Commodity Exports Fall While Manufactured Exports Rise

By Colin Twiggs

July 7, 2010 11:00 p.m. ET (1:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Global Trade

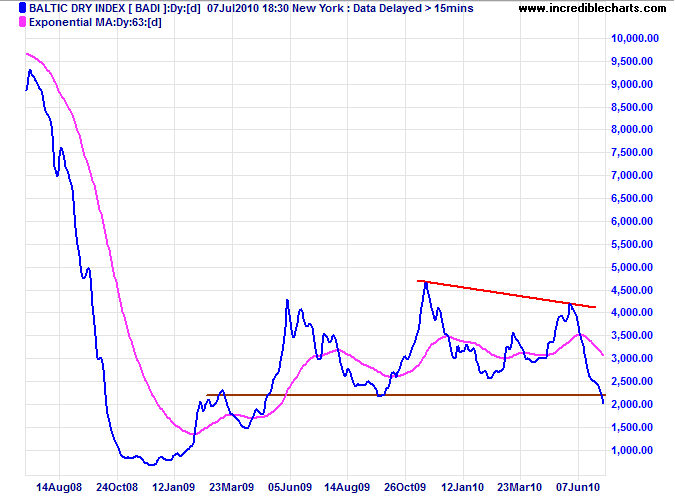

The Baltic Dry Index broke through support at 2200 to confirm a primary down-trend. Declining shipping rates indicate falling demand for dry-bulk commodities such as iron ore and coal, especially from China.

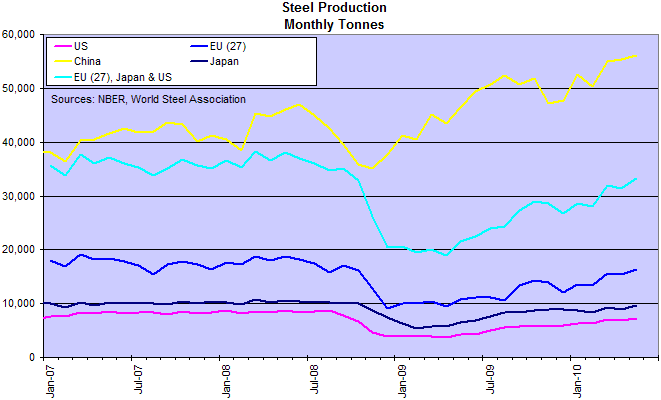

Despite falling bulk shipping rates, steel production is on the increase.

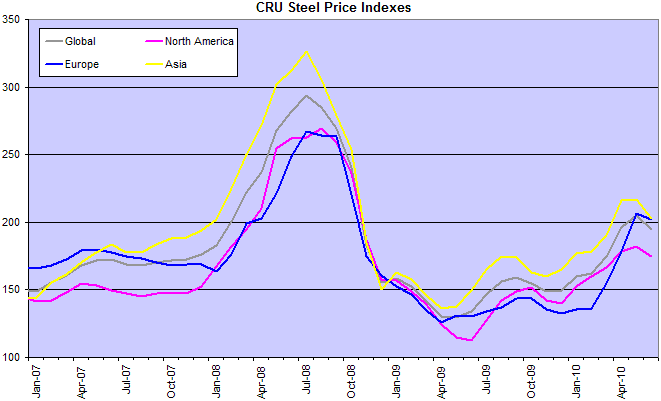

And steel prices, as reflected by the CRU Steel Price Index, are recovering even faster.

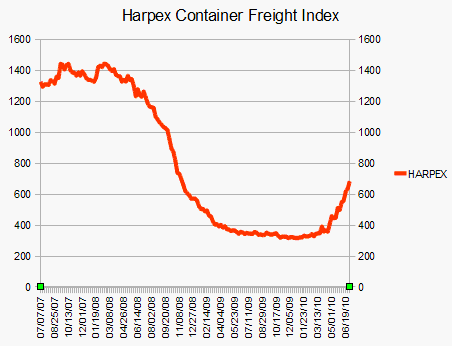

The HARPEX container freight index also indicates that container shipping rates — and global manufactured exports — are recovering. The figures are borne out by container traffic through US West Coast ports of Long Beach and Los Angeles, with a combined 18.3% increase in inbound traffic and 9.4% increase in outbound traffic for May 2010 (over May 2009).

This leads me to believe that steel stockpiled during the worst of the financial crisis is now being used for production, resulting in a down-turn in imports without a corresponding fall in manufactured exports — which remain in a healthy up-trend.

Preventing Future Banking Panics

To protect ourselves from future banking panics we need to understand the underlying causes. Panics are normally precipitated by an insolvency crisis, which then escalates into a liquidity crisis as depositors rush to withdraw their funds. The most common cause of a solvency crisis is the collapse of a stock market or property bubble, with a sharp fall in prices leaving banks exposed to write-downs. And the primary cause of asset bubbles is a rapid expansion in credit leading to inflation of asset values.

Banks are also particularly vulnerable to liquidity crises because of the nature of their business. Their major source of profits is from borrowing short and lending long, commonly referred to as maturity transformation (or maturity mis-match), where they make a healthy margin between long-term loan rates and short-term deposit rates.

Without maturity transformation, systemic banking panics would be extremely rare. Banks would call in short-term assets to meet their short-term obligations, with no need for the Federal Reserve to provide additional liquidity. The only remaining crises would be solvency-based.

Banks are protected by the federal government in two important ways:

- Solvency is guaranteed by deposit insurance where the federal government underwrites bank liabilities to depositors; and

- Liquidity is provided by the Federal Reserve discount window where banks can obtain additional liquidity in the event of a run.

The taxpayer effectively acts as a buffer to the banking system, absorbing losses which the banks cannot withstand, and providing additional liquidity as required. There is no way around this as collapse of the entire banking system would bring down the entire economy. What the taxpayer can, however, do is to discourage banks from taking unnecessary solvency or liquidity risks.

Solvency Risks

If we examine history we will find that measured introduced to solve a particular problem often end up causing far greater problems in the long run. The creation of the Federal Reserve in 1913, in response to the banking panic of 1907, provided a safety net for banks. The safety net enabled banks to take on more risk, with capital reserves levels falling sharply. And open market operations by the Fed enabled the rapid expansion of credit prior to the 1929 crash.

So the unintended consequence of measures taken to protect against future banking panics was to almost halve capital reserve ratios and facilitate the rapid expansion of bank credit through suppression of market interest rates.

The first step in protecting banks against solvency risk is to guard against future asset bubbles. Limiting Fed interference with market interest rates would provide a natural counter-balance to credit expansion. Expansion would cause interest rates to rise, thereby deterring further borrowing.

The second step is to gradually increase bank reserves. The direct route would be to force banks to raise additional equity capital. An appealing alternative proposed by Gregory Mankiw is to require banks to raise contingent debt that can be converted to equity if the financial regulator deems the bank to have insufficient capital.

The third step is the Volcker rule: to prevent banks from engaging in proprietary trading while enjoying the protection of the taxpayer's dollar. I am uncomfortable with the 3 percent rule, which allows banks to trade up to 3 percent of their capital. Rules are far easier to enforce when they are absolute. How long will it take the banks to find a way to leverage the 3 percent into a significant exposure? It also leaves the door open for later increases in the percentage limit.

Liquidity Risk

The primary cause of liquidity risk, as discussed earlier, is maturity mis-match. With the Fed's zero interest rate policy, banks pay close to zero interest on call deposits, netting them a handsome spread when they lend/invest that money in the market at longer maturity. This can lead to over-reliance on short-term funding and should be discouraged.

An institution that raises deposits with an average maturity of 2 weeks and invests these in loans with an average maturity of 6 years has far greater liquidity risk than an otherwise identical institution that invests in short-term financial assets with an average maturity of 2 weeks — or an institution that raises deposits with an average maturity of 12 months and invest in identical loans with a maturity of 6 years.

The easiest solution may be to increase capital reserve requirements for institutions who engage in short-term funding. That would also slow the rate of credit expansion during a boom.

Deposit Insurance

When too much of a good idea becomes a bad idea.

Deposit insurance was introduced in the 1930s and saved the US banking system from extinction. Administered by the FDIC, and funded by a levy on all banking institutions, deposit insurance encourages moral hazard. Depositors need not concern themselves with the solvency of the bank where they deposit their funds so long as deposits are FDIC insured. High-risk institutions are able to compete for deposits on an equal footing with well-run, low-risk competitors. This inevitably leads to higher failure rates, as in the Savings & Loan crisis of the 1980s.

The FDIC does a good job of policing deposit-takers, but no regulator can substitute for market forces. Deposit insurance is critical during times of crisis, but should be scaled back when the crisis has passed. Either limit insured deposits to say $20,000 or only insure deposits to say 90% of value, where the depositor takes the first loss of 10%. That should be sufficient to keep depositors mindful as to where they bank. And restore the competitive advantage to well-run institutions.

Shadow Banking

Development of an unregulated shadow banking system has twice come close to bringing down the entire financial system: unregulated investment trusts in 1907 and investment banks in 2007. Banking regulations and capital reserve requirements should apply to all institutions who engage in large scale maturity transformation.

Securitization

Securitization of real estate assets was rife in the lead up to the crash of 1929 and again in the lead up to the latest financial crisis. Securitization often masks maturity transformation, where long-term assets are financed through liquid markets and traded on a short-term basis in much the same way as stocks. The problem is that liquidity tends to dry up during a crisis, leaving short-term investors with a long-term asset. Banks engaged in massive securitization in the last decade in order to circumvent capital reserve requirements. This exacerbated the financial crisis when the market for mortgage-backed securities (MBS) dissolved.

Fannie Mae and Freddie Mac

Fannie Mae was founded in 1938, towards the end of the Great Depression, to facilitate mortgage finance for home buyers and to stimulate the real estate market. Privatized in 1968, it was joined by Freddie Mac in 1970 — to foster increased competition in the home mortgage market. With an implicit government guarantee, the two thrived and by 2008 owned or guaranteed about half of the $12 trillion US residential mortgage market. Following the collapse of the real estate market both were placed under the conservatorship of the FHFA. The national debt ceiling had to be increased by $800 billion to allow for increased Treasury funding, while the Fed purchased $1.25 billion of mortgage-backed securities to support the MBS market and lower mortgage rates.

Fannie Mae and Freddie Mac have so far cost US taxpayers $145bn in bail-out costs and will continue to pose a threat to the taxpayer purse and stability of financial markets. The only long-term solution is to break them up and sell them off — with the clear understanding that there will be no implicit federal guarantee.

Conclusion

The bottom line is that you cannot effectively regulate the banking industry while allowing large parts of the financial sector to bypass banking regulations. The only solution is to create a level playing field by imposing the same regulations and capital reserve requirements on the securitization industry and any other institution that engages in large scale maturity transformation. It is also vitally important that we control the expansion of credit, in part by increasing capital reserve requirements, and prevent banks from engaging in proprietary trading while under taxpayers protection.

I have not discussed bank's use of derivatives and when too-big-to-fail extends to non-banking entities, in the insurance sector or in general industry. These will be covered in a later newsletter.

Compromise is but the sacrifice of one right or good in the hope of retaining another — too often ending in the loss of both.

~

Tryon Edwards

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.