Asia falls as selling pressure rises

By Colin Twiggs

May 23rd, 2011 4:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

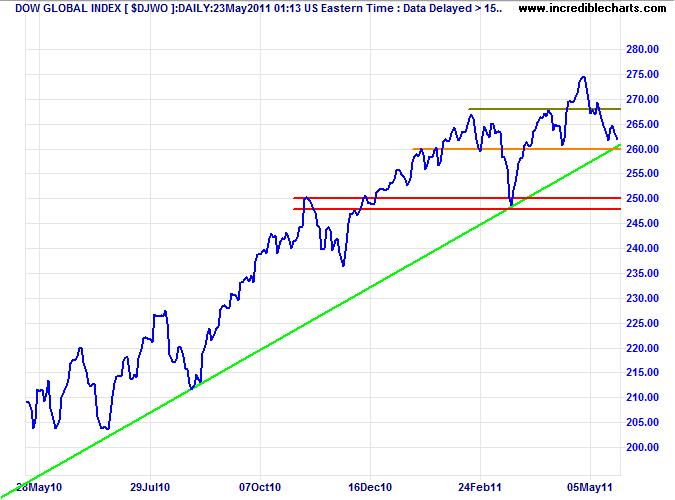

The Dow Jones Global Index is testing medium-term support at 260. Failure would confirm a correction, penetration of the long-term trendline also warning that the primary up-trend is weakening.

USA

Dow Jones Industrial Average

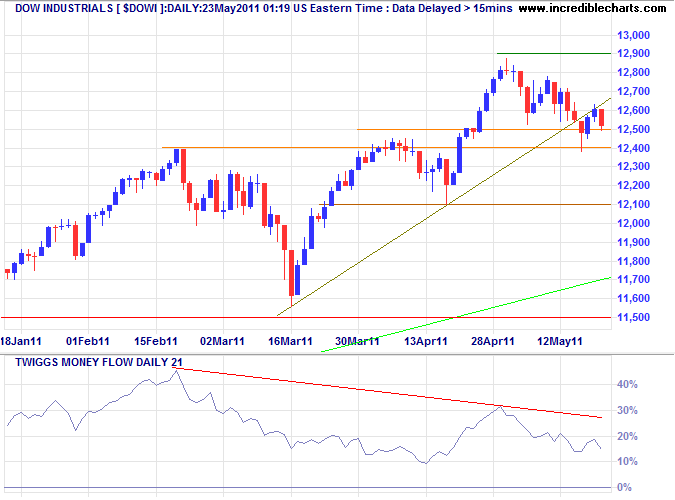

The Dow is again testing medium-term support between 12400 and 12500; failure would signal a correction. Bearish divergence on 21-day Twiggs Money Flow indicates selling pressure. Recovery above 12900 is unlikely but would indicate an advance to 13200*.

* Target calculation: 12400 + ( 12400 - 11600 ) = 13200

S&P 500

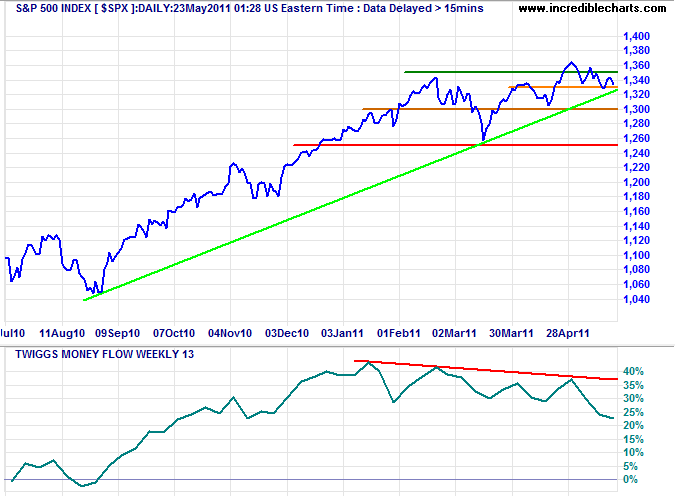

The S&P 500 is testing medium-term support at 1330; failure would confirm a correction. Breach of the rising trendline would also warn that the up-trend is weakening. Bearish divergence on 13-week Twiggs Money Flow indicates continued selling pressure. Recovery above 1350 is most unlikely, but would indicate an advance to 1450*.

* Target calculation: 1350 + ( 1350 - 1250 ) = 1450

Transport

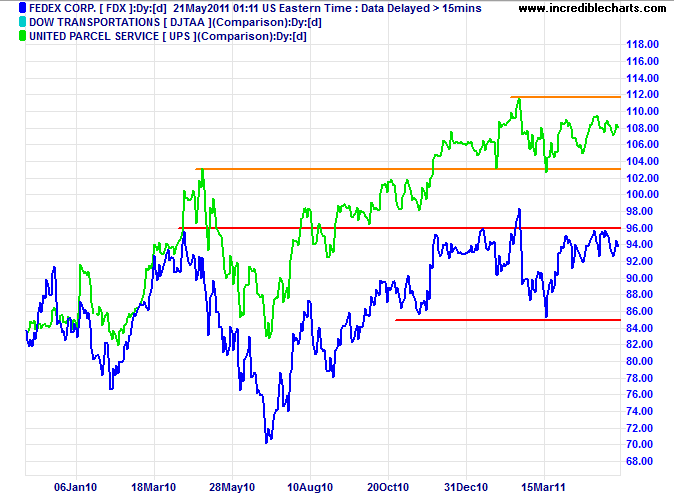

Bellwether stock Fedex continues to range between 85 and 96. Upward breakout would suggest another primary advance, while reversal below 85 would signal a primary reversal. UPS is ranging in a similar fashion; breakout would signal future direction.

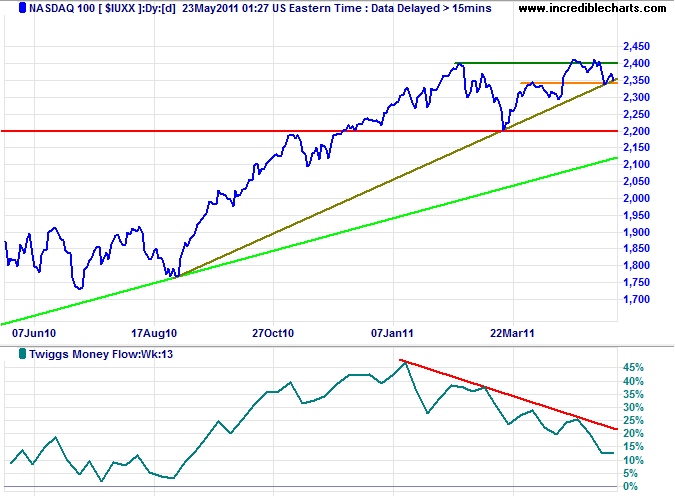

Technology

The Nasdaq 100 is testing medium-term support at 2340; breach would signal a correction to primary support at 2200 and the long-term trendline. Bearish divergence on 13-week Twiggs Money Flow continues to indicate strong selling pressure. Recovery above 2400 is unlikely but would suggest an advance to 2600*.

* Target calculation: 2400 + ( 2400 - 2200 ) = 2600

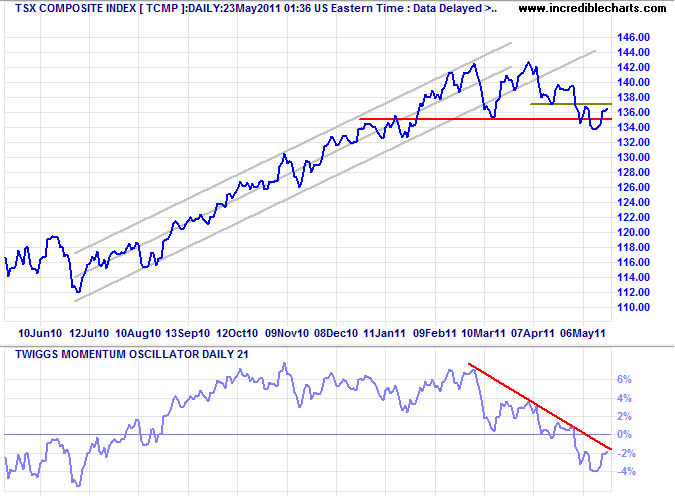

Canada: TSX

TSX Composite Index is one of the few indices looking positive. Breakout above 13700 would confirm a bear trap.

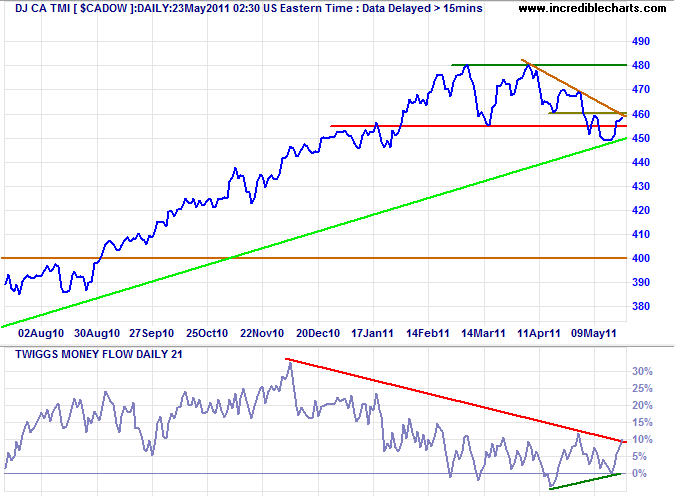

Bullish divergence on $CADOW indicates medium-term buying pressure. Reversal below 450 is unlikely but would confirm a primary reversal.

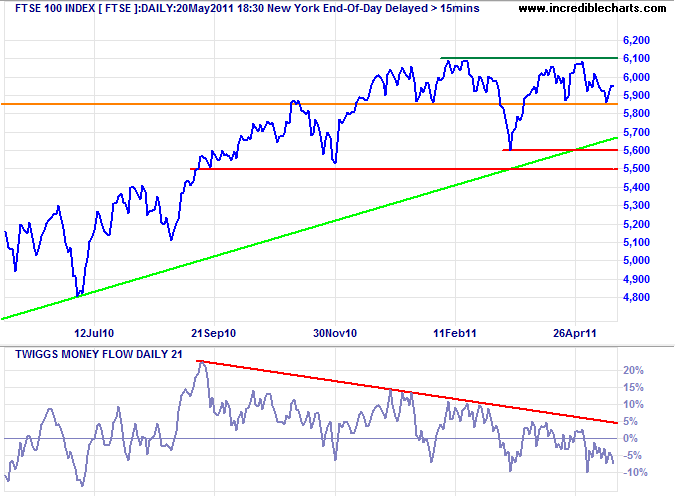

United Kingdom

The FTSE 100 warns of strong selling pressure with a large bearish divergence on 21-day Twiggs Money Flow. Failure of medium-term support at 5860 would signal a correction to test primary support at 5600.

* Target calculation: 6100 + ( 6100 - 5600 ) = 6600

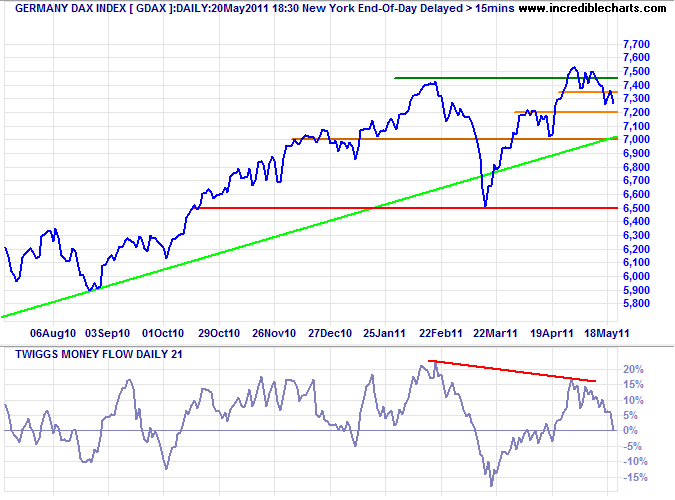

Germany

The DAX broke short-term support at 7350, warning of a correction; failure of medium-term support at 7200 would confirm. Bearish divergence on 21-day Twiggs Money Flow indicates continued selling pressure.

* Target calculation: 7500 + ( 7500 - 6500 ) = 8500

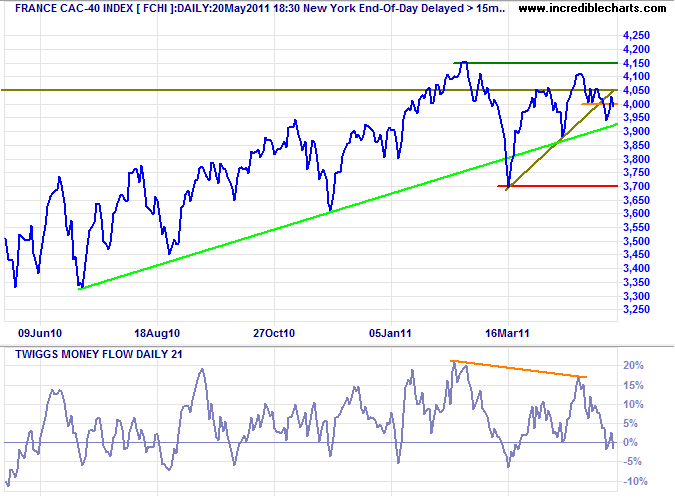

France

The CAC-40 retreated below zero on 21-day Twiggs Money Flow, warning of selling pressure. Breakout above 4150 is now unlikely, but would signal a primary advance to 4750. Breach of the long-term trendline would warn that the primary trend is losing momentum.

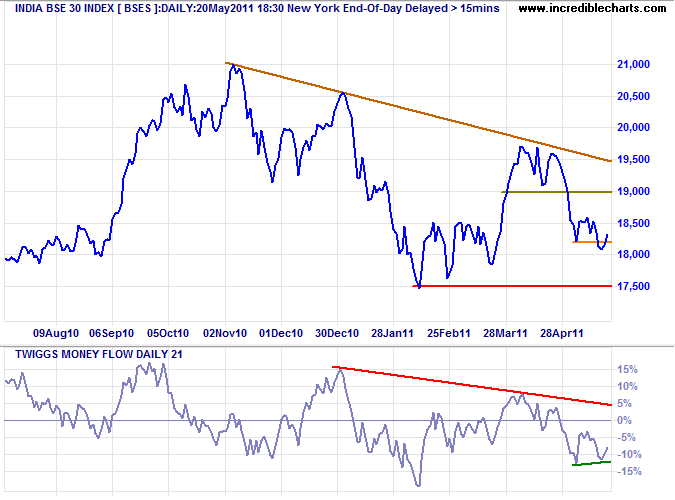

India

The Sensex fell sharply Monday to test support at 18000, 21-day Twiggs Money Flow below zero indicating continued selling pressure. Failure of 18000 would test primary support at 17500.

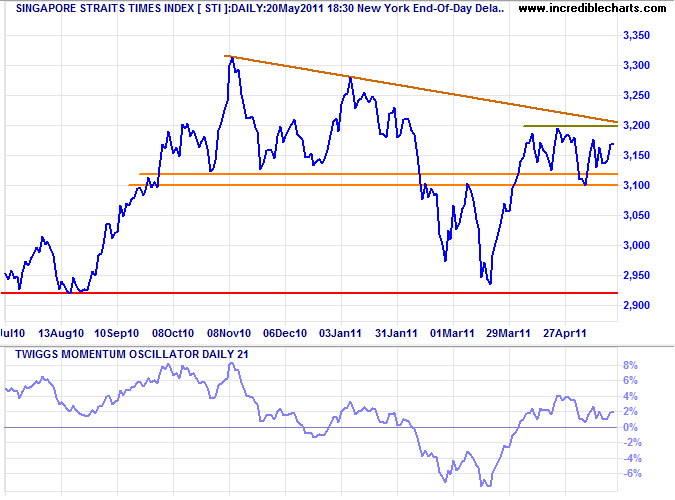

Singapore

The Straits Times Index retreated to test medium-term support at 3100 Monday. Failure would warn of another test of primary support at 2920.

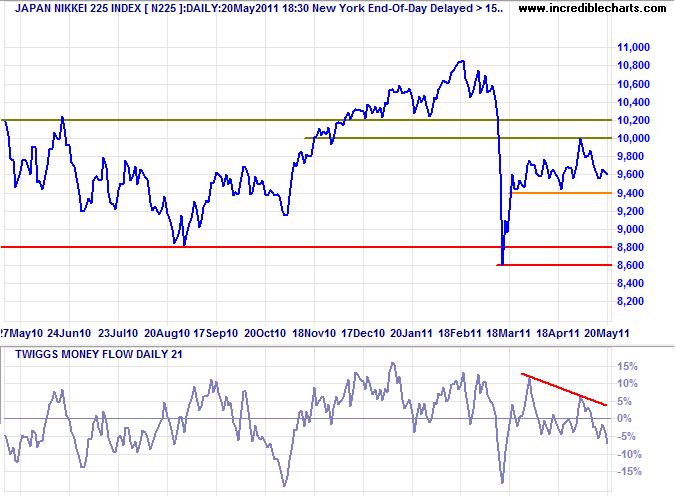

Japan

The Nikkei 225 displays medium-term selling pressure, with a bearish divergence on 21-day Twiggs Money Flow. Failure of medium-term support at 9400 would warn of a correction to primary support at 8600. The primary trend remains down and intervention by the BOJ is unlikely to change this.

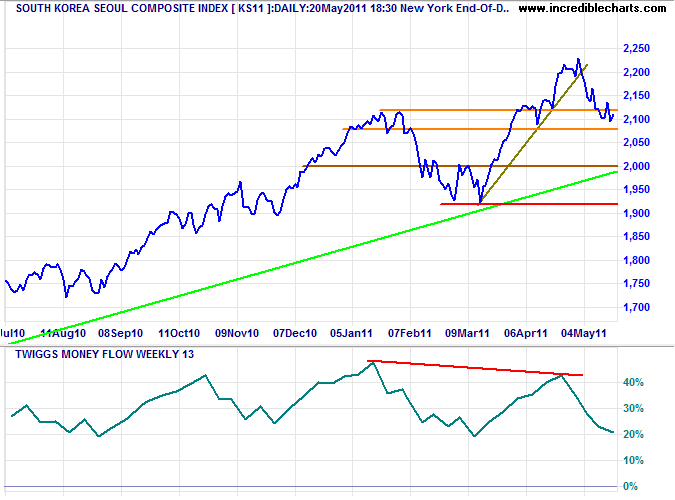

South Korea

The Seoul Composite Index broke through the band of support around 2100 Monday, signaling a correction to the long-term trendline at 2000. Bearish divergence on 13-week Twiggs Money Flow warns of a reversal.

* Target calculation: 2100 + ( 2100 - 1950 ) = 2250

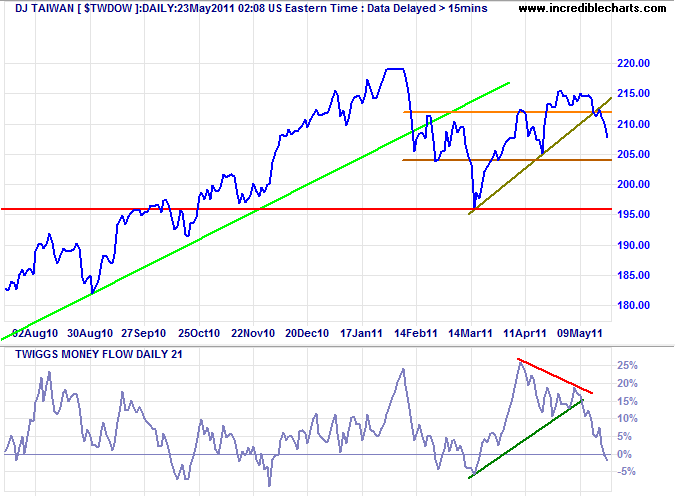

Taiwan

The Dow Jones Taiwan Index retreated below its new support level at 212, warning of weakness. Bearish divergence on 21-day Twiggs Money Flow indicates medium-term selling pressure. Expect another test of primary support at 196.

* Target calculation: 220 + ( 220 - 195 ) = 245

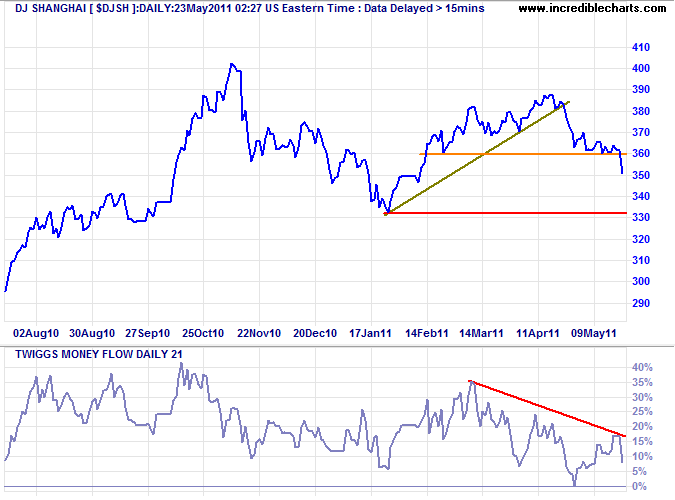

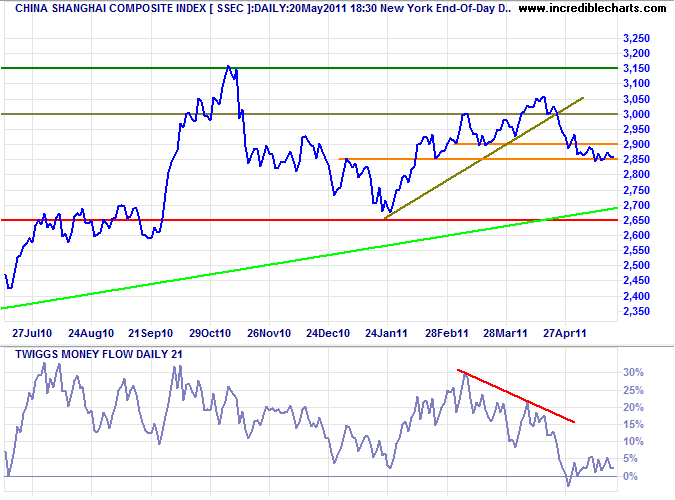

China

The Dow Jones Shanghai Index broke medium-term support at 360 Monday, headed for a test of primary support at 330.

The Shanghai Composite Index broke support at 2850 Monday; signaling a correction to primary support at 2650. Bearish divergence on 21-day Twiggs Money Flow indicates selling pressure.

* Target calculations: 3100 + ( 3100 - 2700 ) = 3500

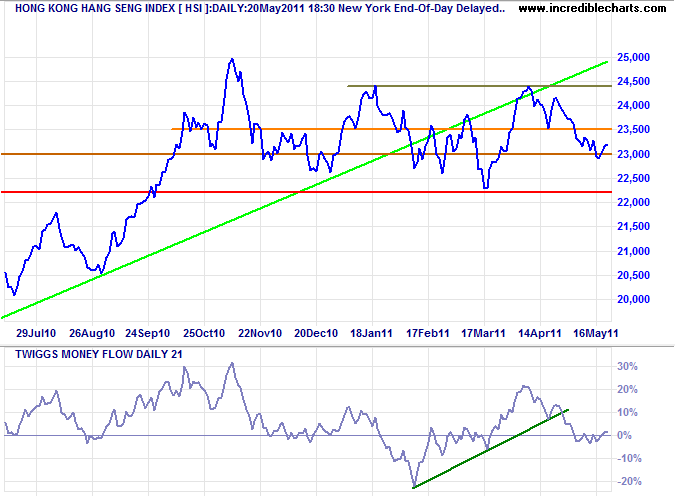

The Hang Seng Index broke support at 23000 Monday, headed for a test of primary support at 22200.

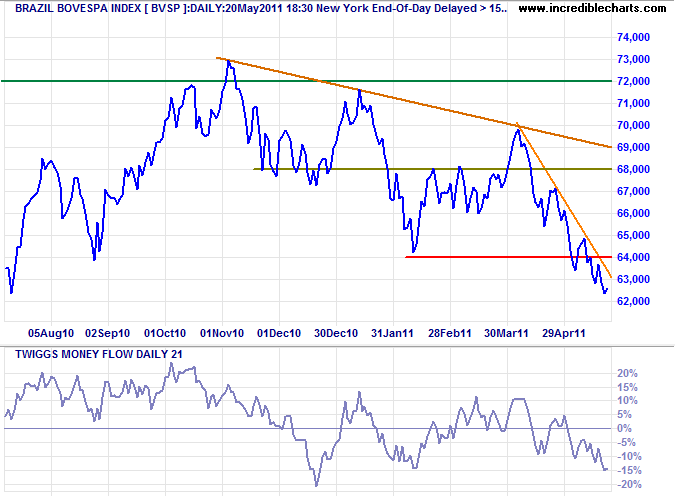

Brazil: Bovespa

The Bovespa Index below primary support at 64000 signals a primary decline with a target of 58000*. Twiggs Money Flow below zero indicates strong selling pressure.

* Target calculation: 64000 - ( 70000 - 64000 ) = 58000

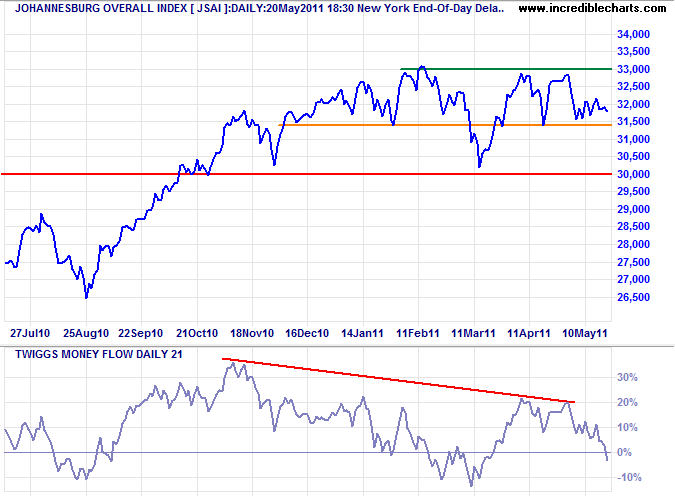

South Africa: JSE

The JSE Overall Index displays selling pressure on 21-day Twiggs Money Flow, with a bearish divergence and fall below zero. Breach of medium-term support at 31400 would signal a correction to primary support at 30000.

* Target calculation: 33000 + ( 33000 - 30000 ) = 36000

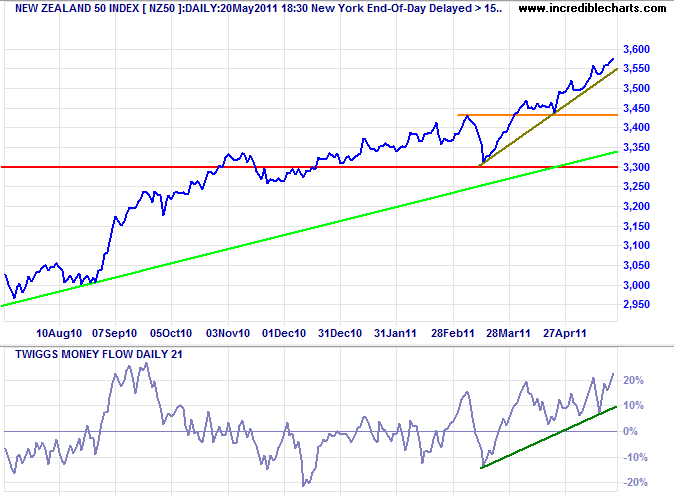

New Zealand: NZX

The NZ50 remains positive, with rising 21-day Twiggs Money Flow indicating buying pressure. Breach of the rising trendline, however, would warn of a correction; failure of medium-term support at 3425 would confirm.

* Target calculation: 3425 + ( 3425 - 3300 ) = 3550

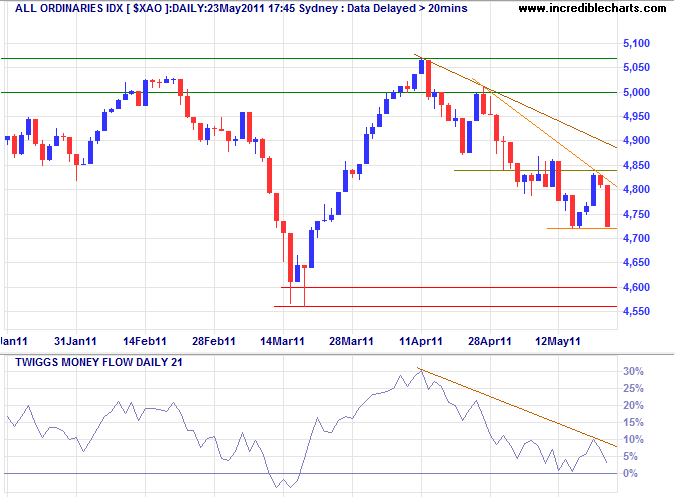

Australia: ASX

The All Ordinaries is testing short-term support at 4725; failure would test primary support around 4600. Declining 21-day Twiggs Money Flow indicates medium-term selling pressure.

* Target calculation: 5000 + ( 5000 - 4600 ) = 5400

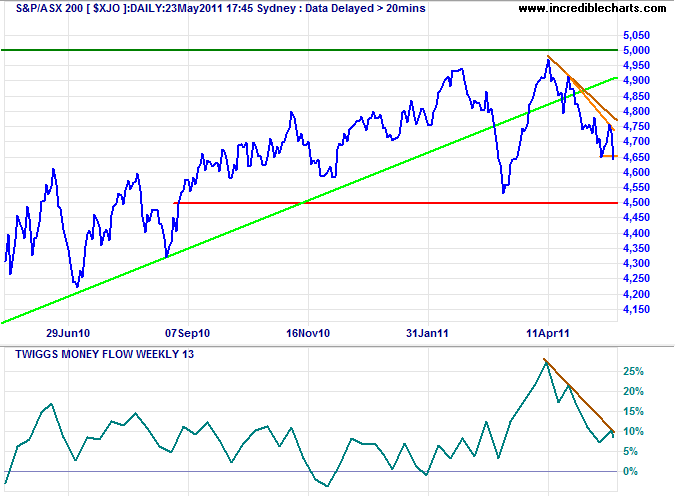

In the longer term, ASX 200 breach of support at 4500 would signal a primary trend reversal. Penetration of the long-term trendline already shows that the index has lost momentum.

If you do not change direction, you may end up where you are heading.

~

Lao Tzu: Tao-Te Ching

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.