Commodity blow-off shakes market

By Colin Twiggs

May 5th, 2011 9:00 p.m. ET (11:00 a:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

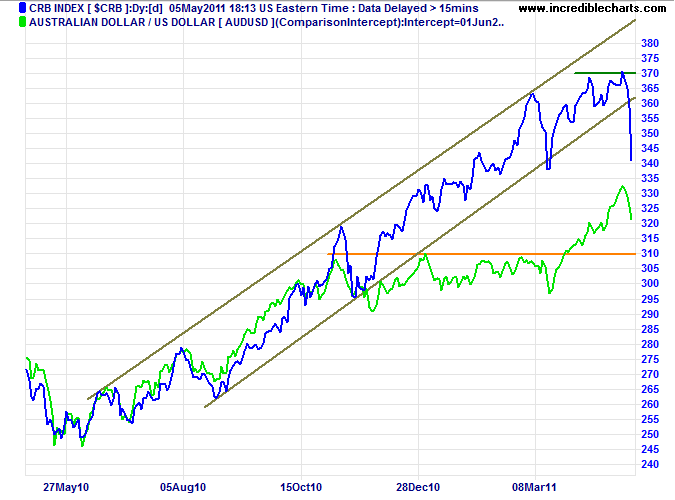

Commodities

The CRB Commodities Index broke out of its trend channel, warning that the trend has lost momentum and is close to an end. The Australian Dollar reacted accordingly.

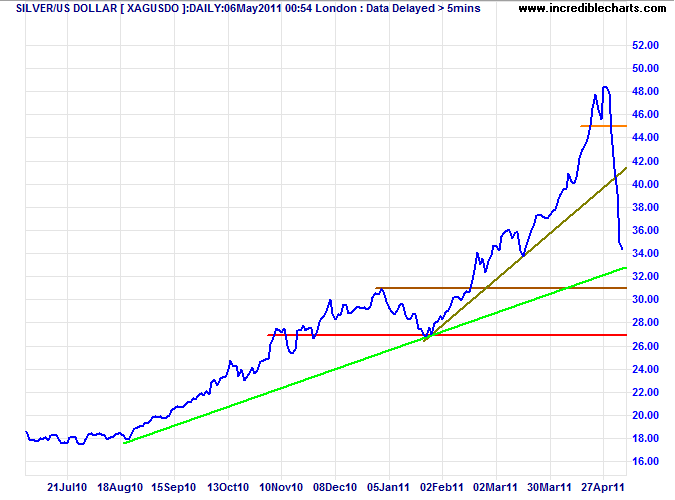

Silver

An early sign of weakness was the blow-off of silver after the accelerating up-trend met profit-taking at $50.

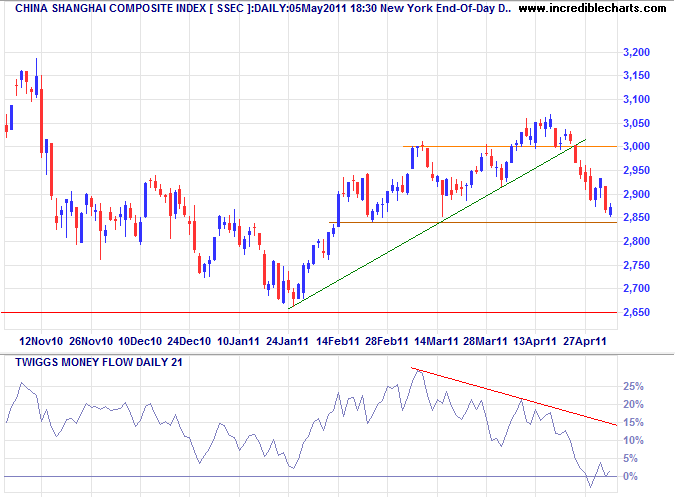

Another contributing factor is the weakening of Asian markets, especially China. The Shanghai Composite Index reversed below 3000 and its rising trendline, warning of a correction. Failure of support at 2850 would test support at 2650, threatening a primary trend reversal. Bearish divergence on 21-day Twiggs Money Flow indicates selling pressure.

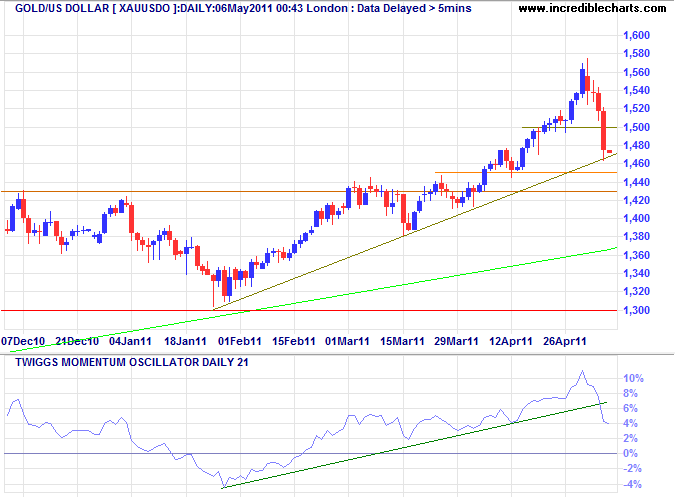

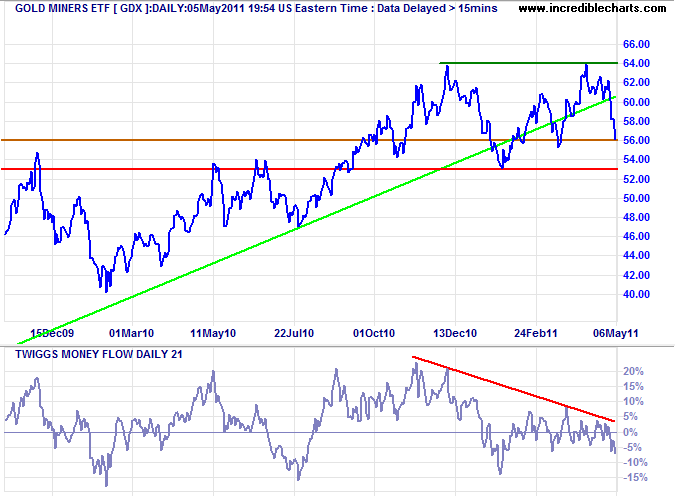

Gold

Gold has been shaken by the fall in commodities, especially silver and crude. Penetration of the rising trendline would warn of a correction to test the long-term trendline around $1400.

* Target calculation: 1430 + ( 1430 - 1310 ) = 1550

The Gold Miners Index often leads the physical metal and has penetrated its long-term trendline, warning of a reversal. Breach of support at 53.00 would confirm. Bearish divergence on 21-day Twiggs Money Flow indicates selling pressure.

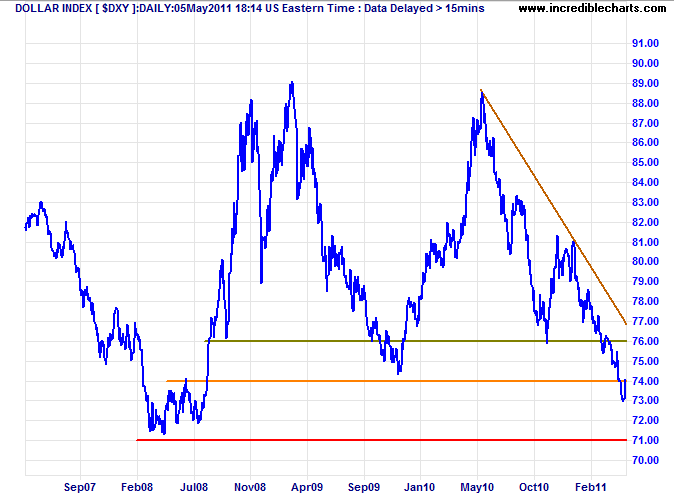

US Dollar Index

The Dollar index recovered slightly, but remains in a strong down-trend, headed for a test of support at 71*.

* Target calculation: 76 - ( 81 - 76 ) = 71

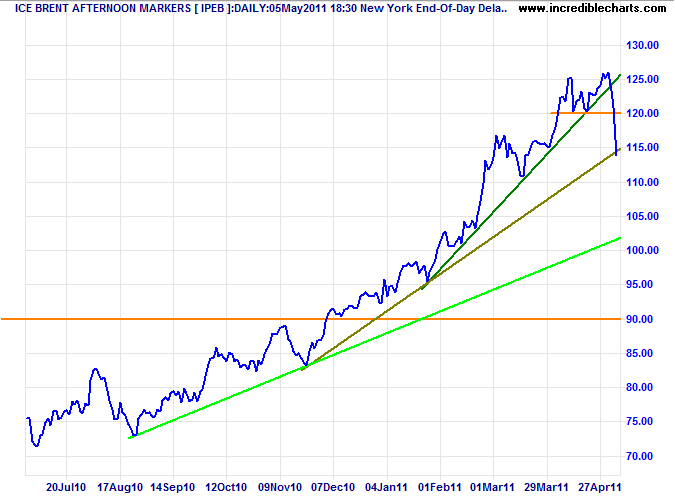

Crude Oil

Brent crude also experienced a blow-off and is headed for a test of the long-term trendline around $100/barrel.

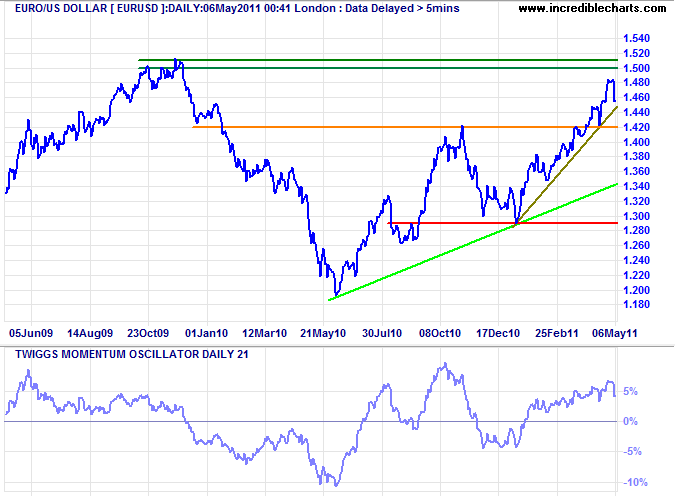

Euro

The euro retraced sharply. Penetration of support at $1.42 would warn of a correction to test the long-term trendline.

* Target calculation: 1.40 + ( 1.40 - 1.30 ) = 1.50

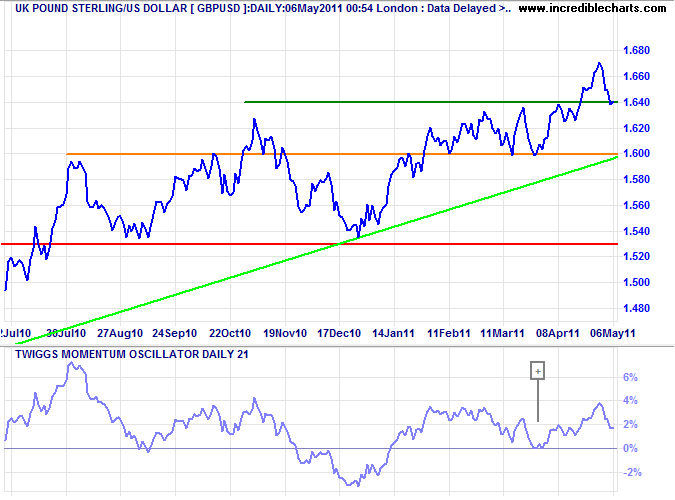

UK Pound Sterling

The pound broke is testing the new support level at $1.64. respect would signal an advance to the 2009 high at $1.70*. Another Twiggs Momentum trough above zero would confirm trend strength.

* Target calculation: 1.63 + ( 1.63 - 1.53 ) = 1.73

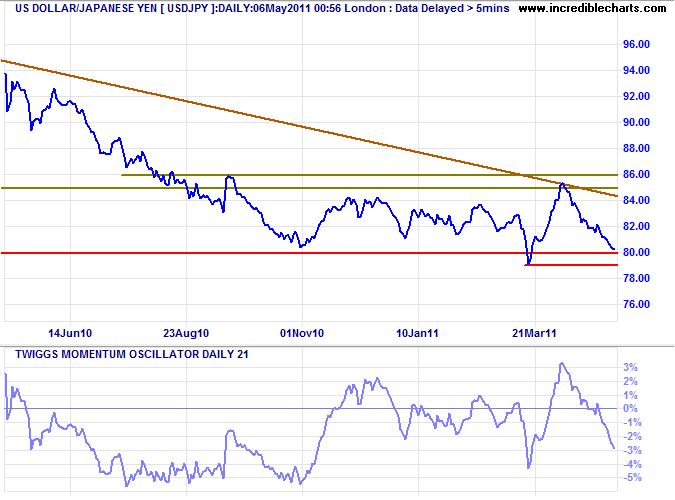

Japanese Yen

The dollar is testing long-term support between ¥79 and ¥80. Respect of support would indicate that the BOJ has succeeded in its attempt to protect exporters. Failure would offer a target of 75*.

* Target calculation: 80 - ( 85 - 80 ) = 75;

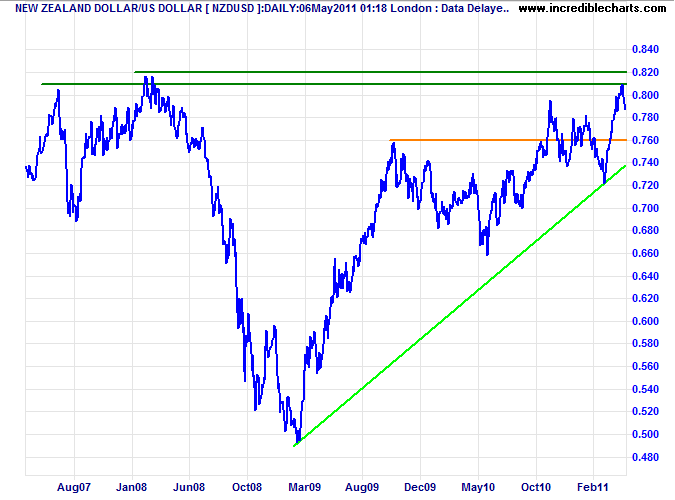

New Zealand Dollar

The kiwi dollar encountered resistance above $0.80. Expect a test of the rising trendline and support at $0.76.

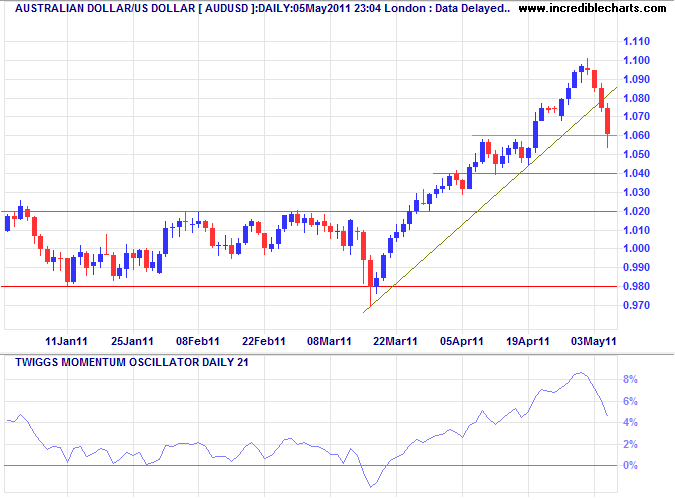

Australian Dollar

The Aussie dollar broke broke its medium-term trendline, warning of a correction. Failure of support at $1.06 would confirm, offering a target of $1.02.

Thus with all things — some are increased by taking away; while some are diminished by adding on.

~ Lao Tzu: Tao Te Ching

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.