Markets cautious after quarter-end

By Colin Twiggs

October 4, 2010 8:30 p.m. ET (11:30 a.m. AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Secondary Asian markets are climbing, but Japan and mainland China remain weak. Europe looks anemic and North America is likely to follow. Resource-rich Australia and Brazil have broken out, but tentatively, and are unlikely to follow-through unless we see a recovery in Japan and mainland China. Quarter-end has passed, together with any motivation for fund managers to support current price levels. Expect a mid-October retracement to test support levels.

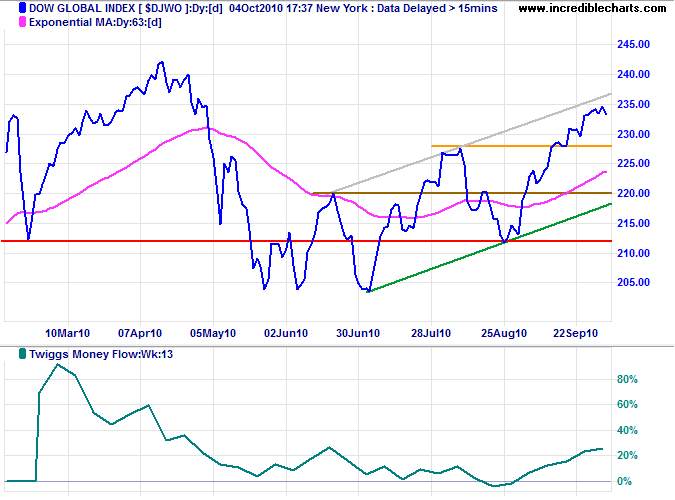

The Dow Global index ($DJWO) is at the upper trend channel and likely to retrace to test support at the June high of 220 (at the lower channel). Respect would confirm the primary up-trend, while failure would test primary support at 212. A Twiggs Money Flow (13-week) retracement that respects the zero line would similarly signal an up-trend.

USA

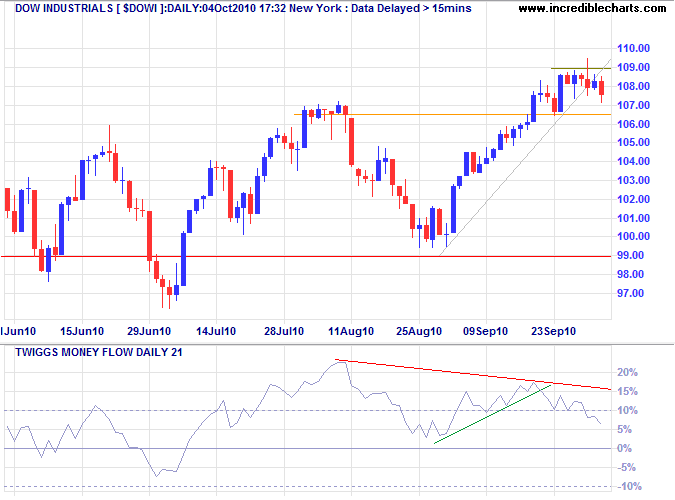

Dow Jones Industrial Average

The Dow encountered resistance at 10900 and is headed for a test of the new support level at 10650. Bearish divergence on Twiggs Money Flow (21-day) warns of selling pressure. Failure of support would warn of a correction to test primary support at 9900. Breakout above 11000 is unlikely, but would signal an advance to 11400*.

* Target calculations: 10700 + ( 10700 - 10000 ) = 11400

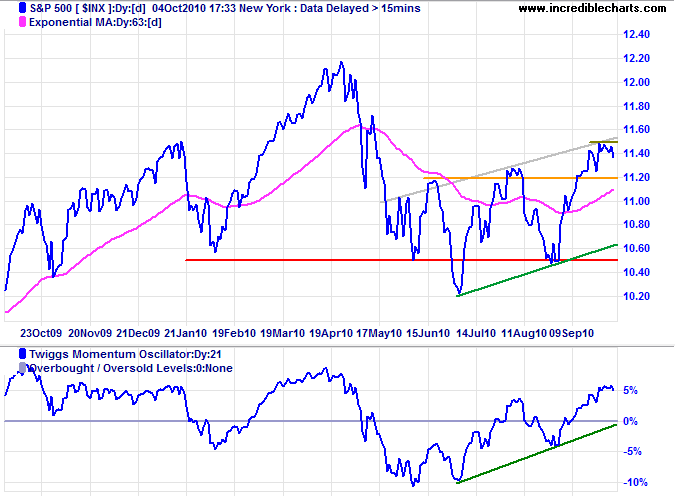

S&P 500

The S&P 500 is testing short-term resistance at 1150. Narrow consolidation suggests an upward breakout, which would indicate an advance to 1220*. The strong rise on Twiggs Money Flow (13-week) signals buying pressure. Reversal below 1120, however, would test primary support at 1050.

* Target calculation: 1120 + ( 1120 - 1020 ) = 1220

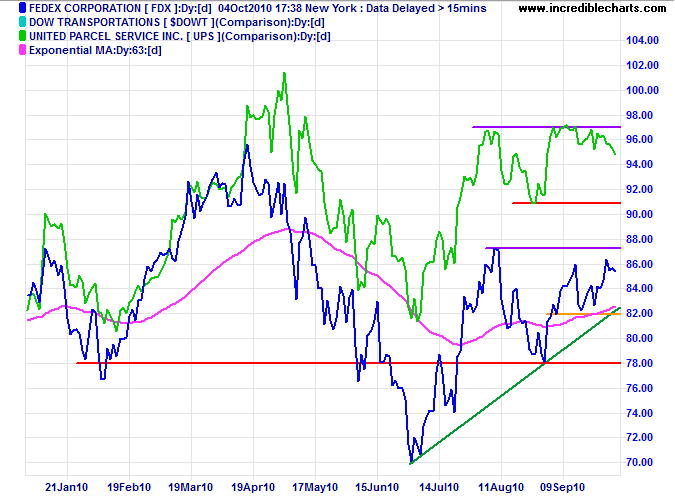

Transport

Fedex is headed for a test of 87.50. Breakout would signal a primary up-trend, while reversal below 78 would continue the current down-trend. UPS recovery above its recent high would add further weight to a bull signal, while reversal below its August low would be cause for concern.

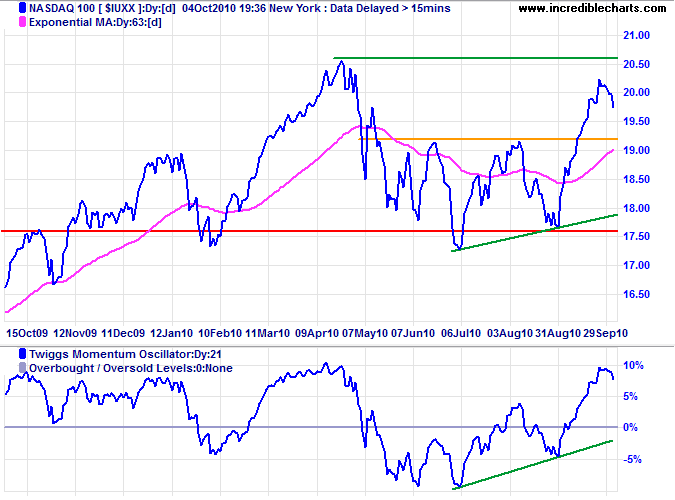

Technology

The Nasdaq 100 is retracing to test support at 1920. Respect would signal a primary advance, while failure would correct to primary support at 1760. Twiggs Momentum (21-day) respect of the zero line would confirm an up-trend. Breakout above 2060 would offer a target of the 2007 high at 2250*.

* Target calculation: 2050 + ( 2050 - 1750 ) = 2350

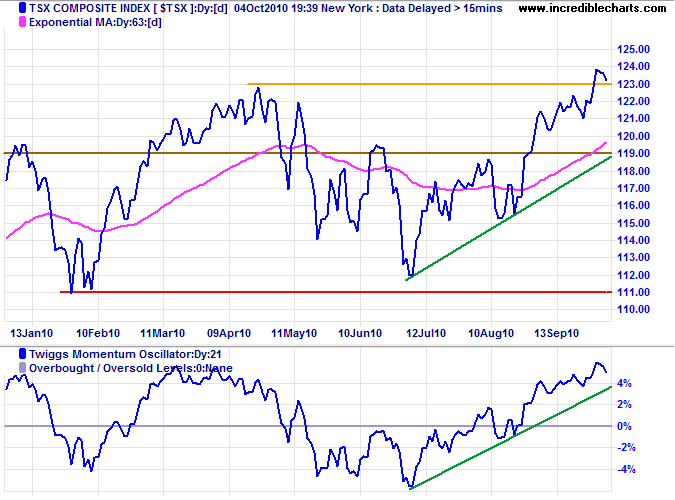

Canada: TSX

TSX Composite broke resistance at 12300, but is likely to retrace to test the new support level at 11900. Subsequent recovery above 12300 would signal an advance to 13000*. A 21-day Twiggs Momentum trough above the zero line would confirm the up-trend.

* Target calculation: 12000 + ( 12000 - 11000 ) = 13000

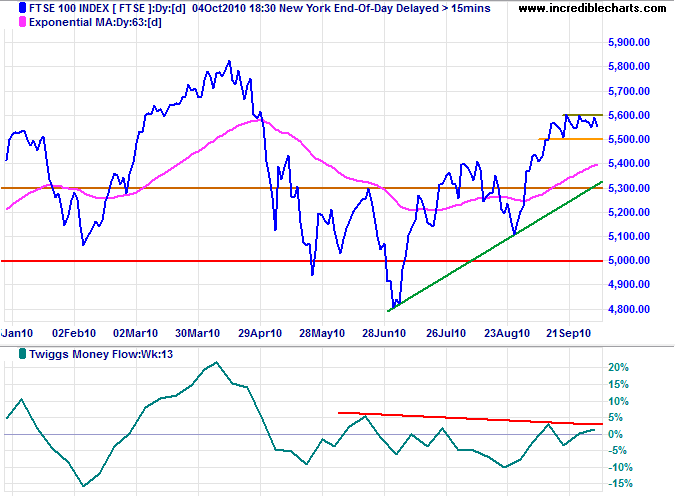

United Kingdom: FTSE

The FTSE 100 is testing short-term resistance at 5600. Narrow consolidation suggests breakout and an advance to the April high of 5800*. Bearish divergence on Twiggs Money Flow (13-week), however, warns of weakness. Expect retracement to test support at 5300.

* Target calculation: 5300 + ( 5300 - 4800 ) = 5800

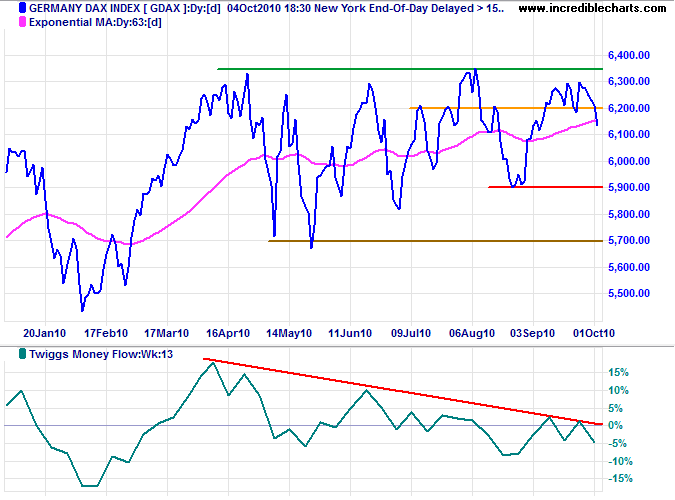

Germany: DAX

The DAX broke short-term support at 6200, signaling a test of primary support at 5900. Bearish divergence on Twiggs Money Flow (13-week) and on 63-day Twiggs Momentum warn of selling pressure. Breakout below 5900 would signal a primary down-trend, with an initial target of 5500*.

* Target calculation: 5900 + ( 6300 - 5900 ) = 5500

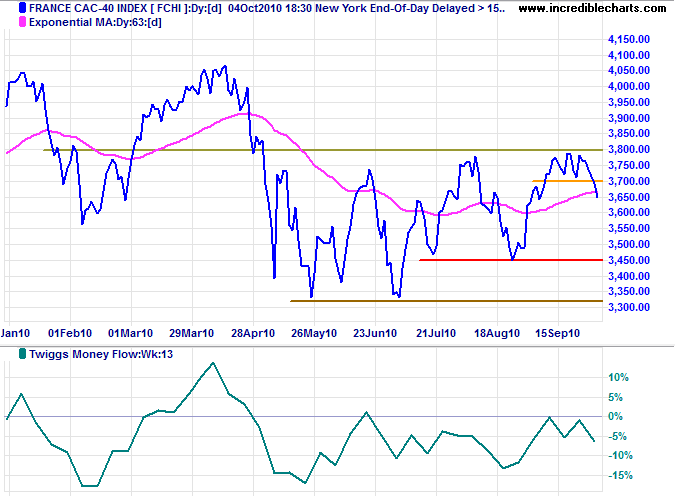

France: CAC-40

The CAC-40 reversal below short-term support warns of a test of primary support at 3450. Failure of primary support would signal a decline to 3000*. Recovery above 3800 is unlikely, but would test the April high of 4050. Twiggs Money Flow (13-week) remains below the zero line, indicating long-term selling pressure.

* Target calculation: 3400 - ( 3800 - 3400 ) = 3000

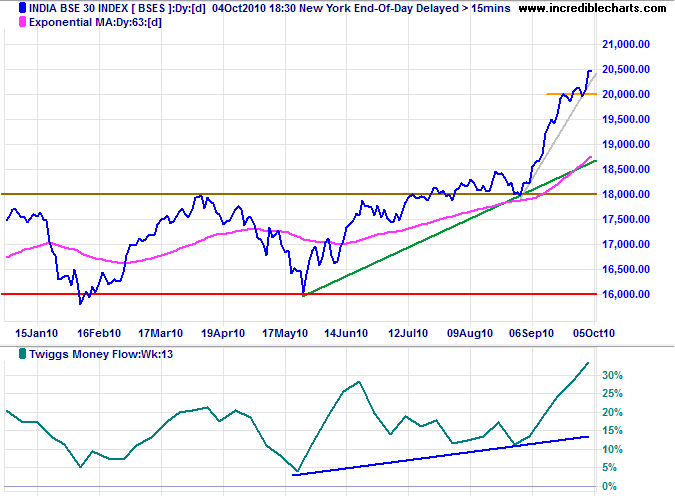

India

The Sensex gapped above 20500 Monday, further indication of a self-reinforcing (accelerating) up-trend. Rising Twiggs Money Flow (13-week) high above zero signals strong buying pressure. Expect rapid gains, but followed by an equally rapid reversal at the blow-off.

* Target calculation: 18000 + ( 18000 - 16000 ) = 20000

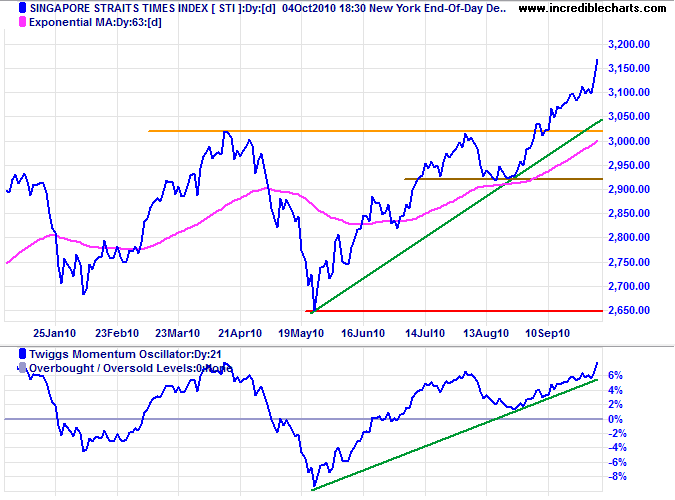

Singapore

The Straits Times Index is advancing towards its long-term target of 3350*. Twiggs Momentum (21-day) holding above the zero line confirms a strong up-trend; reversal below the rising trendline would warn of correction to test the new support level at 3000.

* Target calculation: 3000 + ( 3000 - 2650 ) = 3350

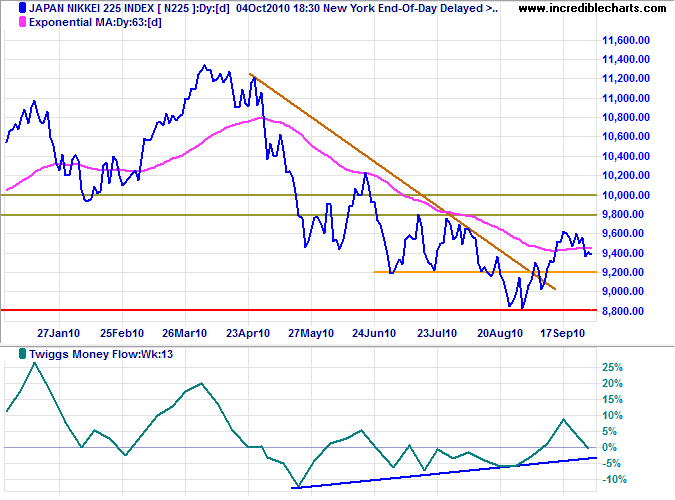

Japan

The Nikkei 225 reversed below 9400 Monday, warning of a test of primary support at 8800. Breach of 9200 would confirm. Twiggs Money Flow (13-week) below zero signals selling pressure.

* Target calculation: 8800 - ( 9600 - 8800 ) = 8000

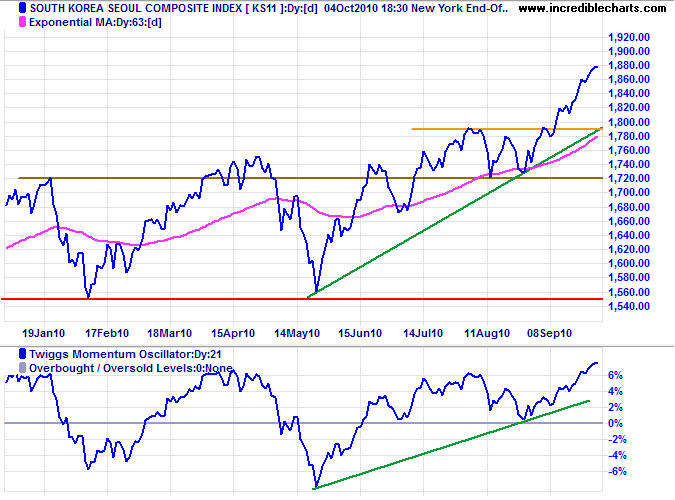

South Korea

The Seoul Composite Index is advancing towards its target of 1950*. Twiggs Momentum (21-day) respecting the zero line confirms a strong up-trend.

* Target calculation: 1750 + ( 1750 - 1550 ) = 1950

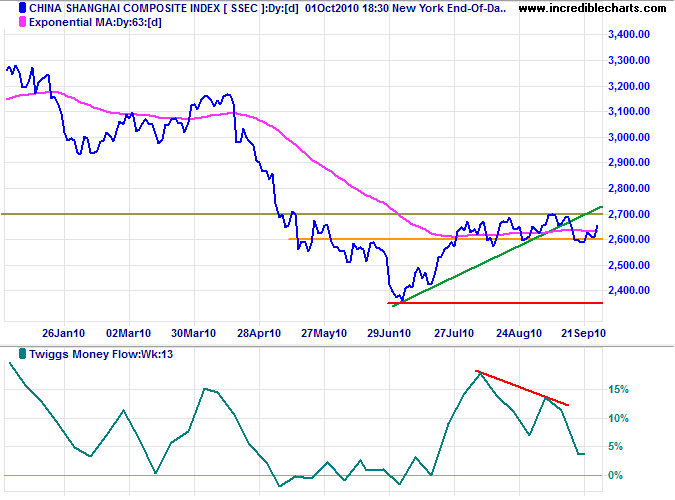

China

The Shanghai Composite Index consolidating below 2700 is a positive sign, but bearish divergence on Twiggs Money Flow (13-week) warns of selling pressure. Reversal below 2600 would signal another test of primary support at 2300. Recovery above 2700 is less likely, but would offer a target of 3100*. Chinese markets are closed this week for the Mid-Autumn Festival and National Day.

* Target calculations: 2700 + ( 2700 - 2300 ) = 3100

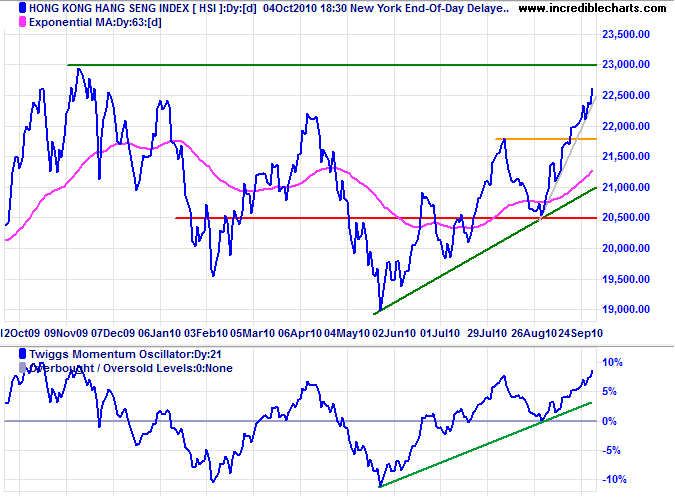

The HangSeng Index is advancing toward the 2009 high of 23000. Twiggs Money Flow (13-week) respecting the zero line confirms buying pressure.

* Target calculations: 21800 + ( 21800 - 20600 ) = 23000

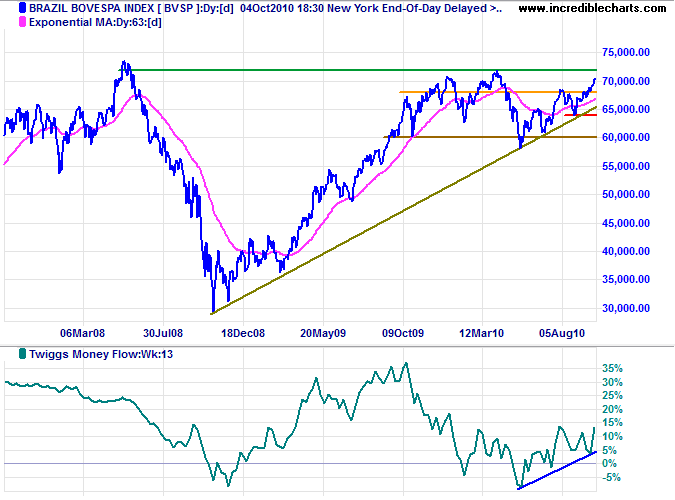

Brazil

The Bovespa index is headed for a test of resistance at 72000 after breaking 68000. Rising Twiggs Money Flow (13-week) signals buying pressure. In the long-term, breakout above 74000 would offer a target of 80000*. Reversal below 68000, however, would test primary support at 64000.

* Target calculation: 70000 + ( 70000 - 60000 ) = 80000

Australia: ASX

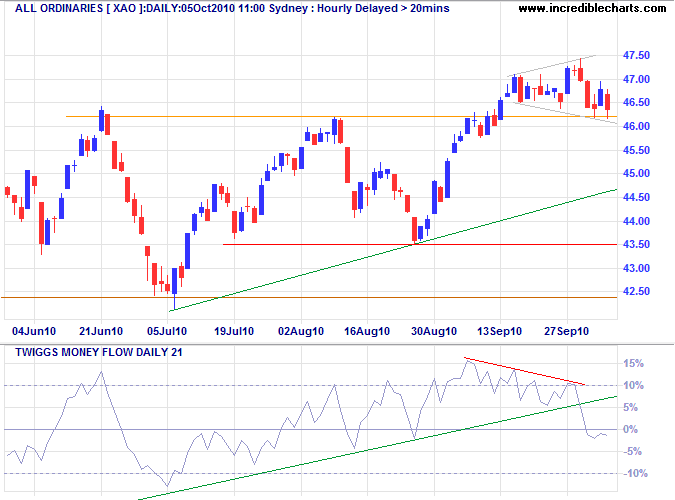

The All Ordinaries is in a broadening wedge consolidation above the new support level at 4620. Twiggs Money Flow (21-day) reversal below zero signals selling pressure. Failure of support would warn of a correction to test primary support at 4350.

* Target calculation: 4600 + ( 4650 - 4250 ) = 5000

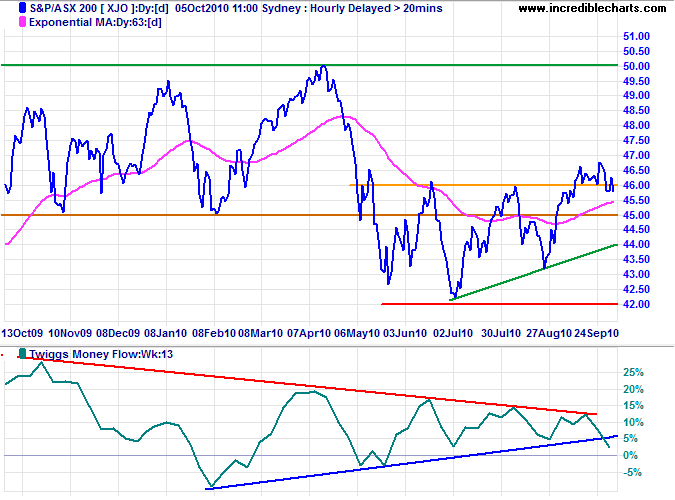

The ASX200 longer term outlook also warns of a correction, if not reversal to a down-trend, with a large bearish divergence on Twiggs Money Flow (13-week). Failure of support at 4500 would confirm the correction to primary support at 4300 — as would Twiggs Money Flow reversal below zero. Breach of support at 4200 would confirm a primary decline and offer a target of 3800*.

* Target calculation: 4200 - ( 4600 - 4200 ) = 3800

I just am allergic to the term "inflation targeting." I don't understand why we are targeting inflation. I was brought up to say inflation was a bad thing; we target stability, not inflation.

~ Former Fed Chairman Paul Volcker

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.