Commodity weakness strengthens the greenback

By Colin Twiggs

May 11th, 2011 8:00 p.m. ET (10:00 a:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

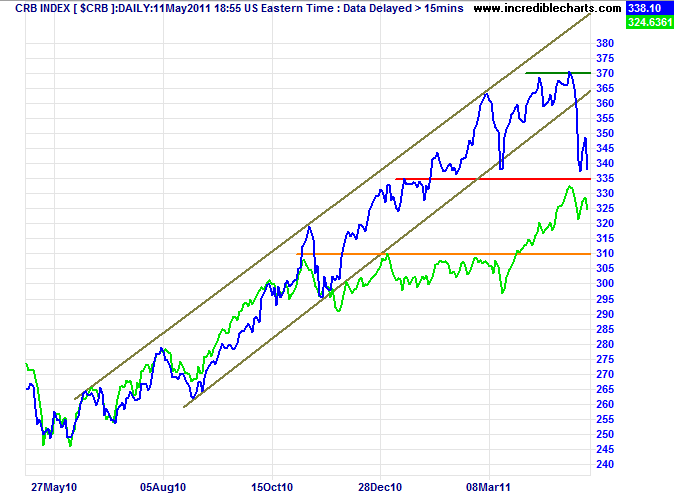

Commodities

The CRB Commodities Index is testing primary support at 335 after breaking out of its trend channel. Failure would signal a primary down-trend. The Australian Dollar is weakening in response.

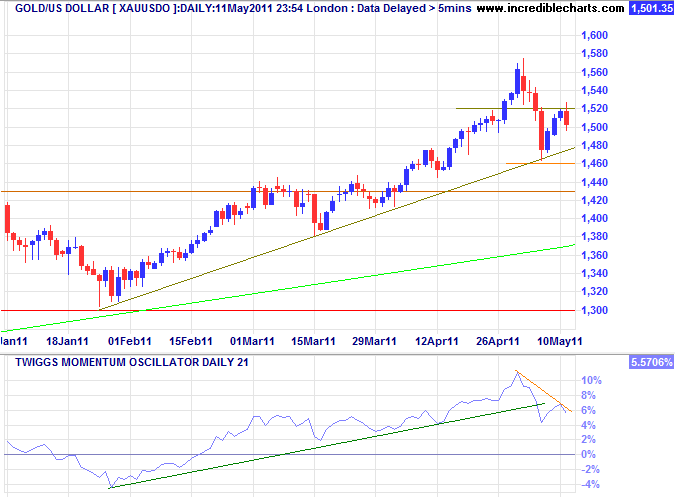

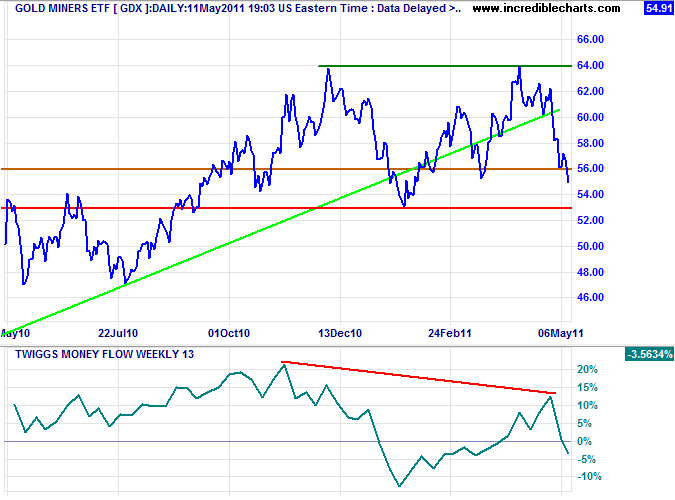

Gold

Gold established short-term support at $1460, near the rising trendline. Failure of support would signal a correction; confirming the warning from declining Twiggs Momentum.

* Target calculation: 1430 + ( 1430 - 1310 ) = 1550

The Gold Miners ETF is already undergoing a correction. Bearish divergence on 13-week Twiggs Money Flow followed by a retreat below zero warns of reversal to a primary down-trend. Breach of support at 53.00 would confirm. Gold miners often lead trend changes on the physical metal.

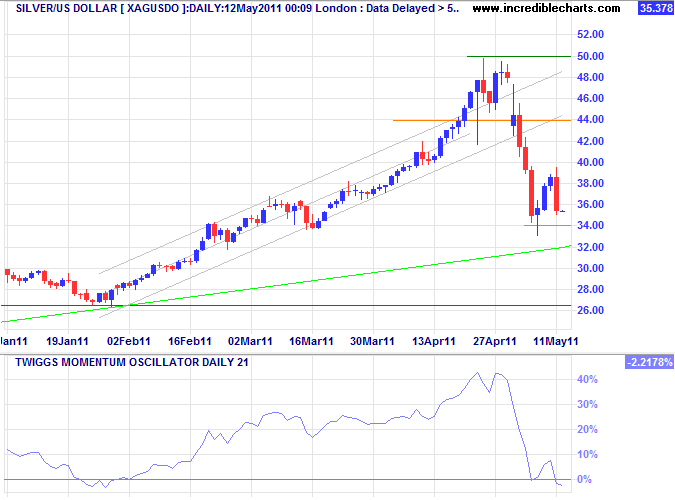

Silver

Silver is testing short-term support at $34. Failure would signal a test of primary support around $26.

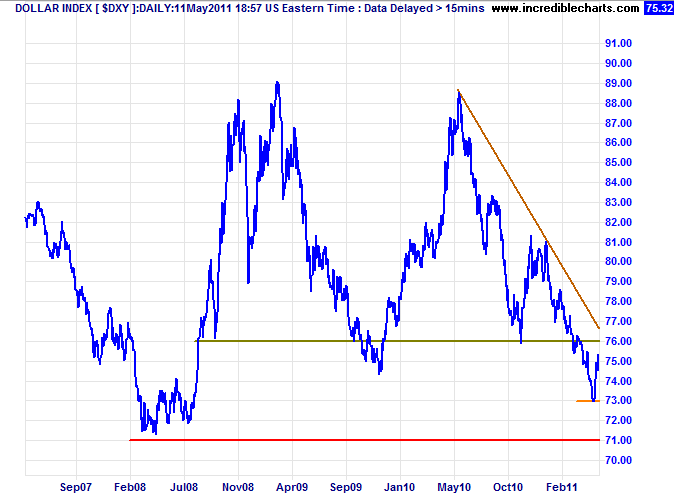

US Dollar Index

The Dollar index rallied but remains in a strong down-trend, headed for a test of long-term support at 71*. Expect resistance at 76.

* Target calculation: 76 - ( 81 - 76 ) = 71

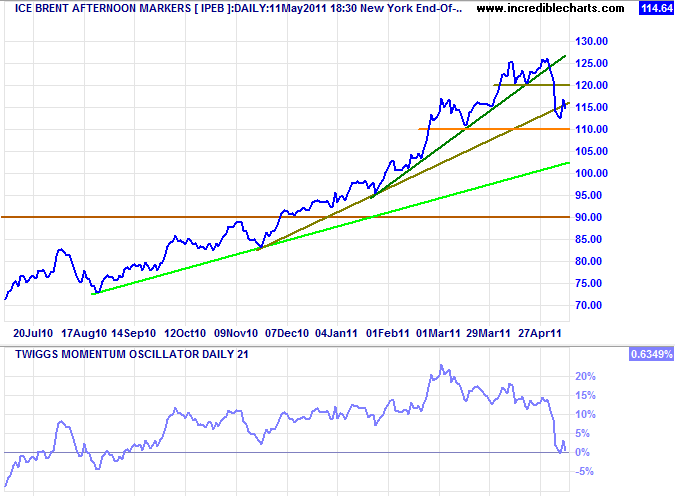

Crude Oil

Brent crude is testing support at $110/barrel. Failure would indicate a test of the long-term trendline around $100/barrel.

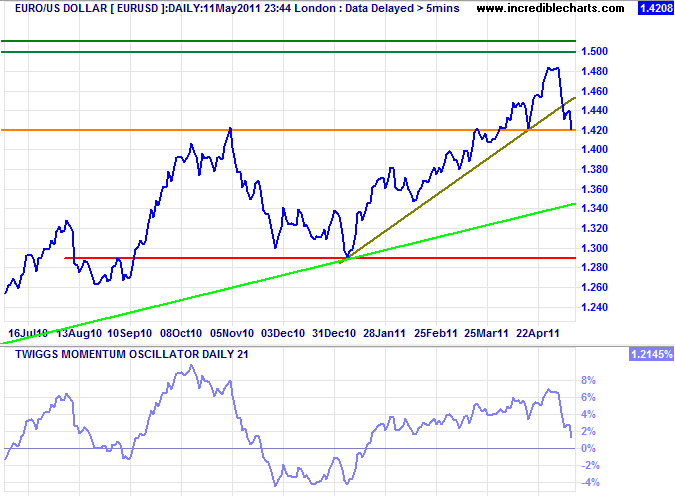

Euro

The euro is testing support at $1.42. Failure would warn of a correction to the long-term trendline.

* Target calculation: 1.40 + ( 1.40 - 1.30 ) = 1.50

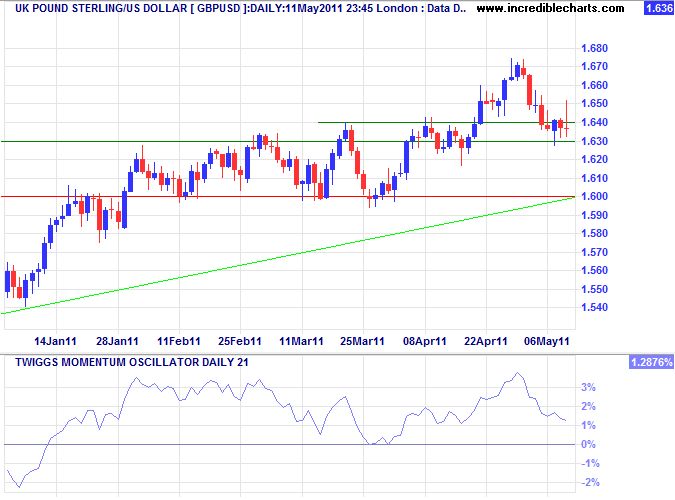

UK Pound Sterling

The pound broke is testing the new support level at $1.63. The tall shadow on today's candle warns of short-term selling pressure. Failure of support would test $1.60, while respect would confirm an advance to the 2009 high at $1.70*. Another Twiggs Momentum trough above zero would indicate trend strength.

* Target calculation: 1.63 + ( 1.63 - 1.53 ) = 1.73

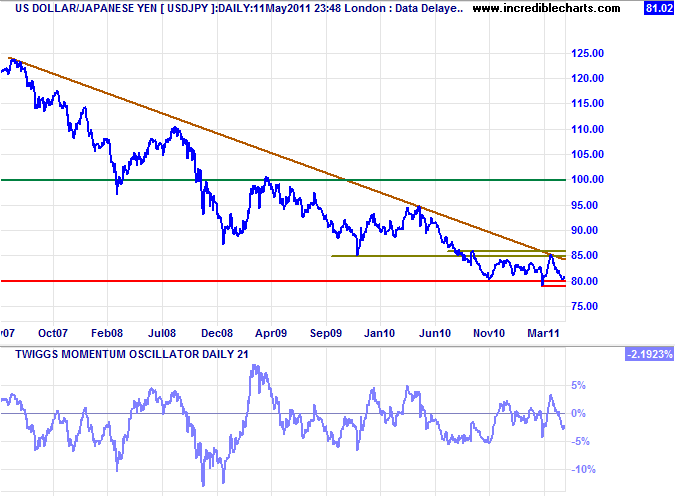

Japanese Yen

The dollar is testing long-term support between ¥79 and ¥80. Respect would indicate another test of resistance at ¥85 to ¥86, while failure of support would warn of a decline to ¥75*.

* Target calculation: 80 - ( 85 - 80 ) = 75;

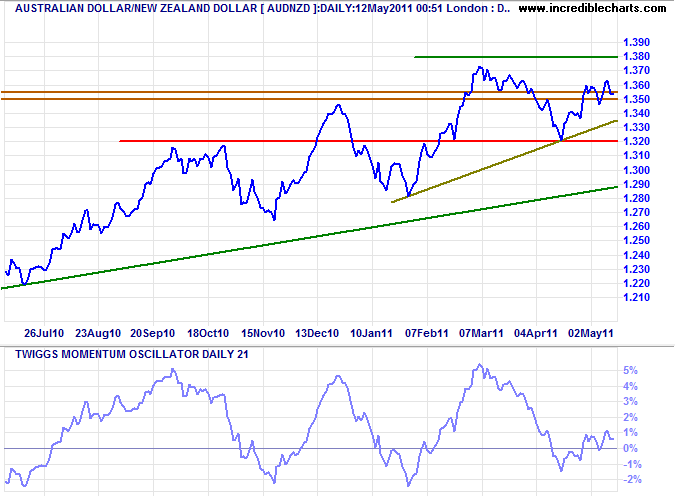

New Zealand Dollar

The Australian dollar remains in an up-trend against its kiwi counterpart, but long-term resistance (from the high in 2000) at $1.3500/$1.3550 impedes progress. Failure of support at $1.3200 would warn of a reversal, while breakout above $1.3800 would confirm another primary advance.

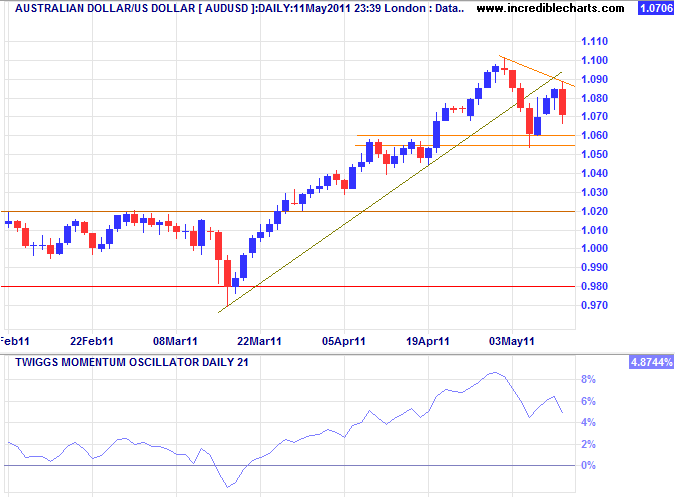

Australian Dollar

The Aussie dollar is testing support at $1.06. Failure would signal a correction, with a target of $1.02.

A leader is best when people barely know he exists. When his work is done, his aim fulfilled, they will say: we did it ourselves.

~ Lao Tzu: Tao Te Ching

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.