Seoul-mates

By Colin Twiggs

November 11, 2010 3:00 a.m. ET (7:00 p:m AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

President Barack Obama urged the G-20 nations to stand firm against protectionism and called for a joint commitment to growth, part of an effort by U.S. officials to soften discord as the G-20 prepared for its meeting here beginning Thursday.

~ Wall Street Journal

The G-20 summit this week is likely to end with a display of unity, but deliver little in the way of real substance. The Seoul communiqué is unlikely to set firm boundaries nor provide the means to enforce them. China will continue to export capital as well as goods in an effort to maintain its current trade advantage. Considering that efforts to curb the flow of goods would risk a trade war that would damage all parties, and that fast-growing nations such as Brazil are already taxing foreign bond investments, restricting capital inflows is the most attractive option. QE by the Fed is not a viable response: it is likely to cause the US economy as much harm as the manipulators.

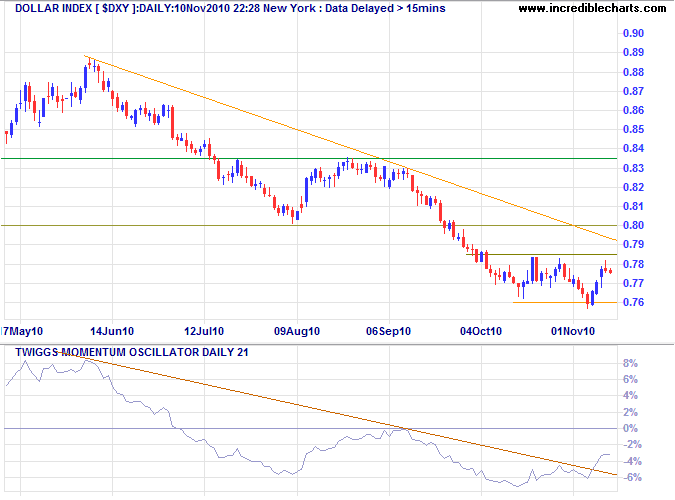

US Dollar Index

The US Dollar Index rallied off support at 76, but is now encountering resistance at 78.5. Breakout would test 80, while reversal below 76 would offer a medium-term target of 73.5*. Penetration of the declining trendline by Twiggs Momentum (21-day) favors a rally, but respect of the zero line would confirm the primary down-trend.

* Target calculation: 76 - ( 78.5 - 76 ) = 73.5

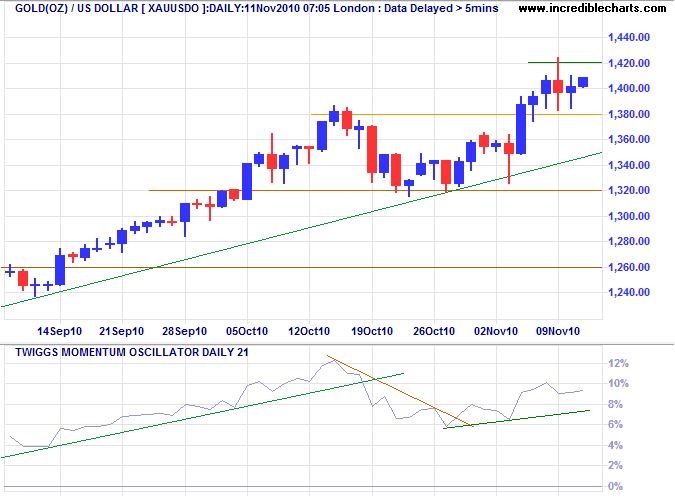

Gold

Spot gold is consolidating in a narrow range below resistance at $1420, favoring continuation of the up-trend. Breakout would signal a surge to $1500. A Twiggs Momentum (21-day) trough high above zero would indicate another strong advance.

* Target calculation: 1380 + ( 1380 - 1260 ) = 1500

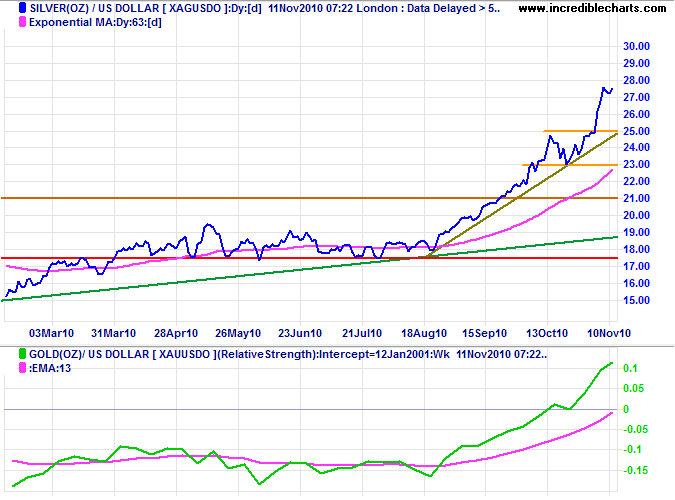

Silver

Silver continues to out-perform gold, with Relative Strength rising strongly. The accelerating up-trend runs the risk of a blow-off, especially if there is no retracement to test the new support level at $25.

* Target calculation: 25 + ( 25 - 23 ) = 27

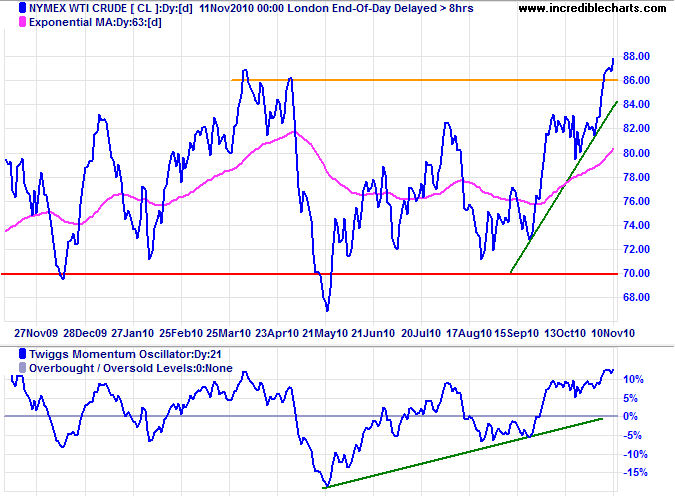

Crude Oil

Nymex WTI Crude broke through resistance at $86/$87 per barrel, offering a target of $107*. A Twiggs Momentum (21-day) trough above the zero line confirms the strong up-trend.

* Target calculation: 87 + ( 87 - 67 ) = 107

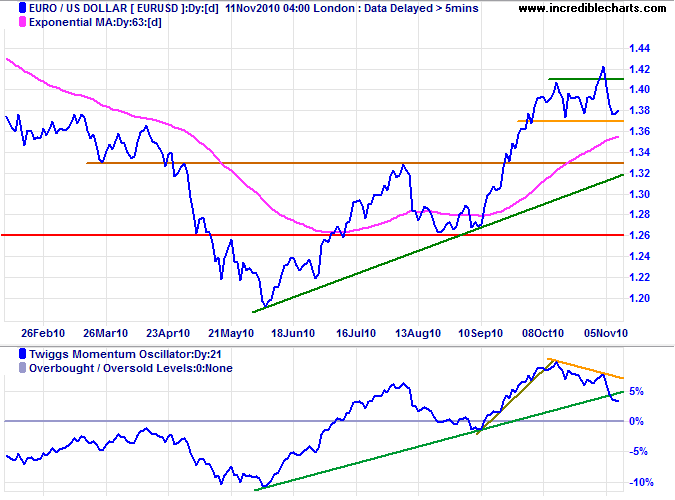

Euro

The euro retraced to test support at $1.37; respect would signal an advance to $1.50*. Bearish divergence on Twiggs Momentum (21-day), however, warns of a correction. Respect of the zero line in the medium term would confirm the primary up-trend.

* Target calculation: 1.41 + ( 1.41 - 1.33 ) = 1.49

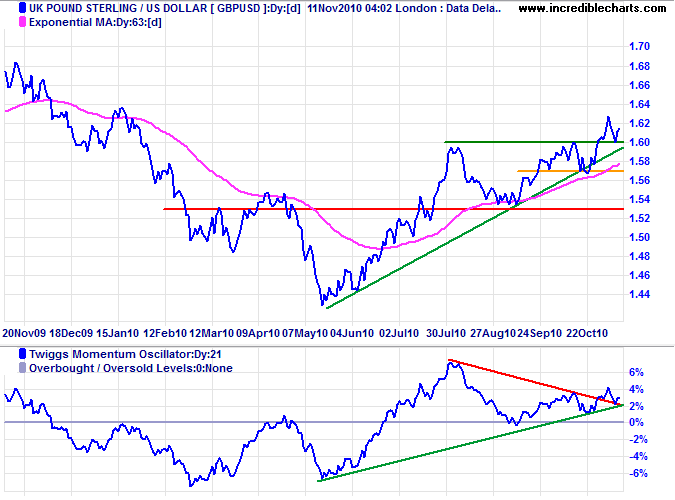

UK Pound Sterling

The pound sterling is testing the new support level at $1.60. Respect would signal an advance to $1.66*. Twiggs Momentum (21-day) respect of its rising trendline favors continuation of the up-trend.

* Target calculation: 1.60 + ( 1.60 - 1.54 ) = 1.66

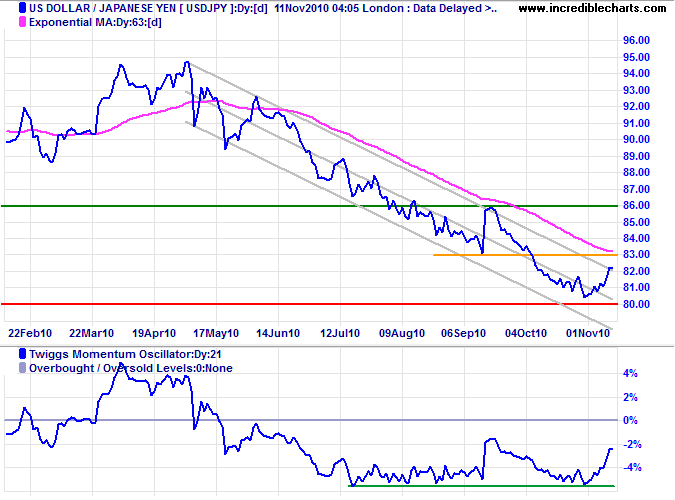

Japanese Yen

The dollar is testing its upper trend channel after finding support at ¥80. Breakout above ¥83 (or Twiggs Momentum recovery above zero) would warn that the down-trend is weakening, while reversal below ¥80 (or TM respect of zero) would suggest a decline to ¥77*.

* Target calculations: 80 - ( 83 - 80 ) = 77

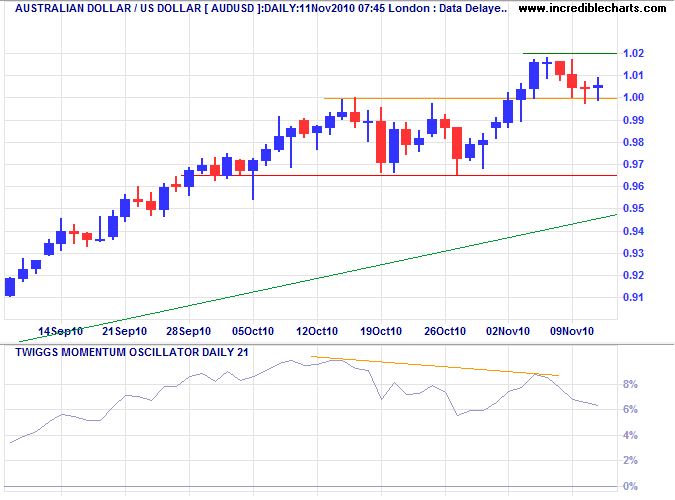

Australian Dollar

The Aussie dollar is testing its new support level at $1.00. Recovery above $1.02 would offer a short-term target of $1.04*. Bearish divergence on Twiggs Momentum (21-day) warns of profit-taking. Failure of support would suggest another test of $0.9650, but the primary trend remains upward.

* Target calculation: 1.02 + ( 1.02 - 1.00 ) = 1.04

If you do not choose to lead, you will forever be led by others.

~ J. M. Straczynski

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.