Chinese checkers in Paris

By Colin Twiggs

February 21st, 2011 4:00 a.m. ET (8:00 p.m. AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Western markets are strengthening, while eastern markets, apart from China, remain subdued. The world faces two major uncertainties at present: the outcome of pro-democracy demonstrations sweeping the Arab world, and the meaning (or lack thereof) of a convoluted 53-word sentence in the the G-20 communique from Paris.

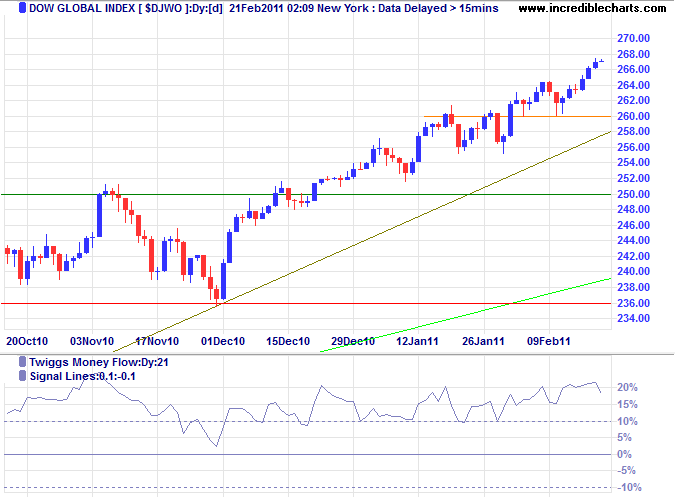

Global

The Dow Global index ($DJWO) continues its upward surge, with rising Twiggs Money Flow (21-day) indicating buying pressure. Penetration of the rising (olive) trendline would warn of a correction. Breach of support at 236 is unlikely, but would signal a primary reversal.

* Target calculations: 250 + ( 250 - 236 ) = 264

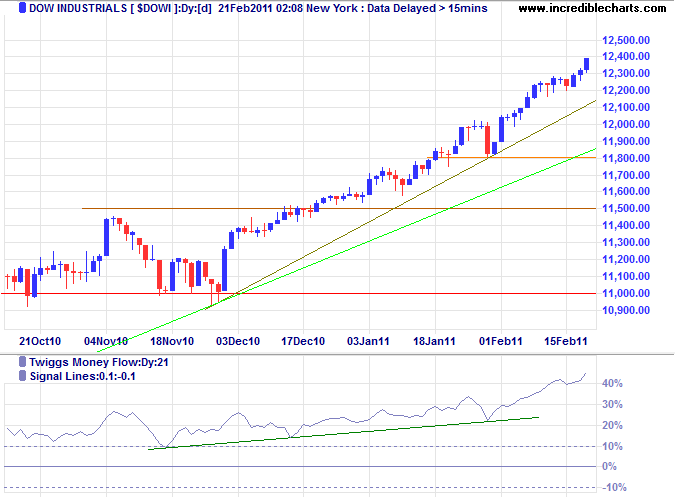

USA

Dow Jones Industrial Average

The Dow reinforces the signal, with Twiggs Money Flow (21-day) rising strongly. Expect a test of 12600*. Penetration of the (olive) trendline would warn of a correction. Reversal below 11000 is most unlikely, but would signal a primary reversal.

* Target calculation: 11200 + ( 11200 - 9800 ) = 12600

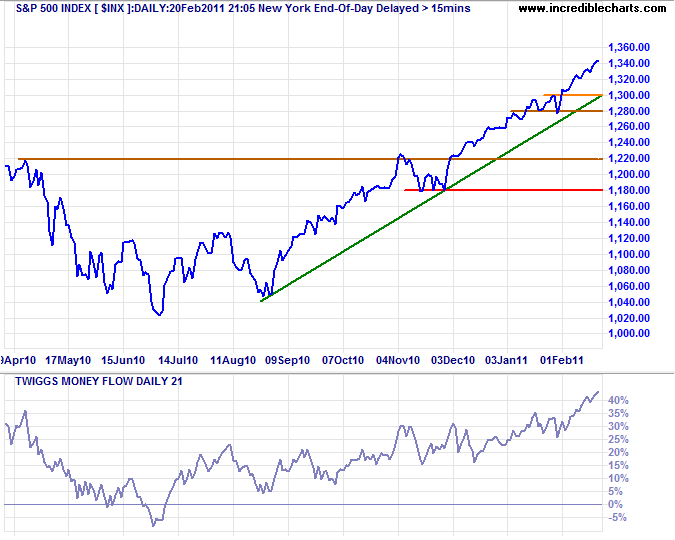

S&P 500

The broader S&P 500 reflects even stronger buying pressure on Twiggs Money Flow than the Dow. The advance offers a target of 1420*.

* Target calculation: 1220 + ( 1220 - 1020 ) = 1420

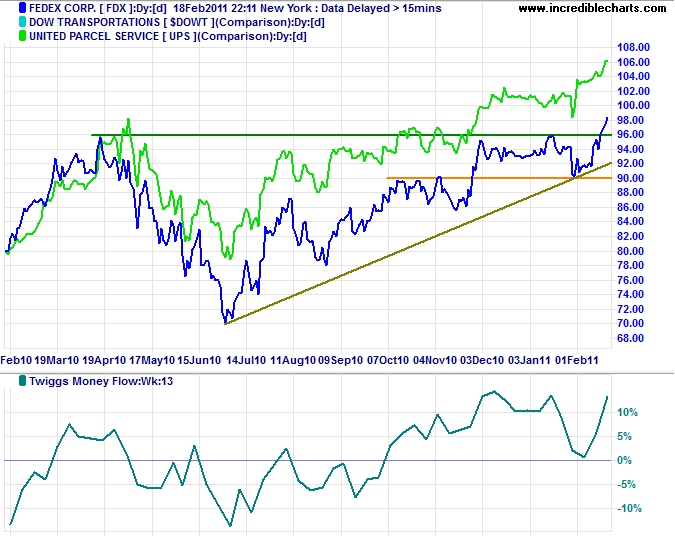

Transport

Fedex broke through resistance at the 2010 high of 96, signaling a fresh primary advance. UPS and Fedex advancing together predict stronger economic growth.

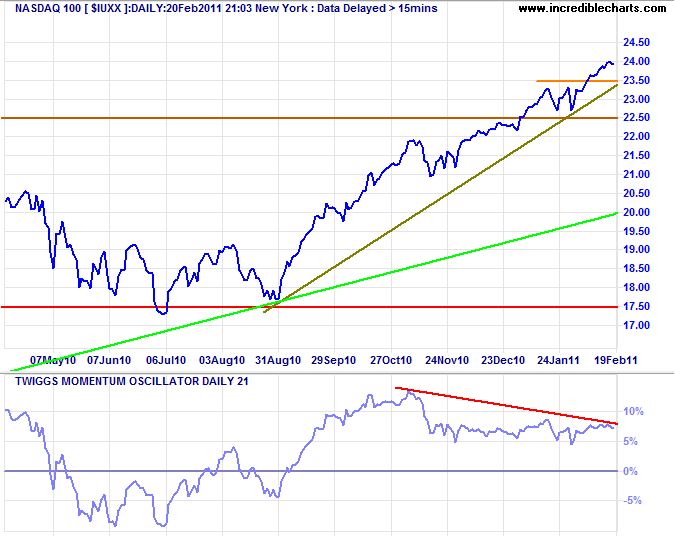

Technology

The Nasdaq 100 is also advancing but there is a bearish divergence on Twiggs Momentum. Penetration of the rising olive trendline would confirm that momentum is slowing and warn of a correction. Rising Twiggs Money Flow (21-day), however, continues to indicate buying pressure.

* Target calculation: 2050 + ( 2050 - 1750 ) = 2350

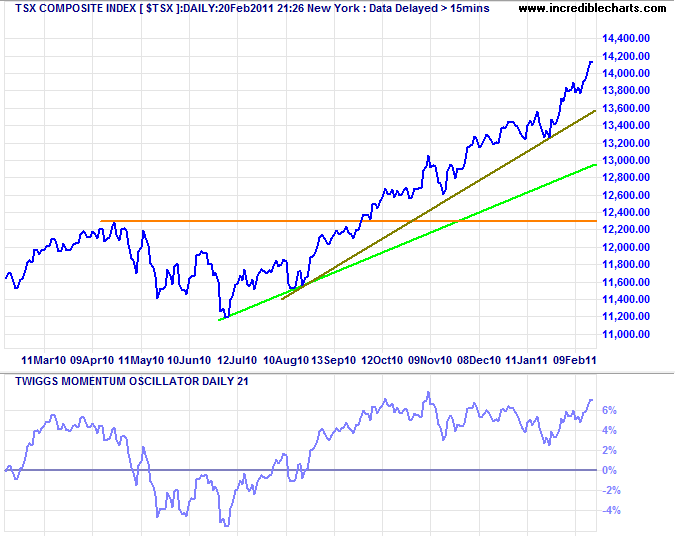

Canada: TSX

Twiggs Momentum respected the zero line, but Twiggs Money Flow on the $CADOW continues to warn of a correction. Penetration of the recent rising trendline would strengthen the warning, suggesting a test of the longer-term, green trendline.

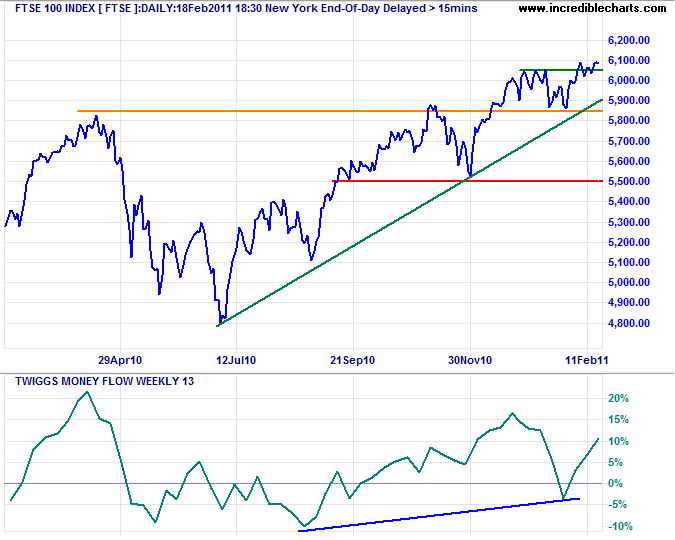

United Kingdom

The FTSE 100 index follow-through above 6050 signals an advance to the 2007 high at 6750*.

* Target calculation: 5800 + ( 5800 - 4800 ) = 6800

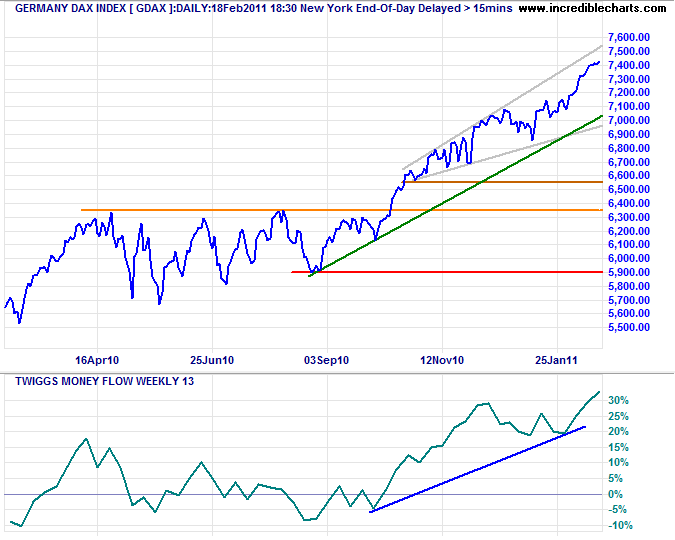

Germany

The DAX continues its strong rally. The bearish ascending broadening wedge pattern favors a downward breakout and retracement to 6550, but a further strong rise, high above zero, on 13-week Twiggs Money Flow makes this unlikely.

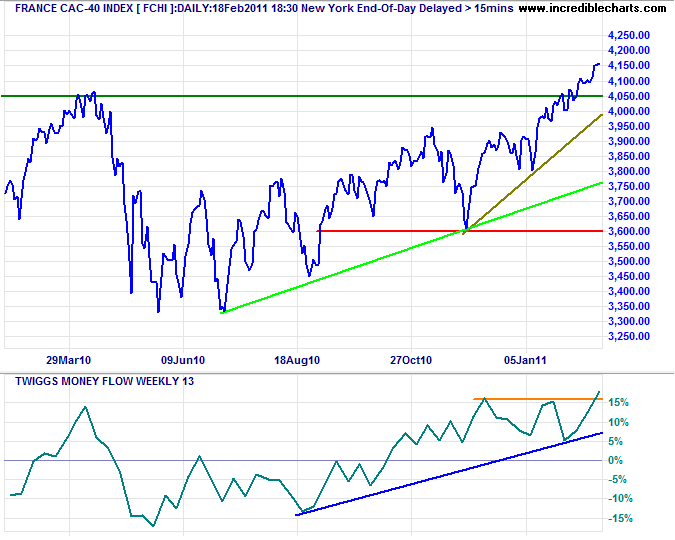

France

The CAC-40 also displays a recovery on 13-week Twiggs Money Flow, indicating buying pressure. Retracement that respects 4050 would suggest a long-term target of 4750*. Retreat below 4000 is unlikely, but would signal a test of the rising green trendline around 3750.

* Target calculation: 4050 + ( 4050 - 3350 ) = 4750

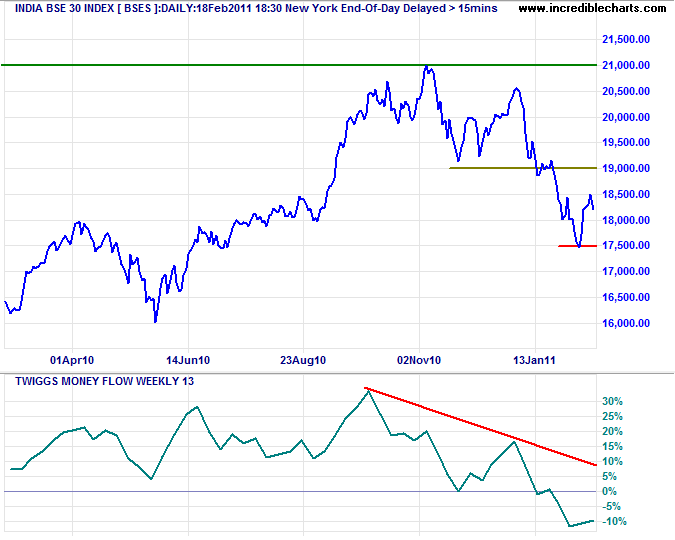

India

The Sensex remains in a primary down-trend. Having encountered resistance at 18500 the index is retracing to test support at 17500. Failure would signal a decline to 16500*. Twiggs Money Flow (13-week) below zero indicates strong selling pressure.

* Target calculation: 17500 - ( 18500 - 17500 ) = 16500

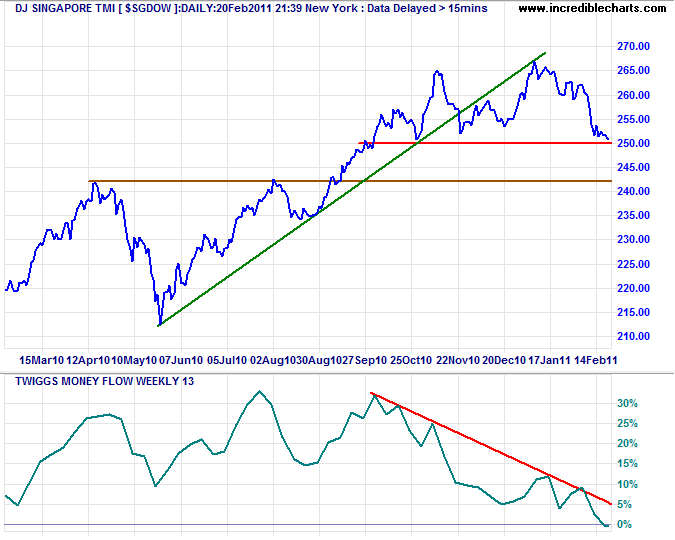

Singapore

The Straits Times Index broke support at 3120, signaling a primary down-trend. An $SGDOW breakout below 250 would confirm the signal.

* STI Target: 3100 - ( 3300 - 3100 ) = 2900

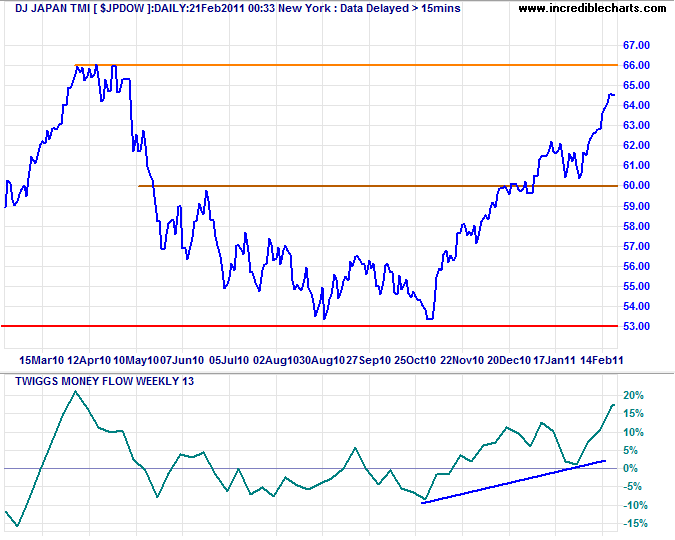

Japan

The Nikkei 225 and $JPDOW are advancing towards resistance at their 2010 high. Rising Twiggs Money Flow (13-week) reflects increased buying pressure. Breakout above 66 on the $JPDOW (or 11400 on N225) would signal a primary advance, offering a long-term target of 79* (14000* on the N225).

* Target calculation: 66 + ( 66 - 53 ) = 79; 11400 + ( 11400 - 8800 ) = 14000

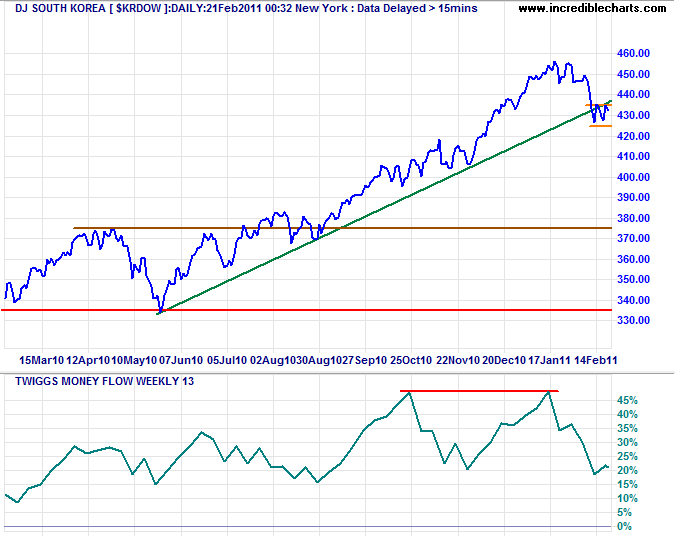

South Korea

The Seoul Composite Index and $KRDOW penetration of their rising trendlines warn of a strong correction. Breakout below short-term support at 425 on $KRDOW would confirm. Bearish divergence on Twiggs Money Flow (13-week) strengthens the signal.

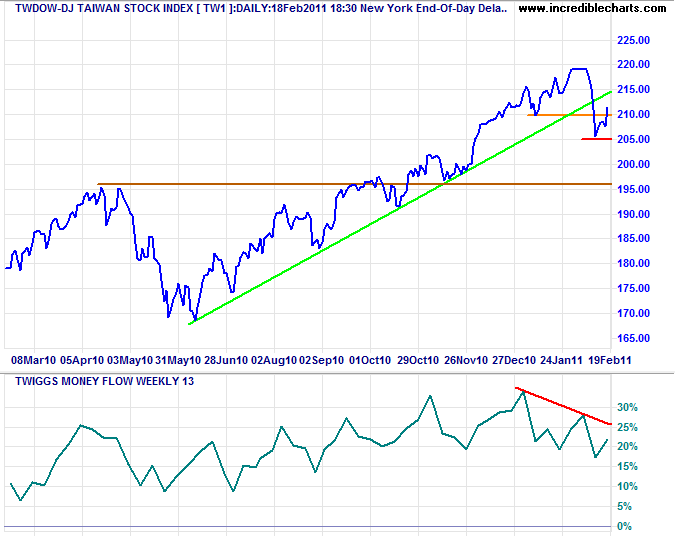

Taiwan

The Dow Jones Taiwan Index rallied off support at 205, but bearish divergence on Twiggs Money Flow (13-week) continues to warn of a correction. A lower peak would confirm.

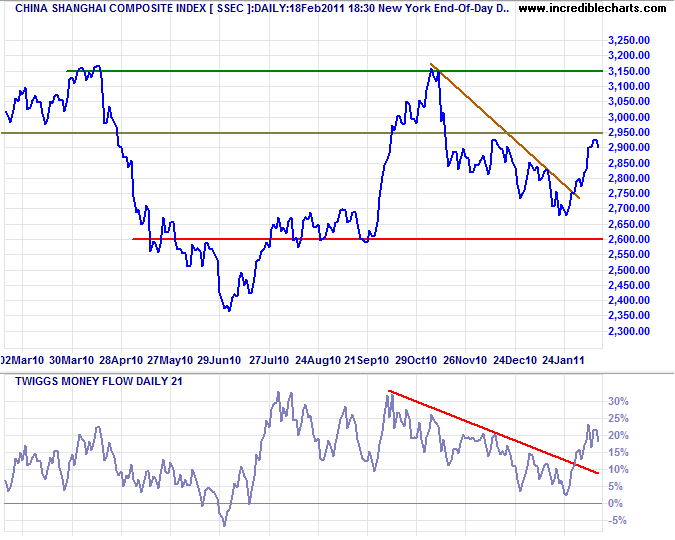

China

The Shanghai Composite Index rallied Monday despite a 0.5% increase in bank reserve requirements — further evidence that we are witnessing a bottom. But the primary down-trend continues — until there is a breakout above 3150.

* Target calculations: 2800 - ( 3100 - 2900 ) = 2600

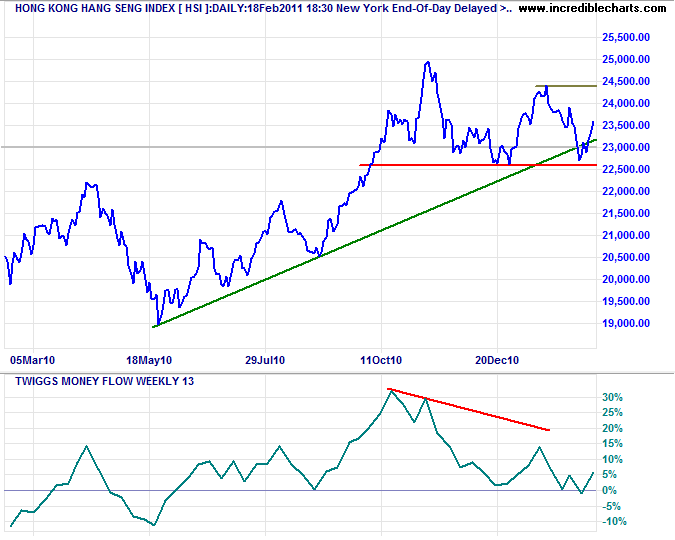

The Hang Seng Index drifted sideways Monday, struggling to break clear of 23500. Twiggs Money Flow (13-week) continues to display a large bearish divergence, warning of a primary down-trend. Reversal below 22600 would confirm, while recovery above 24400 would indicate a fresh primary advance.

* Target calculation: 25000 + ( 25000 - 22500 ) = 27500

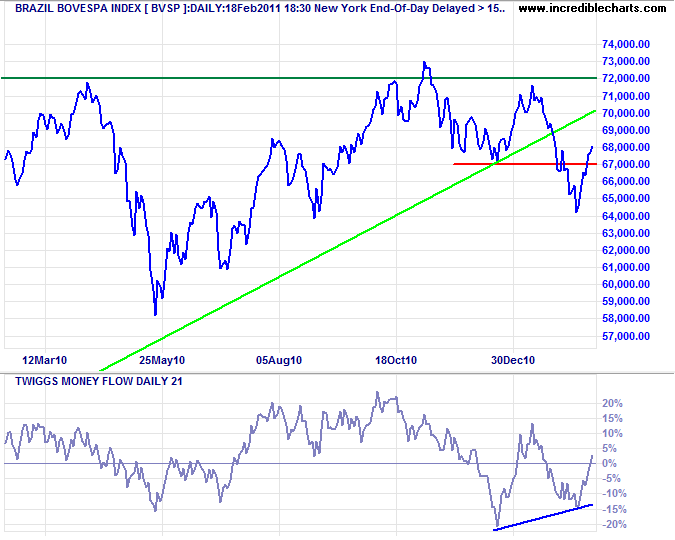

Brazil

The Bovespa Index remains in a primary down-trend, but recovery above 67000 and bullish divergence on Twiggs Money Flow (21-day) suggest that a bottom is forming.

* Target calculation: 67000 + ( 72000 - 67000 ) = 62000

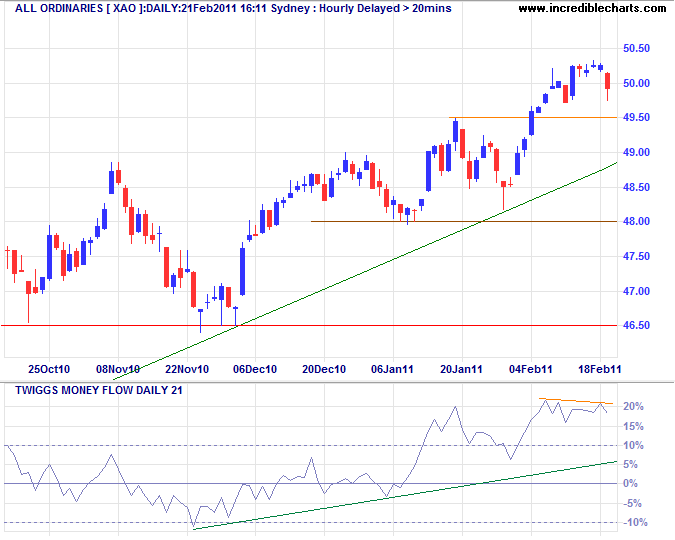

Australia: ASX

The All Ordinaries retreated below 5000, with a slight divergence on Twiggs Money Flow (21-day) warning of retracement. The primary advance is expected to continue, confirmed if retracement respects support at 4950, offering a long-term target of 5750*.

* Target calculation: 5000 + ( 5000 - 4250 ) = 5750

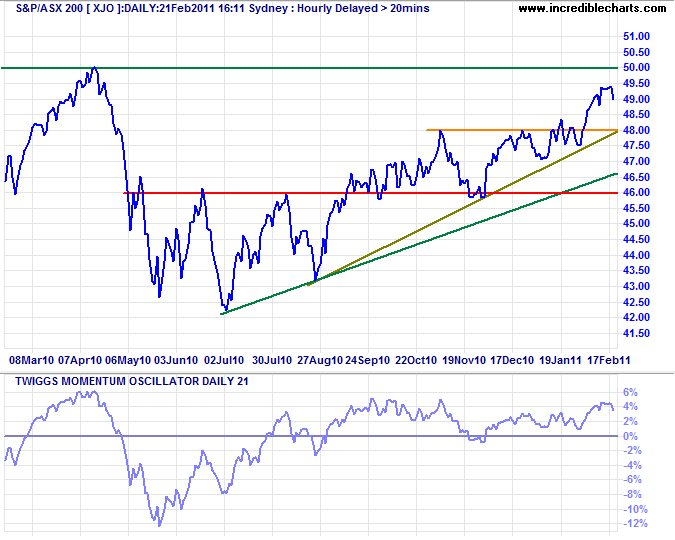

ASX 200 Twiggs Momentum continues to oscillate above the zero line, indicating a healthy up-trend. Breakout above 5000 would signal a fresh primary advance.

* Target calculation: 4800 + ( 4800 - 4600 ) = 5000

In all things success depends on preparation, and without such preparation there is sure to be failure.

~ The Analects of Confucius

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.