What's New: Momentum Trading

By Colin Twiggs

March 17, 2010 4:00 a.m. ET (7:00 p.m. AET)

This newsletter is subject to Incredible Charts Terms of Use.

Momentum Trading [Part 1 of 3]

Introduction

The purpose of this 3-part series of articles is to provide information about the potential benefits of momentum investing. In this series, I will try and explain what momentum is, the potential returns available to momentum investors, and the way that Porter Capital combine mechanical, rules-based strategies with the momentum effect to deliver benefits to investors.

The 'premier' anomaly

Since its initial discovery by DeBondt & Thaler in 1985[1], the momentum effect has been documented and researched in many markets worldwide.

Many traders and investors would know of the academic notion of the ‘efficient’ market, and the implication that this efficiency has on the ability of investors and traders to earn profits.

What you may not be aware of is that the father of the ‘efficient market hypothesis’, Eugene Fama, refers to momentum as “the premier unexplained anomaly”[2]. In other words, the success of momentum based investing is regarded by many as an exception to the efficient market hypothesis.

What is it?

In its simplest terms, momentum refers to buying stocks which exhibit past over-performance. Research shows that stocks which have exhibited strong performance over some defined historical period, have a tendency to continue to exhibit strong performance for some number of future periods. It means that investors can potentially hitch a ride on strong momentum stocks. In part 2 of this series, I will use simulations to explore the potential risks and rewards of the momentum approach.

A Typical Momentum Trade

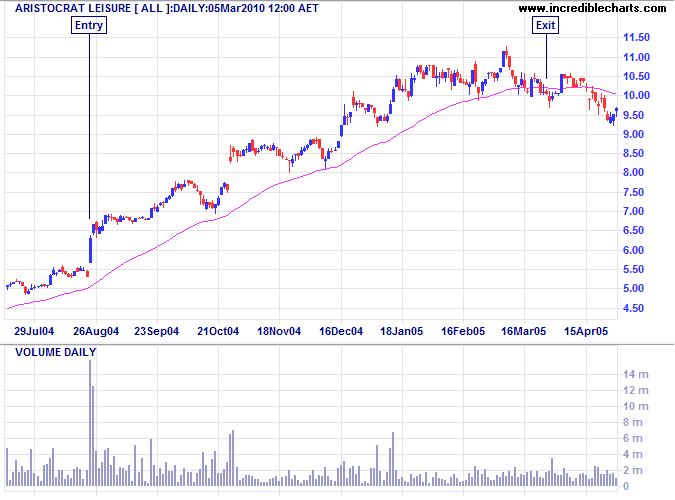

The typical momentum trade has a history of clearly defined direction and strength. Figure 1 shows a chart of price activity for ALL (Aristocrat Leisure), from August 2004 to April 2005. During late August 2004, there is a clear price breakout on very heavy volume. This marks the start of the momentum opportunity. Over the next few months, the price activity demonstrates clearly defined direction.

Is it credible?

The momentum effect has been widely researched and documented in both the international and Australian equity markets. For example, Rouwenhorst[3] tested momentum strategies in 12 European markets using data from 1980 to 1995, and found that momentum returns were present in every country, and their effects lasted for approximately one year. Griffin et al.[4] found support for the profitability of momentum investing in over 40 countries, and concluded ‘Globally, momentum profits are large and statistically reliable in periods of both negative and positive economic growth’.

Momentum has been thoroughly researched in virtually all of the worlds equity markets. Momentum effects have also been documented in other asset classes, such as foreign currencies[5], commodities[6] and real estate[7].

It is fair to say that the momentum effect appears to be one of the most beneficial effects for investors. Thorough research appears to indicate that momentum based investment does not increase investment risk, and that momentum effects are present during both economically good and bad cycles.

When does it work best?

Like all investment approaches, momentum investing is subject to the vagaries of the investor. For many investors, poor returns are not so much a function of their investment strategy, but of their own implementation of that strategy.

All investment strategies benefit from the increased discipline and accountability that mechanical, rule-based trading brings, particularly during difficult investment cycles. I will discuss this topic in more detail in the third part of this momentum series.

References

- DeBondt, W.F.M. and R.H. Thaler, Does the stock market overreact? Journal of Finance, 1985. 40: p. 793-805.

- Fama, E. and K. French, Common Risk Factors in the Returns on Stocks and Bonds. Journal of Financial Economics, 1993. 33(1).

- Rouwenhorst, K.G., International Momentum Strategies. Journal of Finance, 1998. 53(1): p. 267-284.

- Griffin, J.M., S. Ji, and J.S. Martin, Global Momentum Strategies: A Portfolio Perspective. Available at: SSRN: http://ssrn.com/abstract=492804, 2004.

- Okunev, J. and D. White, Do momentum-based strategies still work in foreign currency markets? Journal of Financial and Quantitative Analysis, 2003. 38.

- Taylor, S.J., Forecasting Market Prices. International Journal of Forecasting, 1998. 4: p. 421-426.

- Stevenson, S., Momentum effects and mean reversion in real estate securities. Journal of Real Estate, 2002. 23: p. 47-64.

How Socialism Works

I have been unable to trace the original source of this piece received via email.

An economics professor at a local college made a statement that he had never failed a single student before, but had once failed an entire class.

That class had insisted that socialism worked and that no one would be poor and no one would be rich, a great equalizer. The professor then said, "OK, we will have an experiment in this class......." All grades would be averaged and everyone would receive the same grade so no one would fail and no one would receive an A.

After the first test, the grades were averaged and everyone got a B. The students who studied hard were upset and the students who studied little were happy. As the second test rolled around, the students who studied little had studied even less and the ones who studied hard decided they wanted a free ride too so they studied little. The second test average was a D! No one was happy.

When the 3rd test rolled around, the average was an F. The scores never increased as bickering, blame and name-calling all resulted in hard feelings and no one would study for the benefit of anyone else. All failed, to their great surprise, and the professor told them that socialism would also ultimately fail because when the reward is great, the effort to succeed is great but when government takes all the reward away, no one will try or want to succeed.

Development Plans

Thank you for all the suggestions and requests for new features. While not all can be accommodated, the weight of requests guides us in setting new development priorities. Based on the results of our last survey, we are currently undertaking a major revamp of Incredible Charts to provide live/delayed feeds and charts with hour/minute bars. This is expected to occupy most of our time over the next 6 months.

We hope to reward your patience by delivering superior software at an affordable price.

Success demands singleness of purpose.

~ Vince Lombardi.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.