Beware Of The Bear

By Colin Twiggs

July 18, 2010 6:00 p.m. ET (8:00 a.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

The recent uncertainty, typified by broadening wedges across a number of market indices, is now beginning to resolve to the downside. Failed up-swings (an up-swing that fails to reach the upper border of the broadening wedge) are prevalent and warn of a downward breakout. The long-term picture is clear: four of the big five are in a primary down-trend, warning of a global bear market. The signal would be strengthened further if the DAX joins the other four (Dow/SPX, FTSE, N225, SSEC) in a primary down-trend.

USA

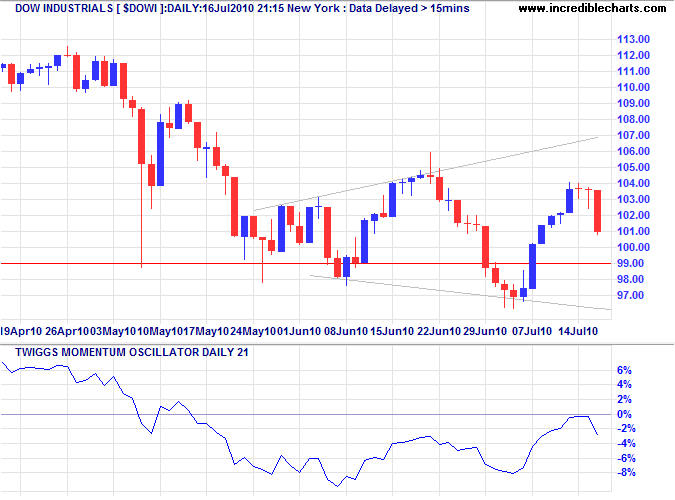

Dow Jones Industrial Average

The Dow retreated sharply on Friday, the latest up-swing failing to test the upper boarder of the broadening wedge formation — a bear signal. Reversal below 9900 would confirm the primary down-trend. The signal would be strengthened even further if there is a breach of the lower wedge border. Twiggs Momentum respect of the zero line from below would also warn of a down-trend. Breakout above the uupper border of the wedge is most unlikely, but would indicate a bear trap.

* Target calculation: 10000 - ( 11000 - 10000 ) = 9000

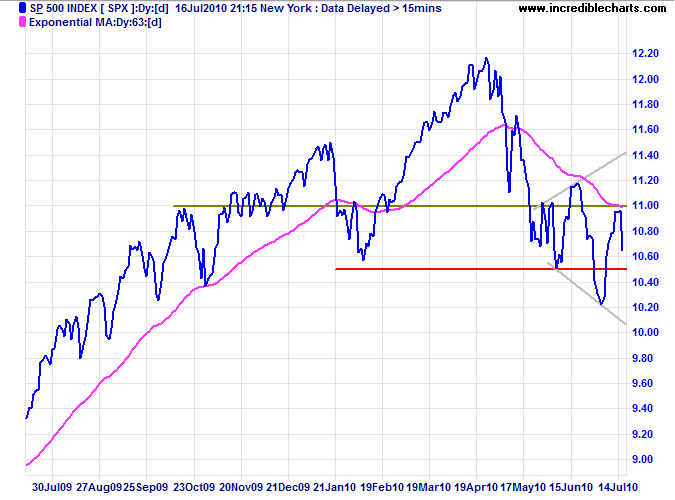

S&P 500

S&P 500 reversal below 1050 would confirm a bear market.

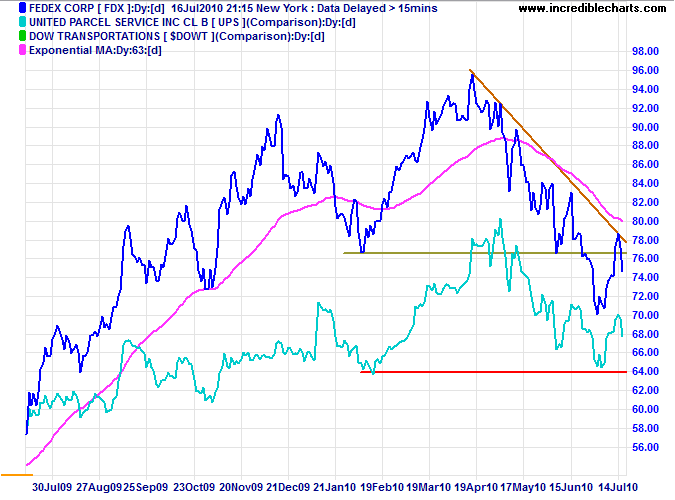

Transport

Bellwether transport stock Fedex reversed below its key support level of $76.50, confirming a primary down-trend. UPS reversal below its February low would confirm the slow-down in economic activity.

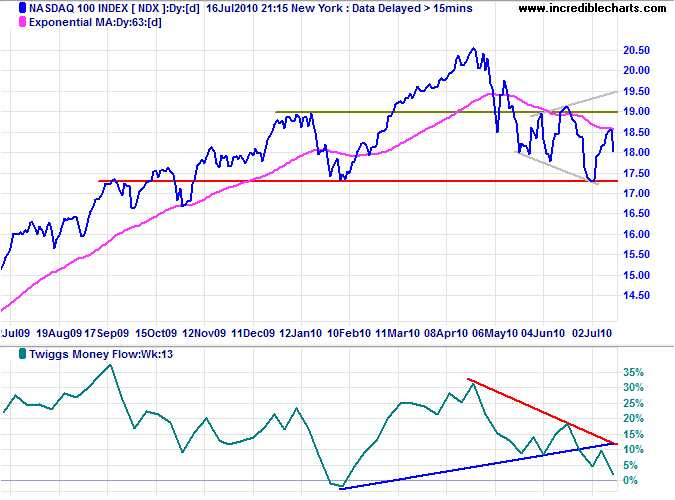

Technology

The Nasdaq 100 also portrays a broadening wedge and failed up-swing. Reversal below 1730 would signal a primary down-trend and confirm the bear market. Declining Twiggs Money Flow (13-week) strengthens the bear signal.

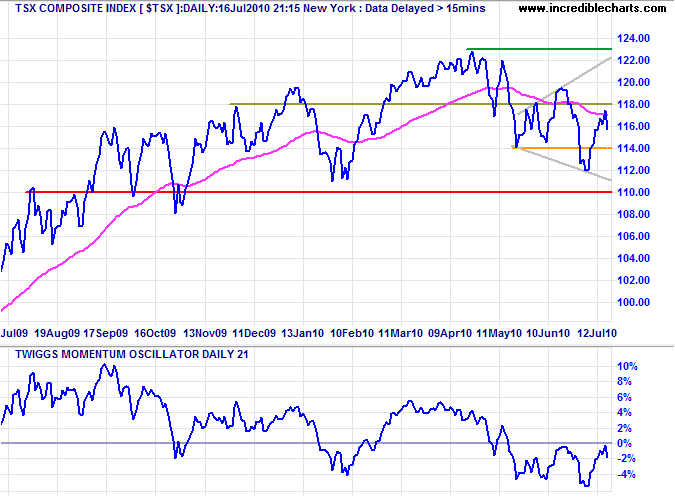

Canada: TSX

The TSX Composite displays a failed up-swing within a broadening wedge formation. Reversal below 11400 would signal a primary down-trend. Breakout below 11000 (the lower border of the wedge) would confirm. Twiggs Momentum respecting the zero line from below also warns of a down-trend.

* Target calculation: 11400 - ( 12000 - 11400 ) = 10800

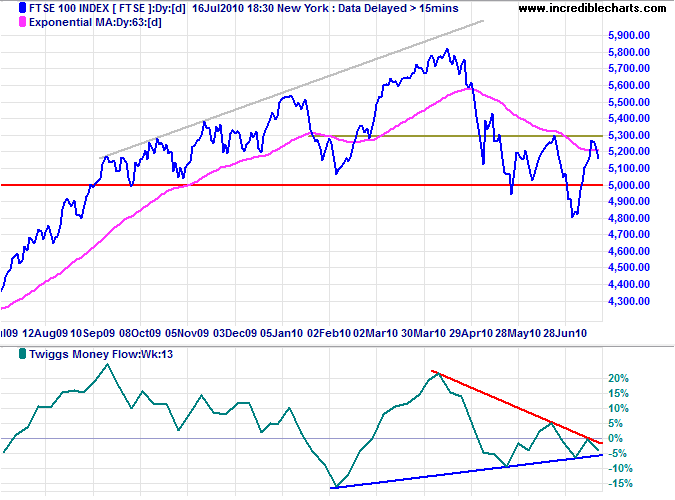

United Kingdom: FTSE

The FTSE 100 is retracing to test support at 5000; failure would confirm the primary down-trend. Twiggs Money Flow (13-week) breakout below the triangular pattern would strengthen the signal. Reversal above 5300 is unlikely, but would warn of a bear trap.

* Target calculation: 5000 - ( 5800 - 5000 ) = 4200

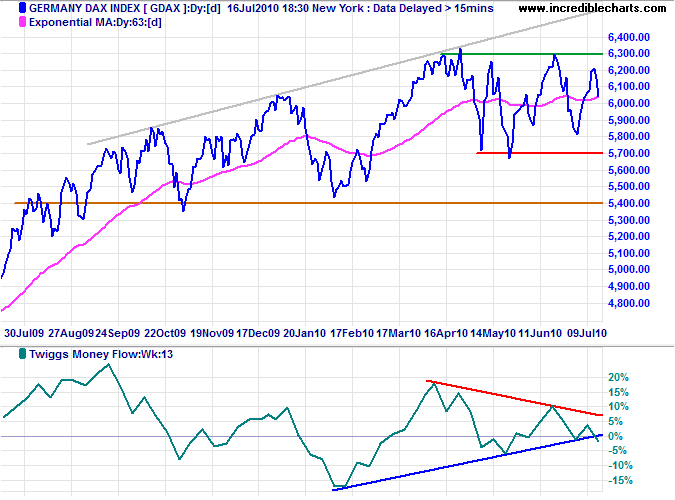

Germany: DAX

The DAX is condolidating in a broad band between 5700 and 6300, currently retracing to test the support level. Failure of support would signal a primary down-trend. Declining Twiggs Money Flow (13-week) warns of a bear market.

* Target calculation: 5700 - ( 6300 - 5700 ) = 5100

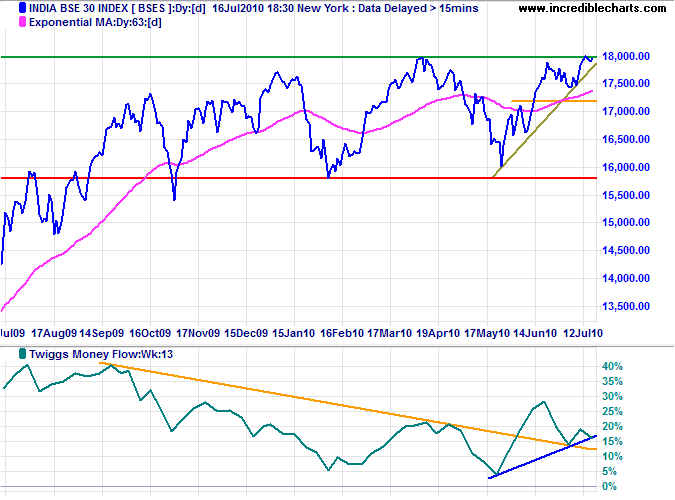

India: Sensex

The Sensex remains bullish, consolidating in a narrow range below resistance at 18000. Upward breakout would offer a target of 20000*. A completed higher trough on Twiggs Money Flow (13-week) would confirm strong buying pressure. Bearish influence from global markets, however, is likely to dampen enthusiasm.

* Target calculation: 18000 + ( 18000 - 16000 ) = 20000

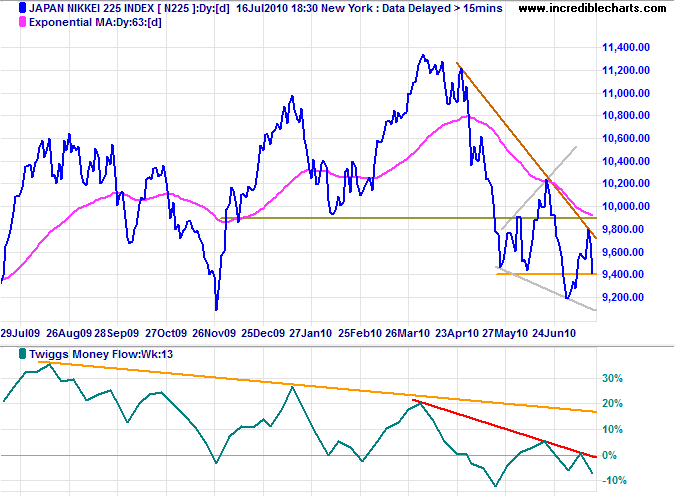

Japan: Nikkei

The Nikkei 225 is in a primary down-trend. Reversal below 9400 would signal another down-swing with a target of 8200*. Upward breakout from the broadening wedge is most unlikely, but would indicate an advance to 11400.

* Target calculation: 9200 - ( 10200 - 9200 ) = 8200

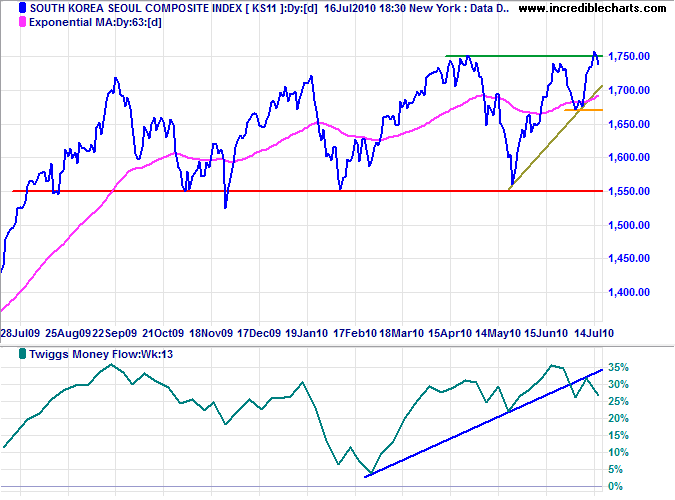

South Korea

The Seoul Composite remains bullish, with Twiggs Money Flow (13-week) holding high above zero. Breakout above 1750 would signal an advance with a target of 1950*. Bearish influence from global markets is likely to dampen buying pressure, however, and reversal below short-term support at 1670 would test primary support at 1550.

* Target calculation: 1750 + ( 1750 - 1550 ) = 1950

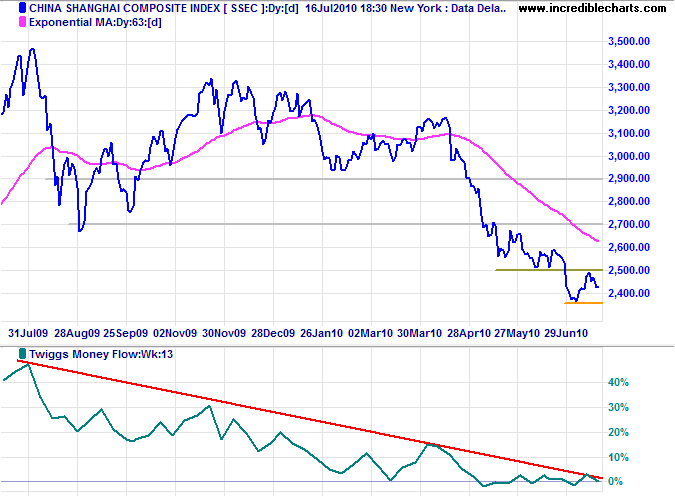

China

The Shanghai Composite Index respected short-term resistance at 2500 and is retracing to test support at 2350; failure would signal continuation of the down-swing towards its target of 2100*. Twiggs Money Flow (13-week) reversal below zero would indicate selling pressure.

* Target calculations: 2700 - ( 3300 - 2700 ) = 2100

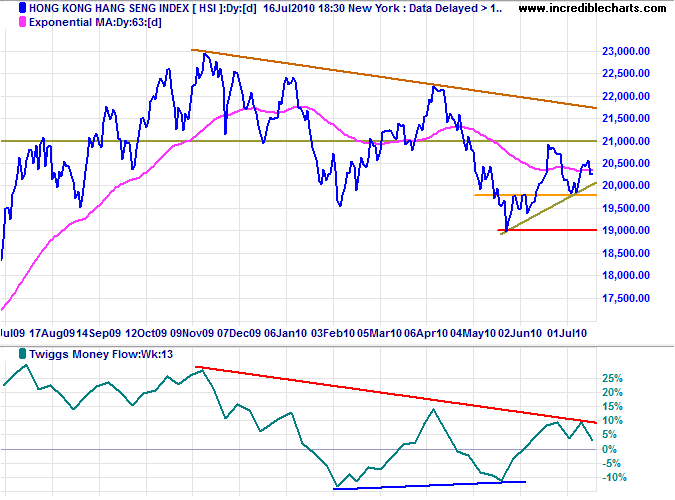

The Hang Seng Index is retracing to test short-term support at 19700; failure would test primary support at 19000. Twiggs Money Flow (13-week) reversal below zero would warn of selling pressure.

* Target calculations: 19000 - ( 21000 - 19000 ) = 17000

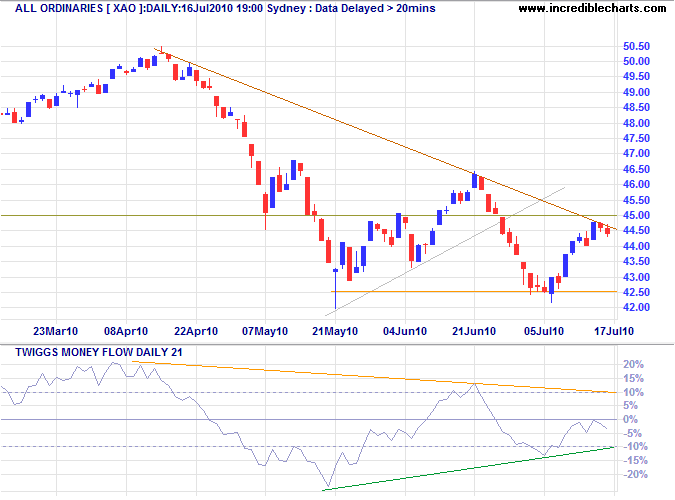

Australia: ASX

The All Ordinaries encountered primary resistance at 4500; reversal below 4250 would confirm the primary down-trend. Twiggs Money Flow (21-day) respect of the zero line from below would strengthen the bear signal.

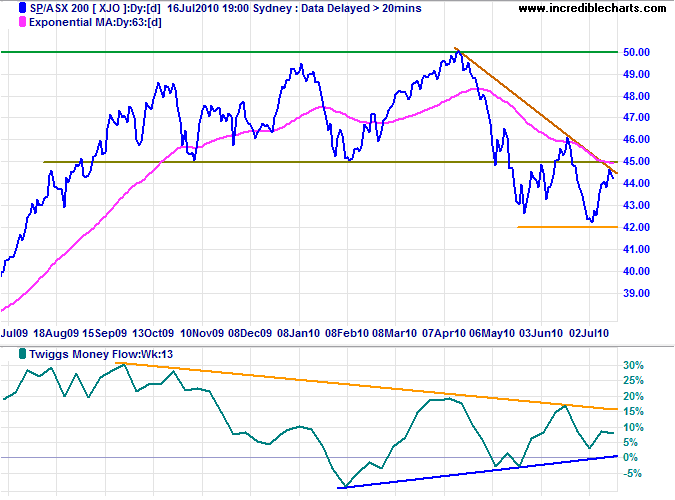

A Twiggs Money Flow (13-week) reversal below zero on the ASX 200 would warn of selling pressure. Breakout below 4200 would signal another primary down-swing with a target of 3800*.

* Target calculation: 4200 - ( 4600 - 4200 ) = 3800

Time makes more converts than reason.

~ Thomas Paine: Common Sense (1776)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.