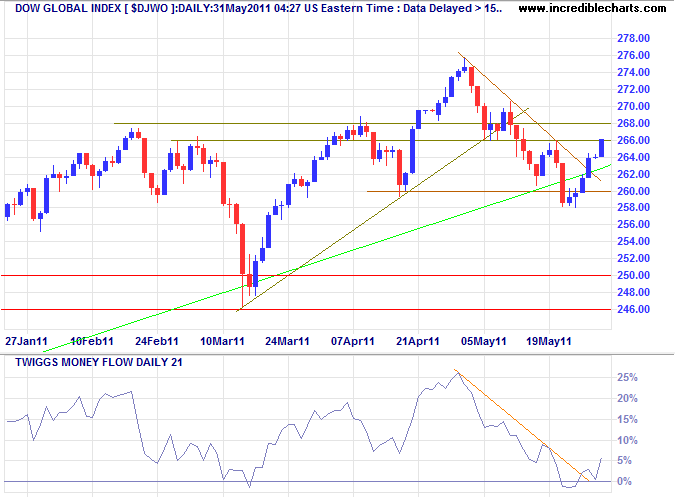

Recovery hinges on China

By Colin Twiggs

May 31st, 2011 6:30 a.m. ET (8:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

The Dow Jones Global Index broke through the descending trendline, indicating that the correction is ending. Follow-through above 266 would confirm. Breakout above 268 would signal a fresh advance, continuing the primary up-trend.

USA

US markets were closed on the 30th for Memorial Day.

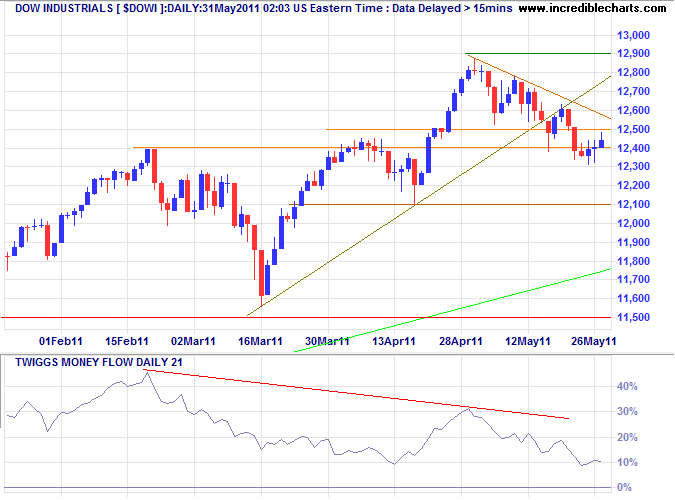

Dow Jones Industrial Average

The Dow is edging lower but has still not broken clear of medium-term support between 12400 and 12500. Failure would confirm a correction, while respect would suggest an advance to 13200*. Bearish divergence on 21-day Twiggs Money Flow, however, continues to warn of selling pressure.

* Target calculation: 12400 + ( 12400 - 11600 ) = 13200

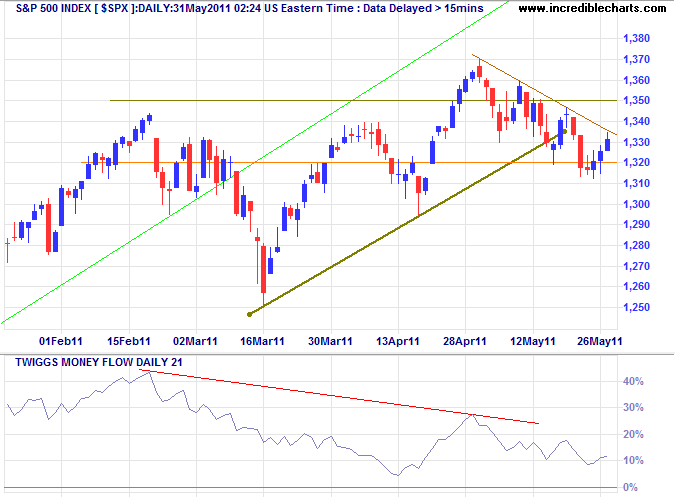

S&P 500

The S&P 500 broke its long-term trendline in March, signaling primary trend weakness and bearish divergence on 13-week Twiggs Money Flow warns of selling pressure. The index is edging lower, however, rather than falling sharply, and penetration of the descending trendline would suggest an advance to 1450*. Breakout above 1350 would confirm.

* Target calculation: 1350 + ( 1350 - 1250 ) = 1450

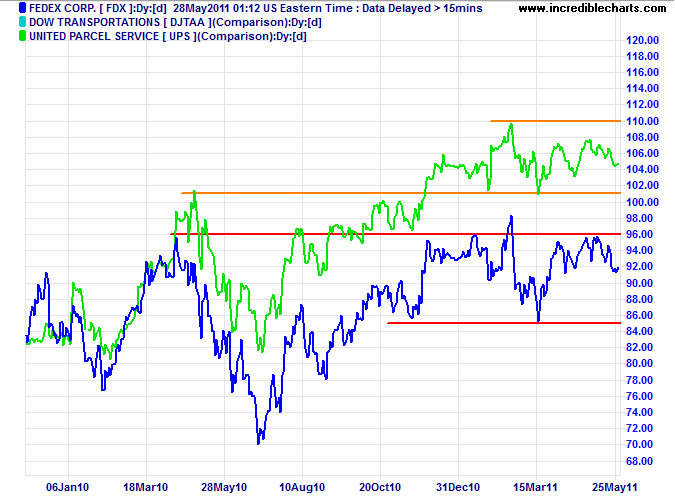

Transport

Bellwether transport stocks Fedex and UPS continue in a ranging market. Breakout will signal future direction of the market.

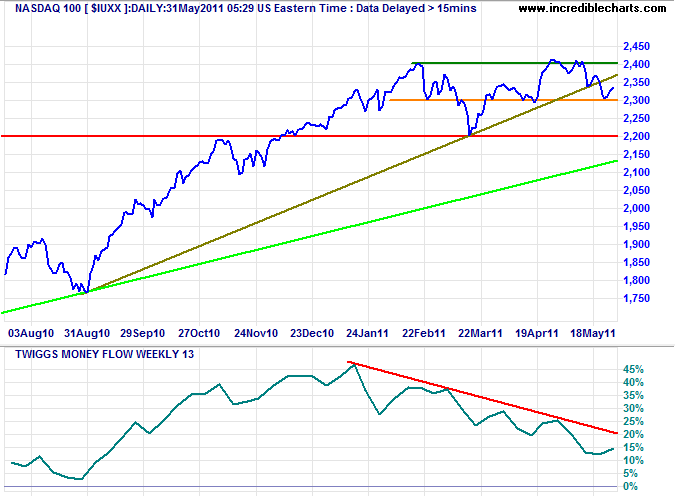

Technology

The Nasdaq 100 is undergoing a correction; failure of medium-term support at 2300 would confirm a test of primary support at 2200 (and the long-term trendline). Bearish divergence on 13-week Twiggs Money Flow continues to warn of strong selling pressure. Recovery above 2400 is unlikely but would suggest an advance to 2600*.

* Target calculation: 2400 + ( 2400 - 2200 ) = 2600

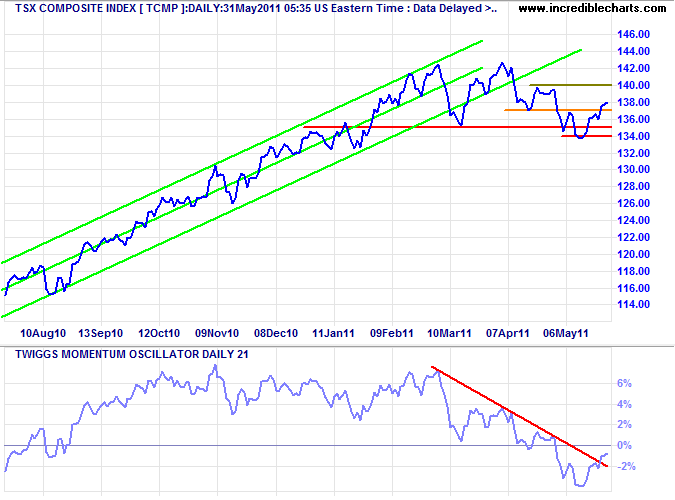

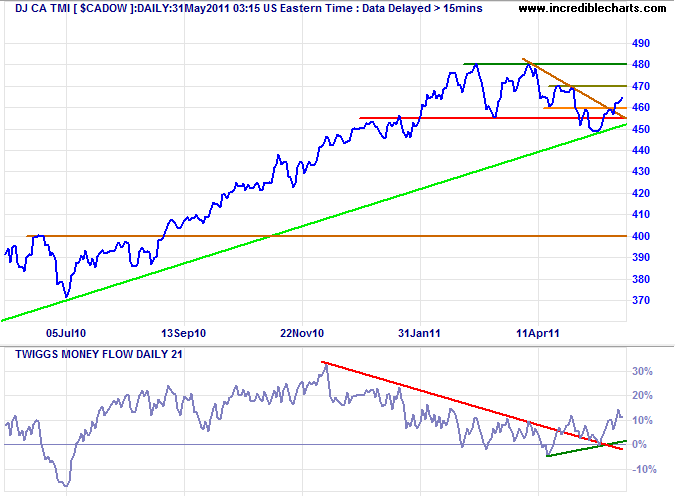

Canada: TSX

TSX Composite Index recovered above 13700 signals a bear trap. Retracement that respects primary support at 13400 would confirm; so would breakout above 14000.

Bullish divergence on $CADOW (21-day Twiggs Money Flow) indicates medium-term buying pressure.

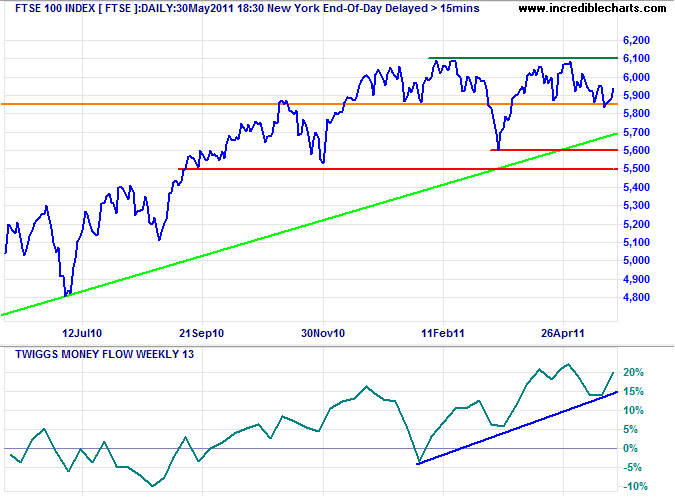

United Kingdom

The FTSE 100 is strengthening, with 13-week Twiggs Money Flow indicating buying pressure. Breakout above 6100 would signal an advance to 6600*. Failure of medium-term support at 5860 is less likely, but would signal a test of primary support at 5600.

* Target calculation: 6100 + ( 6100 - 5600 ) = 6600

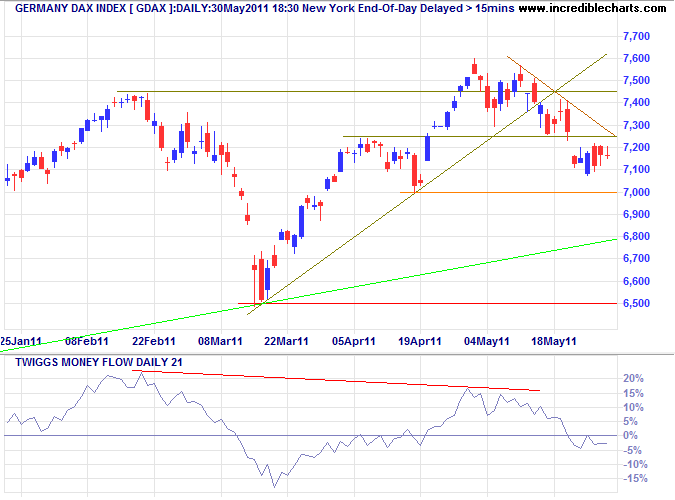

Germany

The DAX reflects EMU uncertainty, undergoing a correction to the long-term trendline. Bearish divergence on 21-day Twiggs Money Flow (and a fall below zero) indicates continued selling pressure.

* Target calculation: 7500 + ( 7500 - 6500 ) = 8500

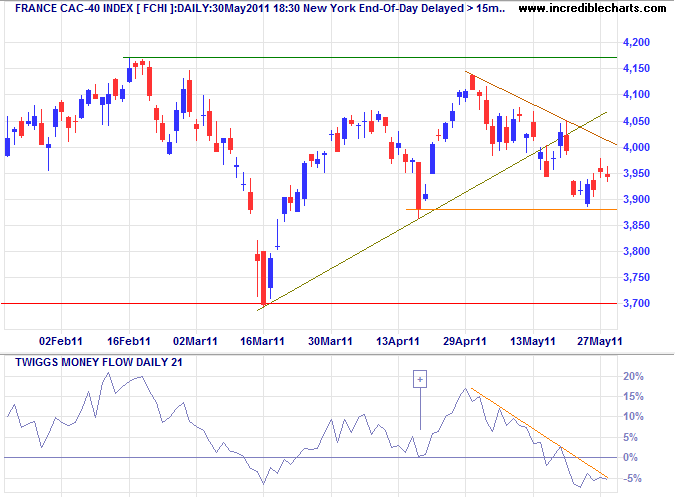

France

The CAC-40 is likewise testing medium-term support at 3880, while 21-day Twiggs Money Flow (below zero) warns of selling pressure. Recovery above 4150 is most unlikely, but would signal a primary advance to 4750. Breach of 3880 would test primary support at 3700.

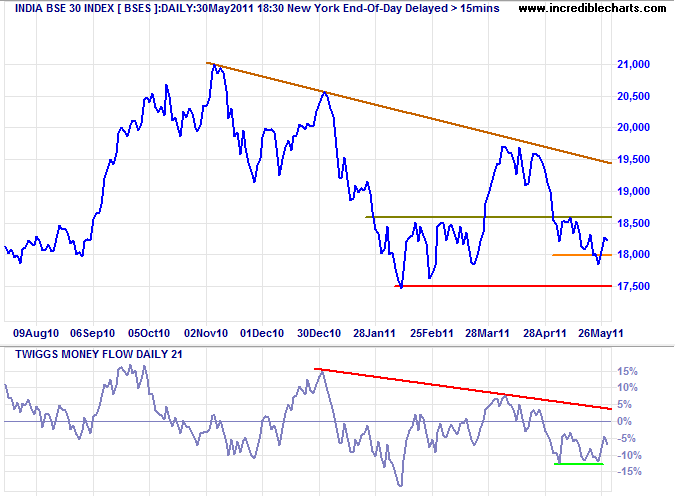

India

The Sensex recovered to test 18500 Tuesday. Breakout would indicate another bear rally, but the higher low suggests a bottom. Recovery above the descending trendline would confirm. A small bullish divergence on 21-day Twiggs Money Flow indicates short-term buying pressure.

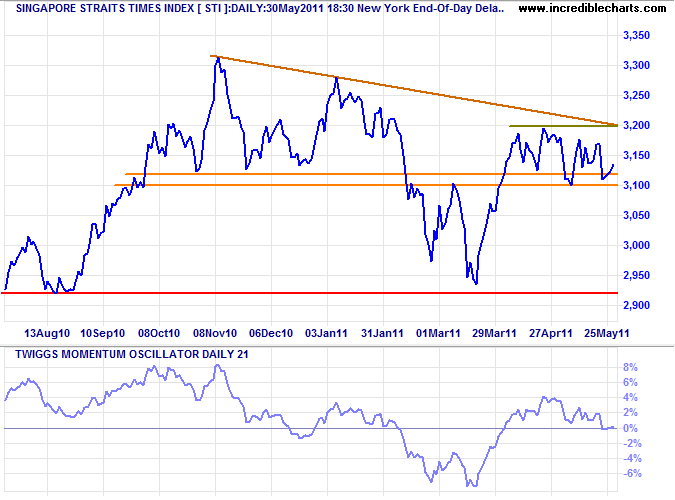

Singapore

The Straits Times Index is ranging above medium-term support at 3100. Breakout would indicate future direction: above 3200 would signal another test of 3300, while below 3100 would re-visit primary support at 2920.

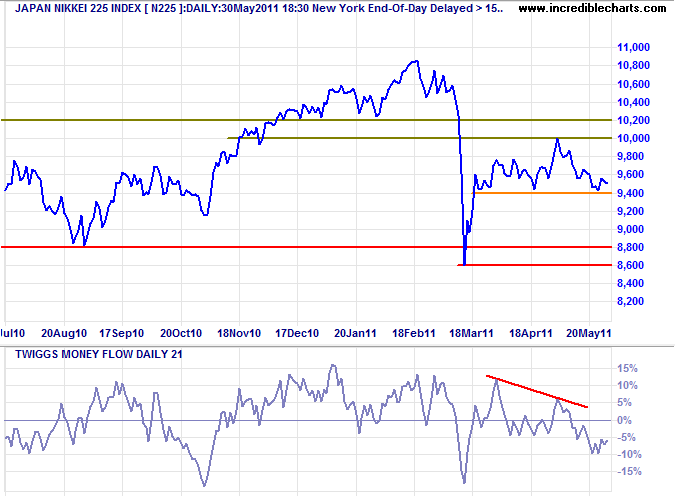

Japan

The Nikkei 225 recovered to 9700 Tuesday but 21-day Twiggs Money Flow continues to warn of selling pressure. Failure of medium-term support at 9400 would signal a correction to primary support at 8600.

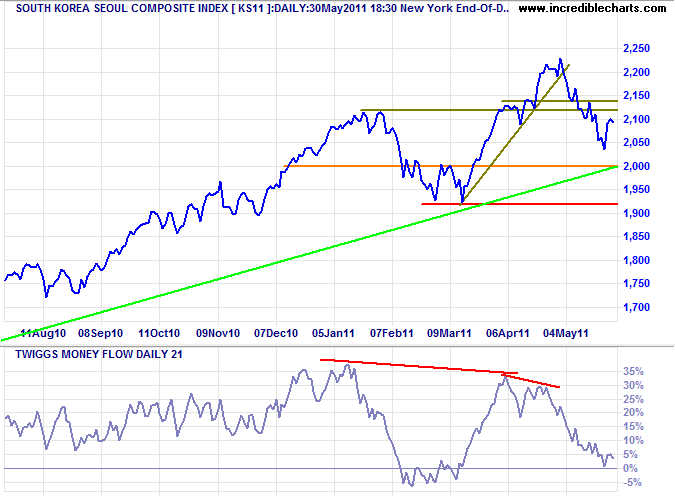

South Korea

The Seoul Composite Index is testing resistance at 2140 Tuesday; breakout would signal an advance to 2300*. Respect of the zero line by 21-day Twiggs Money Flow would support this.

* Target calculation: 2100 + ( 2100 - 1900 ) = 2300

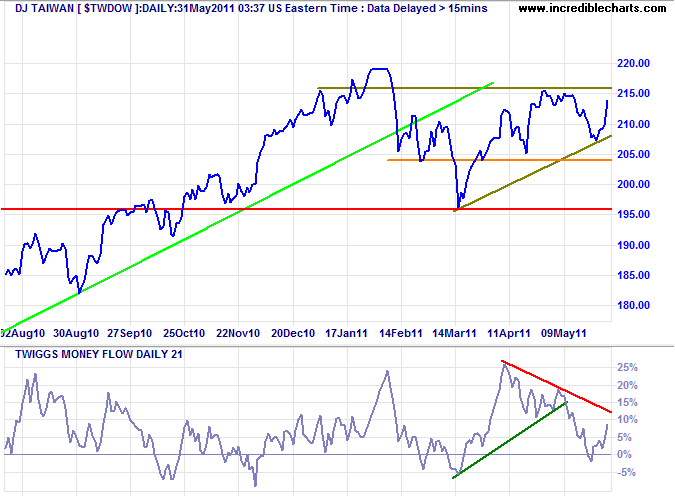

Taiwan

The Dow Jones Taiwan Index is also strengthening. Breakout above 216 would signal a fresh advance. Respect of the zero line by 21-day Twiggs Money Flow would confirm.

* Target calculation: 220 + ( 220 - 195 ) = 245

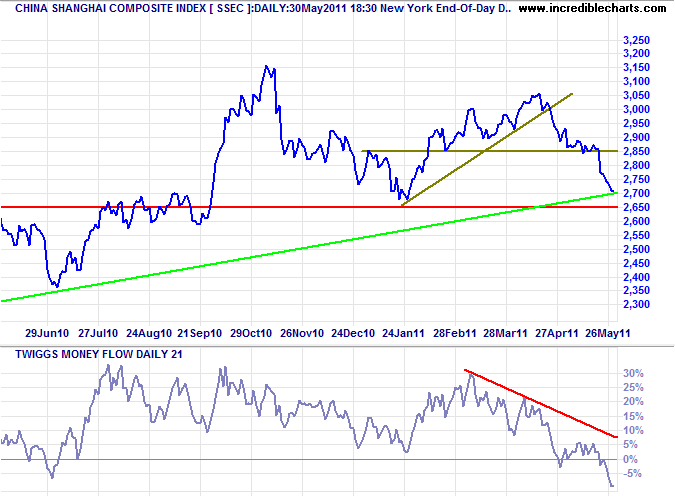

China

The Shanghai Composite Index is testing primary support at 2650. Failure would signal reversal to a primary down-trend. The sharp decline on 21-day Twiggs Money Flow indicates strong selling pressure.

* Target calculations: 3100 + ( 3100 - 2700 ) = 3500

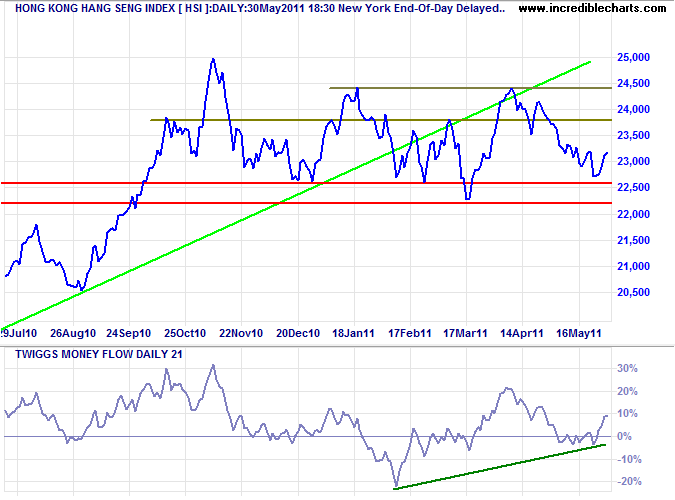

The Hang Seng Index respected primary support at 22200, rallying to 23700 Tuesday. Respect of the zero line on 21-day Twiggs Money Flow would strengthen the signal.

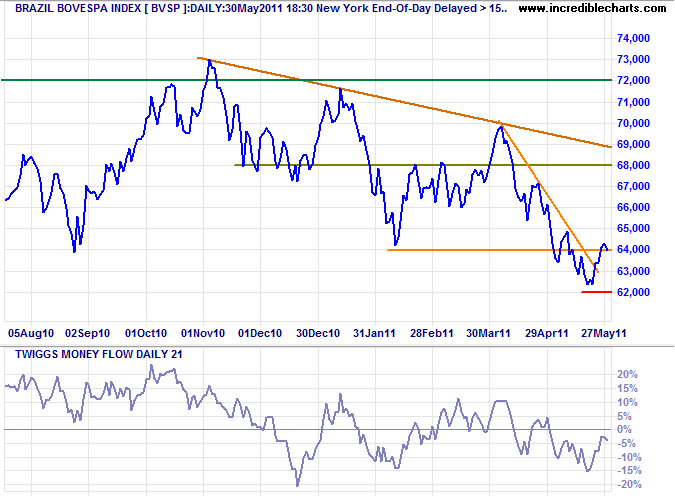

Brazil: Bovespa

The Bovespa Index is testing the new resistance level at 64000. Retreat below 64000 would confirm the decline to 58000*. Twiggs Money Flow below zero confirms strong selling pressure.

* Target calculation: 64000 - ( 70000 - 64000 ) = 58000

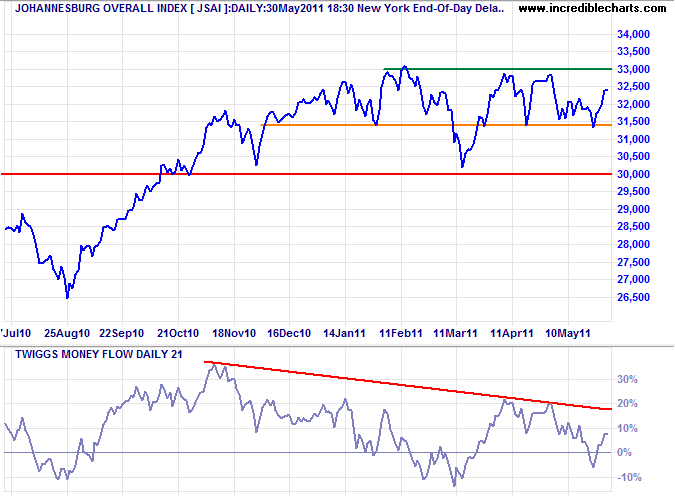

South Africa: JSE

The JSE Overall Index is headed for another test of 33000. Breakout would signal a fresh advance, but bearish divergence on 21-day Twiggs Money Flow continues to warn of selling pressure. Breach of medium-term support at 31400 would signal another test of primary support at 30000.

* Target calculation: 33000 + ( 33000 - 30000 ) = 36000

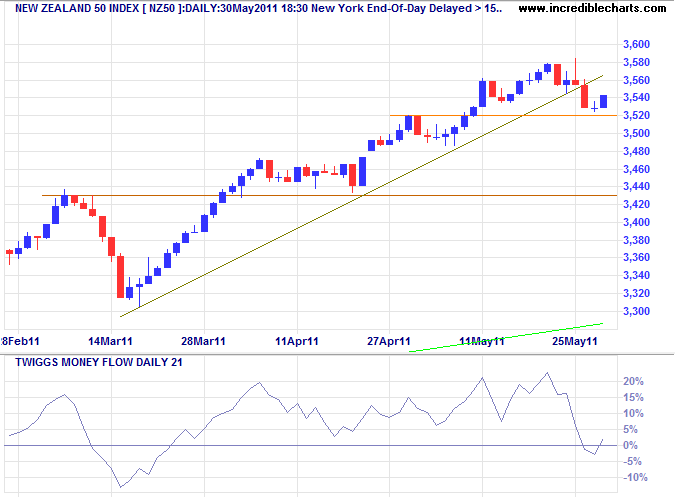

New Zealand: NZX

The NZ50 retreated below the rising trendline, warning the advance is losing momentum. Reversal below zero by 21-day Twiggs Money Flow would confirm selling pressure. Breach of 3520 would warn of a correction.

* Target calculation: 3425 + ( 3425 - 3300 ) = 3550

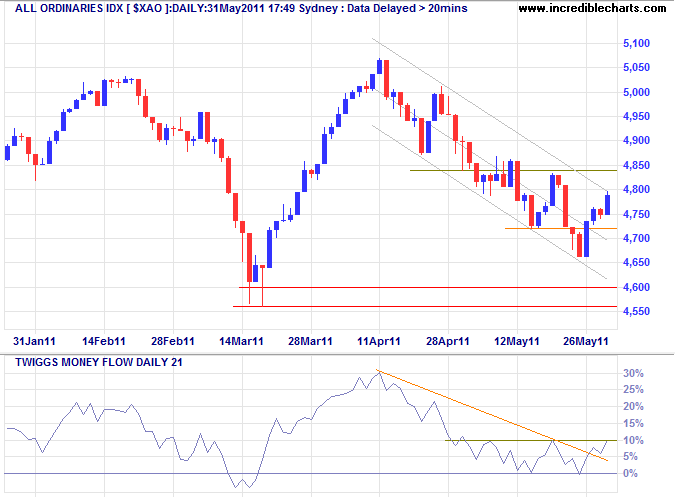

Australia: ASX

The All Ordinaries is testing its upper trend channel. Breakout above 4840 signal the correction has ended, while respect of the upper channel would test primary support around 4600. Respect of the zero line by 21-day Twiggs Money Flow would signal buying pressure.

* Target calculation: 5000 + ( 5000 - 4600 ) = 5400

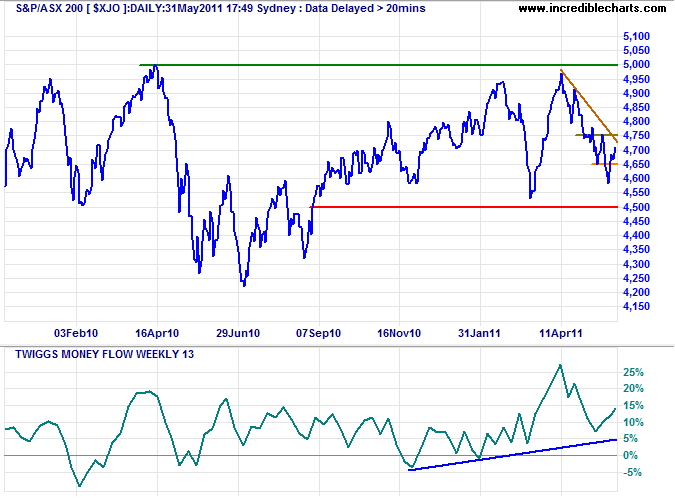

On the ASX 200, rising 13-week Twiggs Money Flow indicates buying pressure. Breach of primary support at 4500 is now unlikely.

All we have of freedom, all we use or know –

This our fathers bought for us long and long ago.

~

Rudyard Kipling, The Old Issue, 1899

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.