Euro Tremors Weaken Gold

By Colin Twiggs

March 25, 2010 3:00 a.m. ET (6:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

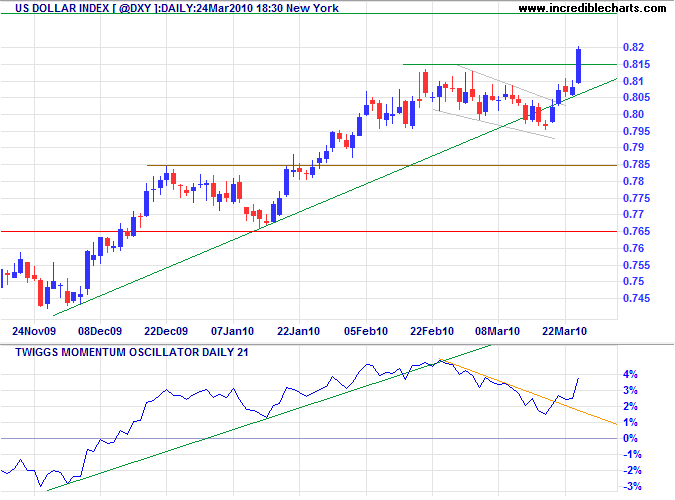

The US Dollar Index completed a flag continuation pattern and is advancing towards the target of 84.5*. Twiggs Momentum (21-day) breakout above the declining trendline reinforces the signal. Retracement that respects the new support level at 81.5 would confirm.

* Target calculation: 81.5 + ( 81.5 - 78.5 ) = 84.5

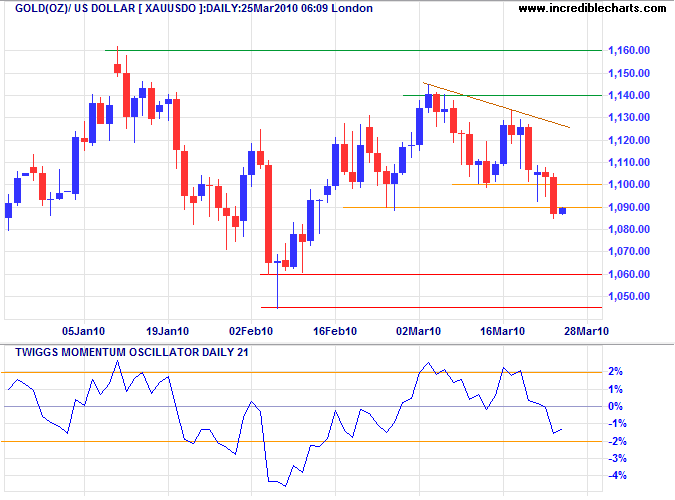

Gold

Gold responded by breaking short-term support at $1100, signaling a test of the band of primary support between $1050 and $1060. A short-term peak on Twiggs Momentum (21-day) that respects the zero line (from below) would strengthen the bear signal. Recovery above the descending trendline is less likely, but would indicate continuation of the advance to $1160.

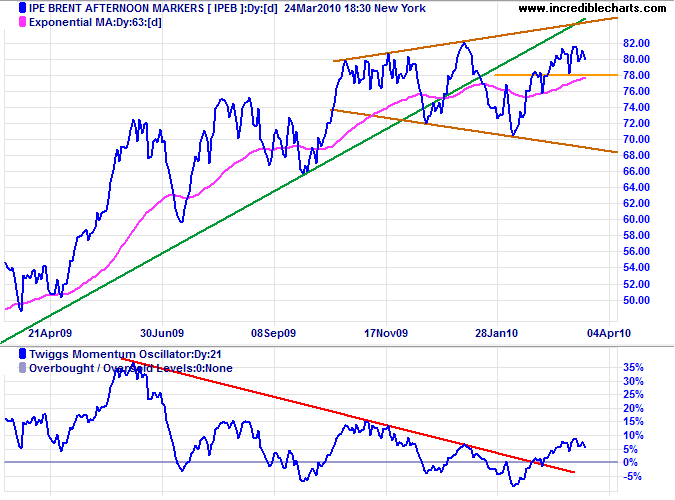

Crude Oil

Crude is retracing to test support at $78/barrel. Respect is likely and would signal a test of the upper border of the large broadening wedge consolidation. Momentum breaking above the declining trendline favors continuation of the primary up-trend; and a large trough that respects the zero line would confirm. Failure of support at $78, however, would indicate a failed up-swing and downward breakout from the wedge formation.

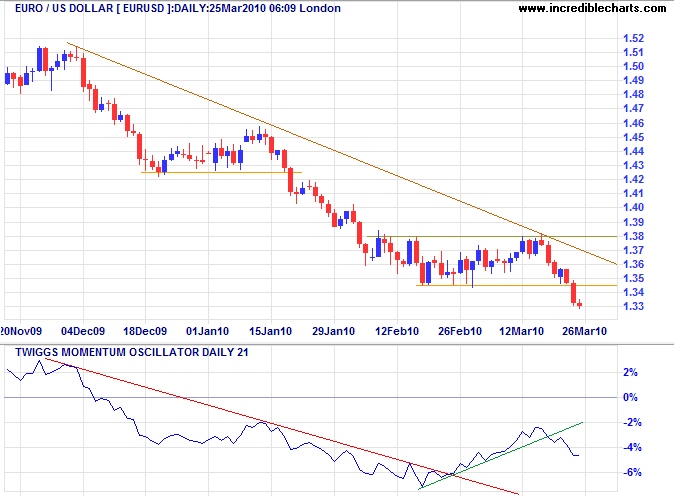

Euro

The euro plunged through support at $1.34 after the Fitch downgrade of Portugal's sovereign debt rating. The European Monetary Union faces significant instability in the months ahead. Assisting Greece (2.6% of EMU GDP) or Portugal (1.8%) may buy some time, but does not solve the debt issues facing the far larger economies of Italy (17% of EMU GDP) and Spain (11.7%). The current decline of the euro will test $1.30*, but the longer term target is the 2009 low of $1.25*.

* Target calculations: 1.34 - ( 1.38 - 1.34 ) = 1.30 and 1.34 - ( 1.42 - 1.34 ) = 1.26

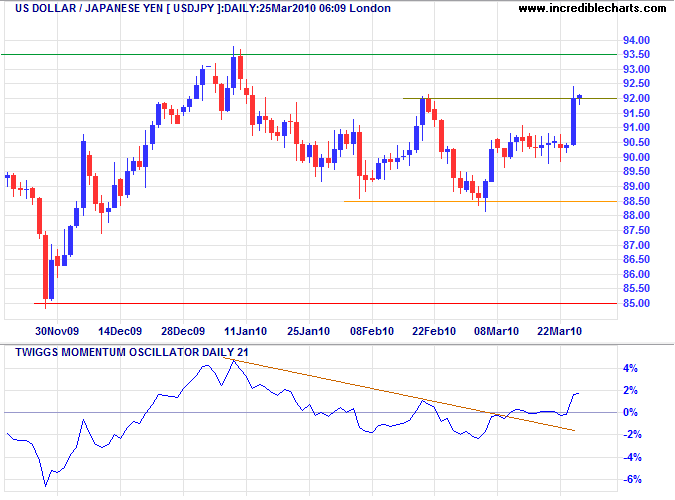

Japanese Yen

The greenback is testing resistance at ¥ 92; breakout would signal the end of the correction — and an advance to ¥ 100*. Recovery above $93.50 would confirm. Reversal below ¥ 88.5, however, would test primary support at ¥ 85.

* Target calculation: 94 + ( 94 - 88 ) = 100

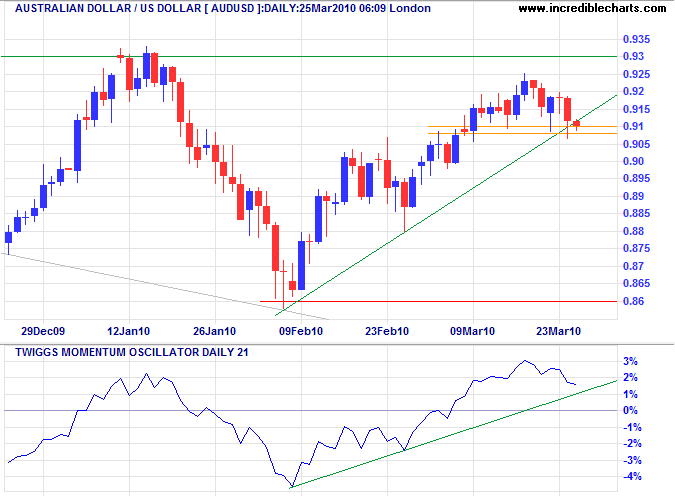

Australian Dollar

The Aussie dollar is testing short-term support and the rising trendline at $0.91 — caused by a general flight to (relative) safety of the greenback. Failure of support would warn of a correction to test primary support at $0.86. Twiggs Momentum Oscillator (21-day) reversal below zero would strengthen the bear signal, but a large trough above the zero line would indicate another primary advance.

I think everyone should experience defeat at least once during their career.

You learn a lot from it.

~ Lou Holtz

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.