Gold Tests $1260

By Colin Twiggs

September 2, 2010 3:00 a.m. EDT (5:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

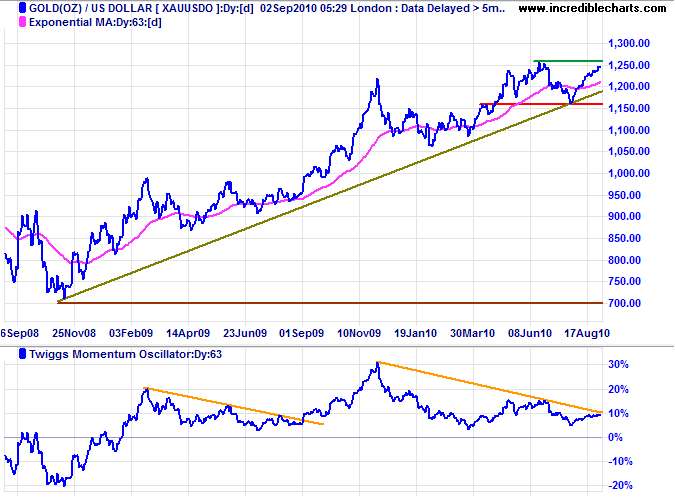

Gold

Gold is headed for another test of $1260; breakout would signal an advance to $1360*. Twiggs Momentum recovery above its declining trendline would indicate continuation of the primary up-trend. Respect of the trendline, however, would signal another test of support at $1160.

* Target calculation: 1260 + ( 1260 - 1160 ) = 1360

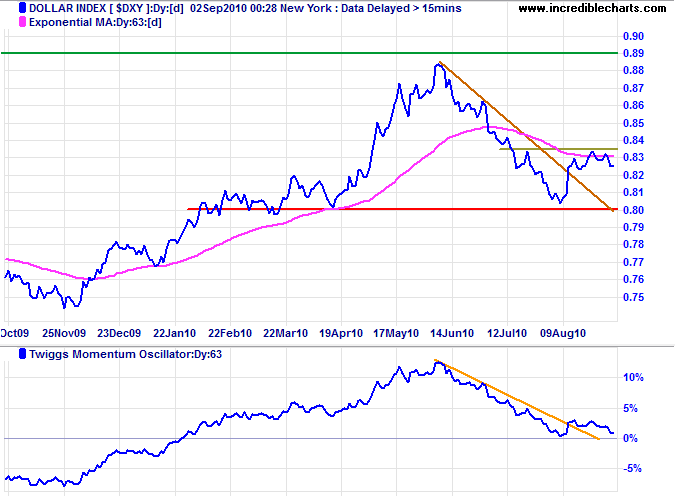

US Dollar Index

The US Dollar Index is retracing to test support after encountering resistance at 83.5. Failure of support at 80 would signal a decline to 76.5*, while recovery above 83.5 would indicate a rally to 89. Respect of the zero line by 63-day Twiggs Momentum would strengthen the bull signal.

* Target calculation: 80 - ( 83.5 - 80 ) = 76.5

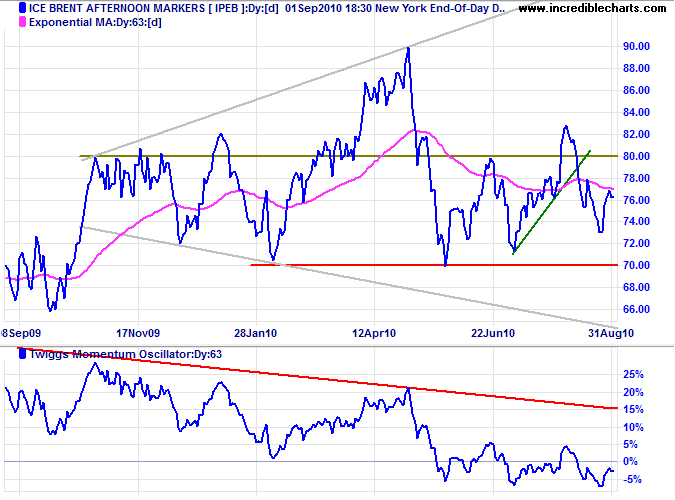

Crude Oil

Crude is headed for a test of primary support at $70. Twiggs Momentum (63-day) oscillating around zero indicates uncertainty. Failure of support would offer a target of $60/barrel*, while recovery above $80 would signal an advance to $90.

* Target calculation: 70 - ( 80 - 70 ) = 60

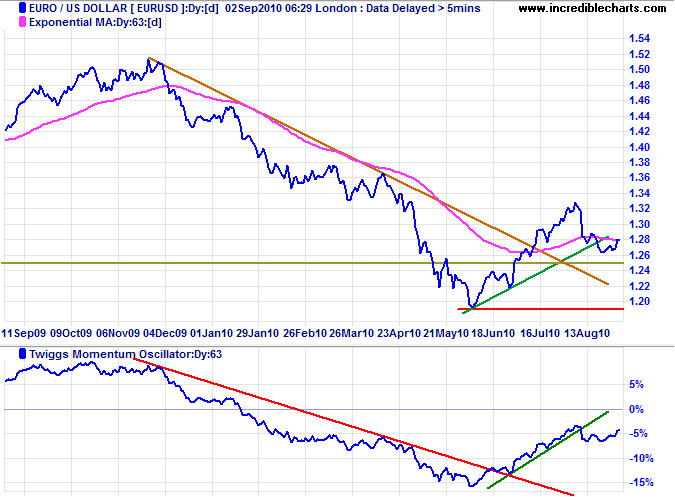

Euro

The euro is testing medium-term support at $1.25. Failure would signal another test of primary support at $1.19. Respect of support is less likely because Twiggs Momentum (63-day) remains below zero, but would indicate the start of a primary up-trend.

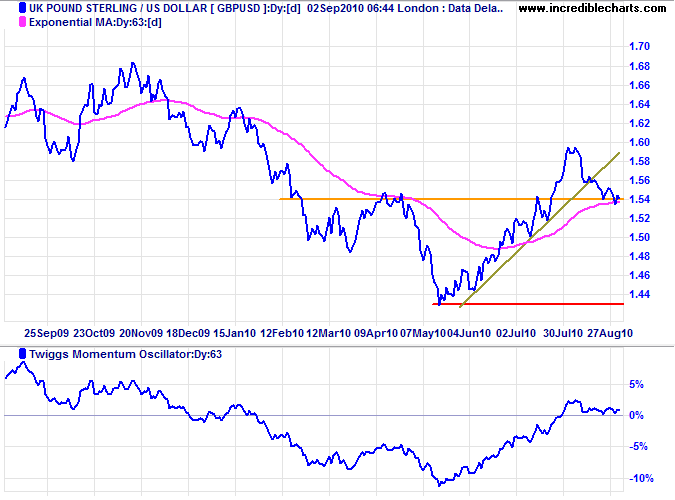

UK Pound Sterling

The pound is testing support at $1.54; respect would confirm the advance to $1.66*. Twiggs Momentum (63-day) respecting the zero line from above suggests continuation of the up-trend.

* Target calculation: 1.60 + ( 1.60 - 1.54 ) = 1.66

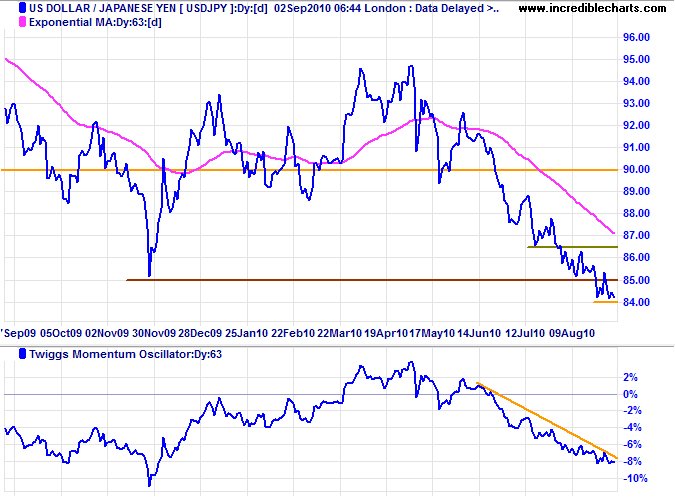

Japanese Yen

The dollar broke through primary support at ¥85 and is headed for a test of support at the 1995 low of ¥80. The Bank of Japan threatens to intervene to prevent further appreciation, but there are doubts about the political will to do so. Recovery above ¥86.50 is unlikely at this stage, but would warn that the down-trend is weakening — as would 63-day Twiggs Momentum recovery above its declining trendline.

* Target calculations: 85 - ( 95 - 85 ) = 75

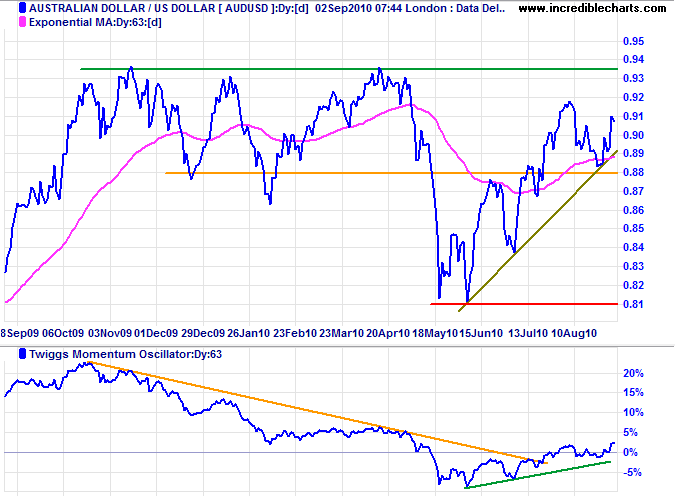

Australian Dollar

The Aussie dollar respected its rising trendline and is advancing to test resistance at $0.9350. Rising 63-day Twiggs Momentum above the zero line suggests continuation of the advance. In the long term, breakout above $0.9350 would offer a target of parity, while reversal below $0.88 would test primary support at $0.81.

* Target calculation: 0.93 + ( 0.93 - 0.81 ) = 1.05

The events of this century should remind us that the hopes of mankind almost always prove illusory, and that we have only a limited ability to devise permanent and equitable solutions to problems which spring from human nature. Violence, shortage amid plenty, tyranny and the cruelty it breeds, the gross stupidities of the powerful, the indifference of the well-to-do, the divisions of the intelligent and well-meaning, the apathy of the wretched multitude — these things will be with us to the end of the race.

~ Paul Johnson

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.