High stakes poker

By Colin Twiggs

October 14, 2010 1:00 a.m. EDT (4:00 p:m AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

The markets are starting to get that warm fuzzy feeling normally associated with another round of morphine-strength quantitative easing from the Fed. Further injections of money into the system, however, appear futile, given the results of the last $1 trillion splurge. And the glaring example of how a similar zero interest rate policy (ZIRP) failed to lift Japan out of the doldrums for almost two decades. Talk of QE may be largely posturing by the Fed ahead of the November G-20 summit on exchange rates.

The importance of this next summit should not be under-estimated. Convincing China and other major exporters to accept a substantial upward revaluation of their currencies will not be easy. And the tools necessary to force such an adjustment are largely un-tested. But failure would inevitably result in a trade war, with tit-for-tat imposition of punitive import tariffs, or a currency war, with competing devaluations. Either would generate massive global instability. The stakes are high. And this is one outcome the G-20 cannot afford to get wrong.

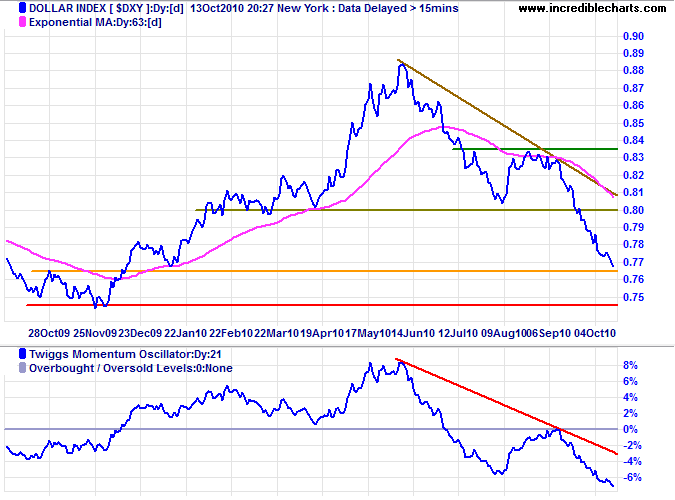

US Dollar Index

The US Dollar Index is testing support at 76.5; failure would test the 2009 low of 74.5. Twiggs Momentum (21-day) below its August low, after respecting the zero line, confirms a strong down-trend.

* Target calculation: 80 - ( 83.50 - 80 ) = 76.50

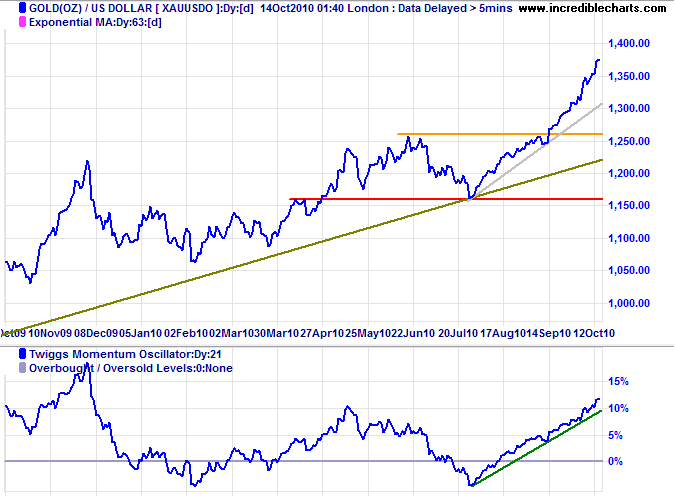

Gold

The gold up-trend is accelerating, highlighted by a series of ever-steeper trendlines. The potential for further rapid gains is great, but so is the risk of a sudden reversal. A 21-day Twiggs Momentum break of its rising trendline would warn of a correction.

* Target calculation: 1260 + ( 1260 - 1160 ) = 1360

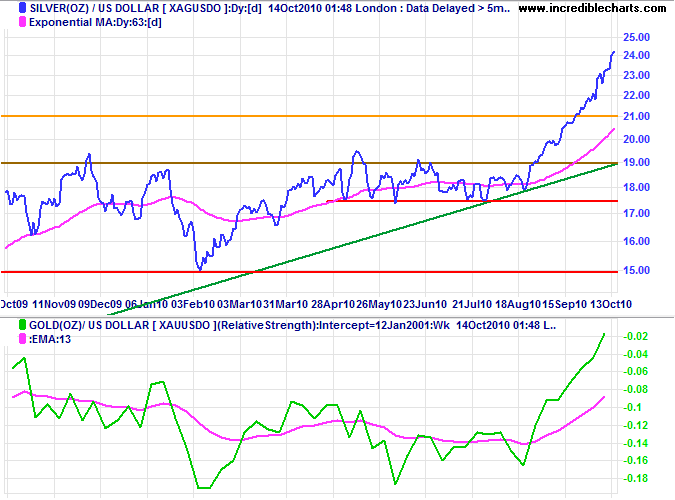

Silver

Silver is out-performing gold at present, with Relative Strength rising. The rapid ascent runs the risk of a blow-off.

* Target calculation: 20 + ( 20 - 15 ) = 25

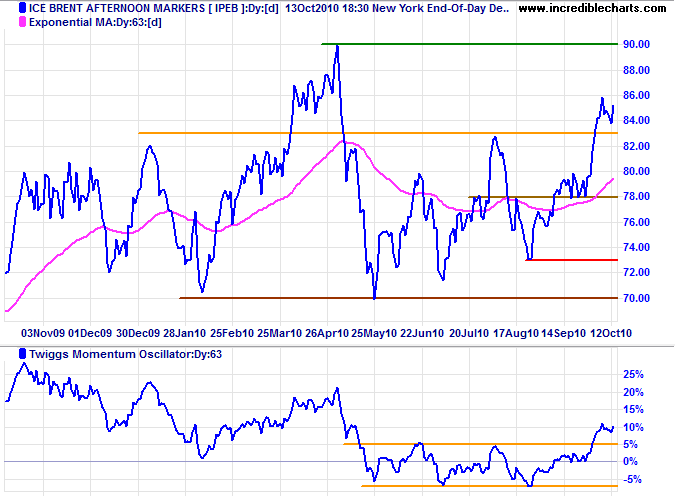

Crude Oil

Crude respected the new support level at $83 per barrel, signaling a test of the 2010 high at $90. Twiggs Momentum (63-day) holding outside its former range confirms the new up-trend.

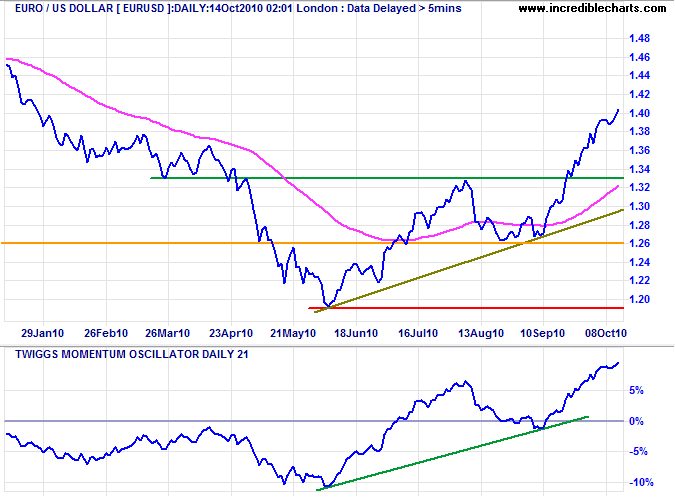

Euro

The euro reached its target of $1.40* but shows no signs of hesitation. Expect retracement to test the new support level at $1.33. Rising Twiggs Momentum signals a strong up-trend.

* Target calculation: 1.33 - ( 1.33 - 1.26 ) = 1.40

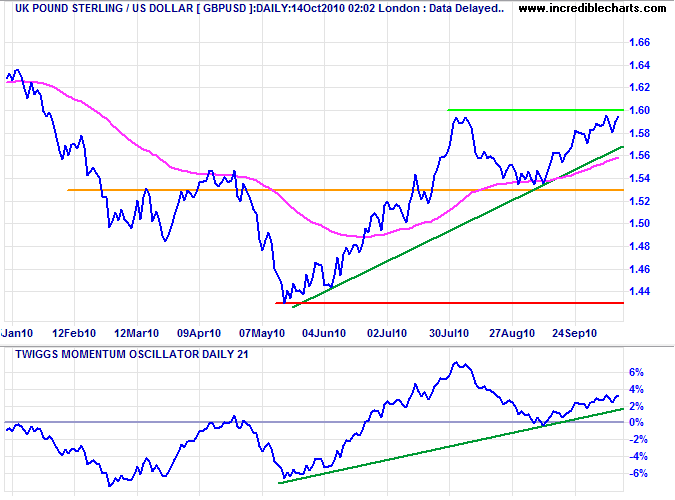

UK Pound Sterling

The pound is testing resistance at $1.60. Breakout would confirm an advance to $1.66*. Twiggs Momentum (21-day) respect of the zero line indicates a strong up-trend; reversal below the rising trendline is unlikely, but would warn of a correction.

* Target calculation: 1.60 + ( 1.60 - 1.54 ) = 1.66

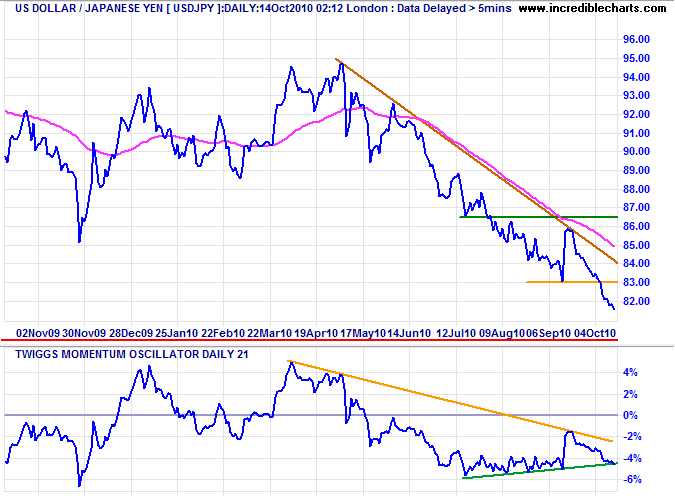

Japanese Yen

The dollar broke through support at ¥83 despite efforts by the Bank of Japan to halt the decline. Expect a test of the 1995 low at ¥80.

* Target calculations: 83 - ( 86 - 83 ) = 80

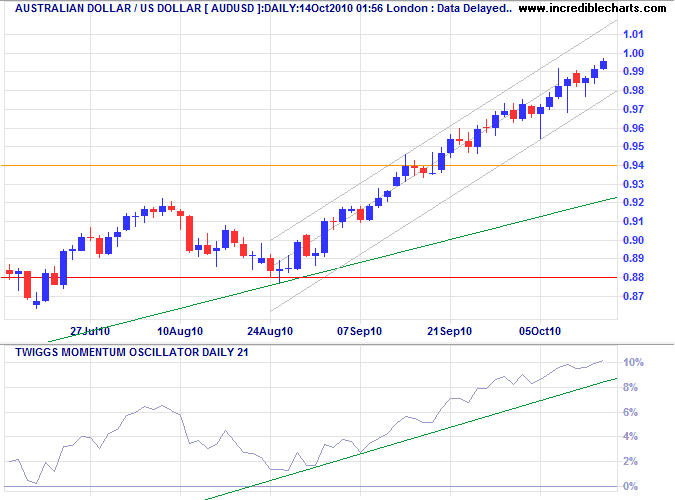

Australian Dollar

The Aussie dollar is testing parity against the greenback. Expect resistance at the key psychological level of $1.00, but expectations are ratcheting upwards, based on recent strength, and targets as high as $1.05* are doing the rounds. Many Australians, I suspect, are planning overseas holidays to take advantage of their increased spending power. My advice would be to book soon. The currency is over-valued — and experience should teach us that the euphoria seldom lasts long. Reversal of Twiggs Momentum (21-day) below its rising trendline would warn of a correction.

Every great crisis reveals the excessive speculations of many [banking] houses which no one before suspected, and which commonly indeed had not begun or not carried very far those speculations, till they were tempted by the daily rise of price and the surrounding fever.

~ Walter Bagehot (1826 - 1877).

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.