The real test

By Colin Twiggs

January 17th, 2011 6:00 a.m. ET (10:00 p.m. AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

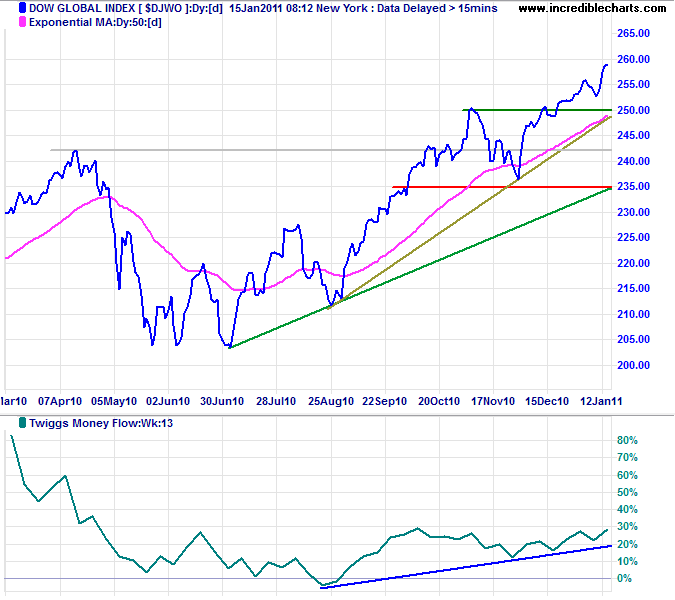

The Dow Global index ($DJWO) is advancing towards its target of 280 after breaking resistance at 250. Rising Twiggs Money Flow (13-week) indicates buying pressure. Reversal below 235 is most unlikely, but would warn of a primary down-trend.

* Target calculations: 242 + ( 242 - 204 ) = 280

The global economy is recovering, but bear in mind this is a result of massive government intervention — mostly unsustainable — and the real test will come when this support is withdrawn.

USA

Dow Jones Industrial Average

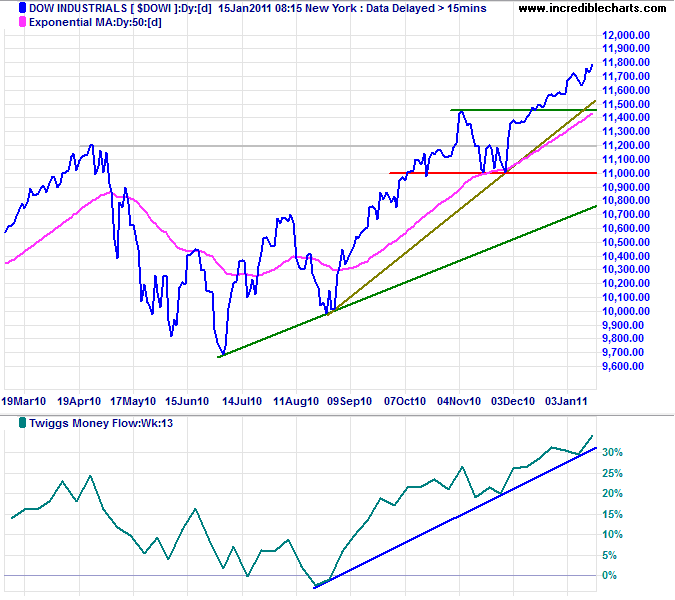

The Dow is advancing to 12000* after breaking resistance at 11450. Rising Twiggs Money Flow (13-week) reflects strong buying pressure. Reversal below 11000 is most unlikely, but would also warn of a primary trend reversal.

* Target calculation: 11000 + ( 11000 - 10000 ) = 12000

S&P 500

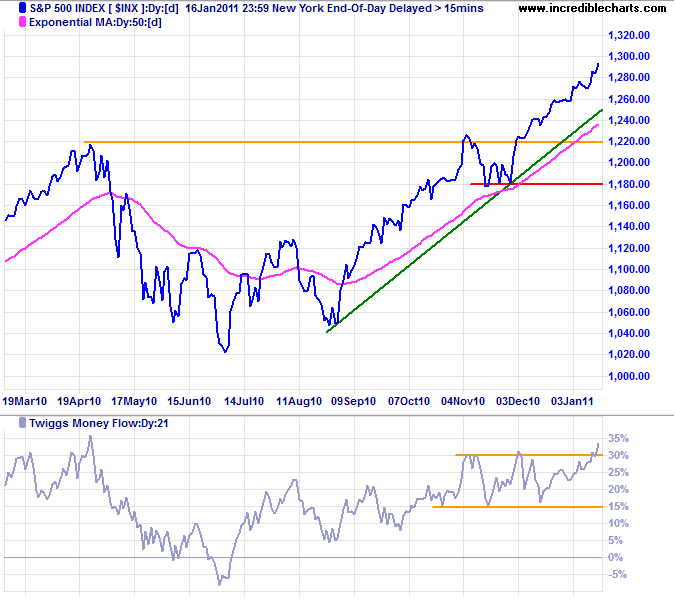

The S&P 500 is likewise in a strong advance, with a target of 1420*. Reversal below 1180 is most unlikely, but would warn of a reversal. Twiggs Money Flow (21-day) breakout above 30 percent signals further buying pressure.

* Target calculation: 1220 + ( 1220 - 1020 ) = 1420

Transport

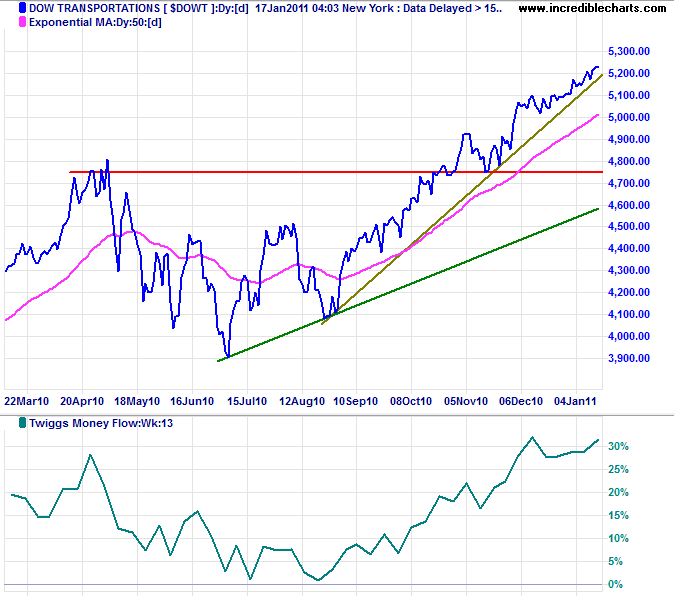

Dow Jones Transport Index is advancing strongly: a bullish sign for the economy.

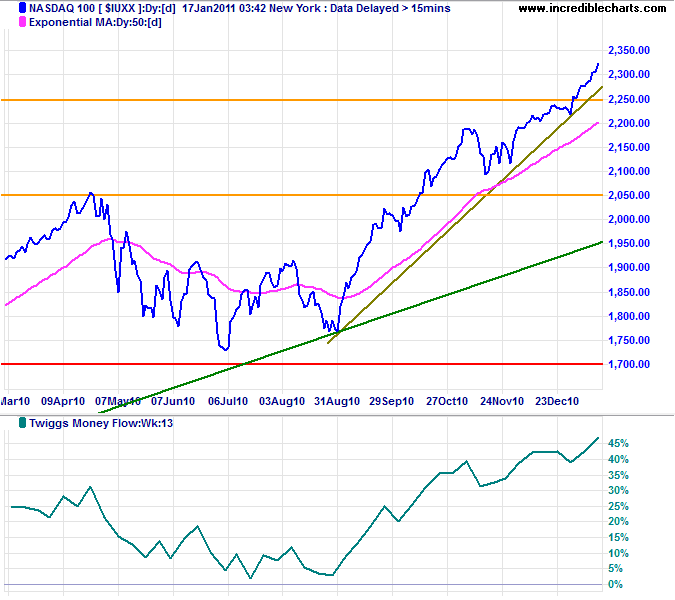

Technology

The Nasdaq 100 broke through its 2007 high at 2250, signaling a fresh advance. Twiggs Money Flow (13-week) troughs high above zero indicate strong buying pressure.

* Target calculation: 2050 + ( 2050 - 1750 ) = 2350

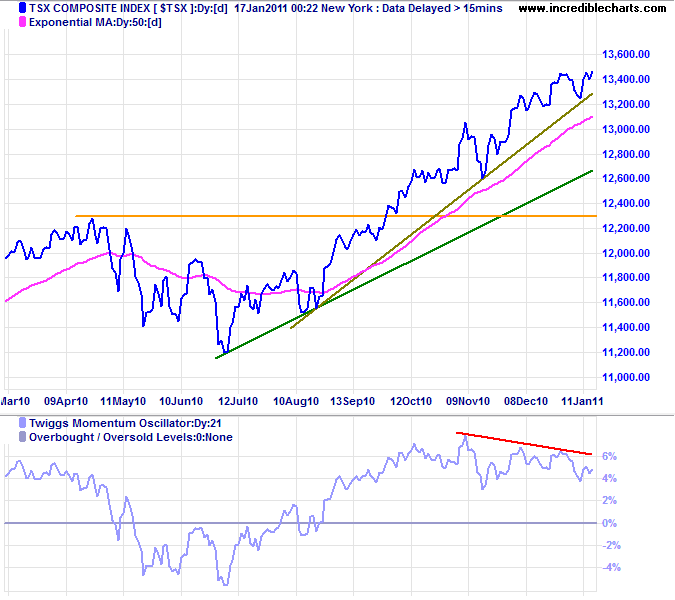

Canada: TSX

The TSX Composite reached its target of 13400*. Bearish divergence on Twiggs Momentum warns of a correction, most likely to test the rising green trendline.

* Target calculation: 13000 + ( 13000 - 12600 ) = 13400

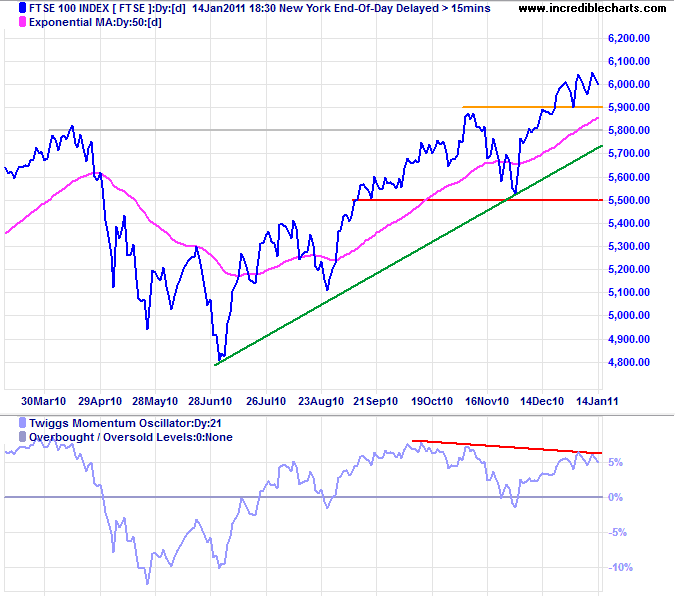

United Kingdom

The FTSE 100 respected support at 5900, but bearish divergence on 21-day Twiggs Momentum warns of another correction. The primary up-trend offers a target of the 2007 high at 6750*. Failure of support at 5500 is most unlikely, but would warn of a primary trend reversal.

* Target calculation: 5800 + ( 5800 - 4800 ) = 6800

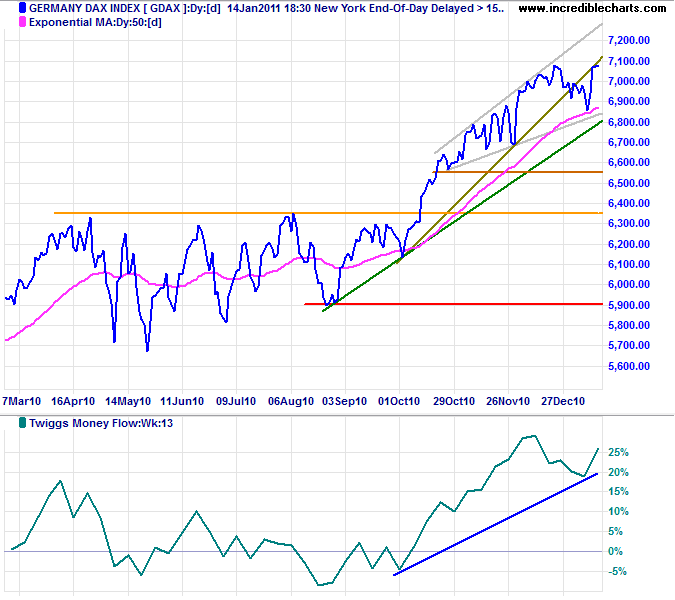

Germany

The DAX is testing resistance at 7100. Upward breakout would indicate an advance to 7450*. A 13-week Twiggs Money Flow trough high above zero indicates strong buying pressure. The ascending broadening wedge pattern is bearish, however, and downward breakout would signal retracement to 6550.

* Target calculation: 7000 + ( 7000 - 6550 ) = 7450

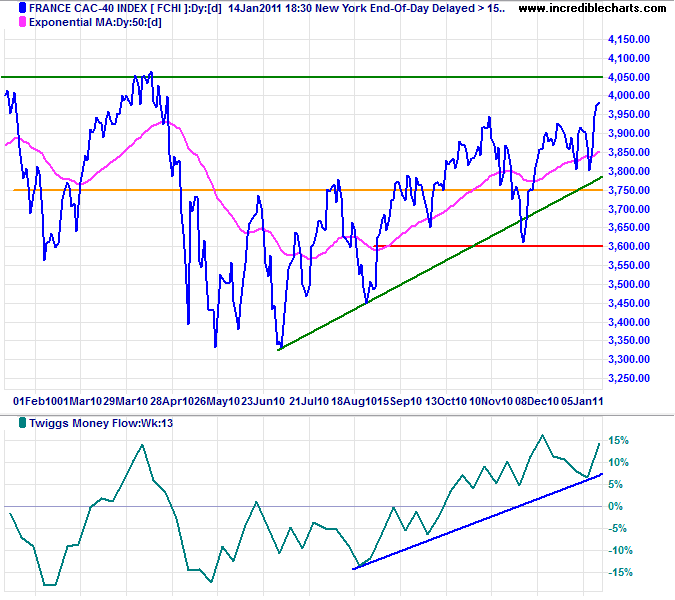

France

The CAC-40 is headed for a test of resistance at 4050, rising 13-week Twiggs Money Flow indicating buying pressure. Breakout would offer a long-term target of 4750*.

* Target calculation: 4050 + ( 4050 - 3350 ) = 4750

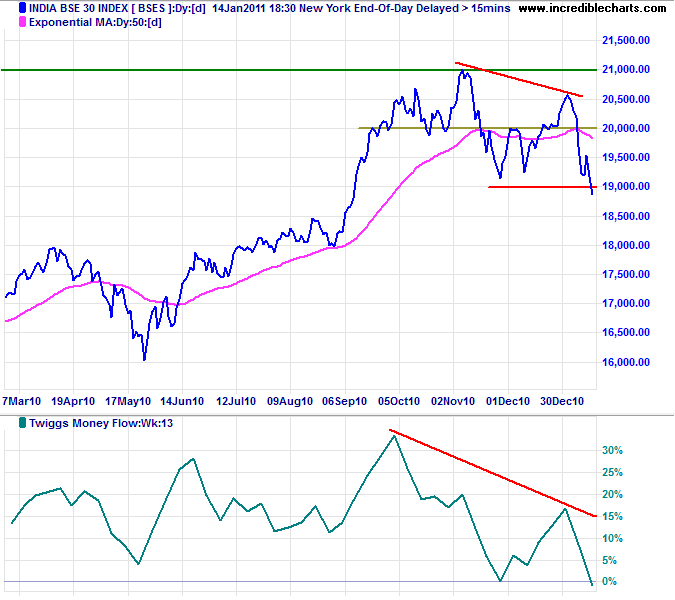

India

The Sensex broke support at 19000, signaling a primary down-trend. Twiggs Money Flow (13-week) reversal below zero confirms strong selling pressure. Expect a decline to 17500*.

* Target calculation: 19000 - ( 20500 - 19000 ) = 17500

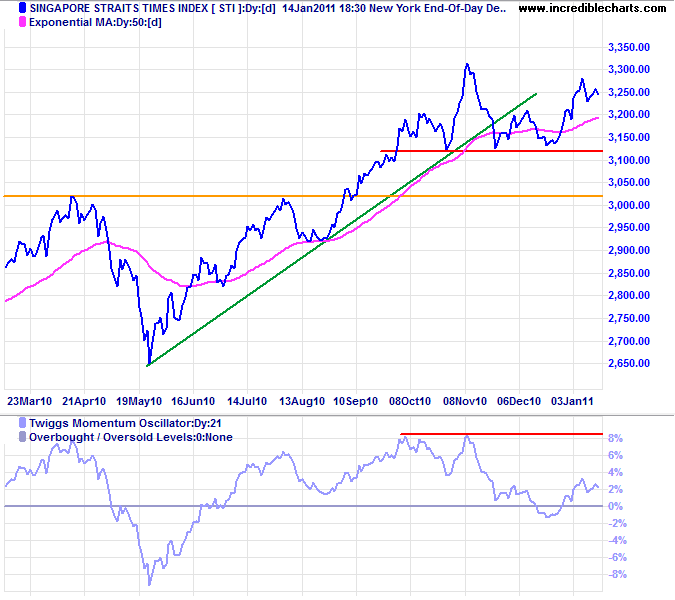

Singapore

The Straits Times Index continues to reflect weak Momentum after breaking the rising trendline. Twiggs Momentum (21-day) reversal below zero would warn of a primary trend reversal. Failure of support at 3120 would confirm.

* Target calculation: 3100 - ( 3300 - 3100 ) = 2900

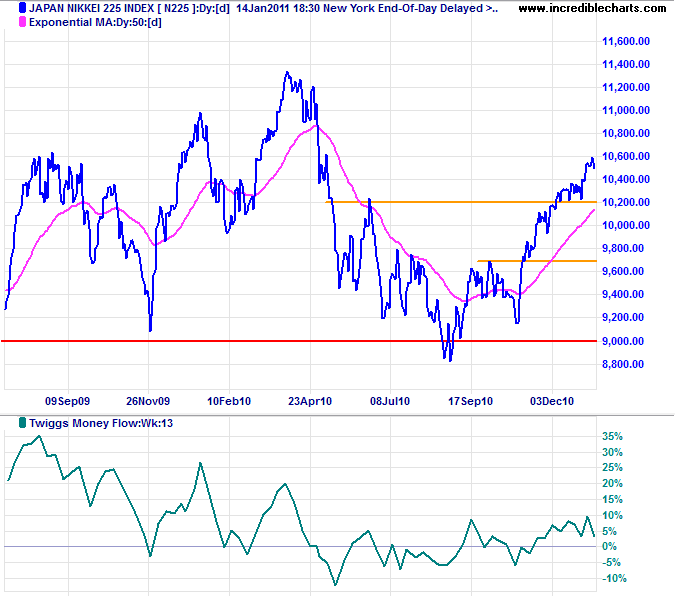

Japan

The Nikkei 225 is edging upwards after the breakout above 10200. Twiggs Money Flow (13-week) oscillating around zero, however, indicates hesitancy. Expect further consolidation above the new support level. Reversal below 10200 would warn of another correction.

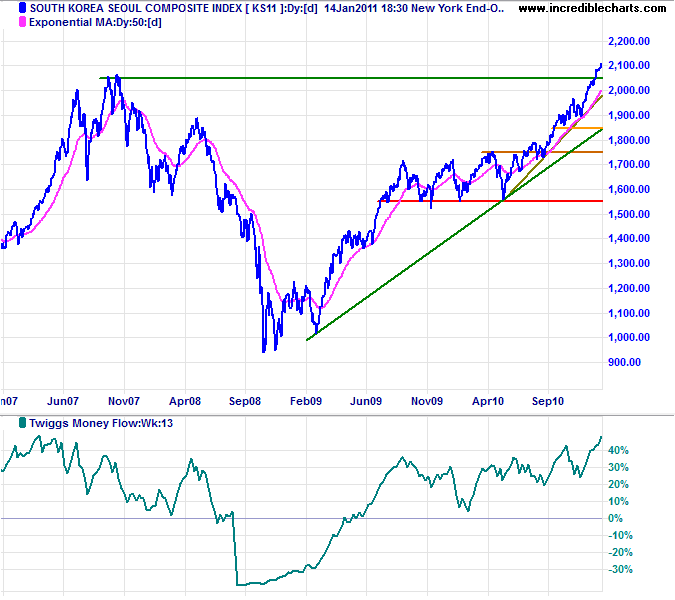

South Korea

The Seoul Composite Index crossed above its 2007 high at 2050, signaling a fresh primary advance. Twiggs Money Flow (13-week) troughs high above zero reflect strong buying pressure.

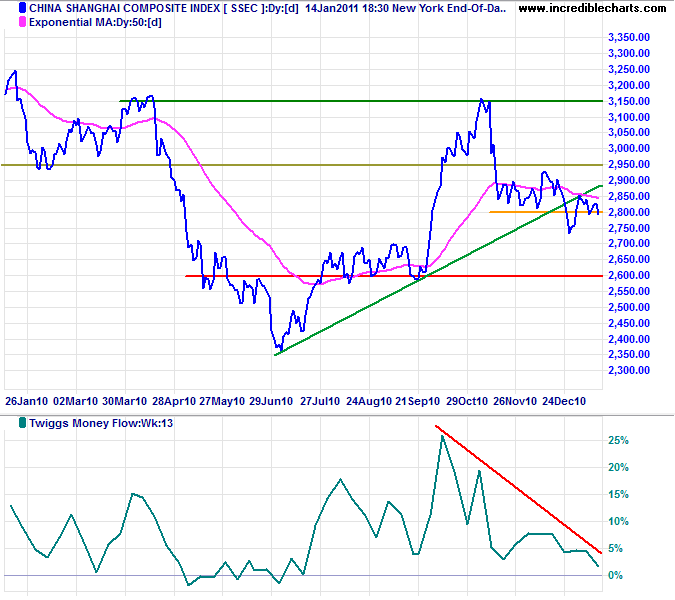

China

The Shanghai Composite index retreated below 2800 and is testing 2700 Monday. Expect a test of 2600*. Declining Twiggs Money Flow (13-week) warns of selling pressure.

* Target calculations: 2800 - ( 3100 - 2900 ) = 2600

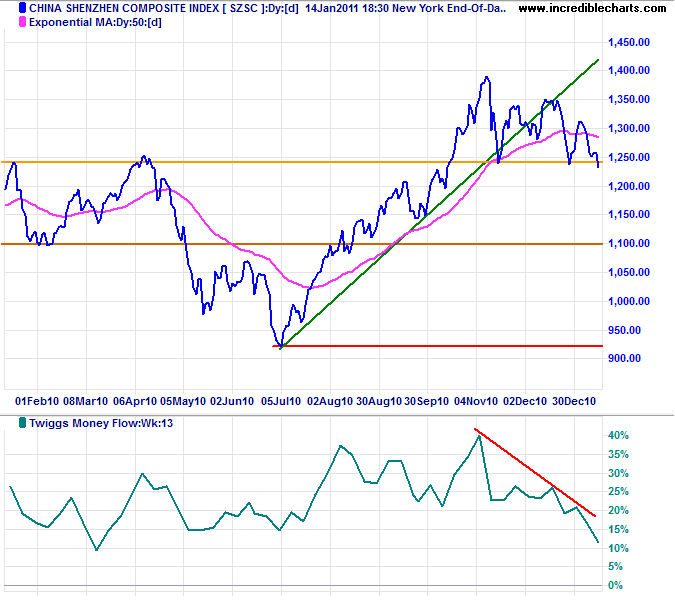

The Shenzhen Composite Index reversed below 1240, signaling correction to 1100. A sharp fall on Twiggs Money Flow (13-week) indicates strong selling pressure.

* Target calculation: 1250 - ( 1400 - 1250 ) = 1100

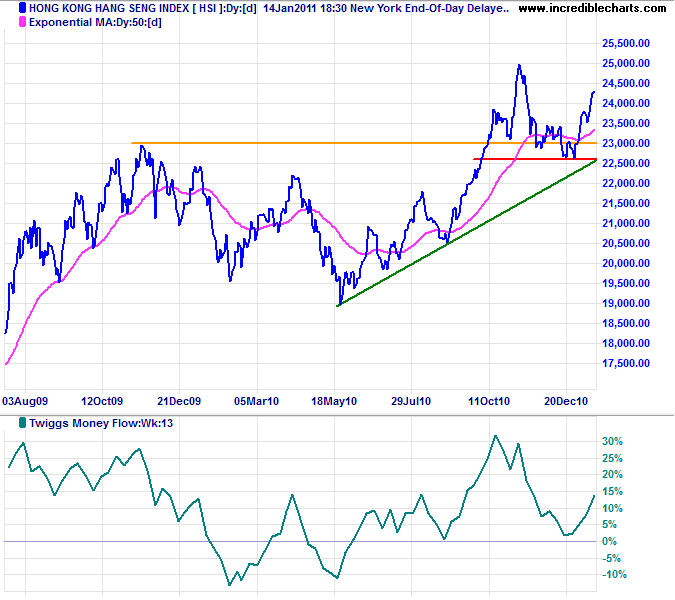

The Hang Seng Index, however, is advancing for another test of 25000. Twiggs Money Flow (13-week) respect of the zero line indicates buying pressure.

* Target calculation: 25000 + ( 25000 - 22500 ) = 27500

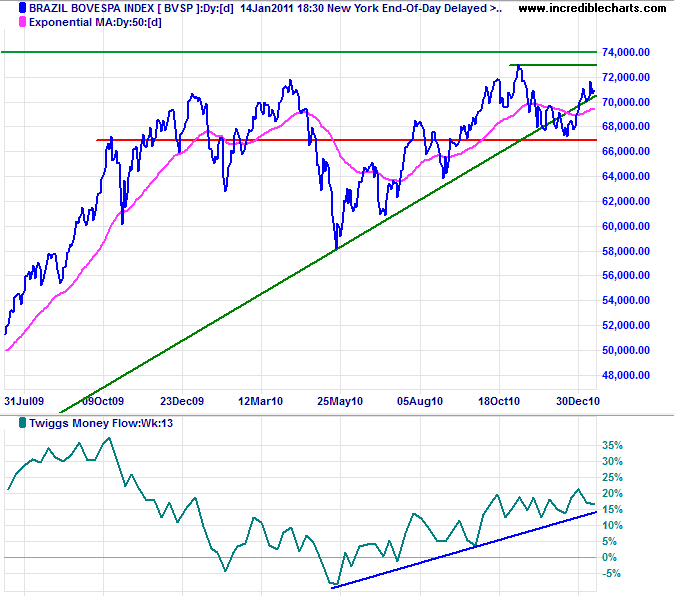

Brazil

The Bovespa Index is headed for a test of 73000. Breakout would signal an advance to 79000*. Rising Twiggs Money Flow (13-week) indicates buying pressure.

* Target calculation: 73000 + ( 73000 - 670000 ) = 79000

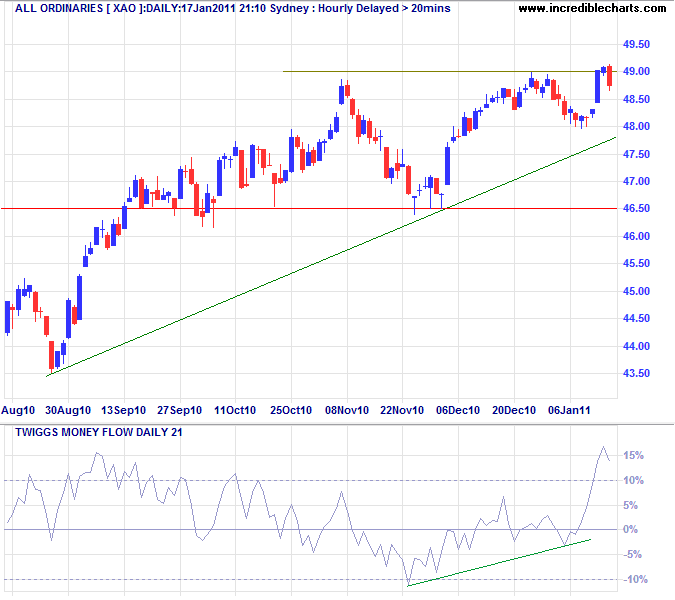

Australia: ASX

The All Ordinaries encountered strong selling at 4900. Twiggs Momentum displays a bearish divergence, but Twiggs Money Flow (21-day) remains strong. Reversal below the rising trendline would reinforce the declining Momentum; recovery above 4900 is less likely, but would signal an advance to 5150*.

* Target calculation: 4900 + ( 4900 - 4650 ) = 5150

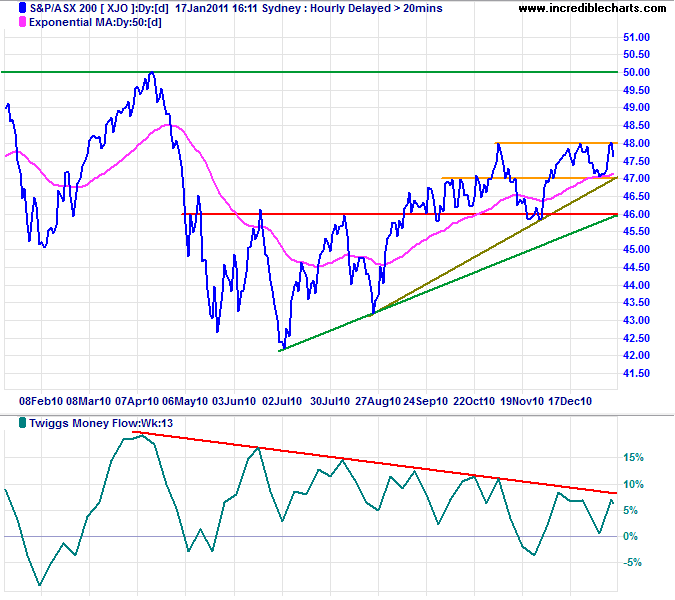

The ASX 200 encountered similar resistance, but at 4800. Breakout would test 5000, but declining Twiggs Money Flow (13-week) warns of selling pressure and reversal below 4600 would signal a primary trend reversal.

I should be very sorry to see the United States holding anyone in confinement on account of any opinion that that person might hold. It is a fundamental tenet of our institutions that people have a right to believe what they want to believe and hold such opinions as they want to hold without having to answer to anyone for their private opinion.

~ Calvin Coolidge

(appropriate to the visit of Chinese premier Hu Jintao)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.