Dollar Rally, Stocks Retreat

By Colin Twiggs

November 18, 2010 2:00 a.m. ET (6:00 p:m AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

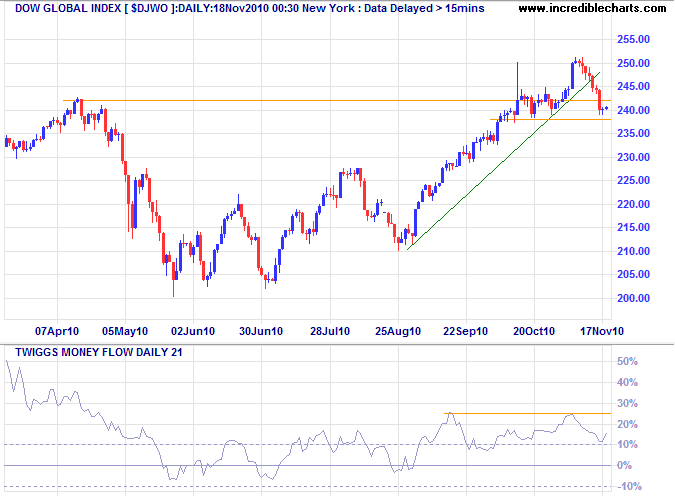

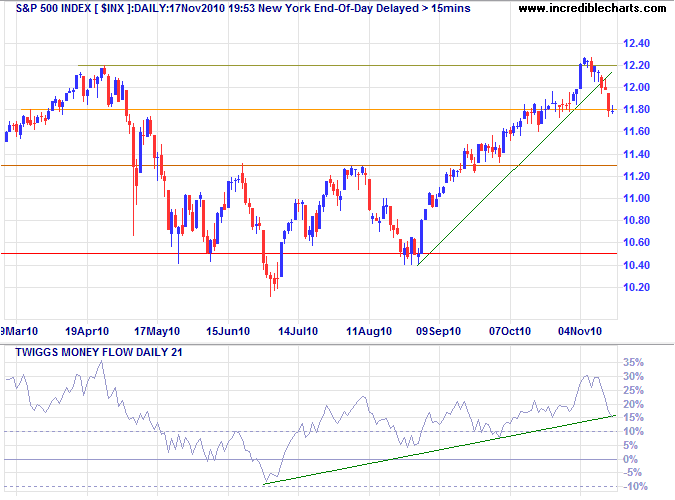

The dollar rallied while stocks declined in the last week, suggesting that fears of inflation are subsiding. Major stock indices have retreated sharply since a rash of breakouts signaled the start of a fresh primary advance. The Dow Jones Global index reversed below its April high of 242, but found short-term support at 238. Divergence on Twiggs Money Flow (21-day) warns of a correction/consolidation. Failure of support at 238 would confirm the correction.

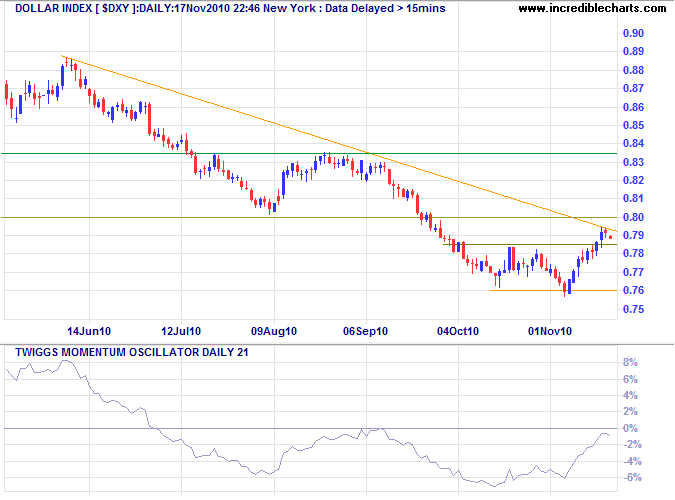

US Dollar Index

The US Dollar Index broke through resistance at 78.5 and is headed for a test of 80. Reversal below 76 remains likely, however, and would offer a medium-term target of 72*. Respect of the zero line by Twiggs Momentum (21-day) would signal continuation of the primary down-trend.

* Target calculation: 76 - ( 80 - 76 ) = 72

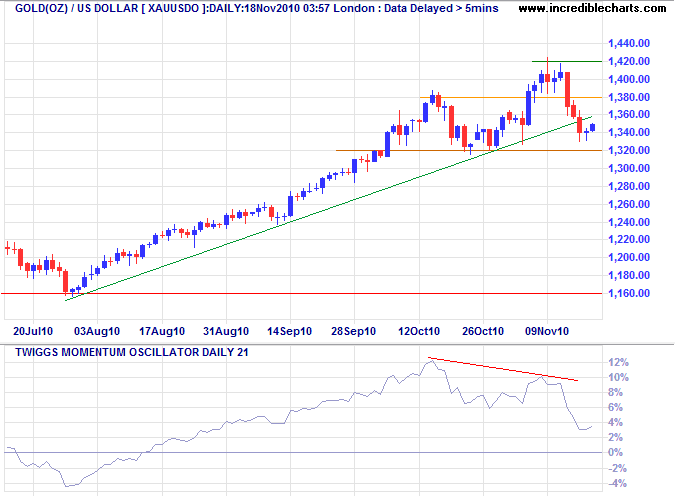

Gold

Bearish divergence on Twiggs Momentum (21-day) and penetration of the rising trendline both warn of a correction. Penetration of support at $1320 would confirm — while recovery above $1380 would indicate an advance to 1500*.

* Target calculation: 1420 + ( 1420 - 1340 ) = 1520

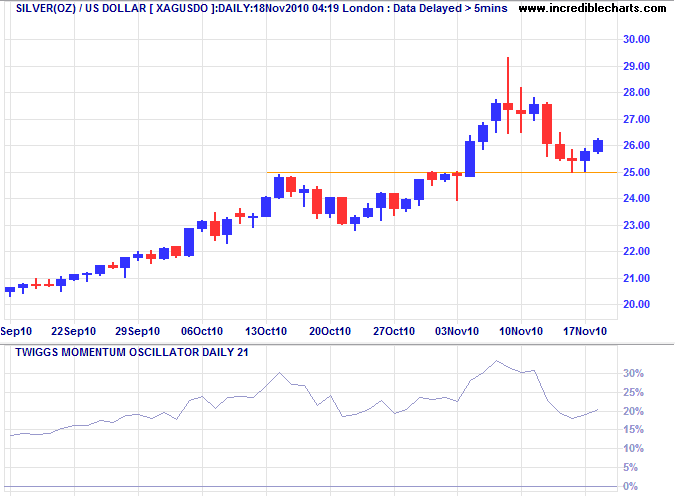

Silver

Silver respected the first line of support at $25, displaying stronger momentum than gold. Failure of support would warn of a correction, while respect would signal an advance to 31*.

* Target calculation: 28 + ( 28 - 25 ) = 31

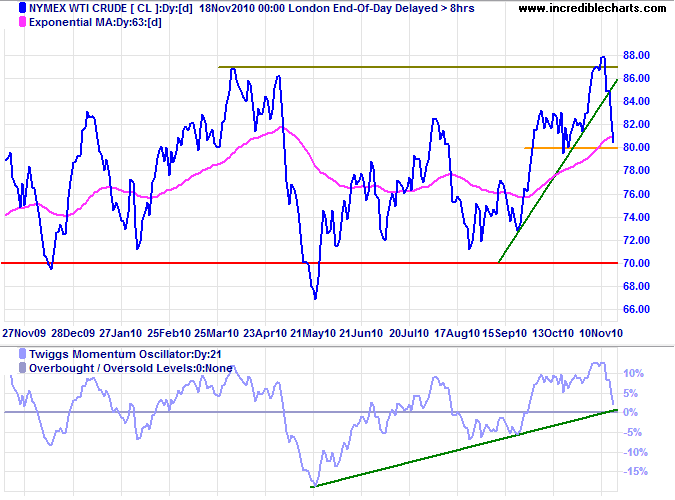

Crude Oil

Nymex WTI Crude retreated to short-term support at $80 per barrel. Failure would signal a test of $70. Respect is unlikely, but would indicate another test of $88. A Twiggs Momentum (21-day) trough above the zero line would confirm the up-trend.

* Target calculation: 87 + ( 87 - 67 ) = 107

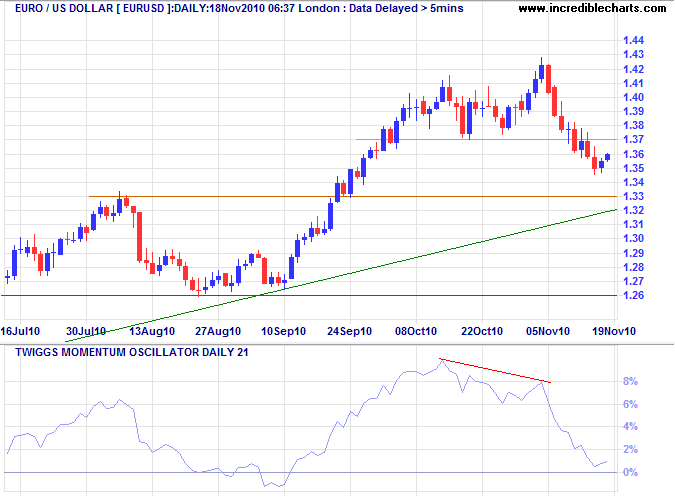

Euro

The euro broke support at $1.37, confirming the correction indicated earlier by divergence on Twiggs Momentum (21-day). Expect a test of support at $1.33. Recovery above $1.37 is unlikely, but would warn of a bear trap.

* Target calculation: 1.41 + ( 1.41 - 1.33 ) = 1.49

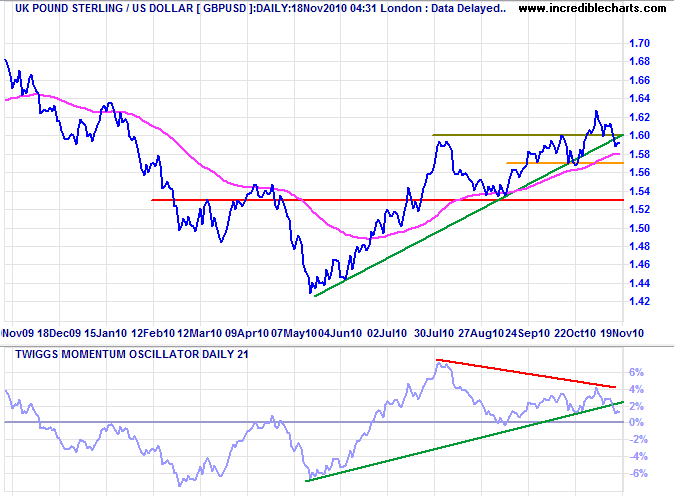

UK Pound Sterling

The pound sterling retreated below its new support level at $1.60. Bearish divergence on Twiggs Momentum (21-day) warns of a correction. Reversal below $1.57 would confirm. Recovery above $1.60 is unlikely, but would warn of a bear trap — and an advance to $1.66*.

* Target calculation: 1.60 + ( 1.60 - 1.54 ) = 1.66

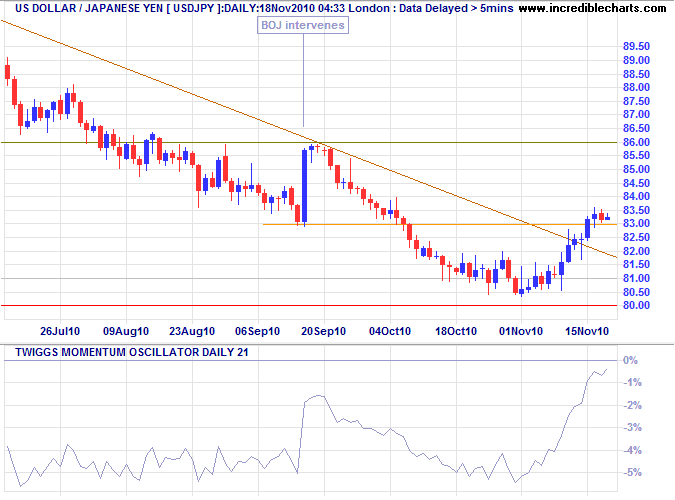

Japanese Yen

The dollar is consolidating after breaking resistance at ¥83. Follow-through would signal a test of ¥86, but failure of the new support level would signal another test of ¥80.

* Target calculations: 80 - ( 83 - 80 ) = 77

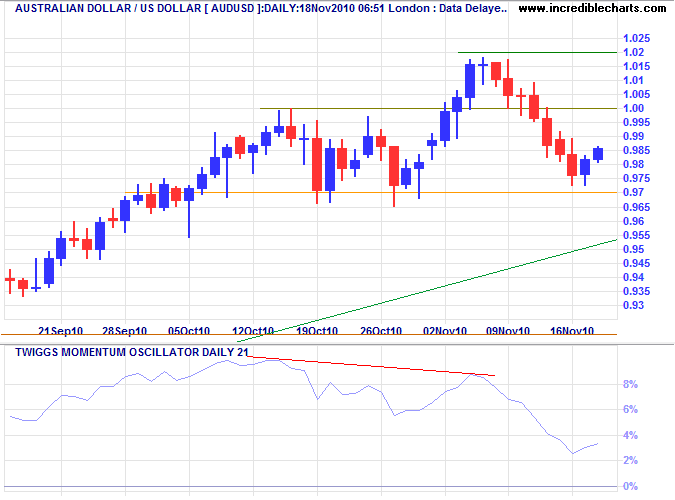

Australian Dollar

The Aussie dollar found support at $0.97 after falling sharply below $1.00. Expect another test of parity, but failure to break through would warn of a correction. Bearish divergence on Twiggs Momentum (21-day) also indicates a correction. The primary trend remains upward, however, and recovery above $1.00 would signal another advance.

* Target calculation: 1.02 + ( 1.02 - 1.00 ) = 1.04

Never follow somebody else's path; it doesn't work the same way twice for anyone... the path follows you and rolls up behind you as you walk, forcing the next person to find their own way.

~ J. M. Straczynski

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.