Austerity and infrastructure spending

By Colin Twiggs

March 18th, 2011 7:00 p.m. ET (11:00 a:m AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Last week I discussed the austerity trap, warning that cuts in government spending can tip the economy back into recession (as in 1937) if compensatory steps are not taken. I would like to expand on this — and clear up any misconception that I may be advocating fiscal profligacy.

The Savings-Investment mismatch

First a quick re-cap of the Savings-Investment mismatch. In a normal economic environment, national savings are recycled through the financial sector into new capital investment, with new stock issues and bank loans used to fund corporate expansion. That means that every dollar earned is eventually spent: either by the consumer or through investment in new capital equipment. Every 50 years or so, however, a banking panic occurs and the normal rules no longer apply. Consumers lose faith in the ability of the banking sector to protect their savings; and the banking sector loses faith in the ability of borrowers to repay loans. Consumers increase savings and pay off debt, while banks are reluctant to lend because of the elevated default risk — and a strong need for liquidity.

The increased savings and reduced lending causes a mismatch that has disastrous consequences if left unattended. The mismatch may only amount to a small percentage of GDP but, similar to a puncture in a automobile tire, the small leakage will cause a far greater fall in GDP. Economists refer to this as the multiplier effect: the effect is amplified through continuous feedback — a similar result to the howl of a sound system if you place the microphone in front of a speaker.

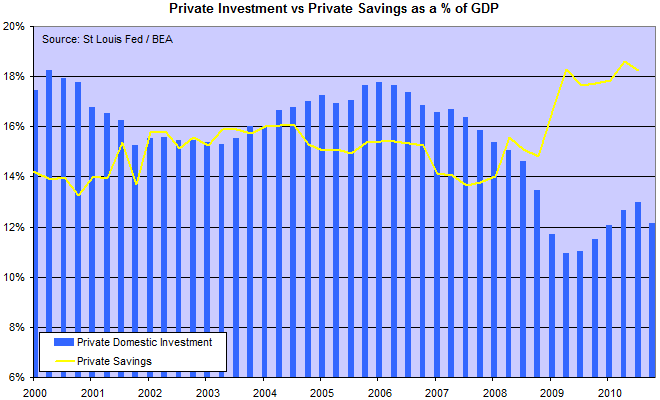

The chart below illustrates the shortfall between Private Savings and Private Investment since 2008. Only when Private Investment recovers can government stimulus be withdrawn.

Fiscal deficits

Governments should only run deficits in times of national emergency: either during a major war or a banking crisis. The US has experienced three such banking crises since 1900:

- the Panic of 1907 that led to creation of the Federal Reserve system;

- the Crash of 1929 that led to the Great Depression; and

- the Global Financial Crisis (GFC) of 2008.

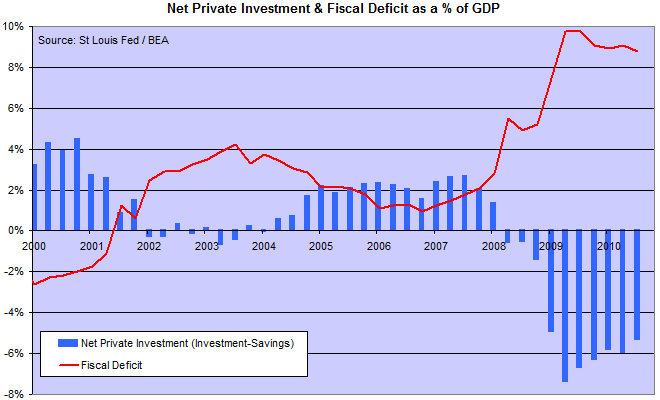

During a banking crisis it is imperative that government step in — borrowing and investing to make up the savings-investment shortfall — and prevent the economy from plunging into depression. The chart below shows how the fiscal deficit was increased to compensate for the excess of Private Savings over Private Investment (when Net Private Investment is negative) from 2008 to 2010.

It is important that government borrow and invest to make up the shortfall, but some politicians interpret this as a license to waste taxpayer money on any crackpot scheme they can think of. That is extremely short-sighted: they are spending borrowed money that will later have to be repaid. If not invested wisely, the result is a crippling debt load and a bunch of worthless (or non-existent) assets.

What Constitutes Investment?

There appears to be some confusion as to what constitutes investment, so let me start with an important definition:

An investment is the purchase (or construction) of an asset that either:

- earns the investor an income; or

- saves him/her from a recurring expenditure.

Here are some examples that many of you may relate to. Land is not an investment if it does not earn you an income. You are merely speculating that land prices will rise over time. Real estate is an investment if you rent it out. If you occupy it, it is an investment only so far as it saves an equivalent amount of rent. A boat or yacht is not an investment; they require ongoing expenditure without earning an income. There are still some gray areas, however. My son argues that a new 3D television would be an investment as it would save expenditure on movie tickets, but my view is that expenditure must be on essentials (food, power, gas, etc.) rather than discretionary items (movie tickets).

Government Stimulus Programs

Sending taxpayers bonus checks through the mail is as profligate as sending them movie tickets. There is no investment to offset the debt incurred, especially if the money is spent on a wide-screen TV from Taiwan or an overseas holiday.

Infrastructure spending by contrast is an investment. That does not include a bridge to nowhere, a new school hall, or a fountain in the town square. Projects should be carefully selected according to the investment criteria stressed earlier: they must either generate an income or save a recurring expenditure — and at market-related rates of return.

Ideally, investment should create saleable assets such as toll-roads, power stations, electricity grids, rail networks, satellite systems and broadband networks — that can later be sold to pay off the debt incurred. Not all infrastructure investments may be saleable, but they should still be evaluated against the same criteria: will the country benefit from the new investment through an identifiable increase in national income — or drop in national expenditures?

Political favorites like health care and defense spending are harder to evaluate and should only qualify if there is a clearly quantifiable benefit. Early detection or prevention programs such as bowel/breast cancer screening or vaccination programs are not hard assets but there may be clear benefits in terms of reducing future health care costs.

Austerity

Austerity is still important. Governments should be as frugal as possible in their normal day-to-day operating expenditure, to maximize funds available for capital investment — and create real assets on the fiscal balance sheet that can be offset against the burgeoning fiscal debt.

Early Preparation, Evaluation & Selection

Infrastructure projects require years of planning and evaluation. Attempts to fast-track this process court disaster. A current example is the $40 billion national broadband network planned for Australia. Without thorough evaluation there is a serious risk that large parts of the network will be unable to compete in the open market — and $40 billion spent to create a $5 billion asset.

Why China Recovered Quicker

China recovered quicker from the GFC than anyone else because of its centrally planned economy. The government already had plans to expand infrastructure (dams, power stations, bridges, roads, etc.) on a massive scale; and was able to accelerate existing programs far more effectively than capitalist economies who were starting from a low base. That does not justify a centrally planned economy, but there are some advantages during times of national crisis.

Early Preparation

What is evident is that all governments need some measure of central planning. Infrastructure projects should be prepared well in advance, for just such an eventuality. And continually updated and re-evaluated in terms of new technologies and demographic changes. One of the administrators who best understood this was Herbert Hoover — the last engineer to occupy the White House and president during the 1929 crash. Hoover prepared plans for major infrastructure programs to be implemented during an economic down-turn — to offset the decline in private sector investment. Unfortunately, he did not anticipate the dramatic fall in government revenues when the economy went into a downward spiral. The sharp fall in revenues prevented Hoover from fully implementing his plans within the constraint of a balanced budget. FDR had no such qualms and ran continuous budget deficits to fund major infrastructure programs. In 1937, however, when the economy appeared to be well on its way to recovery, FDR attempted to reduce the budget deficit. Private sector investment had not sufficiently recovered and, to his consternation, the economy tipped back into recession.

To Sum Up

Austerity is still important during a banking crisis: to minimize wastage and free up as many resources as possible for infrastructure spending. But austerity is only part of the solution. On its own it would pitch the US economy back into recession — or worse.

Government needs to implement infrastructure programs to compensate for the ongoing shortfall in private sector investment. A mismatch between private savings and investment can send the economy into a downward spiral. Emphasis should be on government investment, not government spending. Market-related investment criteria must be used to evaluate all expenditure. Ideally, infrastructure projects should create saleable assets that can later be sold to offset the massive debt incurred. Profligate spending would lead us to financial ruin, with crippling government debt and no assets to offset this.

Wisdom consists not so much in knowing what to do in the ultimate as knowing what to do next.

~ Herbert Hoover (1874 - 1964)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.