Inflation-fueled rally

By Colin Twiggs

October 25, 2010 4:30 a.m. ET (7:30 p.m. AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

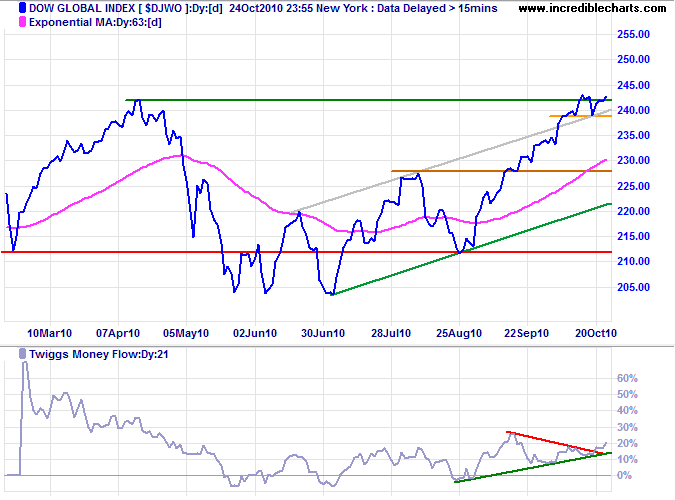

Fear of inflation is driving investors to real assets, primarily stocks at this stage. A weak result from the G-20 finance ministers meeting on the weekend will encourage further weakening of the dollar — and more flows into stocks.

The Dow Global index ($DJWO) recovered above its April high of 242, indicating a primary advance to 280*. Rising Twiggs Money Flow (21-day) confirms buying pressure.

* Target calculations: 242 + ( 242 - 204 ) = 280

USA

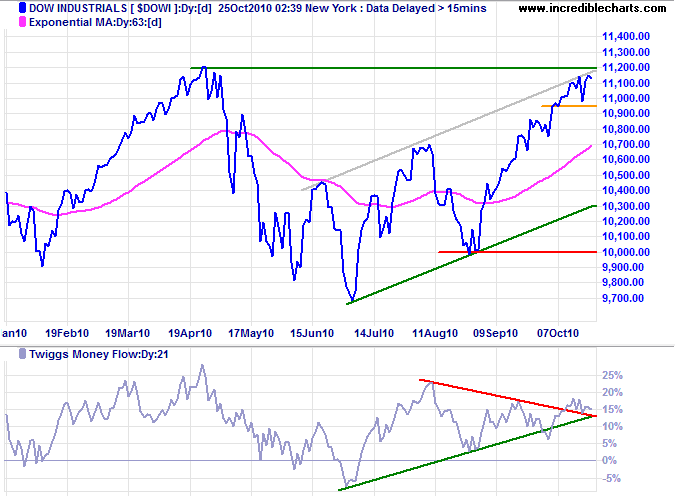

Dow Jones Industrial Average

The Dow is again testing its April high of 11200. Narrow consolidation below resistance favors a breakout. Twiggs Money Flow (21-day) oscillating above the zero line suggests buying pressure; respect of the rising trendline would confirm. Upward breakout would signal a primary advance to 12700*.

* Target calculations: 11200 + ( 11200 - 9700 ) = 12700

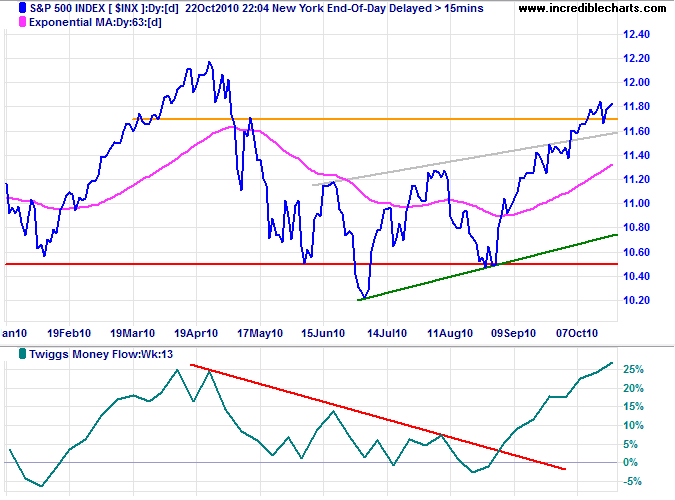

S&P 500

The S&P 500 respected short-term support at 1170, confirming the advance to the April high of 1220. A strong rise on Twiggs Money Flow (13-week) signals buying pressure. Breakout above 1220 would offer a long-term target of 1420*.

* Target calculation: 1220 + ( 1220 - 1020 ) = 1420

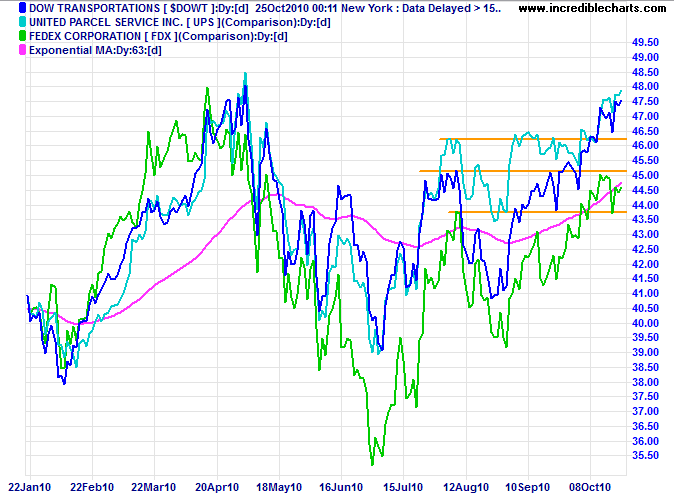

Transport

The Dow Transport index and bellwether stocks Fedex and UPS all continue in primary up-trends — a bullish sign for the broader economy.

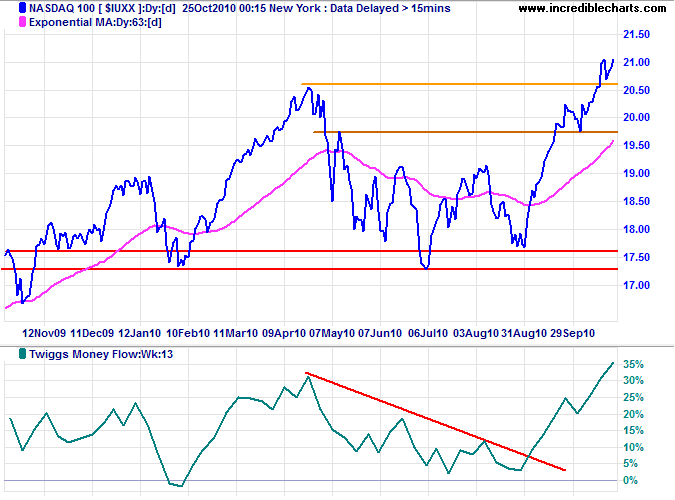

Technology

The Nasdaq 100 respected support at 2060, signaling an advance to the 2007 high of 2250*. The sharp rise on Twiggs Money Flow (13-week) indicates strong buying pressure.

* Target calculation: 2050 + ( 2050 - 1750 ) = 2350

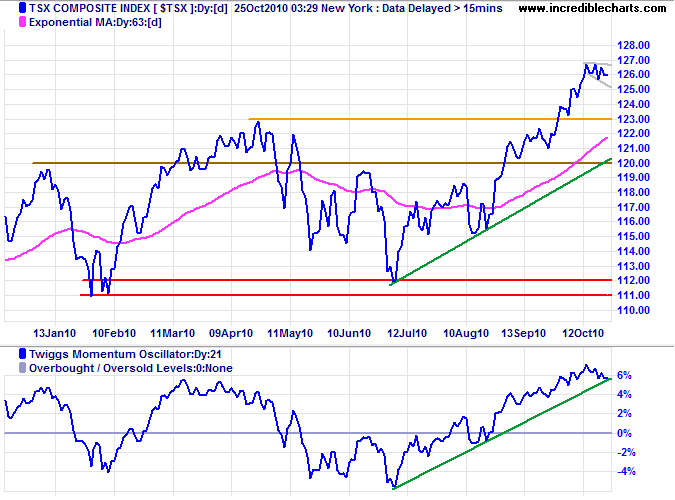

Canada: TSX

TSX Composite short-term consolidation favors continuation of the primary advance to 13400*. Reversal of 21-day Twiggs Momentum below its rising trendline, however, would warn of a correction — but a trough that respects the zero line would confirm the primary advance.

* Target calculation: 12300 + ( 12300 - 11200 ) = 13400

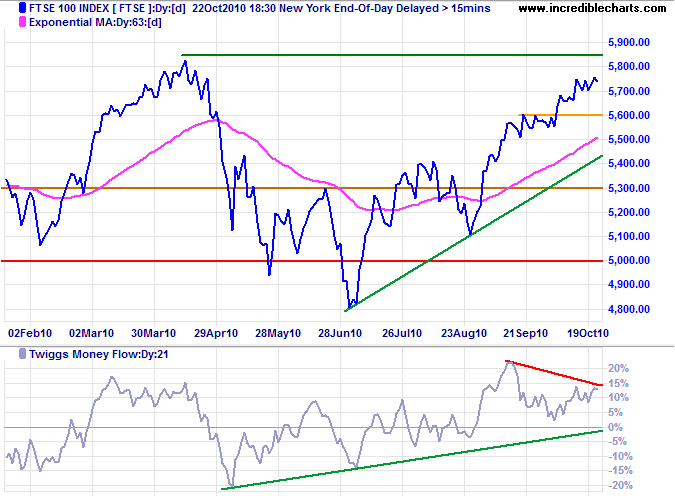

United Kingdom: FTSE

The FTSE 100 is headed for a test of its April high at 5850*. Breakout would offer a long-term target of the 2007 high at 6750*. Bearish divergence on Twiggs Money Flow (21-day), however, warns of medium-term selling pressure.

* Target calculation: 5800 + ( 5800 - 4800 ) = 6800

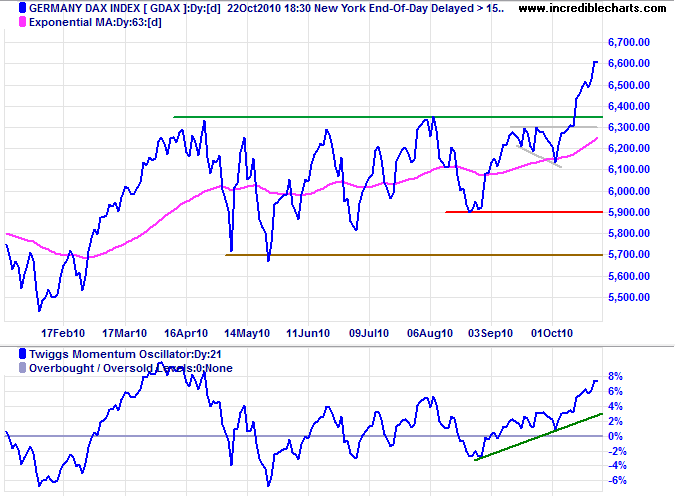

Germany: DAX

The DAX is in a primary advance with a target of 7000*. Expect retracement, but a Twiggs Momentum (21-day) trough that respects the zero line would confirm the strong up-trend.

* Target calculation: 6350 + ( 6350 - 5700 ) = 7000

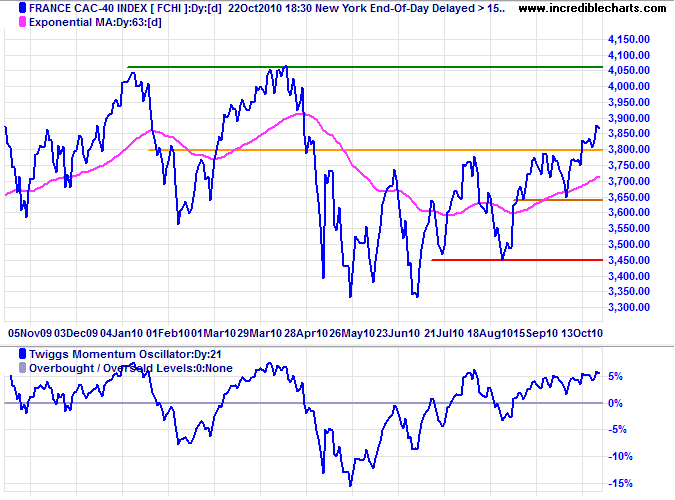

France: CAC-40

The CAC-40 is advancing to test its April high of 4050. Expect retracement, but Twiggs Momentum (21-day) respect of the zero line would likewise confirm the advance.

* Target calculation: 3750 + ( 3750 - 3450 ) = 4050

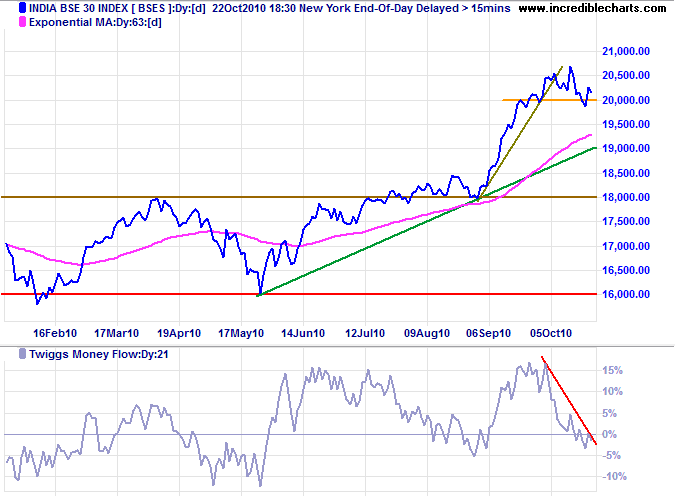

India

The Sensex is testing the new support level at 20000. Bearish divergence on Twiggs Money Flow (21-day), and a fall to below zero, warns of a correction. Failure of support would confirm.

* Target calculation: 18000 + ( 18000 - 16000 ) = 20000

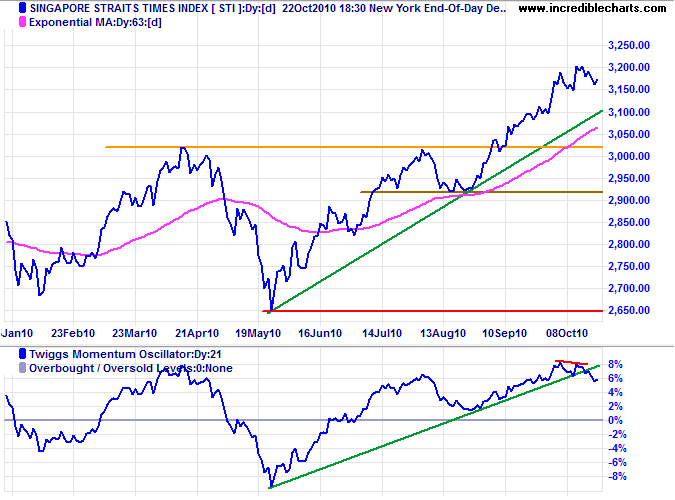

Singapore

The Straits Times index is consolidating below 3200. Reversal of 21-day Twiggs Momentum below its rising trendline warns of a correction, but a trough that respects the zero line would confirm a strong up-trend.

* Target calculation: 3000 + ( 3000 - 2650 ) = 3350

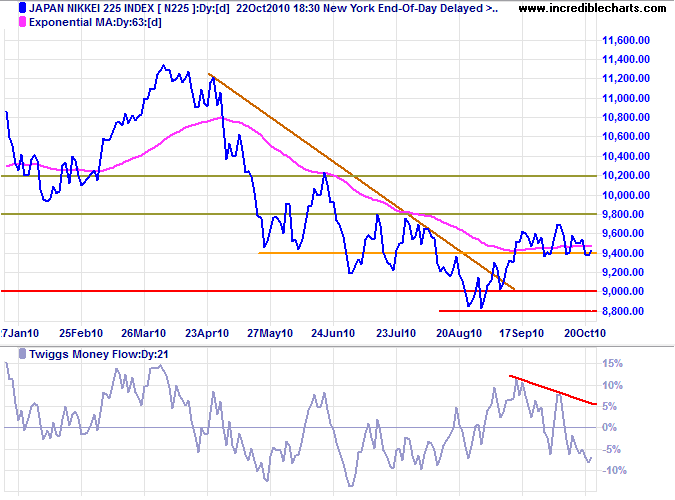

Japan

The Nikkei 225 continues to test medium-term support at 9350; failure would test primary support at 8800. Twiggs Money Flow (21-day) falling sharply below zero warns of strong selling pressure. Recovery above 9800 is unlikely, but would signal an advance to 10200.

* Target calculation: 9000 - ( 11000 - 9000 ) = 7000

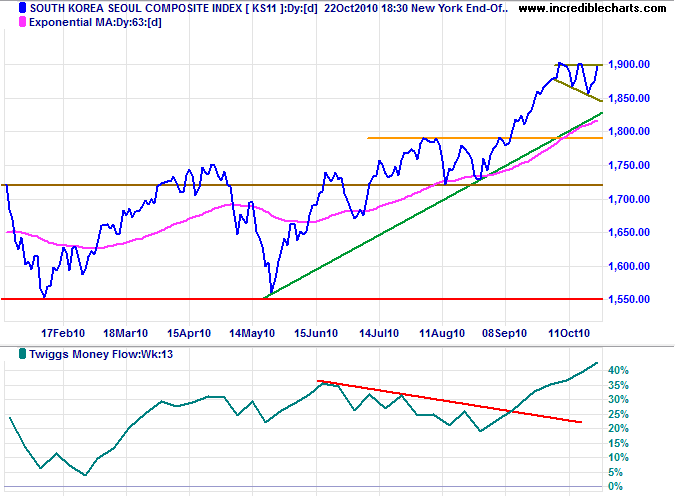

South Korea

The Seoul Composite index broke through resistance at 1900 on Monday. Twiggs Money Flow (13-week) indicates strong buying pressure. Target for the primary advance is 1950*, but the 2007 high is close by at 2050.

* Target calculation: 1750 + ( 1750 - 1550 ) = 1950

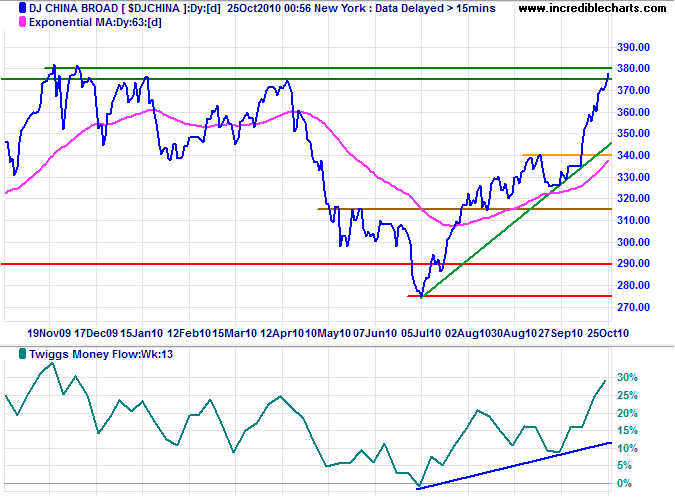

China

The DJ China index is testing resistance at 380. Rising Twiggs Money Flow (13-week) signals strong buying pressure. Breakout would offer a target of 480*. Reversal below the rising trendline is unlikely, but would warn of another correction.

* Target calculations: 380 + ( 380 - 280 ) = 480

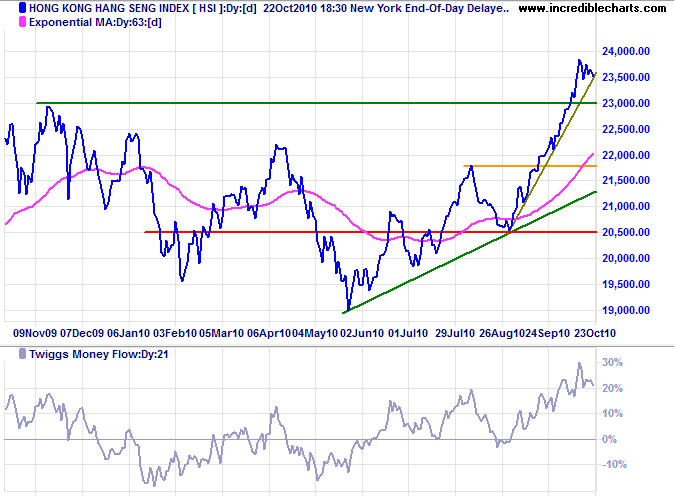

The HangSeng Index is consolidating in a narrow range above 23500, indicating continuation of the up-trend, but breakout below the rising trendline would test the new support level at 23000. Twiggs Money Flow (21-day) oscillating above the zero line signals continued buying pressure.

* Target calculations: 21800 + ( 21800 - 20600 ) = 23000

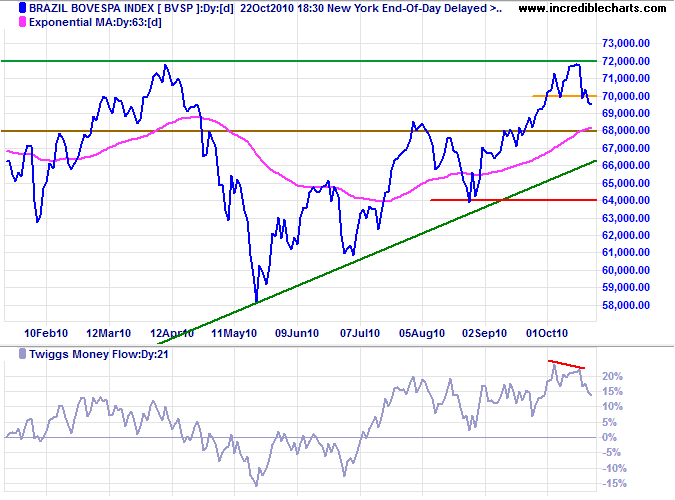

Brazil

The Bovespa index reversed below support at 70000, warning of a correction. Small bearish divergence indicates a lack of selling pressure. Expect a test of 68000. In the longer term, recovery above 72000 would test the 2008 high of 73500/74000.

* Target calculation: 70000 + ( 70000 - 60000 ) = 80000

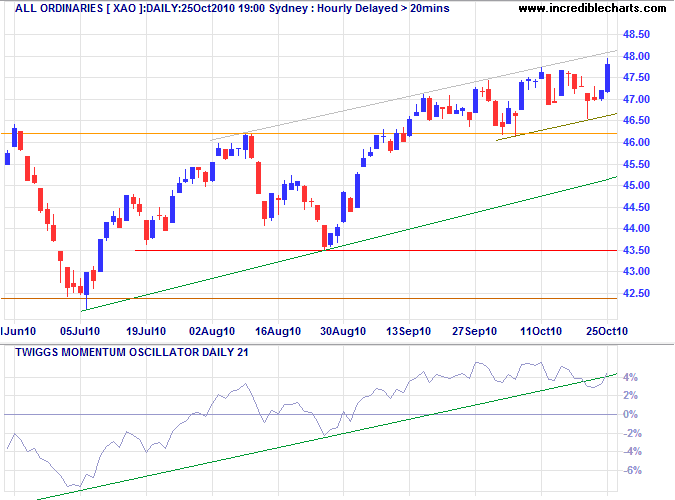

Australia: ASX

The All Ordinaries trend channel indicates an advance to 5000*. Twiggs Momentum (21-day) dipped briefly below the rising trendline but recovered to suggest futher upside. Reversal below 4620 is unlikely, but would warn of a correction to the lower channel line.

* Target calculation: 4650 + ( 4650 - 4250 ) = 5050

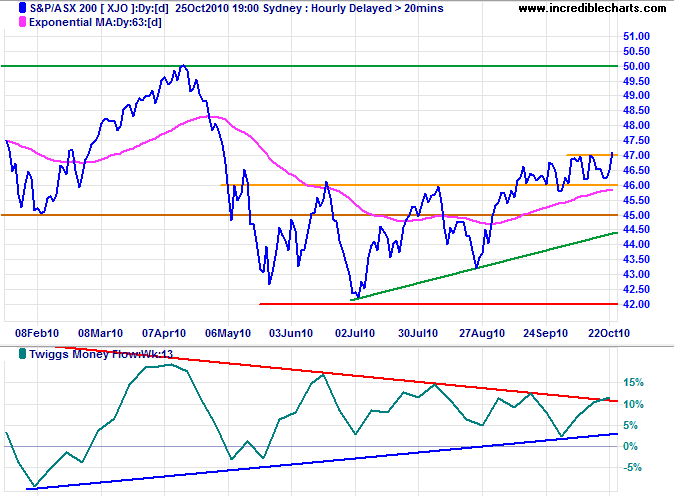

The ASX200 broke above the large triangle on Twiggs Money Flow (13-week), signaling long-term buying pressure. Expect a test of 5000.

If you look for truth, you may find comfort in the end; if you look for comfort you will not get either comfort or truth; only soft soap and wishful thinking to begin, and in the end, despair.

~ C.S. Lewis

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.