Yen Headed For 80

By Colin Twiggs

August 26, 2010 7:30 a.m. EDT (9:30 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

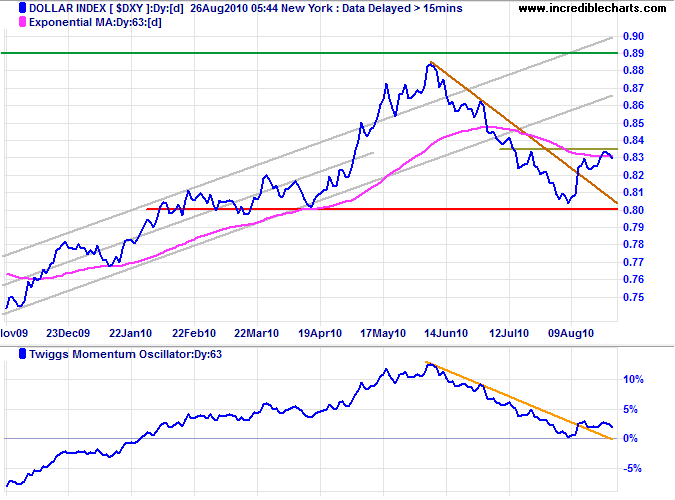

US Dollar Index

The US Dollar Index continues to encounter resistance around 83.5. Expect retracement to test support at 80. Failure of support would signal a decline to 76.5*, while respect of support would indicate a rally to test 89. The (bull) signal would be strengthened if 63-day Twiggs Momentum forms another trough above zero.

* Target calculation: 80 - ( 83.5 - 80 ) = 76.5

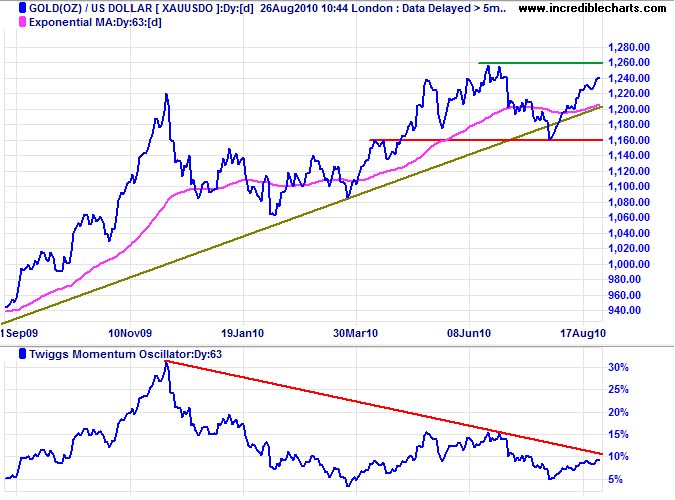

Gold

Gold is advancing towards $1260. Breakout above $1260 would offer a target of $1360*. Bearish divergence on 63-day Twiggs Momentum, however, warns of weakness and respect of resistance would indicate another test of primary support at $1160.

* Target calculation: 1260 + ( 1260 - 1060 ) = 1360

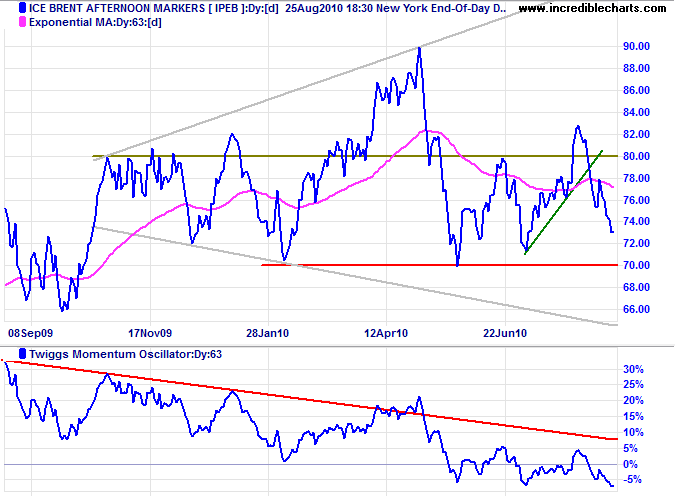

Crude Oil

Crude is headed for a test of primary support at $70. Bearish divergence on 63-day Twiggs Momentum warns of further weakness. Failure of support would offer a target of $60/barrel*.

* Target calculation: 70 - ( 80 - 70 ) = 60

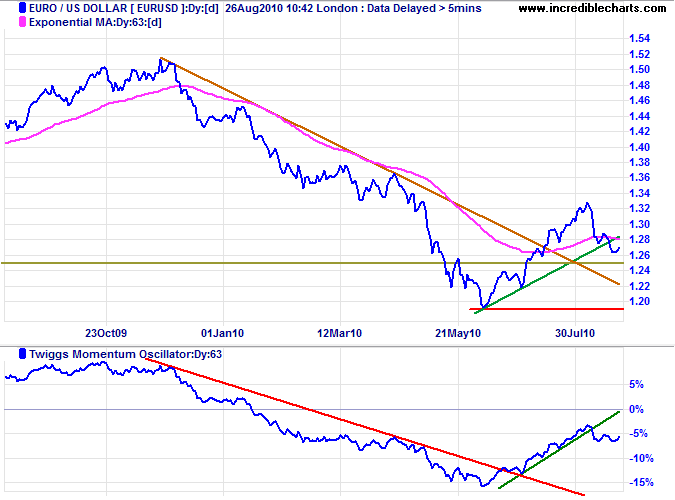

Euro

The euro penetrated its rising trendline, indicating that the rally has weakened. Reversal below $1.25 would signal another test of primary support at $1.19. Respect of support, however, would indicate the start of a primary up-trend. Twiggs Momentum (63-day) is also moving sideways and a rise above zero would strengthen the bull signal.

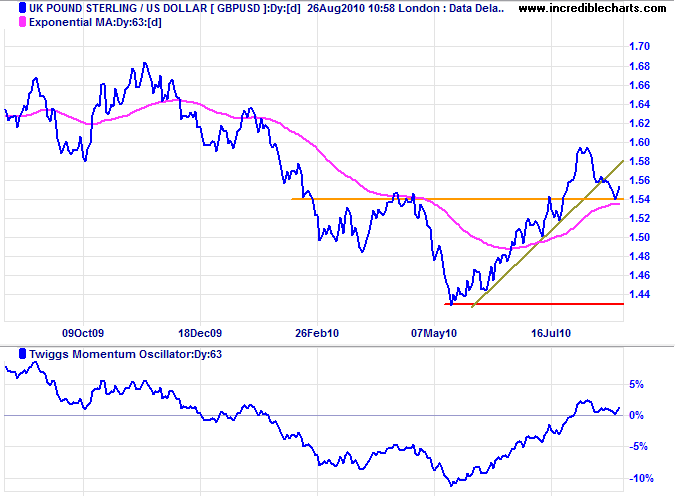

UK Pound Sterling

The pound found support at $1.54. Respect of this level would confirm the advance, with a target of $1.66*. Twiggs Momentum (63-day) respect of the zero line (from above) suggests a primary advance.

* Target calculation: 1.54 + ( 1.60 - 1.54 ) = 1.66

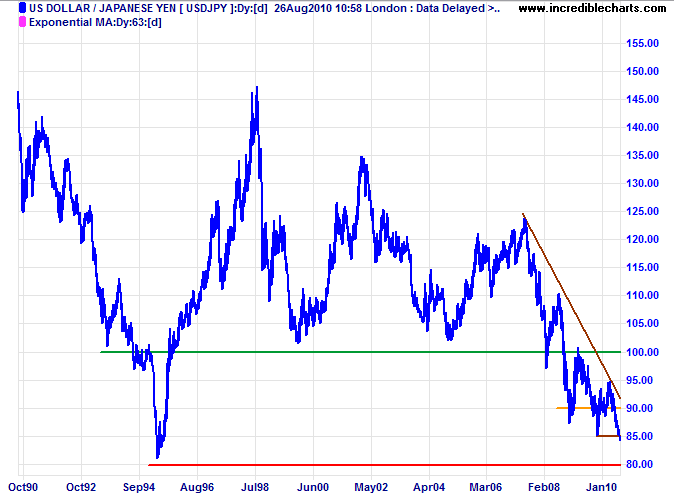

Japanese Yen

The dollar broke through primary support at ¥85 and is headed for a test of support at the 1995 low of ¥80. Bank of Japan intervention grows increasingly likely as the yen strengthens and should prevent any further appreciation below ¥80.

* Target calculations: 85 - ( 95 - 85 ) = 75

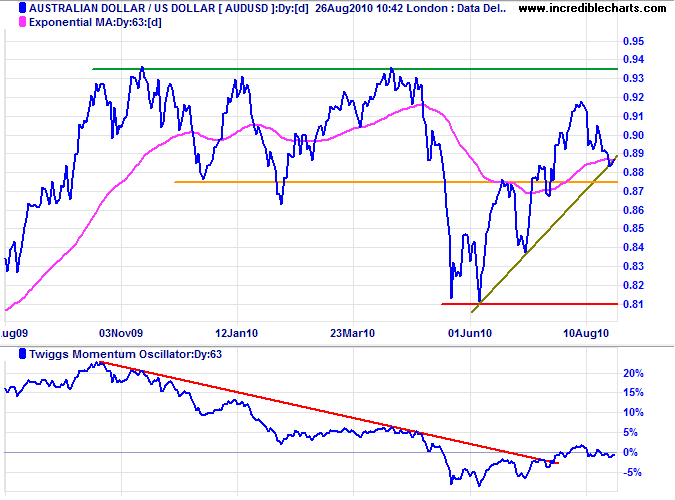

Australian Dollar

The Aussie dollar is testing short-term support around $0.88/$0.8750. Reversal below the rising trendline would warn that the advance is weakening. 63-day Twiggs Momentum oscillating around the zero line indicates hesitancy. In the long term, breakout above $0.9350 would offer a target of parity, while reversal below $0.87 would test primary support at $0.81.

* Target calculation: 0.93 + ( 0.93 - 0.81 ) = 1.05

Nothing appeals to intellectuals more than the feeling that they represent 'the people'. Nothing, as a rule, is further from the truth.

~ Paul Johnson

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.