Gold breakout imminent

By Colin Twiggs

March 24th, 2011 4:00 a.m. ET (7:00 p:m AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

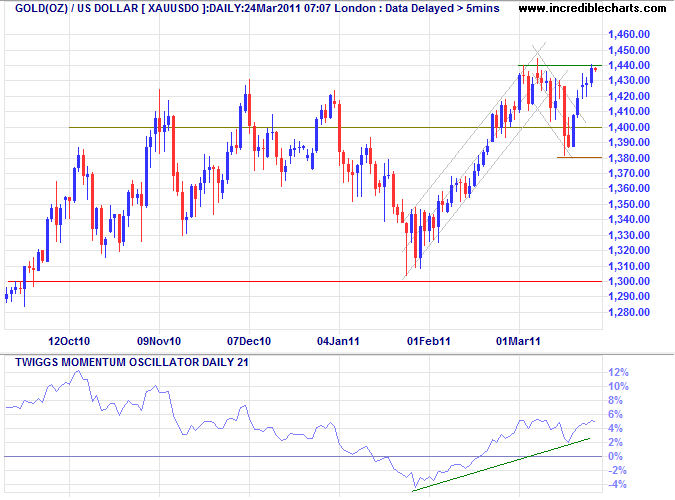

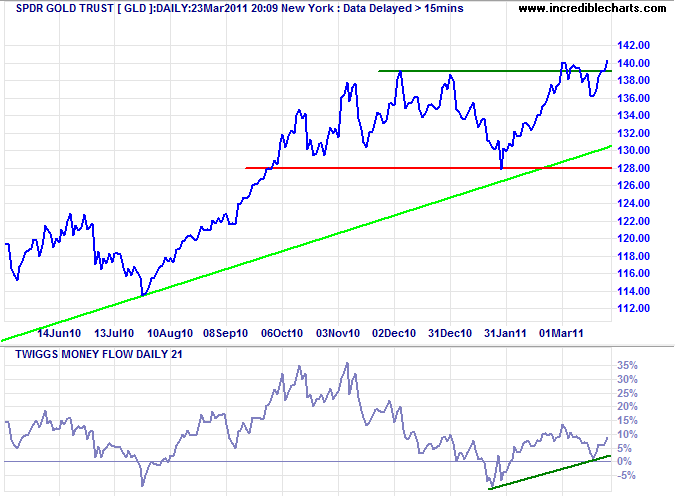

Gold

Gold rallied off support at $1380 and is testing resistance at $1440. Breakout would signal a primary advance to $1500*. Twiggs Momentum (21-day) respected zero, suggesting another advance.

* Target calculation: 1400 + ( 1400 - 1300 ) = 1500

The recent dip on 21-day Twiggs Money Flow also respected the zero line, signaling buying pressure.

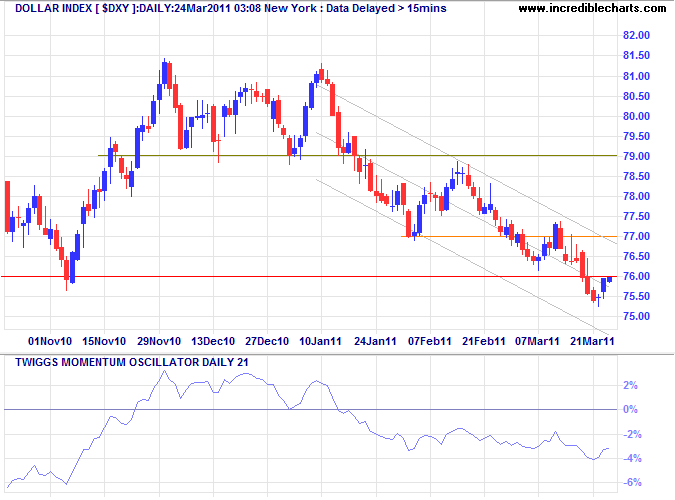

US Dollar Index

The US Dollar retraced to test the new resistance level at 76; respect would signal a decline to 71* — a bullish sign for gold. Twiggs Momentum well below zero suggests the down-trend will continue.

* Target calculation: 76 - ( 81 - 76 ) = 71

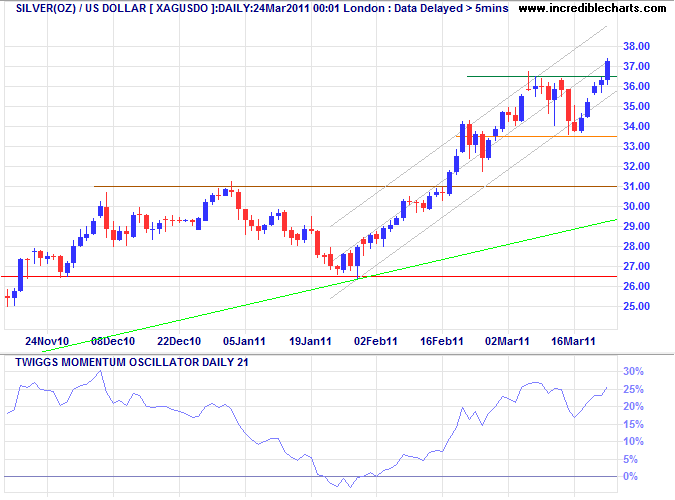

Silver

Silver broke through resistance at $36.50, while Momentum is rising strongly. Gold is likely to follow.

* Target calculation: 36.50 + ( 36.50 - 33.50 ) = 39.50

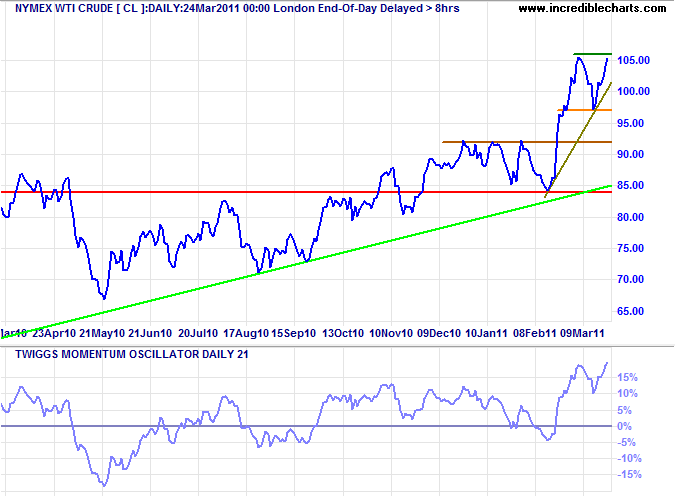

Crude Oil

Nymex WTI recovered sharply. The fast up-trend is likely to eventually end in a blow-off, but will increase inflation fears and boost gold in the short/medium-term.

* Target calculation: 105 + ( 105 - 97 ) = 113

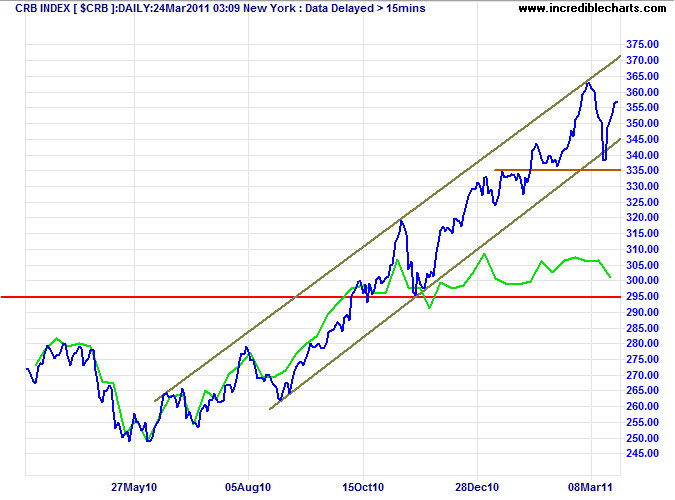

Commodities

The CRB Commodities Index is also recovering; a bullish sign for the Australian Dollar.

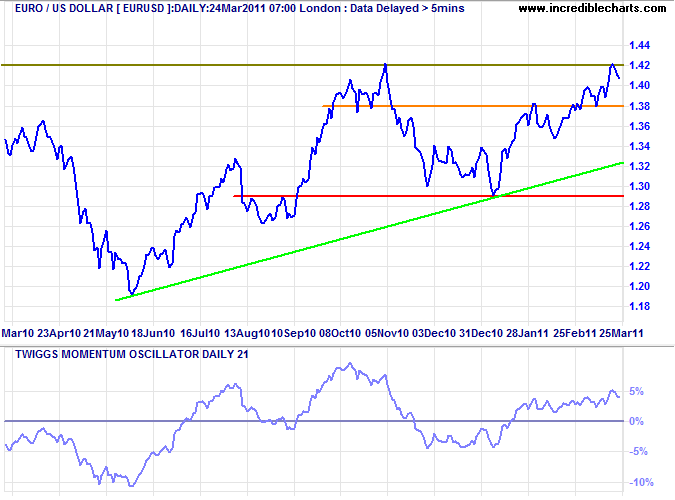

Euro

The euro is testing resistance at $1.42; breakout would offer a target of $1.54*. A Twiggs Momentum trough above zero would strengthen the bull signal.

* Target calculation: 1.42 + ( 1.42 - 1.30 ) = 1.54

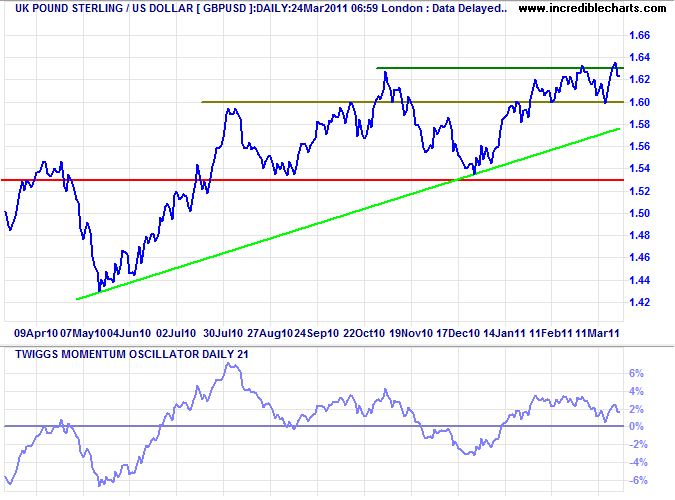

UK Pound Sterling

The pound is consolidating in a narrow range between $1.60 and $1.63; a bullish sign. Breakout above $1.63 would offer a target of the 2009 high at $1.70*. Failure is less likely, but would test primary support at $1.53.

* Target calculation: 1.63 + ( 1.63 - 1.53 ) = 1.73

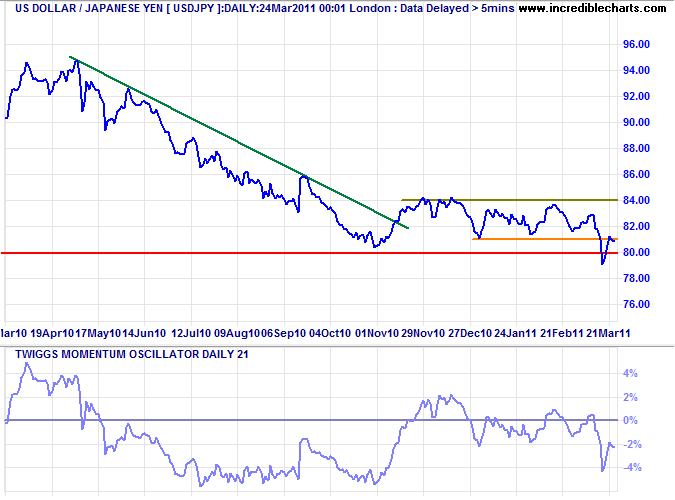

Japanese Yen

The dollar is back in the range between ¥80 and ¥84 the yen — with a bit of help from the G7. The primary trend remains down. Failure of support at ¥80 is likely to encounter further intervention, but the target remains at ¥76*.

* Target calculation: 80 - ( 84 - 80 ) = 76;

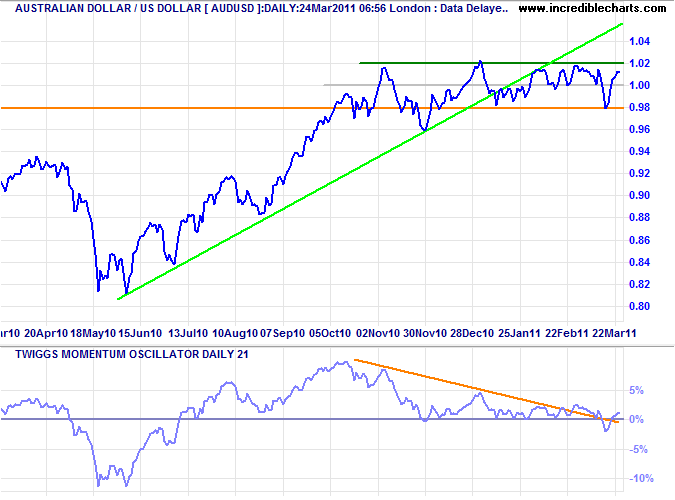

Australian Dollar

The Aussie dollar rallied off support at $0.98 against the greenback, headed for $1.02. Commodity prices are recovering, but expect tough resistance (at $1.02). Breakout would offer a target of $1.06*, while respect would suggest another test of $0.98. Failure of support at $0.96 is unlikely, but would signal a primary down-trend.

* Target calculation: 1.02 + ( 1.02 - 0.98 ) = 1.06

The business of the poet and the novelist is to show the sorriness underlying the grandest things and the grandeur underlying the sorriest things.

~ Thomas Hardy (1840 - 1928)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.