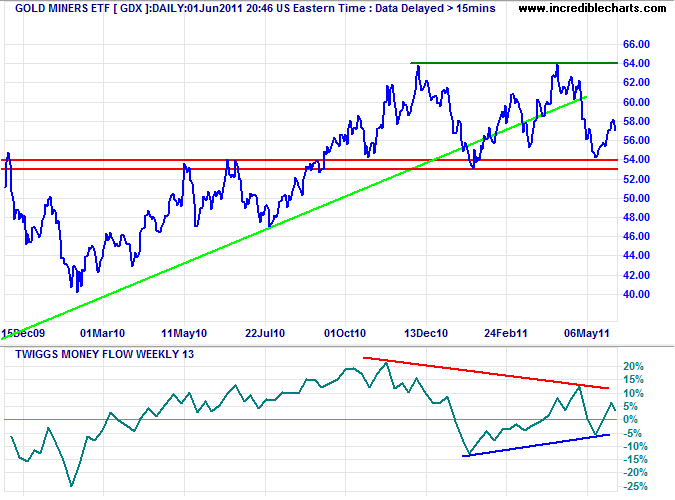

The Gold Miners ETF continues to range between 6400 and support at 5300; breakout would signal future direction. Bearish divergence on 13-week Twiggs Money Flow warns of selling pressure; confirmed if the indicator reverses below zero. Completion of a double top on gold miners would warn of a primary trend reversal on the physical metal.

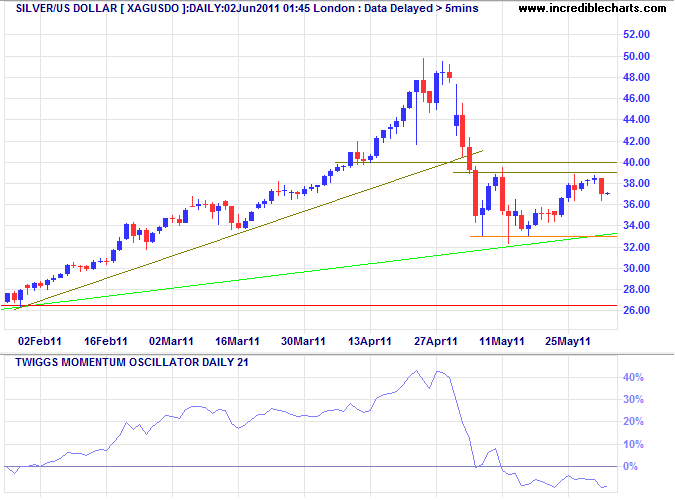

Silver

Silver is ranging between $33 and $39; breakout will indicate future direction. A Twiggs Momentum trough below zero would suggest a downward breakout.

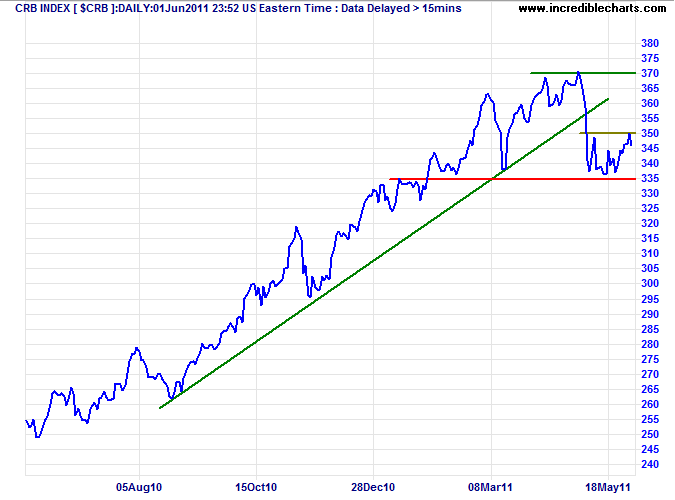

Commodities

The CRB Commodities Index is similarly consolidating between 335 and 350. Breakout will indicate future direction. Again, the dollar is likely to have a strong influence.

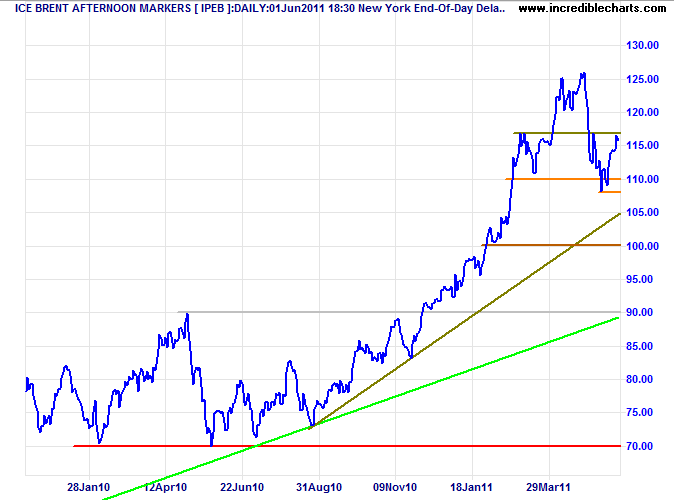

Crude Oil

Brent crude is testing resistance at $117/barrel. Breakout would signal an advance to $125, while respect would warn of another test of support at $108. A slowing of the global economy would weaken demand for crude, making reversion to the long-term trendline at $90 more likely. A stronger dollar would also lower prices.

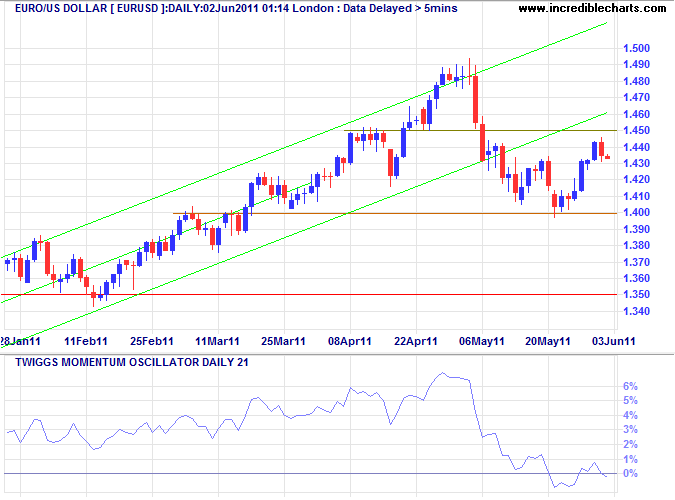

Euro

The euro respected resistance at $1.45, indicating another test of support at $1.40. Failure of support would signal a decline to $1.35.

* Target calculation: 1.40 + ( 1.40 - 1.30 ) = 1.50

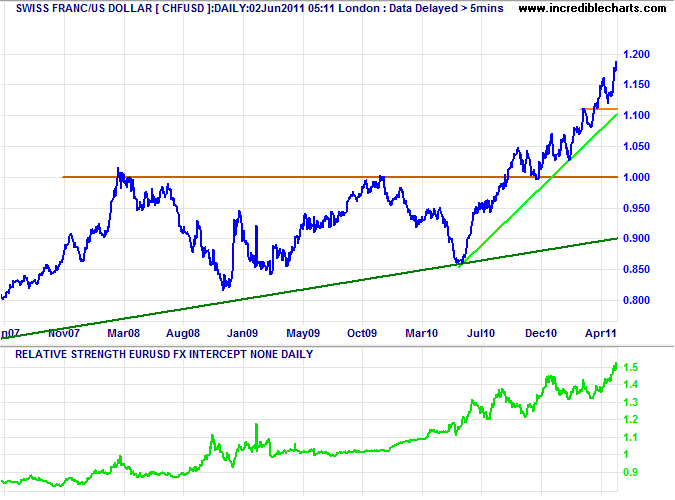

Swiss Franc

There has been discussion recently of holding 5% of your investments in local currency (in cash, not a bank account) so that you are liquid if ever there is another financial crisis. If I were going to hold short-term deposits in any other currency, my personal preference would be the Swiss franc. Firstly, because of their neutrality; second, the Swiss franc has been appreciating against the dollar for most of the past 40 years; and third, because CHF is now appreciating against both the yen and the euro. In the short-term, we are now approaching the target of $1.20 and may be due for a correction.

* Target calculation: 1.00 + ( 1.00 - 0.80 ) = 1.20

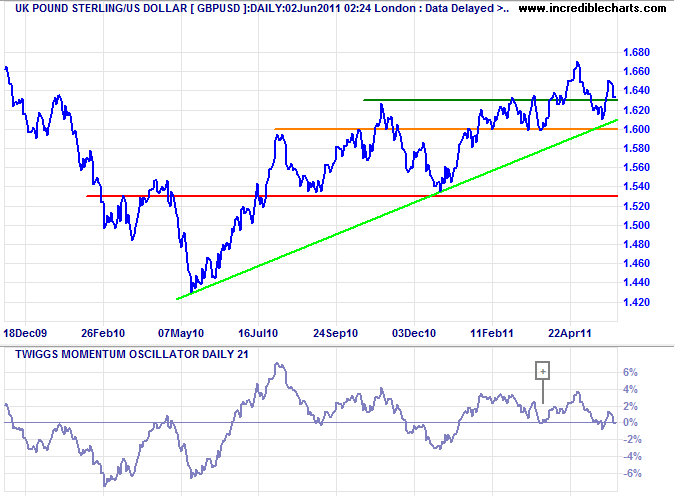

UK Pound Sterling

The pound continues to range above $1.60. Failure of support would warn of a correction to $1.53, while respect would signal continuation of the up-trend.

* Target calculation: 1.63 + ( 1.63 - 1.53 ) = 1.73

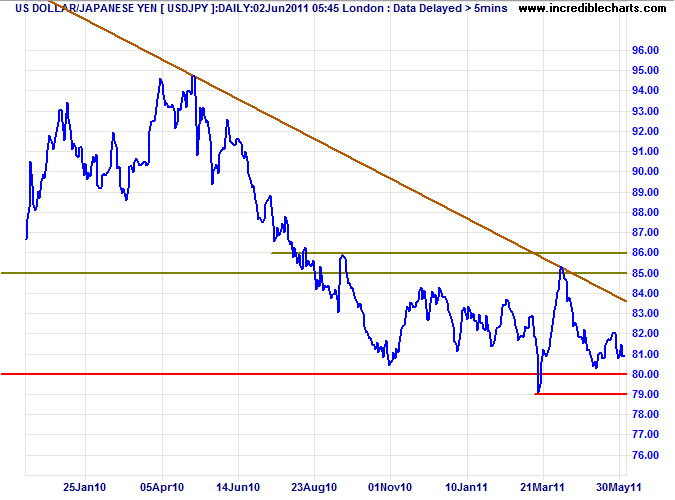

Japanese Yen

The dollar continues to test long-term support at ¥80. Failure would signal a down-swing to ¥75*.

* Target calculation: 80 - ( 85 - 80 ) = 75

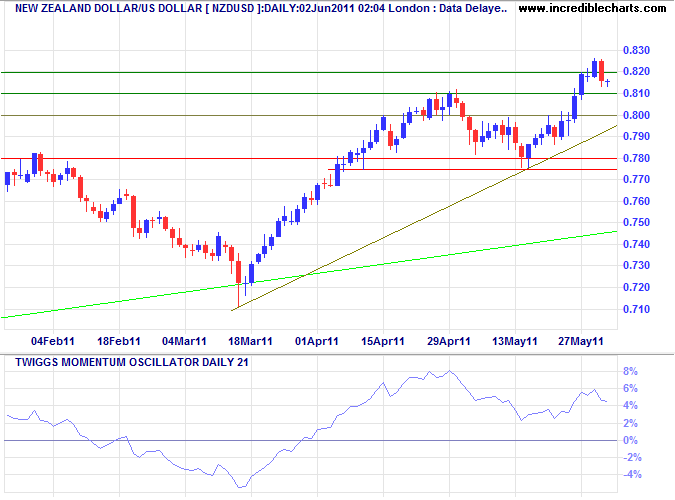

New Zealand Dollar

The kiwi dollar is testing support at $0.81 against the greenback. Penetration of the rising trendline at $0.80 would warn of a correction, while respect would signal an advance to $0.84.

* Target calculation: 81 + ( 81 - 78 ) = 84

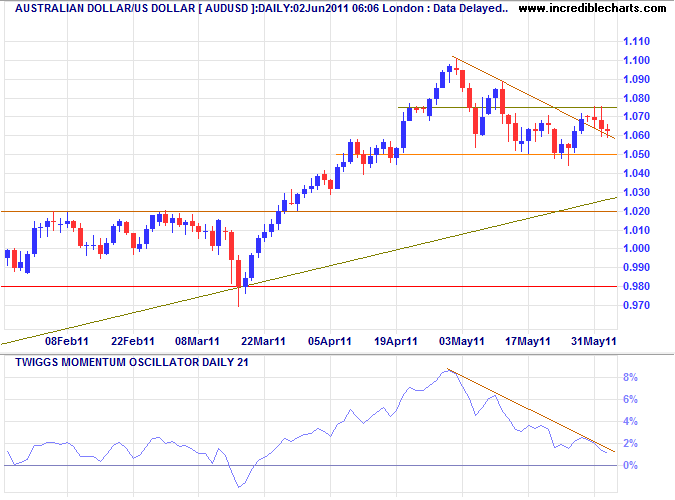

Australian Dollar

The Aussie dollar encountered resistance at $1.075 against the greenback. Expect another test of $1.05. Failure of support would test medium-term support at $1.02, while breakout above $1.075 would signal an advance to $1.15*.

* Target calculation: 1.10 + ( 1.10 - 1.05 ) = 1.15

Because of the crisis, we grew the too-big-to-fail banks into ever more too-big-to-fail banks — we consolidated them. Now we've got this psychology in Washington of “We can't really go after them the way we would want to or in a real manner because we could destabilize them. So let's actually just pretend there's not a problem”. That's the real danger of too-big-to-fail. When you can't enforce the rule of law because you are afraid of harming these institutions, you're really giving them a free pass and free reign to continue to take on more and more risky behaviors.

~

The Fed's “Fatal Flaw”: Gretchen Morgenson & Jonathan Rosner on Why Nothing's Changed Since the Crisis

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.