Moving the goalposts

By Colin Twiggs

February 7th, 2011 7:00 a.m. ET (11:00 p.m. AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

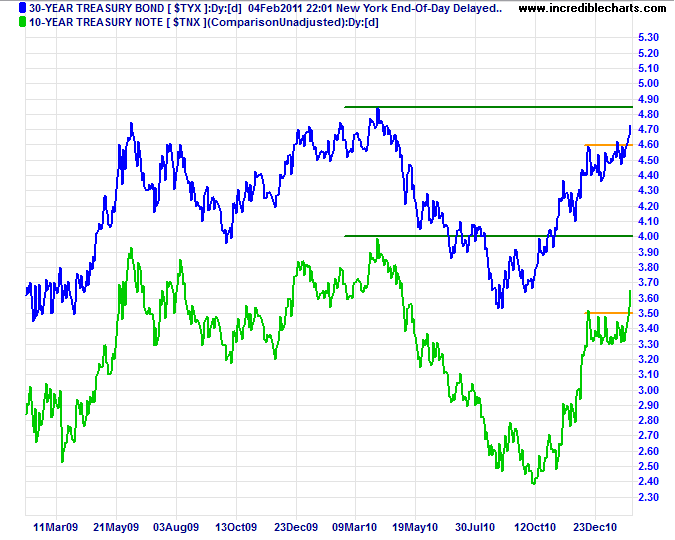

QE2 failed to achieve both of its stated goals: to "foster maximum employment and price stability". Unemployment remains stubbornly high, while long-term treasury yields are increasing — reflecting rising inflation expectations.

But if you listened to the Fed Chairman recently, you may be tempted to question either your memory or your hearing:

"Since August, when we announced our policy of reinvesting maturing securities and signaled we were considering more purchases, equity prices have risen significantly, volatility in the equity market has fallen, corporate bond spreads have narrowed, and inflation compensation as measured in the market for inflation-indexed securities has risen from low to more normal levels. Yields on 5- to 10-year Treasury securities initially declined markedly as markets priced in prospective Fed purchases; these yields subsequently rose, however, as investors became more optimistic about economic growth and as traders scaled back their expectations of future securities purchases."

He now claims that falling bonds and rising stock prices, in anticipation of higher inflation, are evidence that the strategy is succeeding. A clear case of moving the goalposts to fit the result.

Global

Brazil joining India in a primary down-trend, increases the chance of the contagion spreading to other markets. Inflation is already a problem in emerging economies and rising US treasury yields indicate that the market is anticipating its spread to developed economies, which will force the Fed and other central banks to close off the liquidity pump.

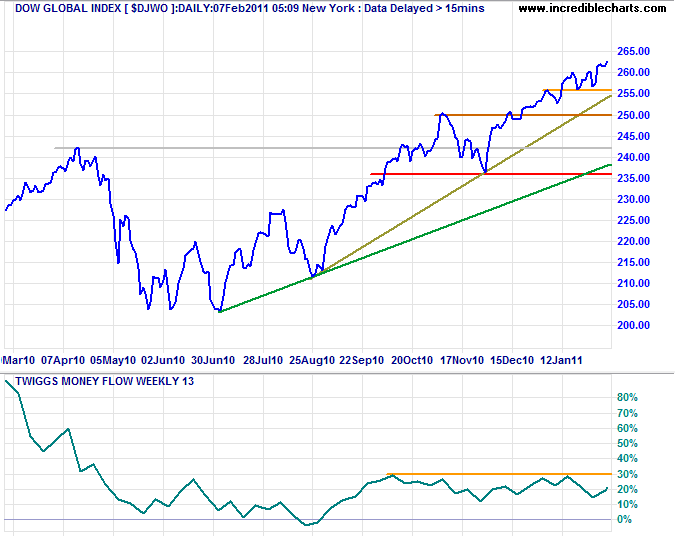

The Dow Global index ($DJWO) is rising, but bearish divergence on Twiggs Money Flow (13-week) warns of a correction. Failure of short-term support at 256 would strengthen the signal. Breach of support at 236 remains unlikely, but would signal a primary reversal.

* Target calculations: 242 + ( 242 - 204 ) = 280

USA

Dow Jones Industrial Average

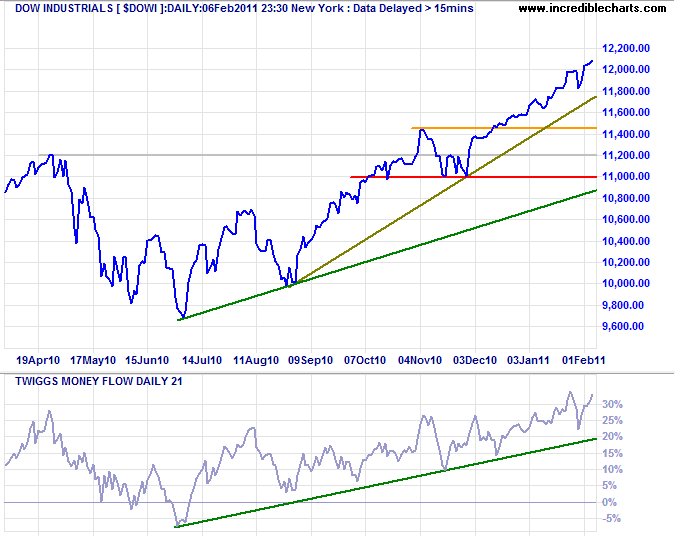

The Dow broke resistance at 12000, while rising Twiggs Money Flow (21-day) indicates buying pressure. Expect a test of 12600*. Reversal below 11000 is most unlikely, but would signal a primary reversal.

* Target calculation: 11200 + ( 11200 - 9800 ) = 12600

S&P 500

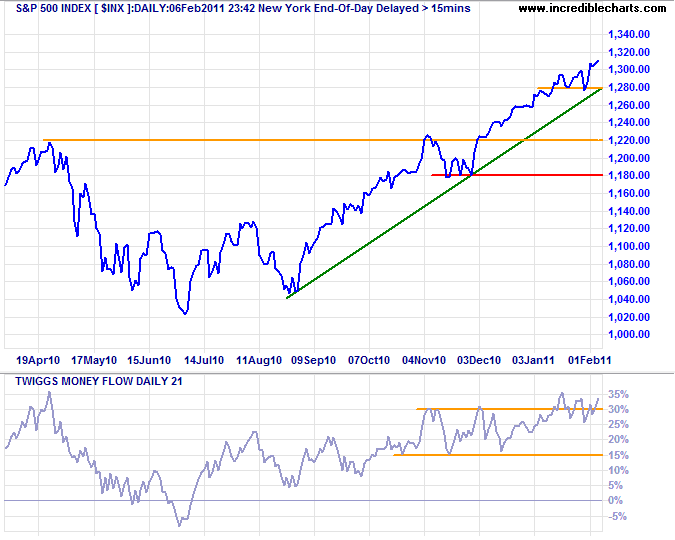

The S&P 500 broke resistance at 1300, reinforcing the Dow signal. Rising money flow again signals buying pressure.

* Target calculation: 1220 + ( 1220 - 1020 ) = 1420

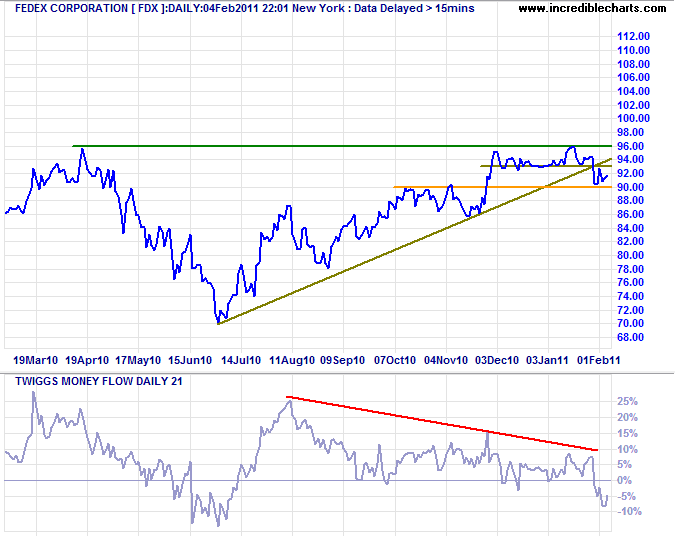

Transport

Fedex reversed below its rising trendline to warn of slowing momentum, while Twiggs Money Flow (21-day) reversal below zero indicates selling pressure. Failure of support at 90 would signal a correction. Recovery above 96, however, would signal a fresh primary advance. UPS remains in positive territory, favoring a recovery.

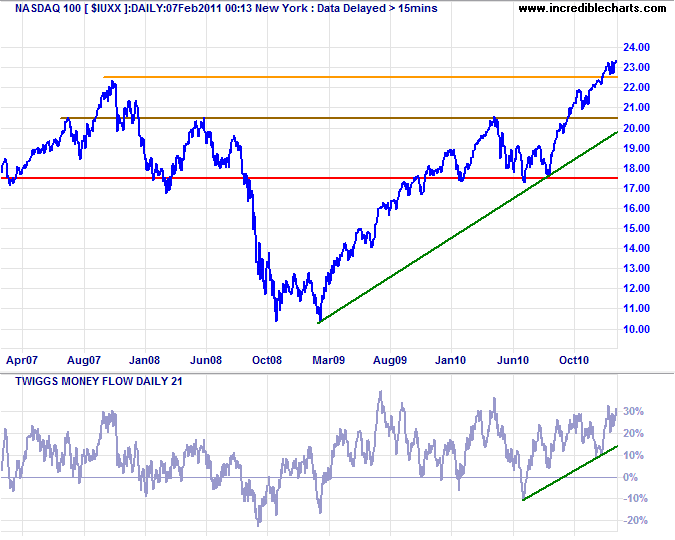

Technology

The Nasdaq 100 is holding above its new support level at 2250; a positive sign. Rising Twiggs Money Flow (21-day) indicates buying pressure.

* Target calculation: 2050 + ( 2050 - 1750 ) = 2350

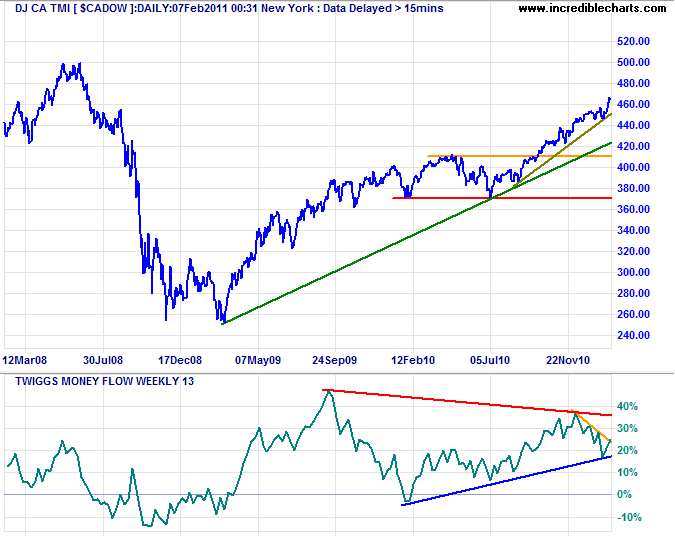

Canada: TSX

Bearish divergence on Twiggs Money Flow for $CADOW warns of a correction. Breach of the recent rising trendline would suggest a test of the longer-term, green trendline.

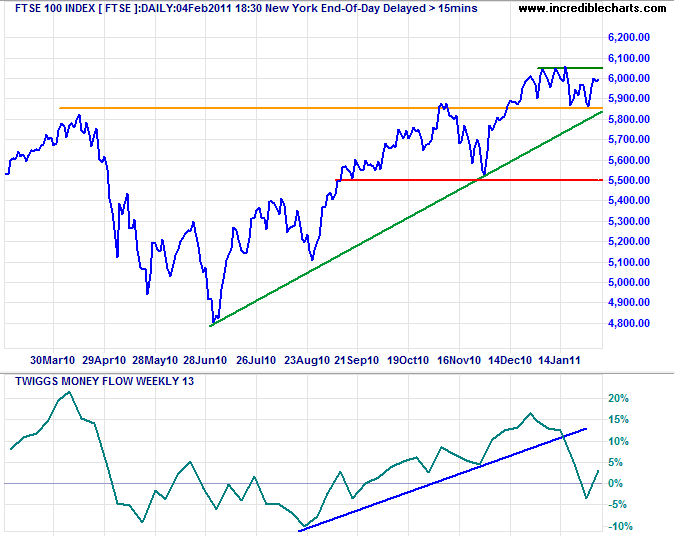

United Kingdom

The FTSE 100 index is holding above its new support level at 5850, while Twiggs Money Flow recovered above zero. Breakout above 6050 would indicate an advance to the 2007 high at 6750*. Failure of the new support level, however, would test primary support at 5500.

* Target calculation: 5800 + ( 5800 - 4800 ) = 6800

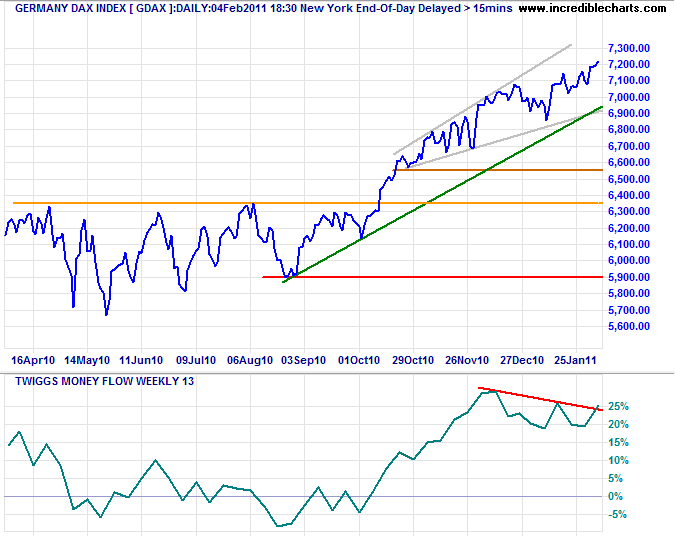

Germany

The DAX continues upward in a bearish ascending broadening wedge pattern; downward breakout would signal retracement to 6550. The bearish divergence on 13-week Twiggs Money Flow is now negated.

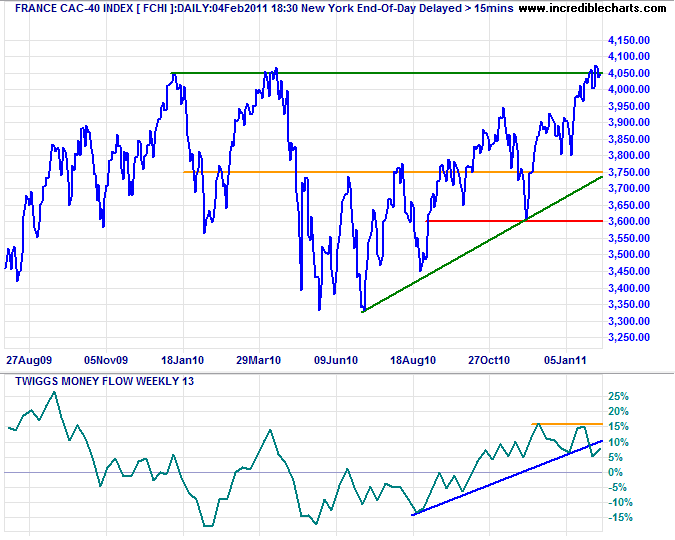

France

The CAC-40 is testing resistance at 4050, while bearish divergence on 13-week Twiggs Money Flow warns of a correction. Retreat below 4000 would signal a test of the rising green trendline around 3750. Follow-through above 4050 would offer a long-term target of 4750*.

* Target calculation: 4050 + ( 4050 - 3350 ) = 4750

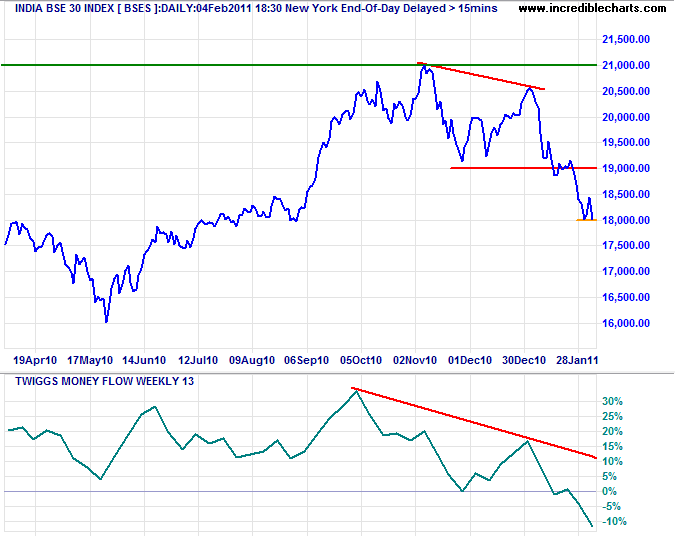

India

The Sensex is testing support at 18000; failure would test 17000. Twiggs Money Flow (13-week) below zero indicates strong selling pressure.

* Target calculation: 18000 - ( 19000 - 18000 ) = 17000

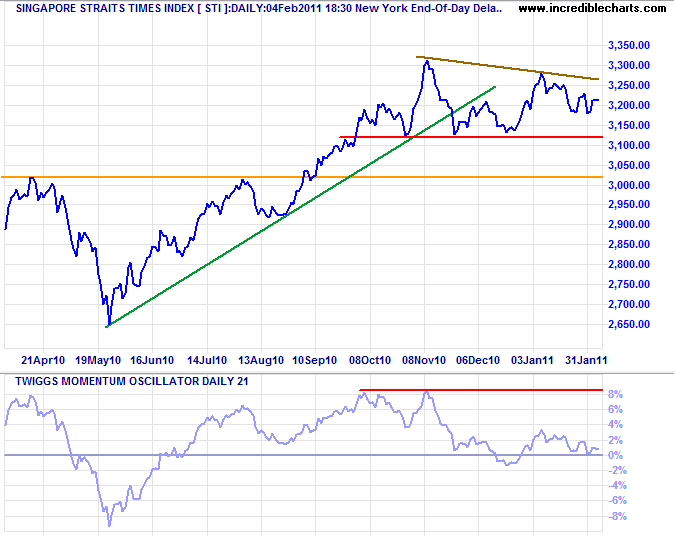

Singapore

Bearish divergence on Twiggs Momentum (and Twiggs Money Flow on $SGDOW) warns of a primary reversal on the Straits Times Index. Failure of support at 3120 would confirm.

* STI Target: 3100 - ( 3300 - 3100 ) = 2900

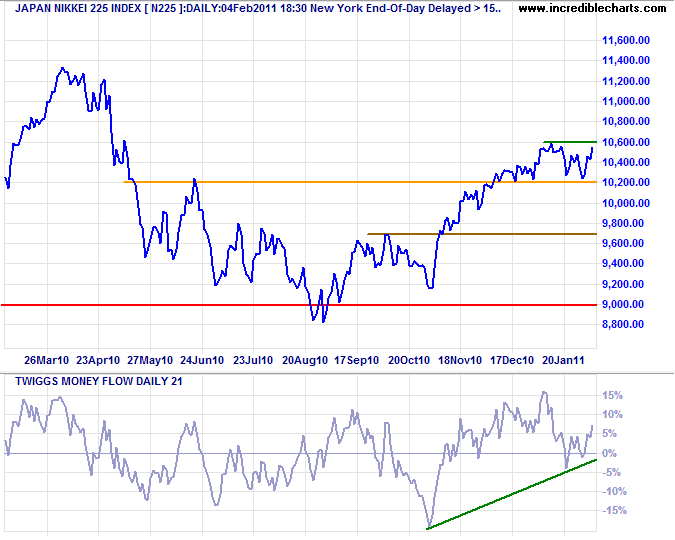

Japan

The Nikkei 225 respected support at 10200, while Twiggs Money Flow (21-day) recovered above zero. Breakout above 10600 would offer a target of the 2010 high at 11400*.

* Target calculation: 10200 + ( 10200 - 9000 ) = 11400

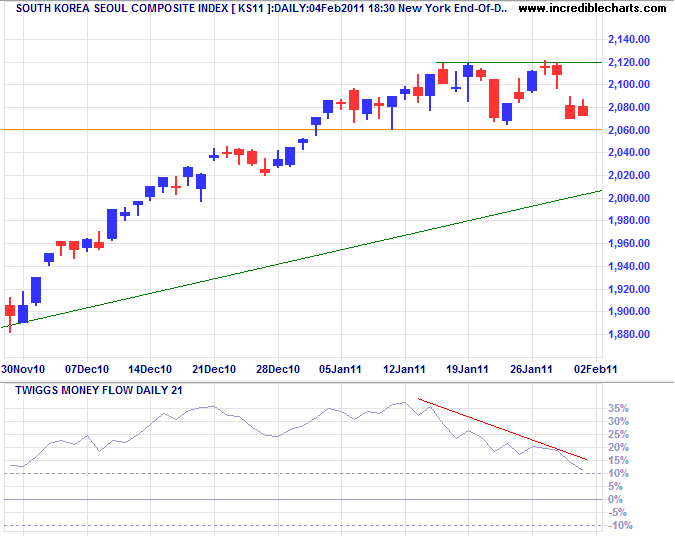

South Korea

The Seoul Composite Index is testing the new support level at its 2007 high of 2060. Bearish divergence on Twiggs Money Flow (21-day) indicate selling pressure. Failure of support would signal a correction to the rising trendline.

* Target calculation: 2060 - ( 2120 - 2060 ) = 2000

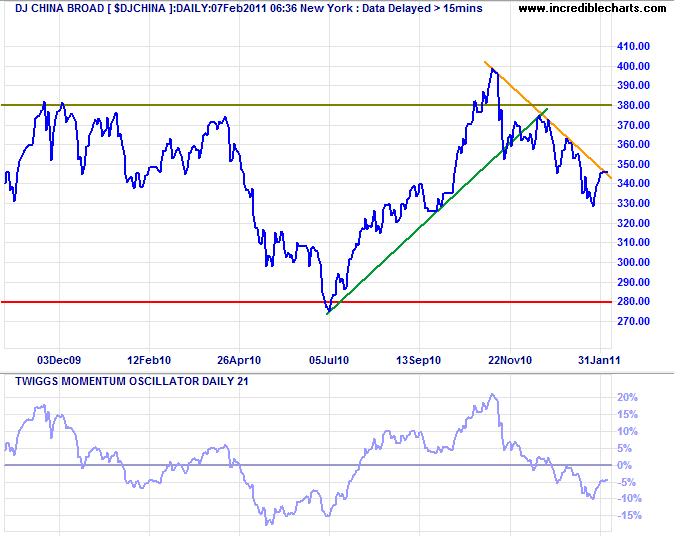

China

Chinese exchanges were closed last week for the Lunar New Year. Monday, the DJ China Broad Index is testing the declining trendline, but Twiggs Momentum (21-day) below zero warns of a down-trend; further troughs below zero would strengthen the signal.

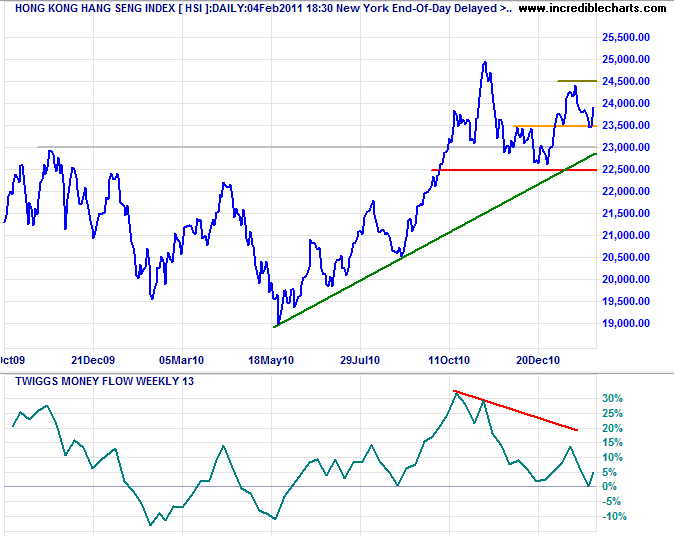

The Hang Seng Index displays a bearish divergence on Twiggs Money Flow (13-week) but the indicator has respected the zero line; a rise above 15% would indicate recovery. Failure of 23500 would test primary support at 22500, while breakout above 24500 would suggest a fresh primary advance.

* Target calculation: 25000 + ( 25000 - 22500 ) = 27500

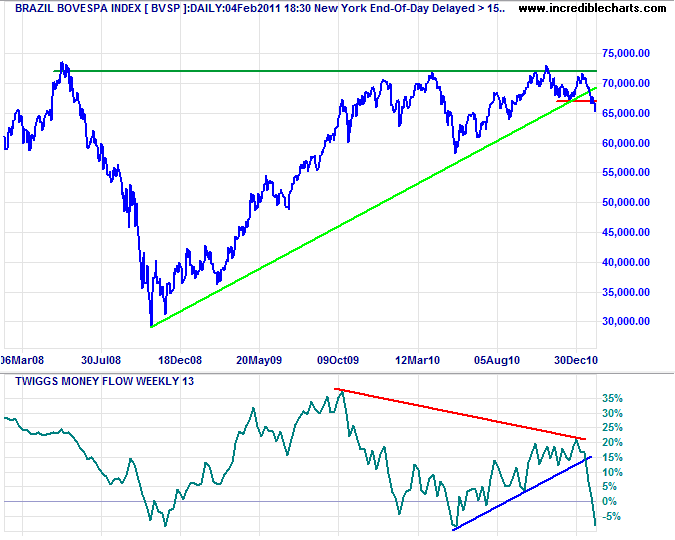

Brazil

The Bovespa Index below 67000 indicates a primary reversal. Twiggs Money Flow (13-week) below zero confirms the signal. Expect a test of the 2010 low at 60000.

* Target calculation: 67000 + ( 72000 - 67000 ) = 62000

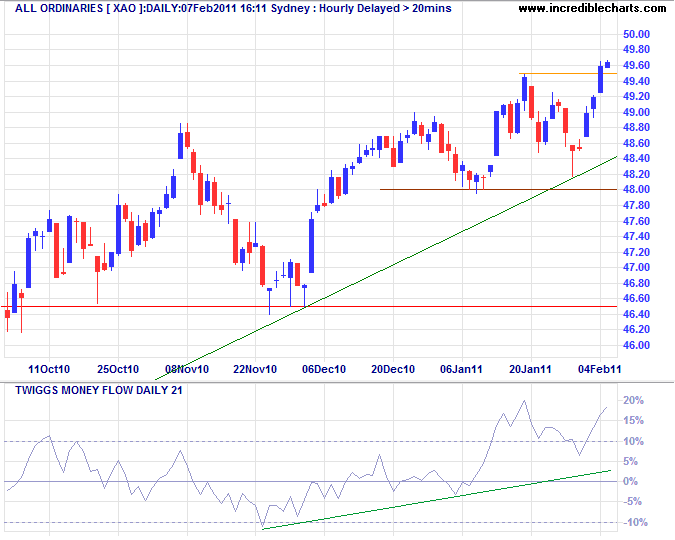

Australia: ASX

The All Ordinaries broke short-term resistance at 4950, indicating another advance. Rising Twiggs Money Flow (21-day) indicates buying pressure. Failure of support at 4800 is now unlikely, but would signal a test of primary support at 4650.

* Target calculation: 4900 + ( 4900 - 4650 ) = 5150

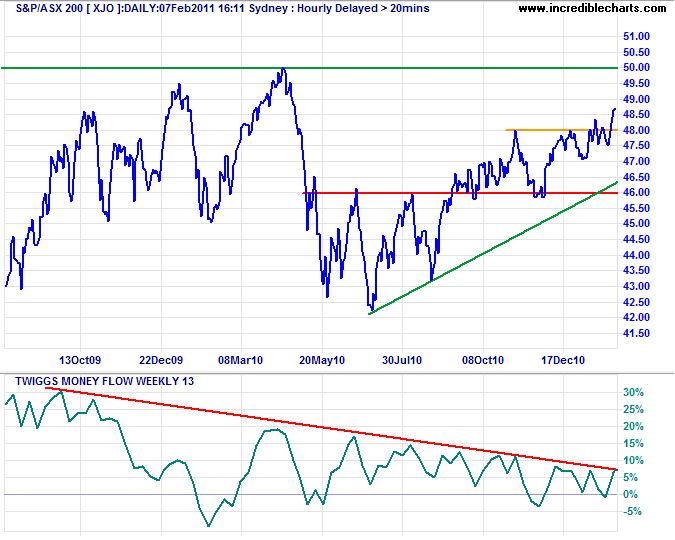

Bearish divergence on Twiggs Money Flow continues to warn of long-term weakness on the ASX 200, but recovery above 4800 indicates a test of 5000*; recovery above the declining (red) trendline would confirm.

* Target calculation: 4800 + ( 4800 - 4600 ) = 5000

The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist.

~ John Maynard Keynes

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.