The Path Of The Euro

By Colin Twiggs

May 13, 2010 1:00 a.m. ET (3:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

The proposed € 750 stabilization fund from the EU and IMF may succeed in stabilizing markets in the short- to medium-term, but it does not solve the underlying problem. Individual members have run up too much debt and are finding it difficult to meet their commitments. Lending them more money will not help in the long-term. Austerity measures are the most appealing solution, but difficult to implement on sufficient scale to make a difference. Debasing the euro would make the debt more affordable, but will meet with strong resistance from Germany and other more conservative members. The only other alternative, however, is for individual members to default on their obligations. This may have initially appealed to Angela Merkel and Nicolas Sarkozy, but would cause a nasty blow-back through the high exposure of French and German banks. The eventual outcome is likely to be a combination of austerity and inflation — resulting from the European Central Bank buying eurozone government bonds.

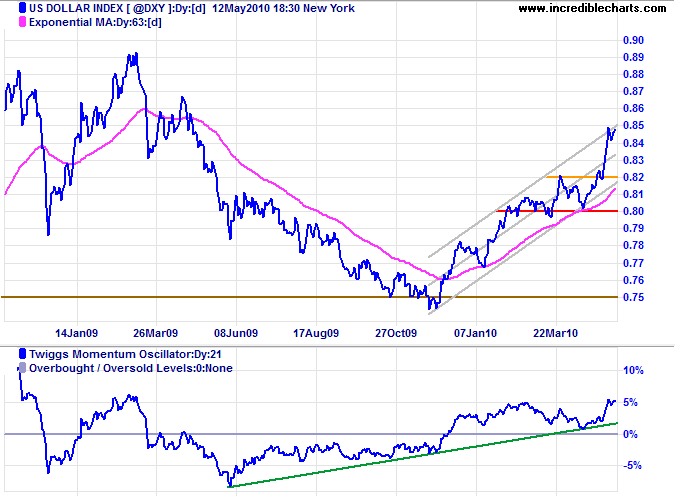

US Dollar Index

The US Dollar Index is testing the upper border of its trend channel. Expect resistance at 85, followed by retracement to the lower channel, testing support at 82. Breakout above 85 is less likely, but would signal another sharp rally, with a target of 88*. Twiggs Momentum (21-day) respecting both zero and the rising trendline confirms a strong primary up-trend.

* Target calculation: 85 + ( 85 - 82 ) = 88

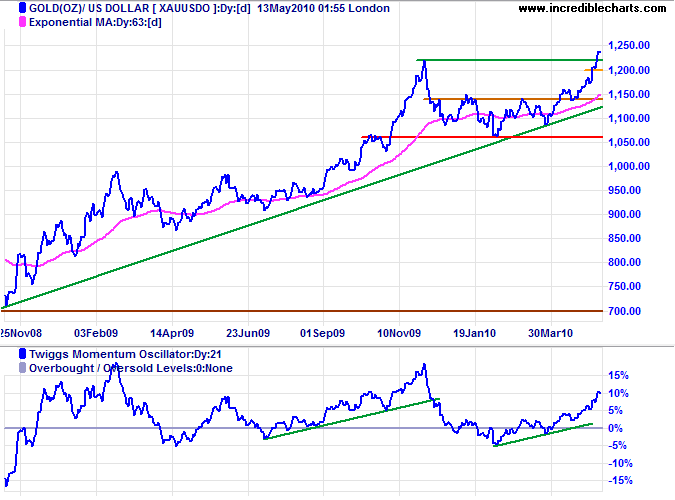

Gold

The normal relationship is that gold weakens when the dollar strengthens, but here we have the two sharing an appeal as shelters from the financial storm. Gold broke through resistance at $1220, signaling another primary advance. Expect retracement in the short-term, however, to test the new support level at $1200. Rising Twiggs Momentum (21-day) confirms the up-trend. The target for the advance is $1380*. Reversal below $1200 is unlikely, but would warn of a bull trap.

* Target calculation: 1220 + ( 1220 - 1060 ) = 1380

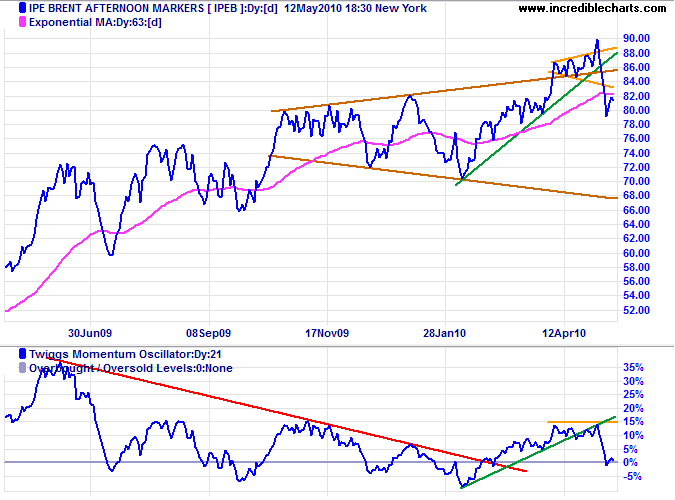

Crude Oil

Crude broke through the lower border of the small broadening wedge formation, warning of a bear trap — and test of primary support at $70. Twiggs Momentum reversal below zero would strengthen the signal.

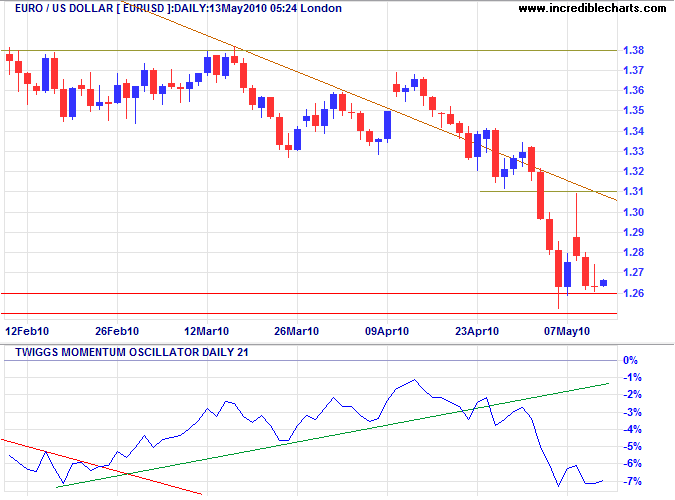

Euro

The euro is testing the band of long-term support between $1.25 and $1.26. Respect of short-term resistance at $1.30 warns of strong selling pressure; Twiggs Momentum oscillating below zero confirms. Failure of support at $1.25 would offer a long-term target of parity*.

* Target calculation: 1.25 - ( 1.50 - 1.25 ) = 1.00

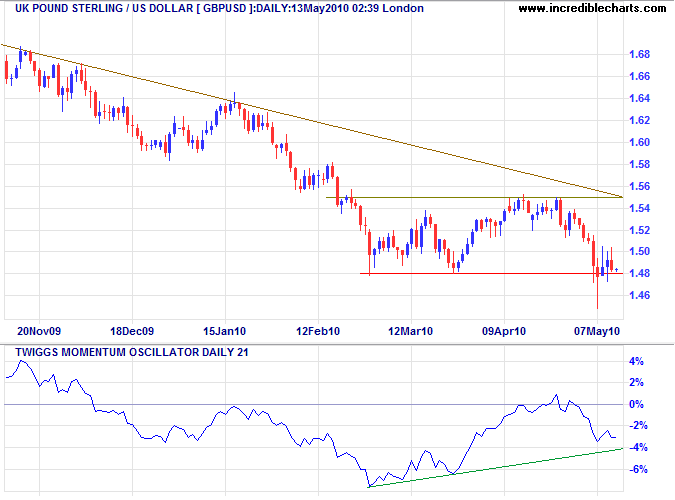

UK Pound Sterling

The pound is testing primary support at $1.48; failure would offer a target of $1.41*. Twiggs Momentum (21-day) penetration of the rising trendline would indicate continued weakness.

* Target calculation: 1.48 + ( 1.55 - 1.48 ) = 1.41

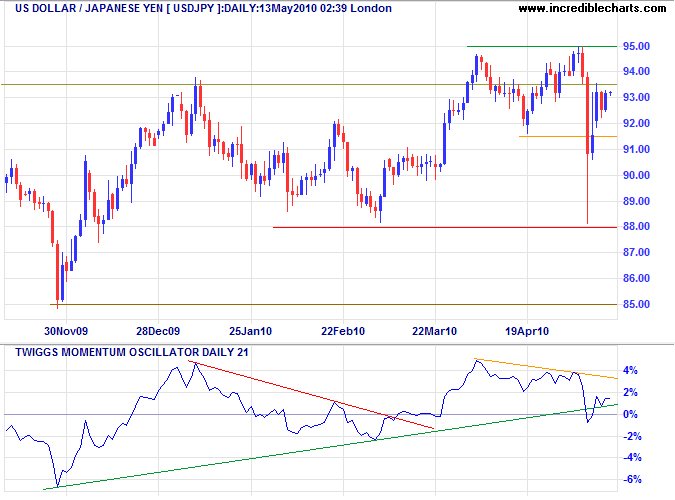

Japanese Yen

The dollar recovered from last week's turmoil against the yen and is testing resistance at ¥93.50. Respect would signal another correction to primary support at ¥88, while upward breakout would indicate a primary advance to ¥100* — confirmed if resistance at ¥95 is broken. Recovery of Twiggs Momentum above the declining trendline would indicate another advance, while reversal below zero would also warn of a correction.

* Target calculation: 94 + ( 94 - 88 ) = 100

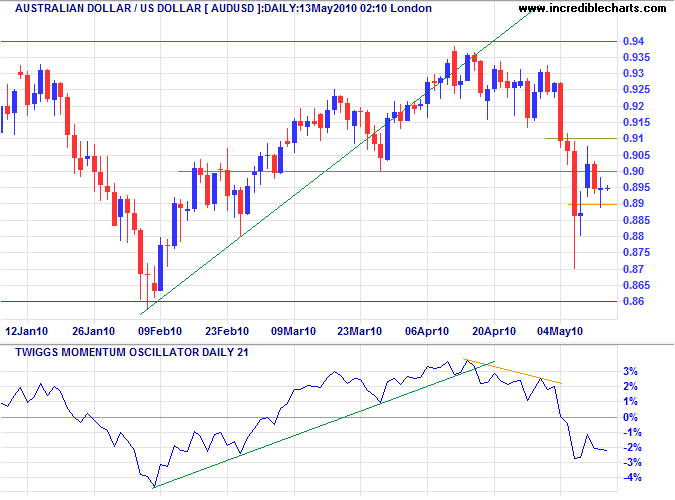

Australian Dollar

The Aussie dollar found resistance at $0.91 before retreating to test support at $0.89. Failure would warn of a test of primary support at $0.86; Twiggs Momentum holding below zero would strengthen the signal. Recovery above $0.91, however, would indicate another test of $0.94 and refresh hopes of reaching parity*.

* Target calculation: 0.94 + ( 0.94 - 0.86 ) = 1.02

And now here is my secret, a very simple secret; it is only with the heart that one can see rightly, what is essential is invisible to the eye.

~ Antoine de Saint-Exupery

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.