Aussie breakout while gold stalls

By Colin Twiggs

March 30th, 2011 11:00 p.m. ET (2:00 p:m AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

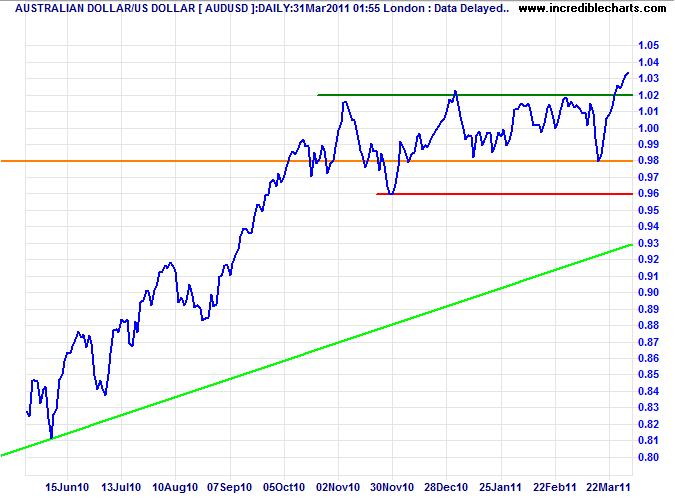

Australian Dollar

The Aussie dollar broke through resistance at $1.02, signaling an advance to $1.06*. Retracement is likely to test the new support level.

* Target calculation: 1.02 + ( 1.02 - 0.98 ) = 1.06

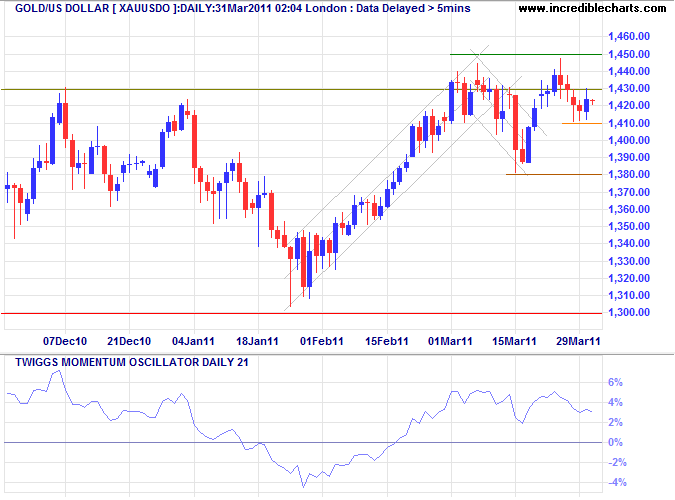

Gold

Gold hesitated below $1450 as crude oil weakened and the dollar rallied, but now looks ready to resume its advance to $1500*. Another Twiggs Momentum (21-day) trough above zero would strengthen the signal. Breakout above $1450 would confirm, while failure of short-term support at $1410 would weaken the signal.

* Target calculation: 1400 + ( 1400 - 1300 ) = 1500

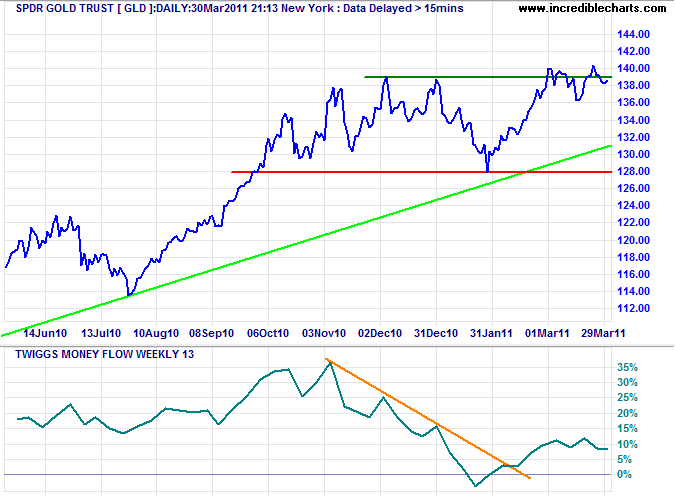

On GLD, a 13-week Twiggs Money Flow trough above zero would confirm another advance.

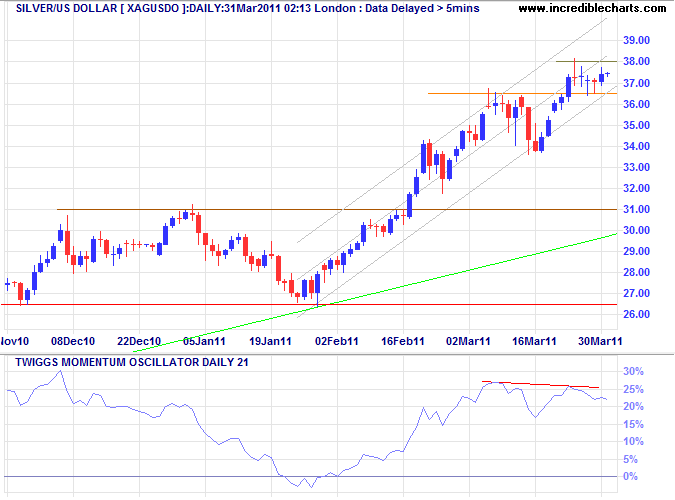

Silver

Silver is consolidating above support at $36.50 — a bullish sign — and breakout above $38 would indicate a test of the upper trend channel. Breakout below the trend channel would, however, confirm the bearish divergence on Twiggs Momentum, warning of a correction.

* Target calculation: 36.50 + ( 36.50 - 33.50 ) = 39.50

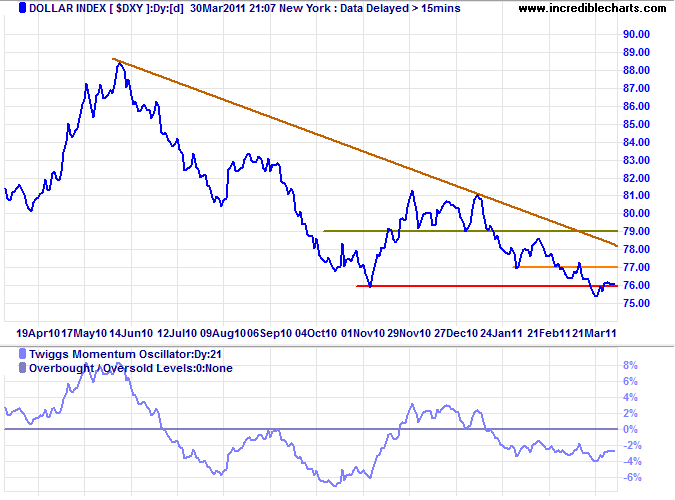

US Dollar Index

The US Dollar Index retraced to test resistance, but is now weakening. Reversal below 76 would signal a decline to 71* — a bullish sign for gold. Twiggs Momentum holding below zero suggests the down-trend will continue.

* Target calculation: 76 - ( 81 - 76 ) = 71

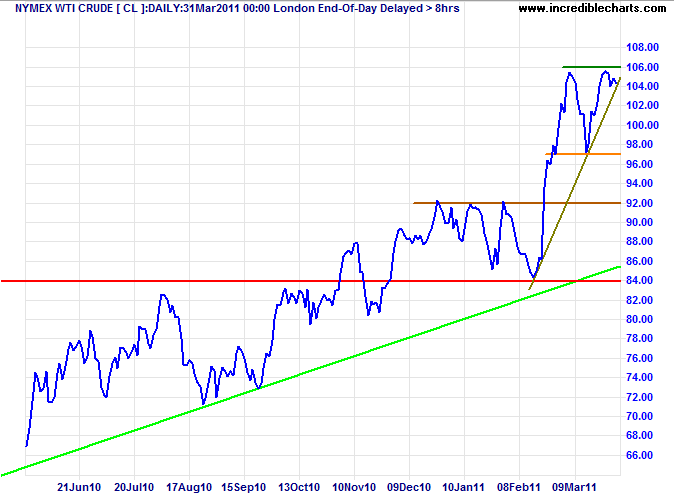

Crude Oil

Nymex WTI crude is consolidating below resistance at $106/barrel. Narrow consolidation would be a bullish sign. Reversal below $97 is unlikely at present, but would warn of a correction back to the long-term trend line. Upward breakout would boost gold in the short/medium-term.

* Target calculation: 105 + ( 105 - 97 ) = 113

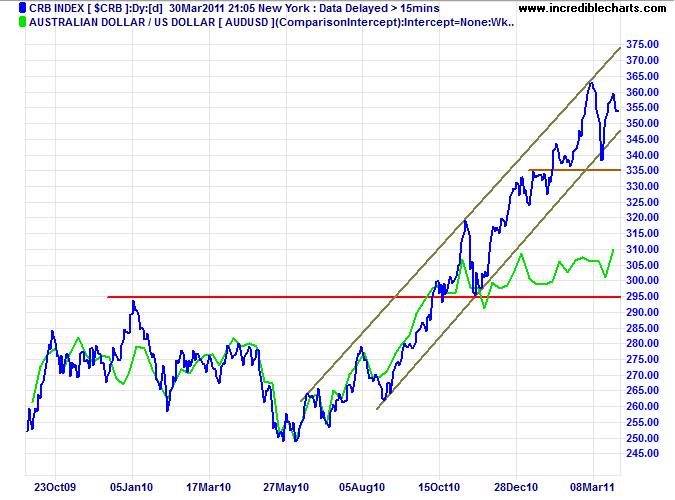

Commodities

The CRB Commodities Index has also weakened slightly. Reversal below 335 is unlikely but would be a bear warning for the Australian Dollar.

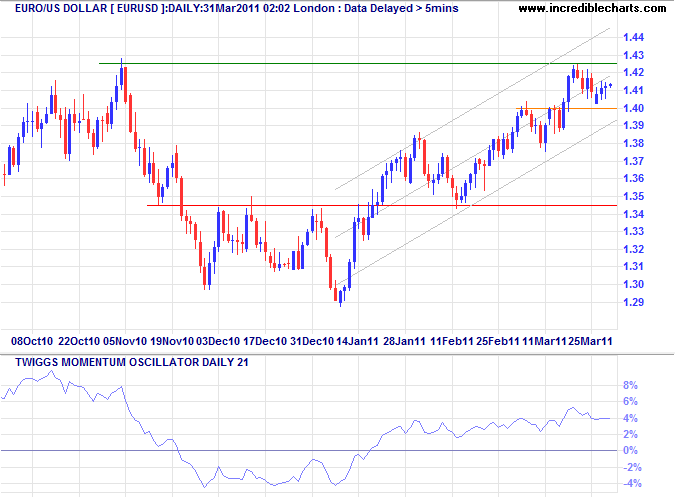

Euro

The euro is testing resistance between $1.42 and $1.43. Breakout would offer a target of $1.54*. Twiggs Momentum holding above zero suggests the up-trend will continue.

* Target calculation: 1.42 + ( 1.42 - 1.30 ) = 1.54

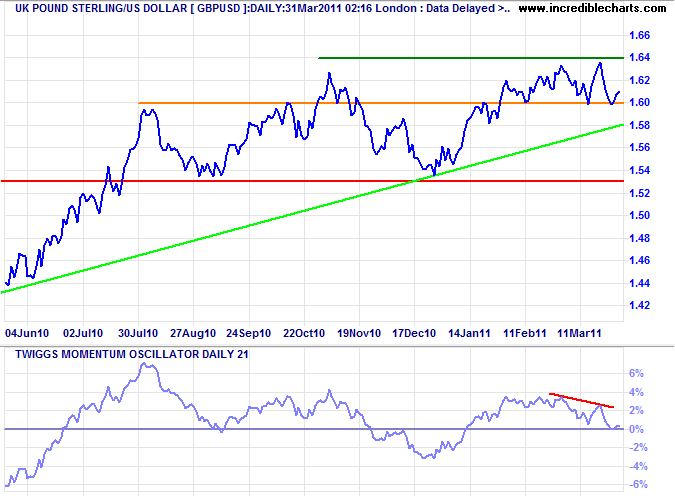

UK Pound Sterling

The pound is consolidating between $1.60 and $1.64. Upward breakout would offer a target of the 2009 high at $1.70*. Declining Momentum, however, warns of weakness and failure of support at $1.60 would test primary support at $1.53.

* Target calculation: 1.63 + ( 1.63 - 1.53 ) = 1.73

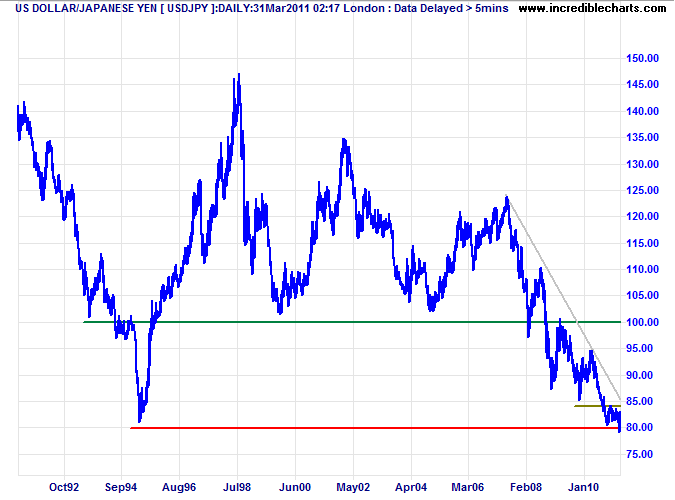

Japanese Yen

The dollar ranging between ¥80 and ¥84 — with a bit of help from the G7. The primary trend remains down. Failure of support is likely to encounter further intervention, but the target remains at ¥76*.

* Target calculation: 80 - ( 84 - 80 ) = 76;

In the spring of 2003 there was worldwide concern that the U.S. economy was falling into a "Japanese-like" malaise; the recovery was stalling, deflation was likely to occur and unemployment was too high. This was the prevailing view despite the fact that the U.S. economy was growing at a 3.2 percent annual rate and the global economy's average growth was nearly 3.6 percent. In addition, the fed funds policy rate was 1¼ percent...... in June 2003 it was lowered further to 1 percent and was left at that rate for nearly a year, as insurance. Following this action, the United States and the world began an extended credit expansion and housing boom...... The long-term consequences of that policy are now well known.

~ Retiring Fed member, Thomas Hoenig

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.