China & North America Rally

By Colin Twiggs

October 11, 2010 3:30 a.m. ET (6:30 p.m. AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Both China and North America are recovering. In anticipation, I expect, of a favorable outcome to the November G20 summit on currency reform. Failure to achieve a resolution would have serious implications for world trade. Quarter-end has passed with no sign of a correction. Expectations of rising inflation are driving investors back into stocks, but attempts at quantitative easing (QE) have so far been ineffectual and any increase in such measures would be short-sighted.

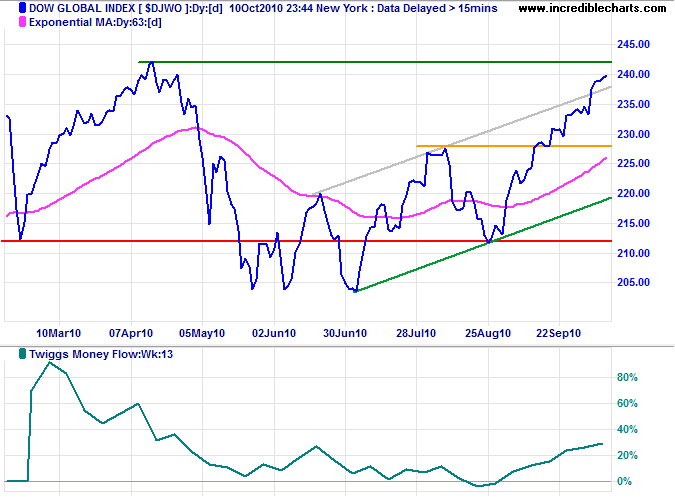

The Dow Global index ($DJWO) is headed for a test of its April high at 242. Twiggs Money Flow (13-week) holding above zero indicates buying pressure. Expect some retracement or consolidation below the resistance level, but breakout is likely and would signal a long-term advance to 280*.

* Target calculations: 242 + ( 242 - 204 ) = 280

USA

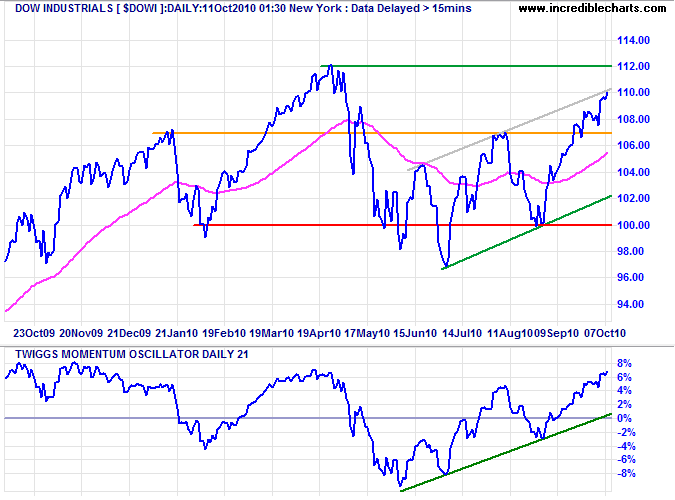

Dow Jones Industrial Average

The Dow is headed for a test of the April high at 11200. A Twiggs Momentum (21-day) retracement that respects the zero line would confirm an up-trend. Breakout above 11200 would signal an advance to 12700*.

* Target calculations: 11200 + ( 11200 - 9700 ) = 12700

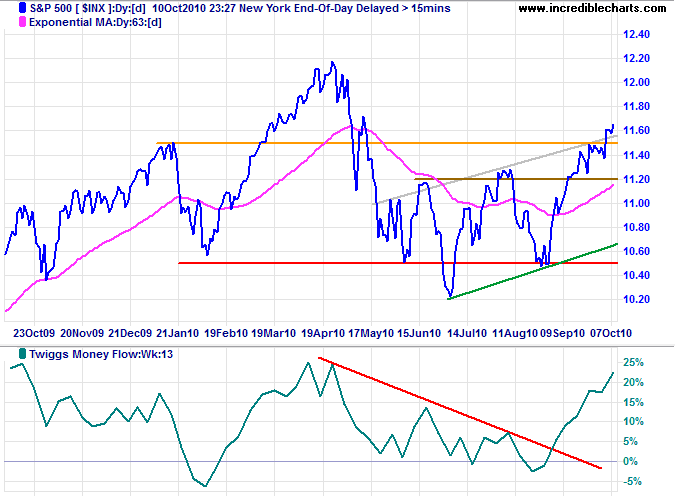

S&P 500

The S&P 500 broke through short-term resistance at 1150 and the upper trend channel, signaling an advance to the April high of 1220*. A strong rise on Twiggs Money Flow (13-week) signals buying pressure. Reversal below 1120 is now unlikely, but would test primary support at 1050.

* Target calculation: 1120 + ( 1120 - 1020 ) = 1220

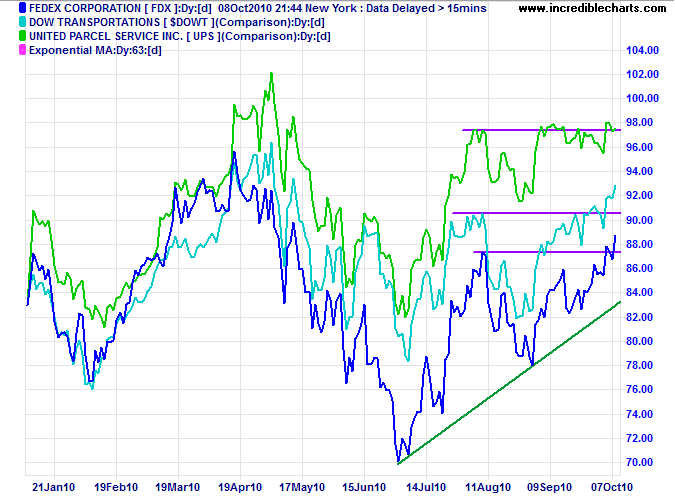

Transport

Fedex, UPS and the Dow Transport index broke through resistance to signal a primary up-trend. Advances generally precede a rise in economic activity.

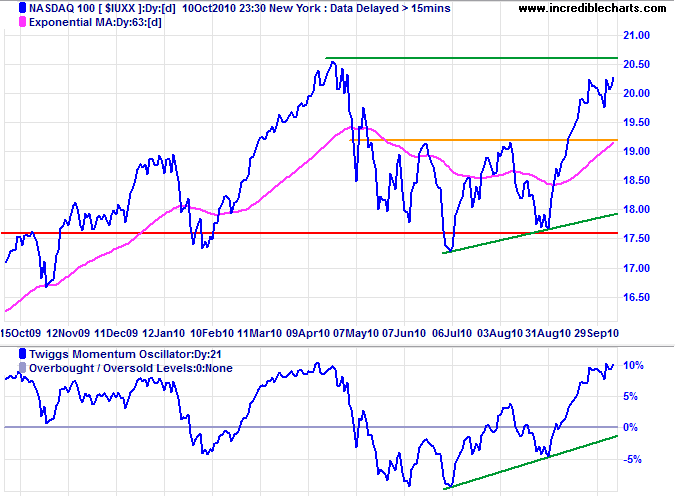

Technology

The Nasdaq 100 is headed for a test of its April high at 2060. Twiggs Momentum (21-day) respect of the zero line would confirm an up-trend. Breakout above 2060 would offer a target of the 2007 high at 2250*.

* Target calculation: 2050 + ( 2050 - 1750 ) = 2350

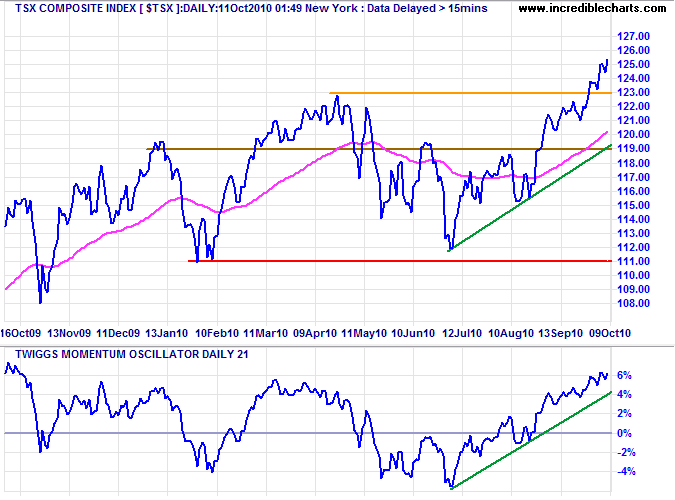

Canada: TSX

TSX Composite followed through above resistance at 12300, signaling a primary advance with a long-term target of 13400*. Retracement to test the new support level at 12300 remains likely. A 21-day Twiggs Momentum trough above the zero line would confirm the up-trend.

* Target calculation: 12300 + ( 12300 - 11200 ) = 13400

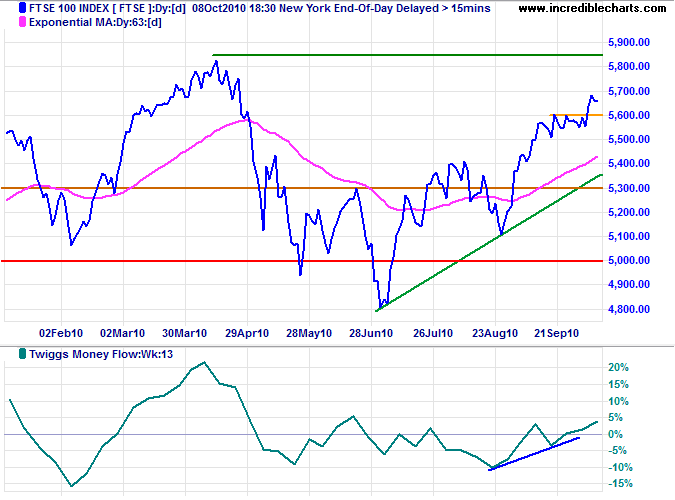

United Kingdom: FTSE

The FTSE 100 broke through short-term resistance at 5600, signaling a test of the April high at 5850*. Rising Twiggs Money Flow (13-week) indicates short/medium-term buying pressure. Breakout above 5850 would signal a long-term advance to the 2007 high of 6750*.

* Target calculation: 5800 + ( 5800 - 4800 ) = 6800

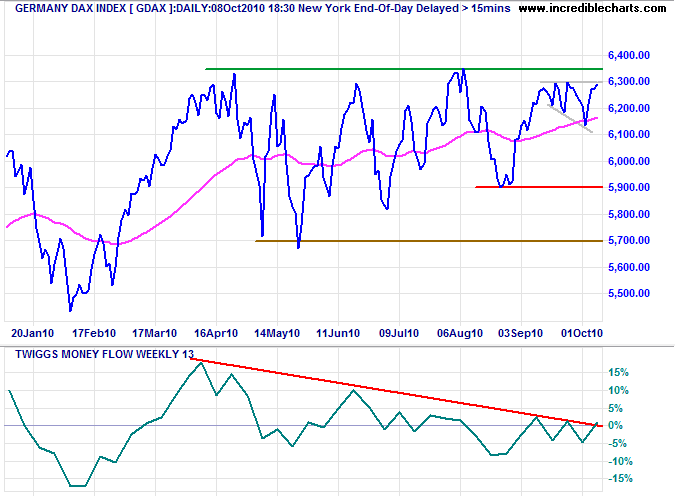

Germany: DAX

The DAX formed a right-angled broadening wedge below resistance at 6300. Bulkowski maintains the pattern is unreliable unless it completes a failed down-swing. Twiggs Money Flow (13-week) broke above its descending trendline, but the future trend remains uncertain. Breakout above 6350 would signal a primary advance to 6700*, while reversal below 5900 would warn of a down-trend, with an initial target of 5500*.

* Target calculations: 6300 + ( 6300 - 5900 ) = 6700 and 5900 - ( 6300 - 5900 ) = 5500

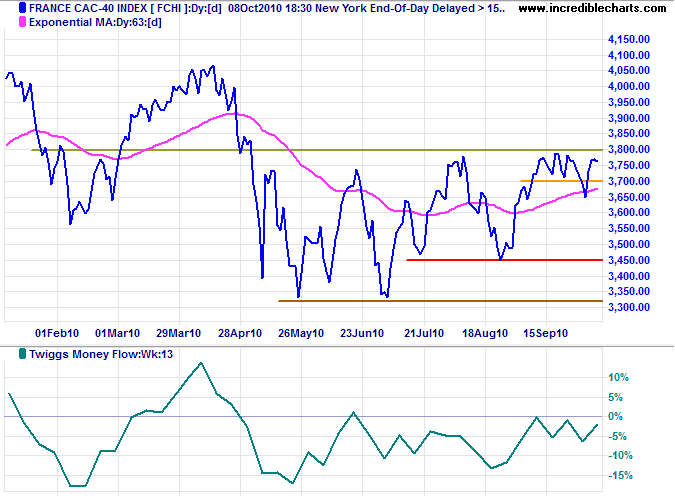

France: CAC-40

The CAC-40 also recovered above short-term support and is testing resistance at 3800. breakout would signal an advance to the April high of 4050. Twiggs Money Flow (13-week) holding below the zero line, however, continues to warn of selling pressure. Reversal below 3450 would signal a decline to 3000*.

* Target calculation: 3400 - ( 3800 - 3400 ) = 3000

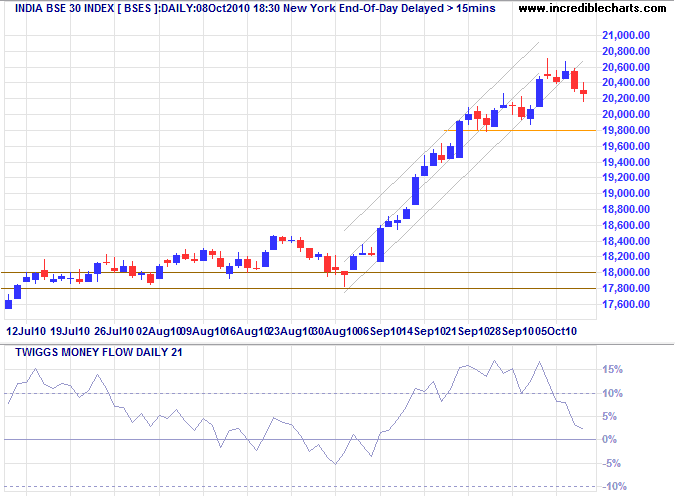

India

The Sensex broke downward from its fast-rising trend channel, indicating a correction. Twiggs Money Flow (21-day) respect of the zero line would confirm strong buying pressure. A brief retracement that respects support at 19800 would also indicate trend strength.

* Target calculation: 18000 + ( 18000 - 16000 ) = 20000

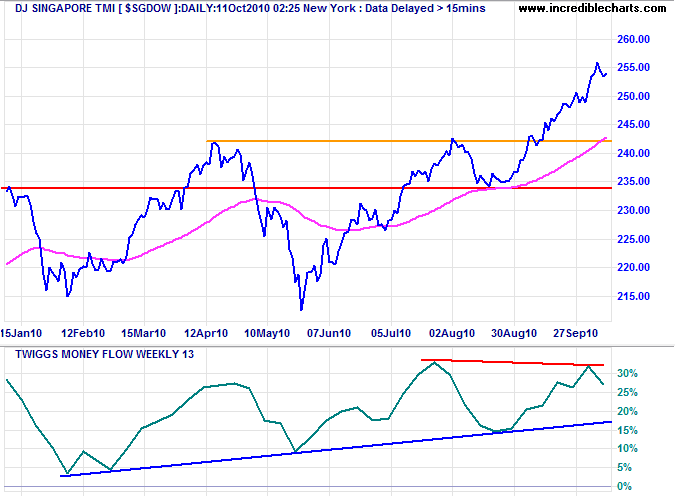

Singapore

Bearish divergence on Twiggs Money Flow (13-week) on the DJ Singapore Index warns of a correction. Expect support at the April high of 242.

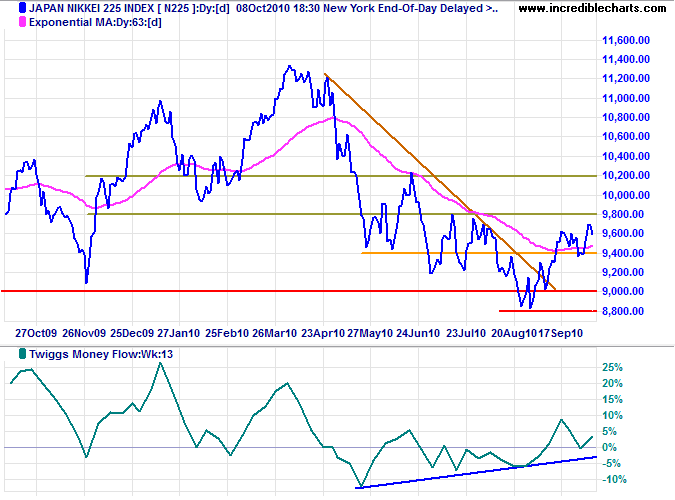

Japan

The Nikkei 225 recovered above 9400, indicating another test of 9800. Breakout would signal an advance to 10200. Twiggs Money Flow (13-week) recovery above zero signals medium-term buying pressure.

* Target calculation: 8800 - ( 9600 - 8800 ) = 8000

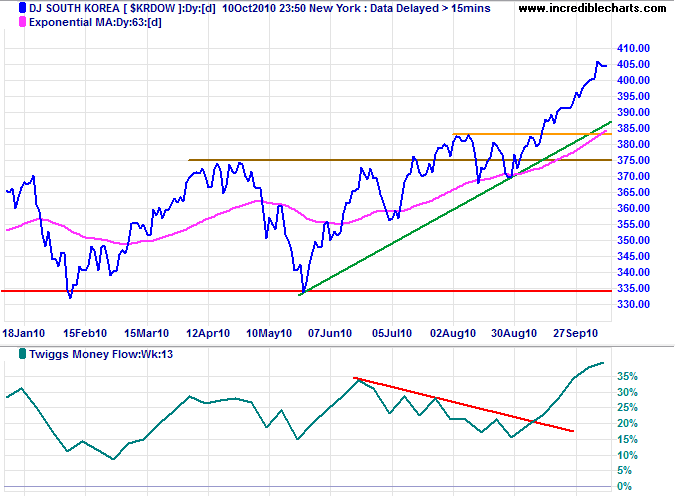

South Korea

The DJ South Korea index continues its primary advance with Twiggs Money Flow (13-week) indicating strong buying pressure.

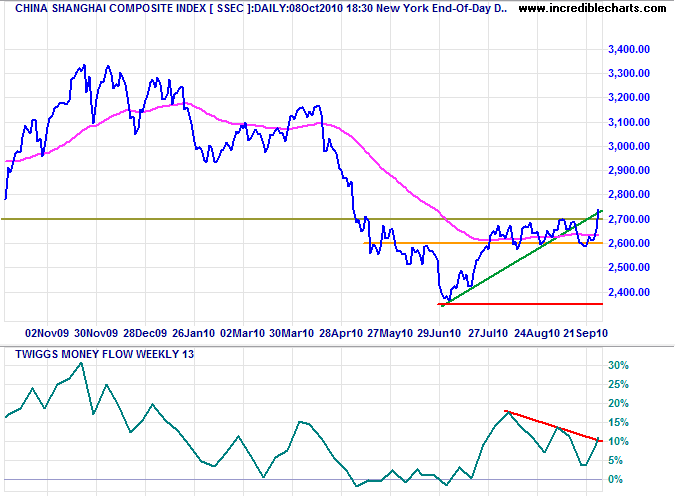

China

The Shanghai Composite index broke resistance at 2700, signaling a primary advance to 3050*. Twiggs Money Flow (13-week) recovery above its declining trendline indicates short/medium-term buying pressure. Reversal below 2600 is unlikely, but would signal another test of primary support at 2350.

* Target calculations: 2700 + ( 2700 - 2350 ) = 3050

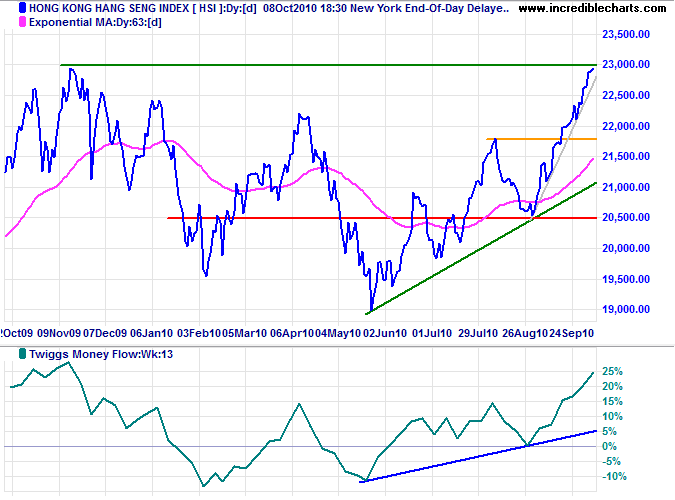

The HangSeng Index is testing its 2009 high of 23000. Rising Twiggs Money Flow (13-week), after respecting the zero line, indicates strong buying pressure.

* Target calculations: 21800 + ( 21800 - 20600 ) = 23000

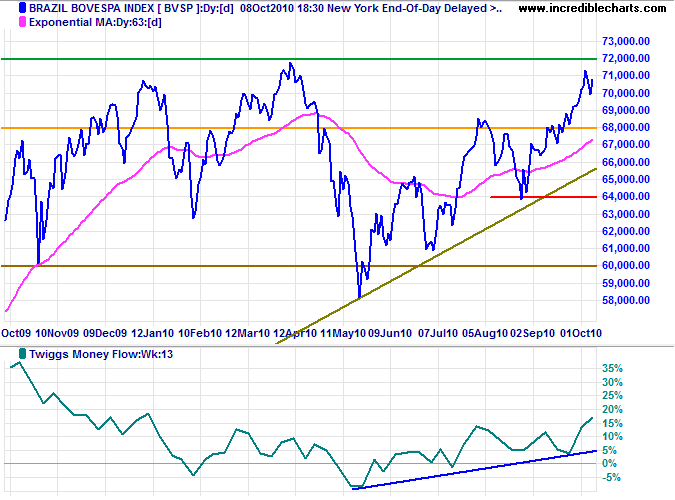

Brazil

The Bovespa index is headed for a test of its April high at 72000. Twiggs Money Flow (13-week) holding above zero signals buying pressure. Reversal below 68000 is unlikely at present, but would test primary support at 64000.

* Target calculation: 70000 + ( 70000 - 60000 ) = 80000

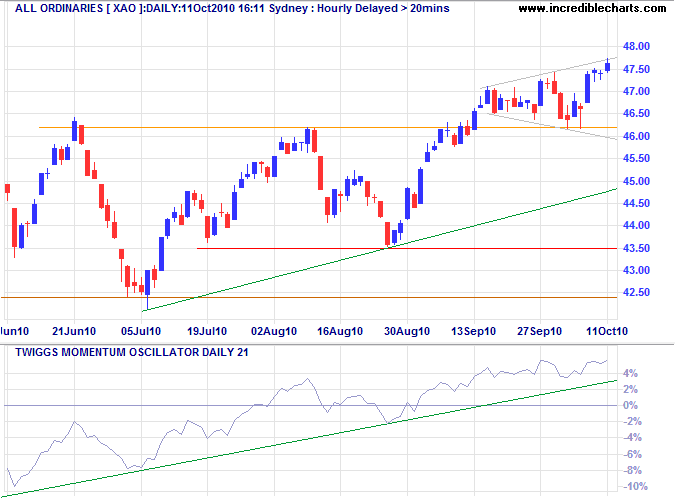

Australia: ASX

The All Ordinaries continues in a broadening wedge consolidation above the new support level at 4620; upward breakout would signal an advance to 5000*. Twiggs Money Flow (21-day) reversal below the rising trendline would warn of a correction. Failure of support at 4620 is unlikely at present but would also warn of a correction to test primary support at 4350.

* Target calculation: 4600 + ( 4650 - 4250 ) = 5000

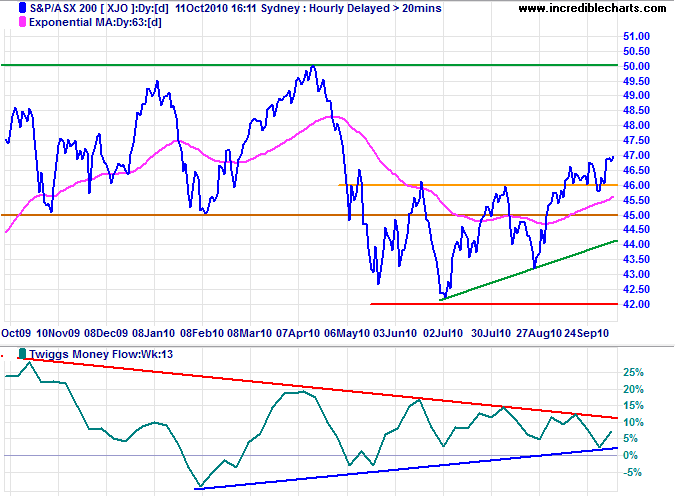

The ASX200 displays a large triangle on Twiggs Money Flow (13-week); breakout would indicate future direction. Failure of support at 4500 is unlikely, but would warn of a correction to primary support at 4300.

Of all tyrannies, a tyranny sincerely exercised for the good of its victims may be the most oppressive. It would be better to live under robber barons than under omnipotent moral busybodies. The robber baron's cruelty may sometimes sleep, his cupidity may at some point be satiated; but those who torment us for our own good will torment us without end for they do so with the approval of their own conscience.

~ C.S. Lewis

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.