Gold long-term view

By Colin Twiggs

September 30, 2010 0:30 a.m. EDT (2:30 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

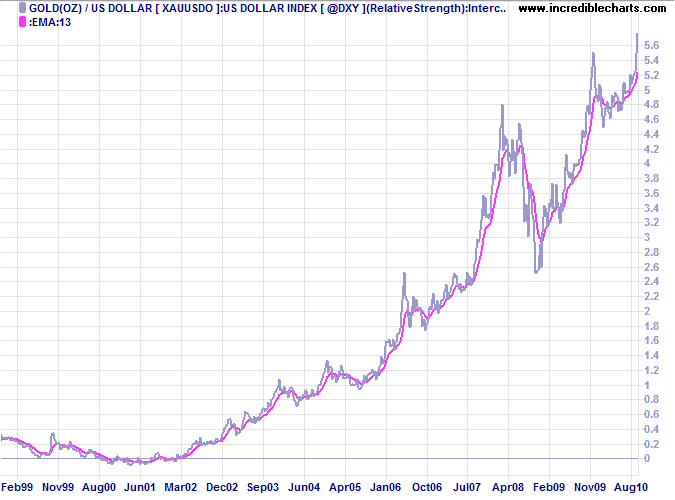

The recent surge in spot gold is attributable to the weakening dollar, but if one compares the Relative Strength of gold against the US Dollar Index it is clear that gold has been appreciating against the entire basket* of currencies since 2001. And the trend shows no signs of abatement.

* The $DXY basket of currencies: Euro 57.6%, Japanese yen 13.6%, Pound sterling 11.9%, Canadian dollar 9.1%, Swedish krona 4.2%, and Swiss franc 3.6%.

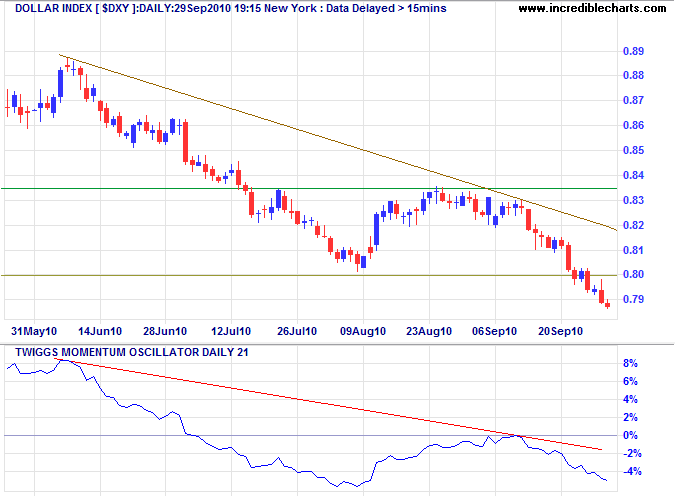

US Dollar Index

The US Dollar Index is declining towards its target of 76.50* after a brief retracement to test the new resistance level at 80. Respect of the zero line by 21-day Twiggs Momentum signals a strong down-trend.

* Target calculation: 80 - ( 83.50 - 80 ) = 76.50

Currency Manipulation

The US House of Representatives passed legislation allowing, but not requiring, the U.S. to levy tariffs on countries that undervalue their currencies (WSJ). This is dangerous ground as imposition of trade tariffs to protect local industries is widely believed to have harmed international trade and increased the severity of the Great Depression in the 1930s. It would be wise to avoid a repeat.

A better alternative may be to isolate flows on the capital account, which are used by trading partners such as Japan and China to manipulate the strength of the US dollar through purchases of US Treasurys, and to deal with these separately to normal trade flows. Steps could then be taken to ensure that capital flows are managed to deter currency manipulators. Either by insisting on reciprocity or levying some form of penalty to discourage further purchases.

Mass exodus of capital may be seen as a potential threat, driving up long-term interest rates and the cost of servicing Treasury debt, but this may prove to be a paper tiger. The resultant fall in the US dollar would stimulate exports and restrict imports, boosting the US economy at the expense of the manipulators. What goes around comes around.

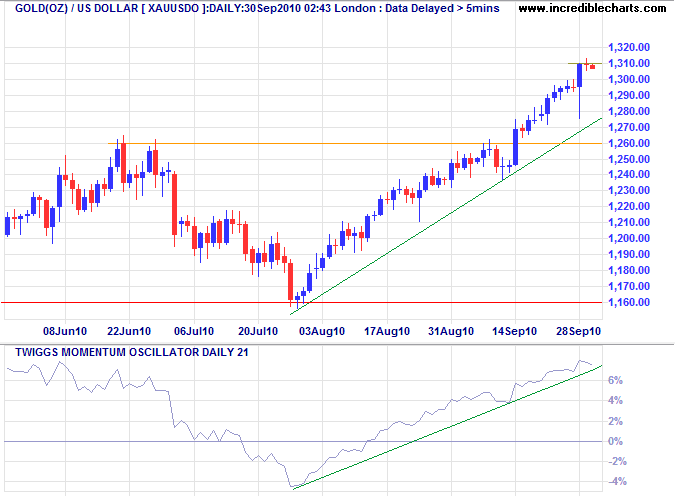

Gold

Gold is testing short-term resistance at $1310. Reversal below the rising trendline on 21-day Twiggs Momentum Oscillator would signal retracement to test the new support level at $1260. Failure of support is unlikely and respect would confirm the primary advance to $1360*.

* Target calculation: 1260 + ( 1260 - 1160 ) = 1360

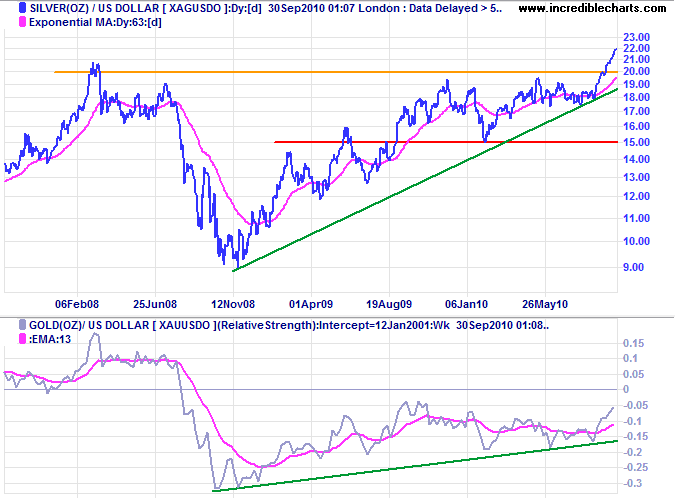

Silver

Silver is also expected to retrace to test its new support level at $20. Respect would confirm an advance to $25*. Rising Relative Strength indicates that silver is appreciating against gold (i.e. rising at a faster rate).

* Target calculation: 20 + ( 20 - 15 ) = 25

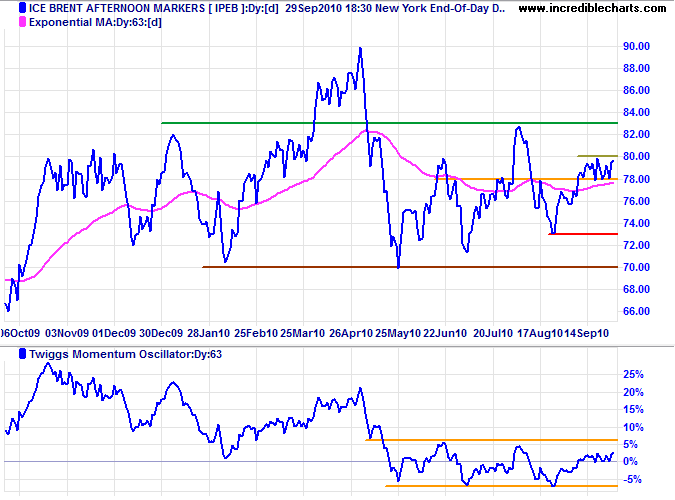

Crude Oil

Crude is consolidating between $78 and $80 per barrel. The narrow rectangle favors continuation of the rally — confirmed if there is a breakout above $80. Reversal below is unlikely, but would warn of another correction. The longer-term picture remains dull with Twiggs Momentum (63-day) oscillating in a narrow band around zero. The ranging market, between $70 and $83, may continue for some time.

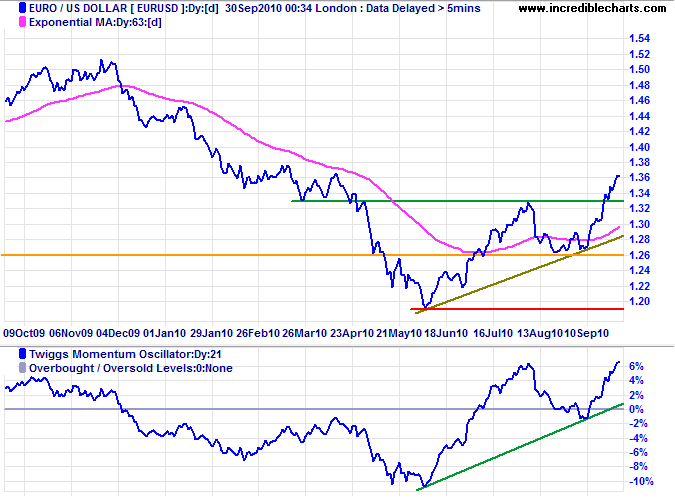

Euro

The euro is advancing towards $1.40* after breaking resistance at $1.33. The shallow dip below zero on Twiggs Momentum (21-day) indicates a solid up-trend.

* Target calculation: 1.33 - ( 1.33 - 1.26 ) = 1.40

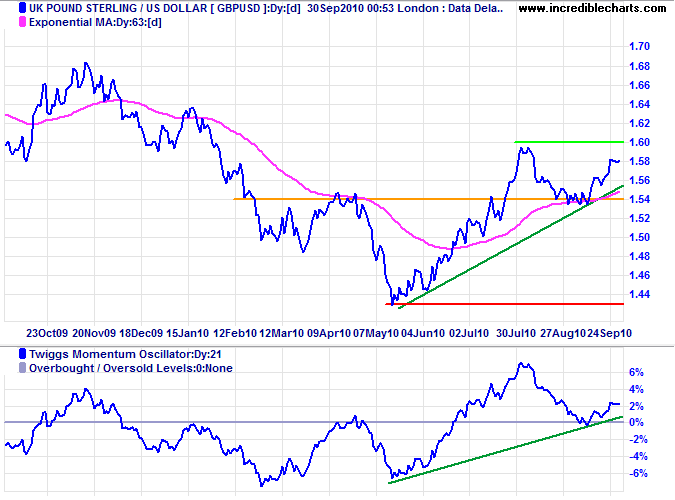

UK Pound Sterling

The pound is headed for a test of $1.60; breakout would confirm an advance to $1.66*. Twiggs Momentum (63-day) respecting the zero line indicates a strong up-trend.

* Target calculation: 1.60 + ( 1.60 - 1.54 ) = 1.66

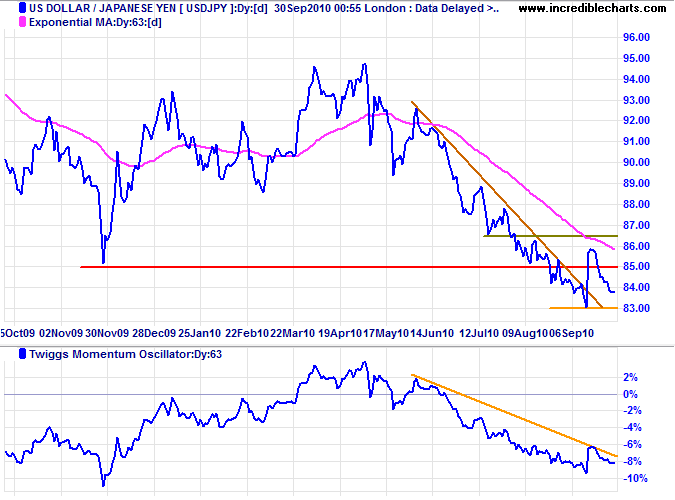

Japanese Yen

The dollar is headed for another test of ¥83 and is likely to elicit further intervention from the BOJ. Ability to hold this support level in the long-term is doubtful, given the magnitude of the currency flows involved. Breach of support would be an admission of failure and would indicate a further primary decline (below the 1995 low of ¥80).

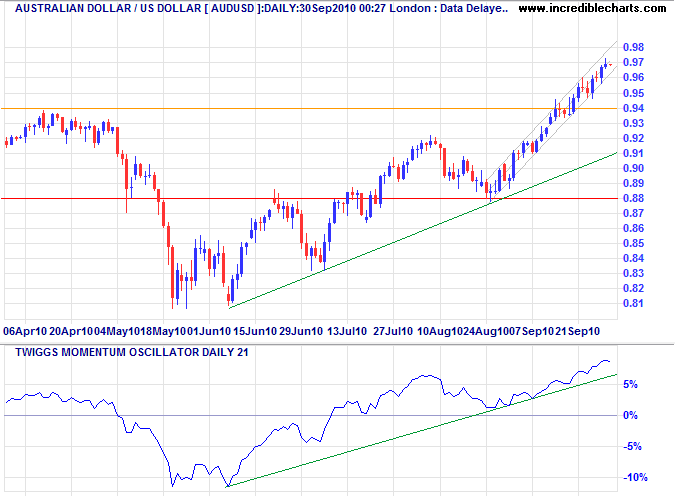

Australian Dollar

The Aussie dollar is headed for a test of the 2008 high at $0.98. Reversal of Twiggs Momentum (21-day) below its rising trendline would signal retracement to test the new support level at $0.94. But failure is unlikely, and respect would signal an advance to $1.02*.

* Target calculation: 0.98 + ( 0.98 - 0.94 ) = 1.02

So in all human affairs one notices, if one examines them closely, that it is impossible to remove one inconvenience without another emerging.

~ Niccolo Machiavelli

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.