Encouraging breakout

By Colin Twiggs

December 1, 2010 8:30 p.m. ET (12:30 p:m AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

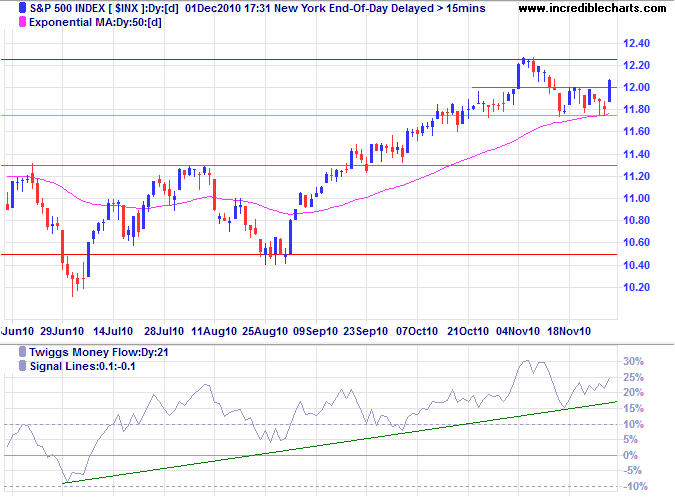

Stocks rallied, with the S&P 500 making an encouraging breakout above 1200. Expect a test of the recent high at 1225. Follow-through above 1225 would flag another primary advance. Rising Twiggs Money Flow (21-day) continues to indicate buying pressure. Reversal below 1180 is unlikely, but would warn of a secondary correction, testing 1130.

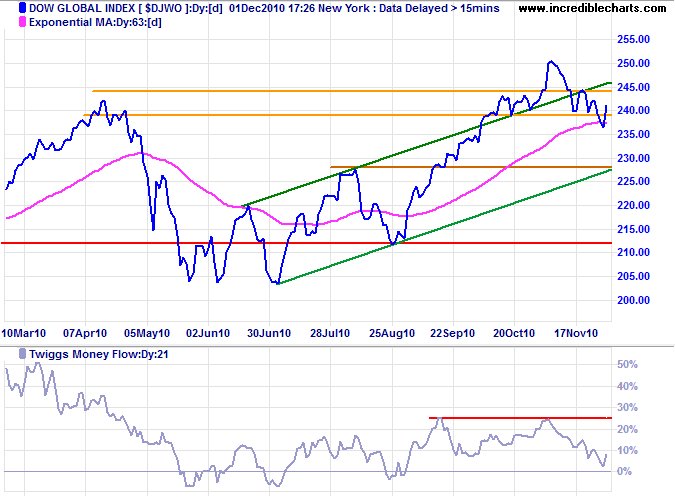

The DJ Global index recovered above recent support at 238. Breakout above 244 would support the S&P signal.

US Dollar Index

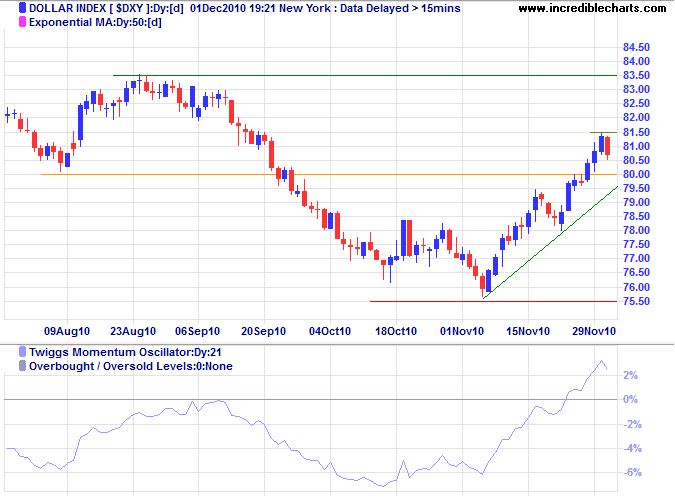

The US Dollar Index is retracing to test the new support level at 80. Reversal below the rising trendline would signal another test of primary support at 75.50, while respect would indicate a test of resistance at 83.50. Twiggs Momentum (21-day) is rising, but has not yet established a primary up-trend — that would come from a trough respecting the zero line.

* Target calculation: 76 - ( 80 - 76 ) = 72

Gold

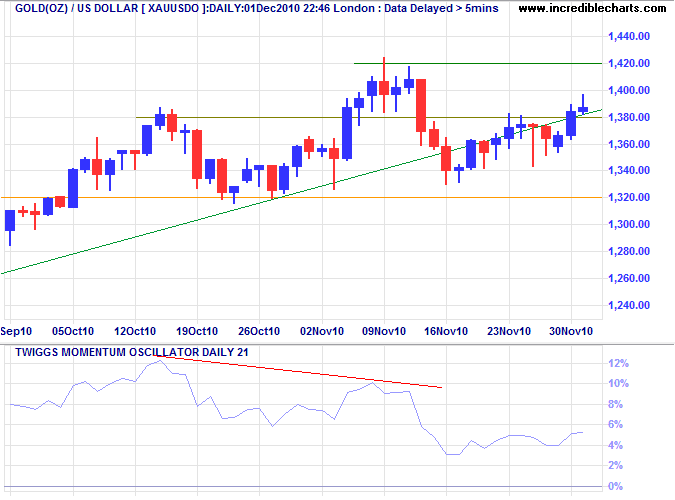

Bearish divergence on Twiggs Momentum (21-day) and penetration of the rising trendline both warn of a correction. Failure of support at $1320 would confirm. Recovery above $1380 is encouraging, but the tall shadow indicates selling pressure. Follow-through above 1420 would signal an advance to 1500*.

* Target calculation: 1420 + ( 1420 - 1340 ) = 1520

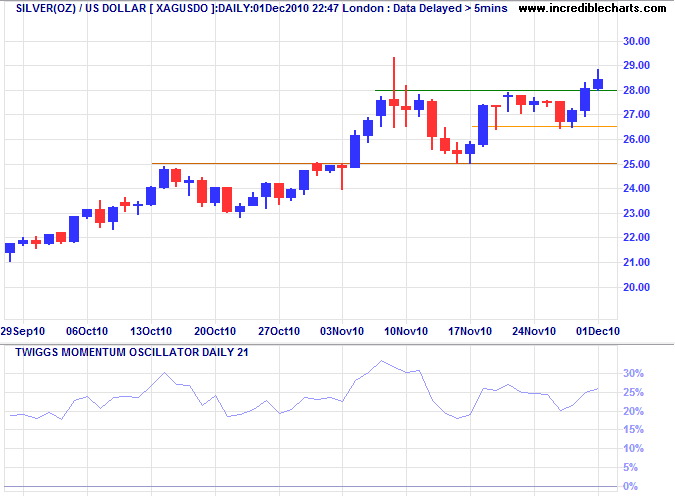

Silver

Silver's breakout above resistance at 28 is more encouraging and respect of the new support level would indicate an advance to 31*. Further gains would spur demand for gold.

* Target calculation: 28 + ( 28 - 25 ) = 31

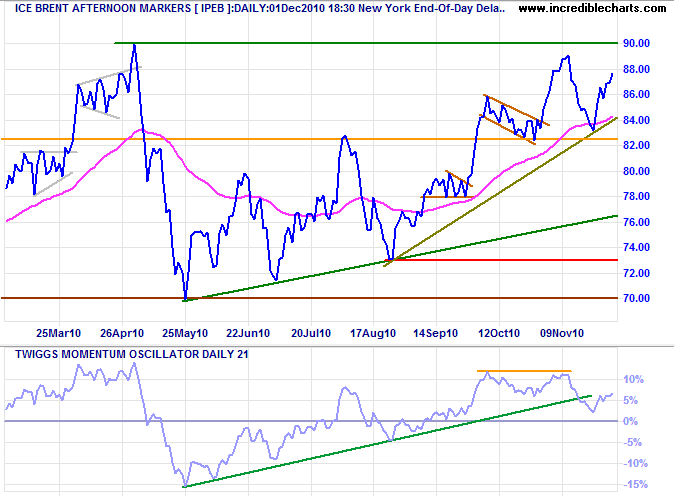

Crude Oil

Brent Crude is headed for resistance at $90/barrel. Breakout would signal a primary advance, offering a target of $110*. Completion of a Twiggs Momentum (21-day) trough above the zero line would strengthen the signal.

* Target calculation: 90 + ( 90 - 70 ) = 110

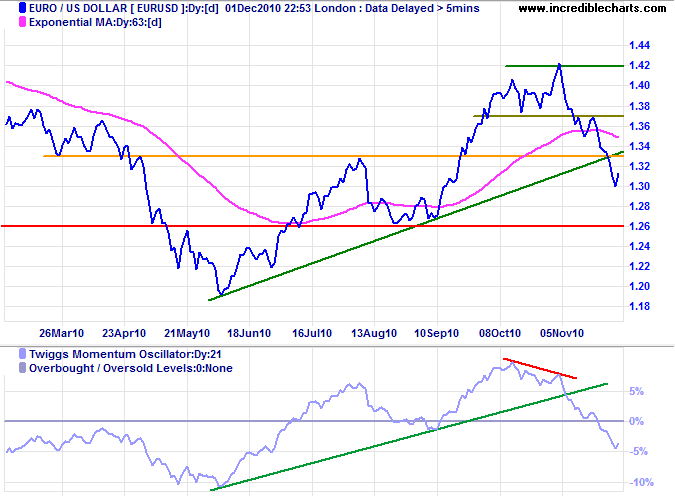

Euro

The euro is retracing to test resistance at $1.33. Respect would confirm that primary momentum is slowing and indicate a test of primary support at $1.26. A Twiggs Momentum (21-day) peak that respects the zero line would warn of reversal to a primary down-trend.

* Target calculation: 1.41 + ( 1.41 - 1.33 ) = 1.49

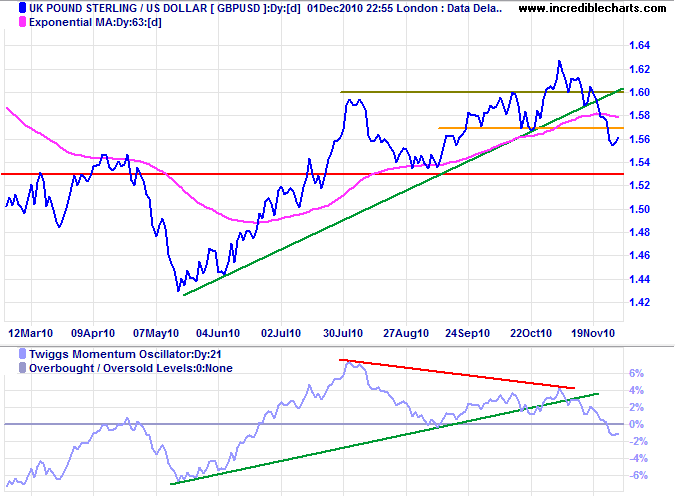

UK Pound Sterling

The pound broke support at $1.57 and is retracing to test the new resistance level. Expect a test of primary support at $1.53. Bearish divergence on Twiggs Momentum (21-day) warns of a reversal; a peak that respects zero (from below) would confirm. Recovery above $1.60 is most unlikely, but would warn of a bear trap and advance to $1.66*.

* Target calculation: 1.60 + ( 1.60 - 1.54 ) = 1.66

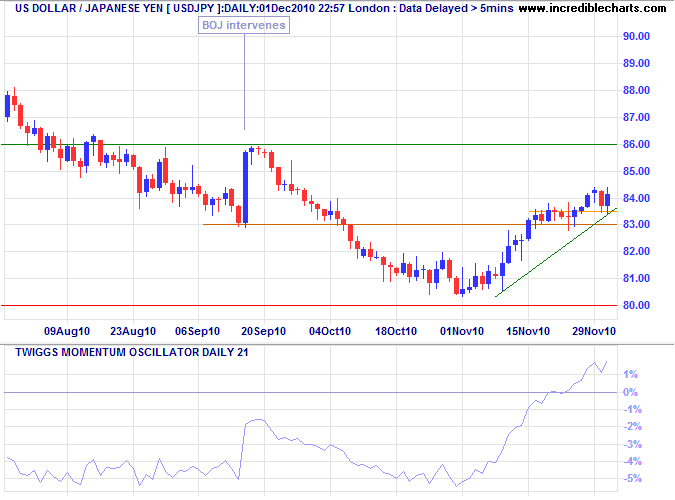

Japanese Yen

The dollar respected support at ¥83, indicating a test of ¥86. Reversal below the new support level is now unlikely, but would signal another test of ¥80. Momentum is rising, but the primary trend remains downward at present.

* Target calculations: 80 - ( 83 - 80 ) = 77

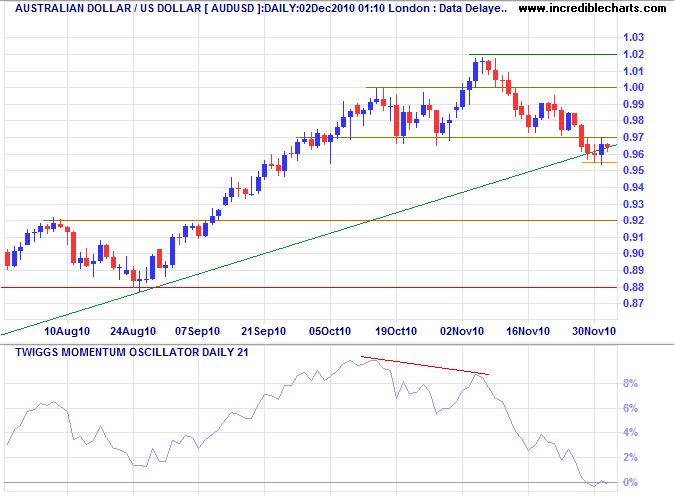

Australian Dollar

The Aussie dollar is consolidating in a narrow band below the new resistance level at $0.97 — a bearish sign. Breakout below $0.9550 would confirm a decline to $0.92. Recovery above $0.97 is less likely, but would suggest another rally to test parity. Bearish divergence on Twiggs Momentum (21-day) continues to warn of a correction. The primary trend, however, remains upward, with primary support at $0.88.

* Target calculation: 0.97 - ( 1.02 - 0.97 ) = 0.92

Nothing in the world can take the place of persistence. Talent will not; nothing is more common than unsuccessful men with talent. Genius will not; unrewarded genius is almost a proverb. Education will not; the world is full of educated derelicts. Persistence and determination alone are omnipotent. The slogan "Press on" has solved and always will solve the problems of the human race.

~ Calvin Coolidge

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.