Euro Tremors

By Colin Twiggs

February 18, 2010 10:00 p.m. ET (1:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

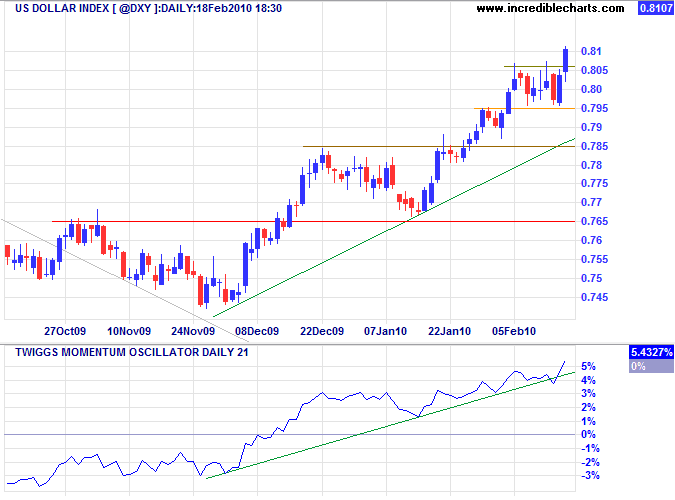

The US Dollar Index is in a primary up-trend, breaking through short-term resistance at 80.5 as the euro weakened. The short consolidation indicates trend strength, with buyers preventing a stronger retracement. Reversal below the rising trendline is now most unlikely.

* Target calculation: 80.5 + ( 80.5 - 79.5 ) = 81.5

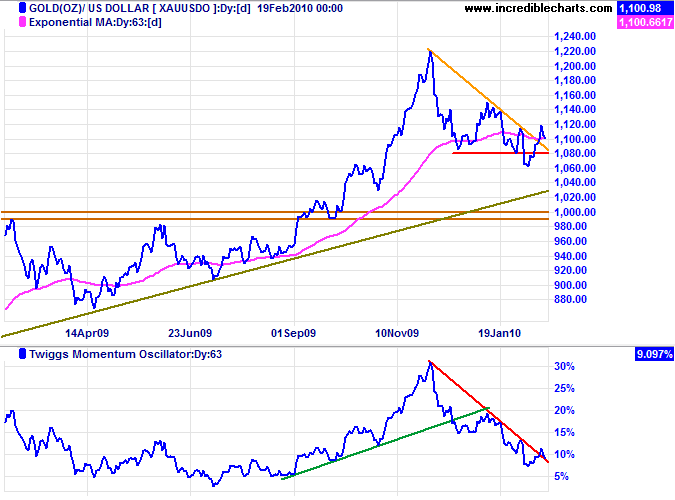

Gold

Gold is retracing to test support at $1080; respect would signal an end to the correction. Reversal below $1060, however, would indicate a primary down-trend. Twiggs Momentum (63-day) holding above its declining trendline would reinforce the bull signal.

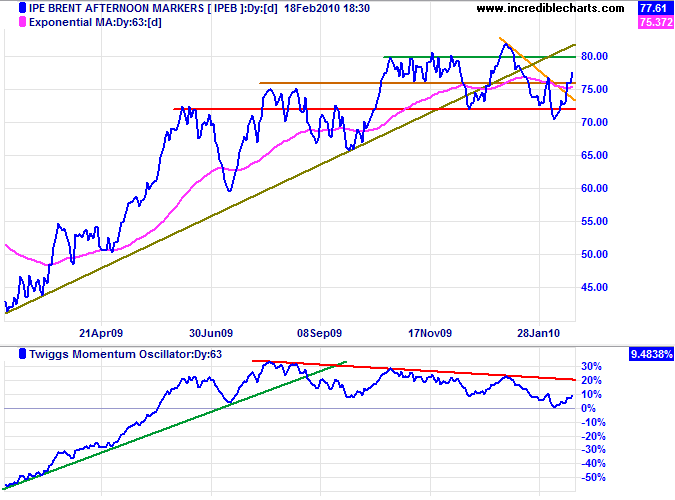

Crude Oil

Crude broke through short-term resistance at $76, offering a target of $80. A large broadening wedge is starting to form: higher peaks and lower troughs. The long term picture remains bearish, with crude below the rising trendline on both the price and Momentum charts. Reversal below $70 would signal a primary down-trend.

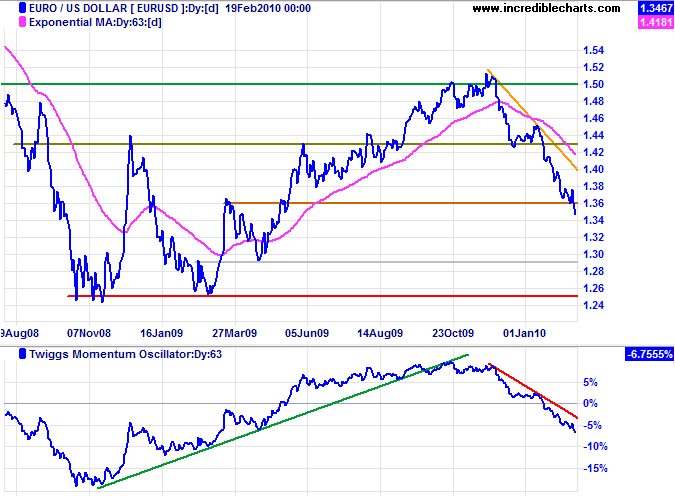

Euro

The euro broke through the $1.36 support level, signaling a further decline to test support at $1.29. Recovery above the declining (orange) trendline is now unlikely — as is breakout above the declining trendline on Twiggs Momentum (63-day).

The market is obviously unhappy with the rate of progress in resolving the Greek debt crisis and is voting with its money.

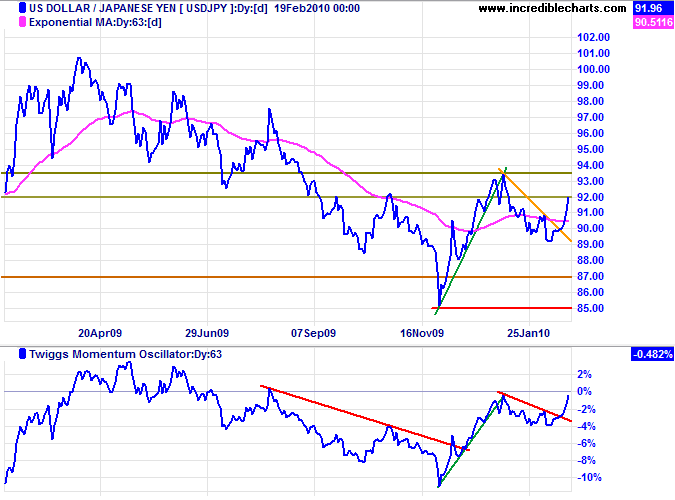

Japanese Yen

The greenback broke through its declining trendline against the yen, signaling another advance. Recovery above ¥ 93.50 would confirm a primary up-trend. Twiggs Momentum Oscillator (63-day) rising above zero would confirm.

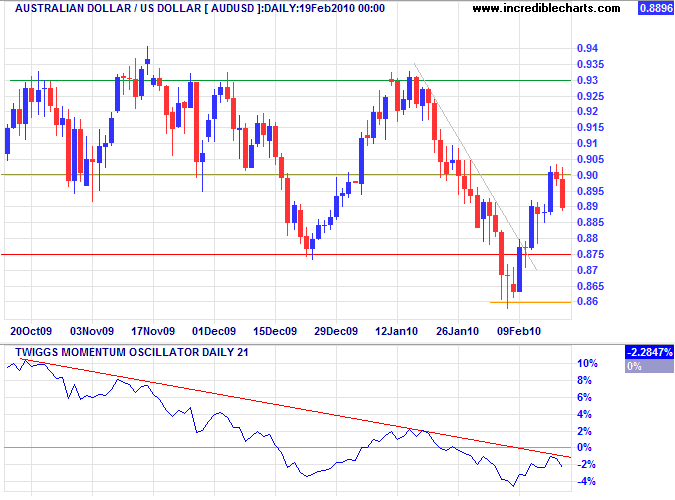

Australian Dollar

The Aussie dollar respected resistance at $0.90 and is retracing to test support at $0.875. Failure of support would signal a primary down-trend — confirmed if support at $0.86 is broken. Recovery above $0.90, however, would offer a target of $0.93. Twiggs Momentum Oscillator (21-day) reversal below its February low would warn of a primary down-trend.

Australia survived the recession by hanging on the coat-tails of China, rather than through local efforts to stimulate the economy. With China forced to cool expansion caused by its the massive stimulus program, because of inflation fears, it will be interesting to see how we survive the "recovery".

If you believe in yourself and have the courage, the determination, the dedication, the competitive drive and if you are willing to sacrifice the little things in life and pay the price for the things that are worthwhile, it can be done.

~ Vince Lombardi in What It Takes to Be #1

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.