China Lifts

By Colin Twiggs

August 9, 2010 5:30 a.m. ET (7:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Global markets remain bearish despite encouraging signs from China, with the Hang Seng starting a new primary up-trend and Shanghai Composite testing 2700. Of the big five markets, however, only the DAX is in a primary up-trend.

USA

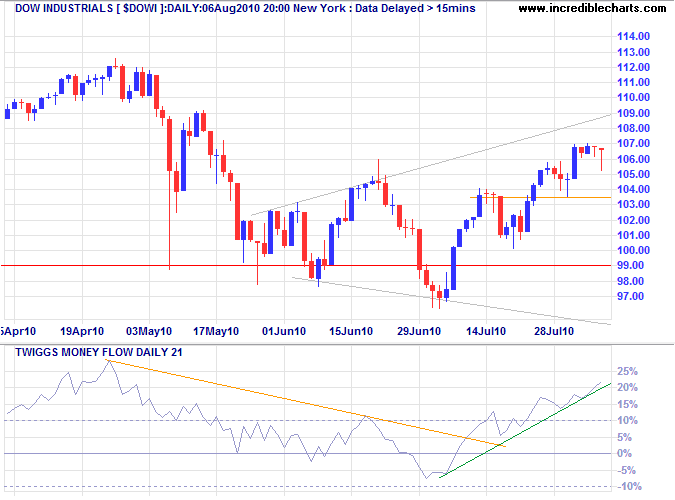

Dow Jones Industrial Average

The Dow primary trend remains down, with a long-term target of 9000*. Another Friday long tail and rising Twiggs Money Flow (21-day) indicates a test of the upper border of the broadening wedge formation. Reversal below short-term support at 10350 would warn of a downward breakout. Upward breakout from the wedge is less likely, but would signal an advance to 11700*.

* Target calculations: 9700 - ( 10700 - 9700 ) = 8700 and 10700 + ( 10700 - 9700 ) = 11700

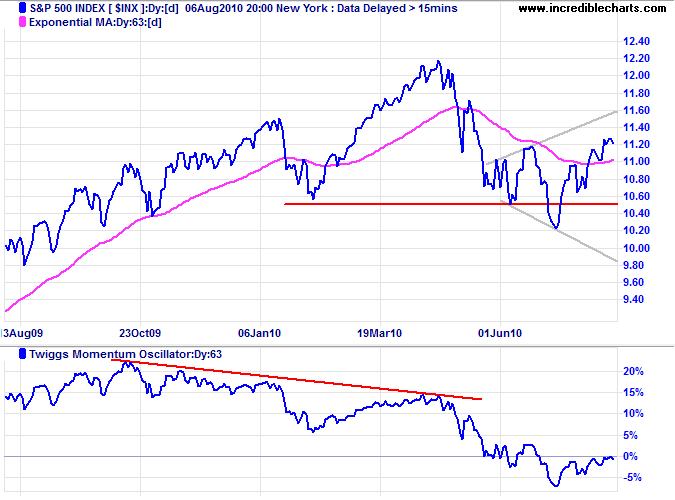

S&P 500

Twiggs Momentum Oscillator (63-day) holding below zero indicates continuation of the primary down-trend. S&P 500 reversal below its former primary support level at 1050 would confirm.

* Target calculation: 1050 - ( 1200 - 1050 ) = 900

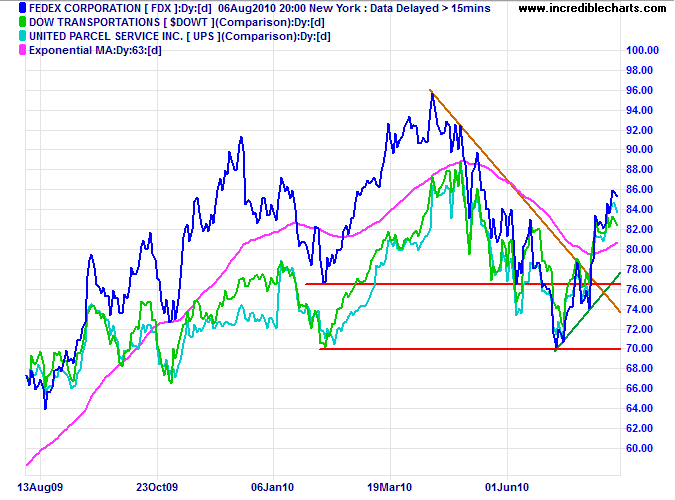

Transport

Bellwether transport stock Fedex remains in a primary down-trend despite its recent rally. But UPS has so far failed to confirm.

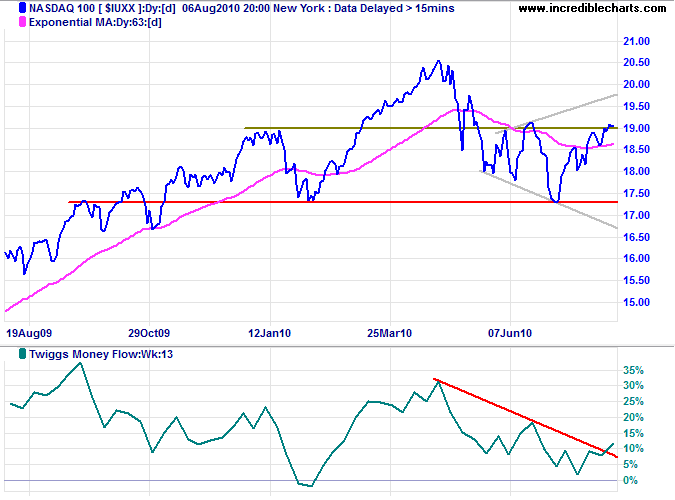

Technology

The Nasdaq 100 is headed for a test of the upper border of its broadening wedge, with rising Twiggs Money Flow (13-week) indicating medium-term buying pressure. But bearish divergence on the 63-day Momentum Oscillator continues to warn of a primary down-trend; reversal below 1730 would confirm.

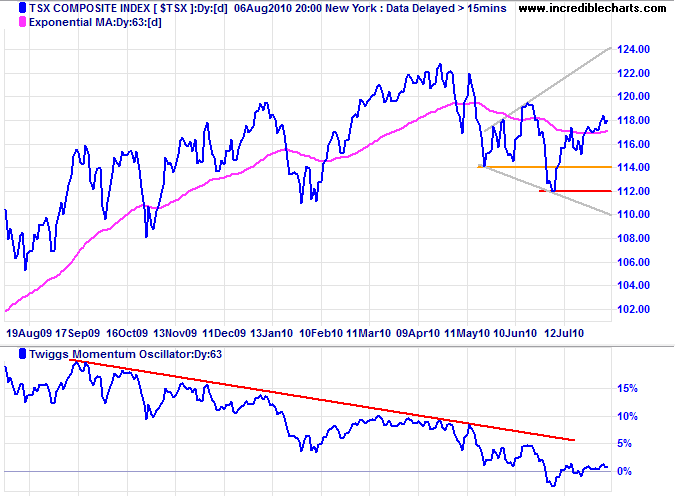

Canada: TSX

TSX Composite large bearish divergence on 63-day Twiggs Momentum warns of a down-trend. Reversal below 11400 would confirm.

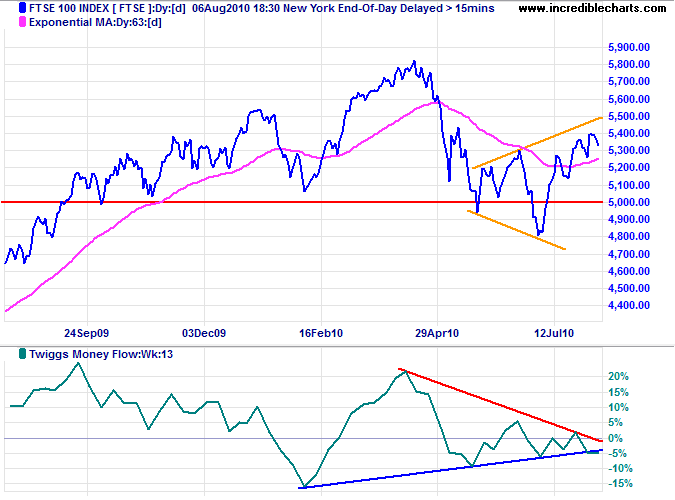

United Kingdom: FTSE

The FTSE 100 bearish divergence on Twiggs Money Flow (13-week) warns of continuation of the primary down-trend. Reversal below 5000 would confirm.

* Target calculation: 4800 - ( 5400 - 4800 ) = 4200

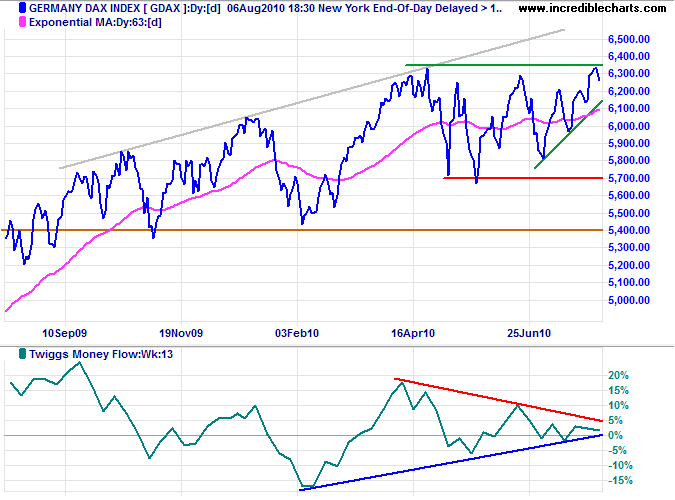

Germany: DAX

The DAX remains in a primary up-trend, testing resistance at 6350. Upward breakout would signal a primary advance to 7000*, while reversal below the rising trendline would test primary support at 5700. Twiggs Money Flow (13-week) oscillating around the zero line reflects uncertainty, while bearish divergence on the 63-day Twiggs Momentum Oscillator warns of reversal to a primary down-trend.

* Target calculation: 6350 + ( 6350 - 5700 ) = 7000

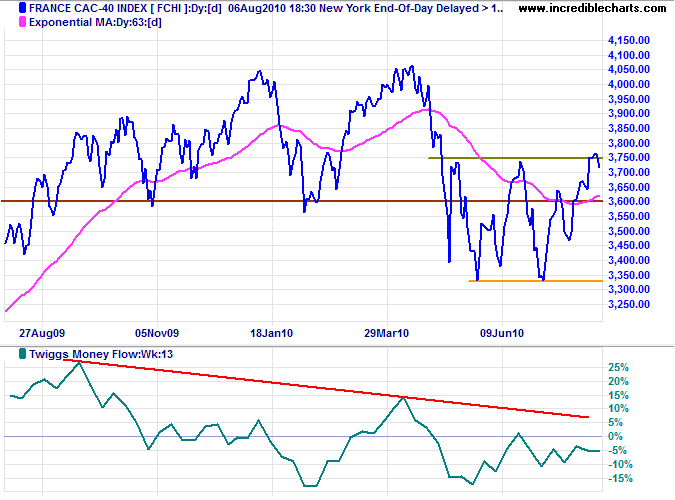

France: CAC-40

The CAC-40 is testing resistance at 3750, but remains in a primary down-trend. Twiggs Money Flow (13-week) and 63-day Twiggs Momentum Oscillator both warn of continuation of the bear market. Reversal below 3350 would offer a target of 2950*. Even if there is an upward breakout, these are notoriously unreliable in a primary down-trend.

* Target calculation: 3350 - ( 3750 - 3350 ) = 2950

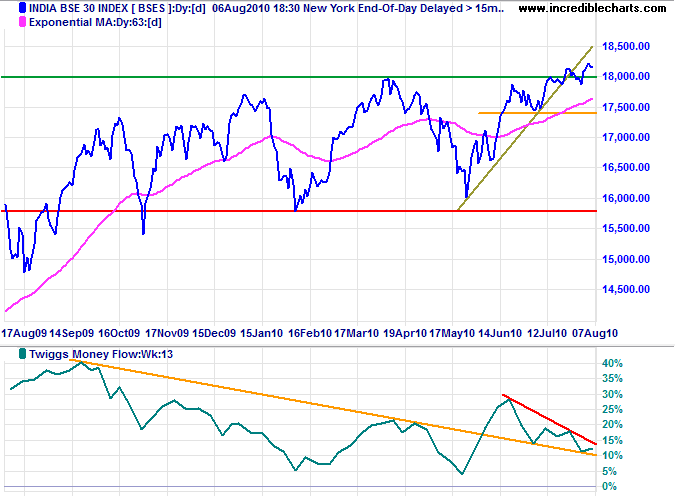

India: Sensex

The Sensex is testing its new support level at 18000. Respect would confirm the breakout and offer a target of 20000*. Declining Twiggs Money Flow (13-week), however, warns of selling pressure. Expect further tests of the new support level.

* Target calculation: 18000 + ( 18000 - 16000 ) = 20000

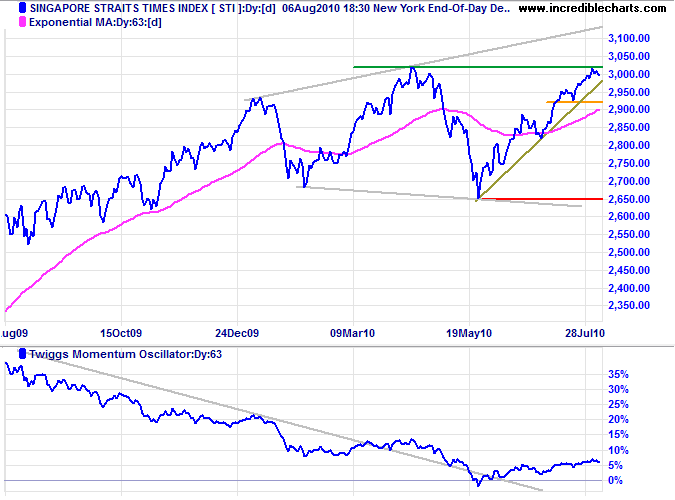

Singapore

The Straits Times Index retreated below 3000 Monday, warning of another correction. Twiggs Momentum Oscillator (63-day) reversal below zero would strengthen the signal. Failure of short-term support at 2920 would confirm.

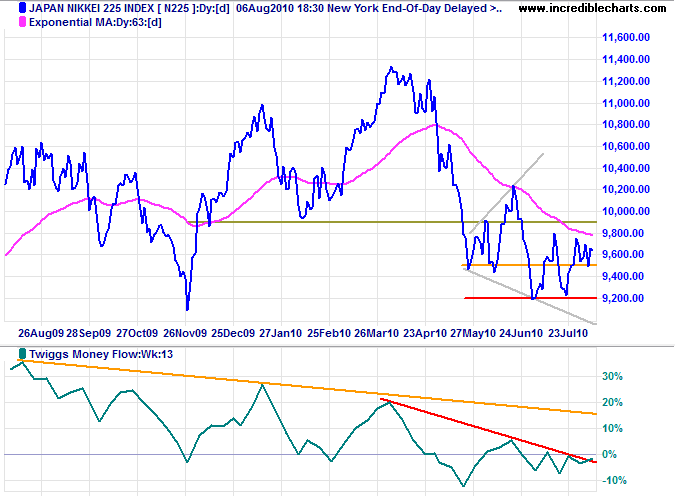

Japan: Nikkei

The Nikkei 225 found short-term support at 9500; breakout would test 9200. Twiggs Money Flow (13-week) below zero warns of selling pressure. Failure of support at 9200 would signal continuation of the primary down-trend, with a target of 8200*.

* Target calculation: 9200 - ( 10200 - 9200 ) = 8200

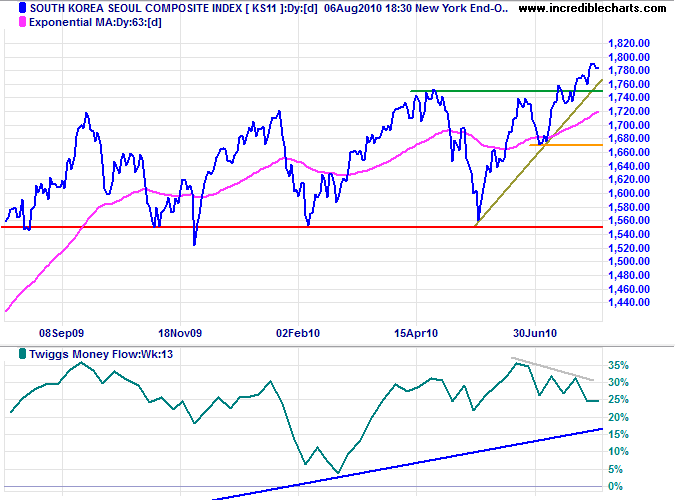

South Korea

The Seoul Composite closed near 1790 on Monday. Target for the primary advance is 1950*. Declining Twiggs Money Flow (13-week), however, warns of short-term selling pressure: expect retracement to test the new support level at 1750. Reversal below 1750 is unlikely, but would indicate a bull trap.

* Target calculation: 1750 + ( 1750 - 1550 ) = 1950

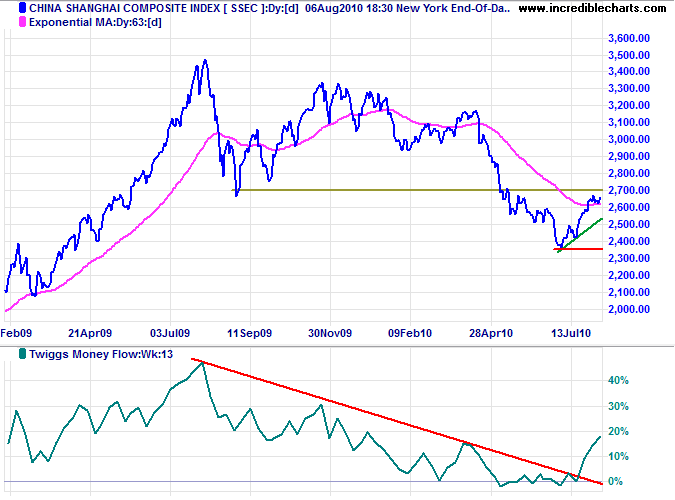

China

The Shanghai Composite Index is headed for a test of resistance at 2700. The primary trend remains downward, however, and respect of 2700 would signal another down-swing — confirmed if support at 2350 is broken. Rising Twiggs Money Flow (13-week) indicates short-term buying pressure, but 63-day Twiggs Momentum Oscillator remains well below zero, offering little promise of a reversal.

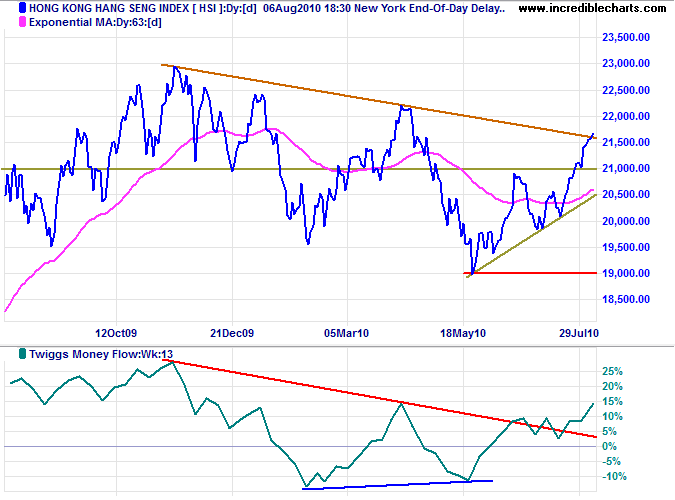

The Hang Seng Index continues to advance, with rising Twiggs Money Flow (13-week) and 63-day Momentum Oscillator confirming the primary up-trend. Reversal below the rising trendline is unlikely, but would warn of a bear trap.

* Target calculations: 21000 + ( 21000 - 20000 ) = 22000

Australia: ASX

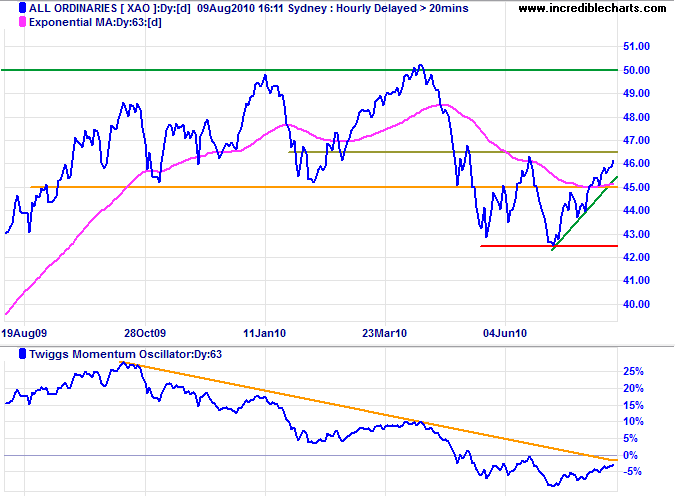

The All Ordinaries is headed for a test of 4650. Bear in mind, however, that approximately two-thirds of upward breakouts during a primary down-trend are bull traps — confirmation is required. Twiggs Momentum Oscillator (63-day) rising above zero would be a bullish sign.

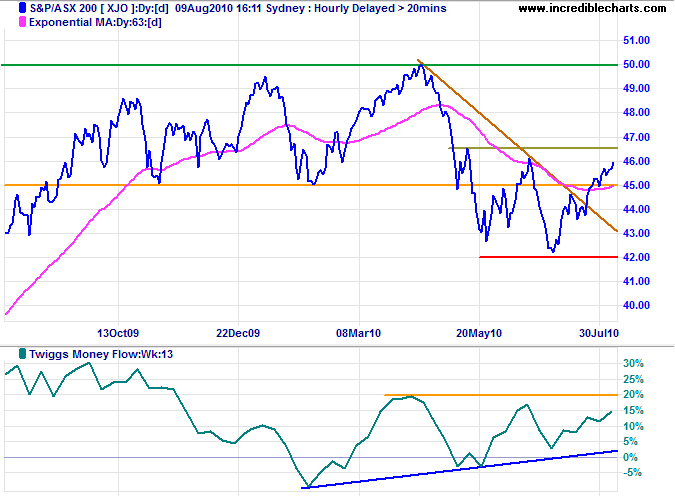

Twiggs Money Flow (13-week) breakout above its April peak at 20% on the ASX 200 would also signal a new primary advance.

* Target calculation: 4200 - ( 4600 - 4200 ) = 3800

Maybe we have so long ridiculed authority in the family and discipline in education and decency in conduct and law in the state that the freedom we fought so hard for has brought us close to chaos. And it could be that our leaders no longer understand the relationship between themselves and the people they lead.

~ Legendary football coach Vince Lombardi (1913 - 1970)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.