Bear Trap Or Down-Trend?

By Colin Twiggs

February 11, 2010 11:30 p.m. ET (3:30 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Gold, crude and the resource-based Australian Dollar all broke through primary support levels before immediately reversing — warning of a possible bear trap. Further confirmation is needed, for either the bear trap or the new down-trend.

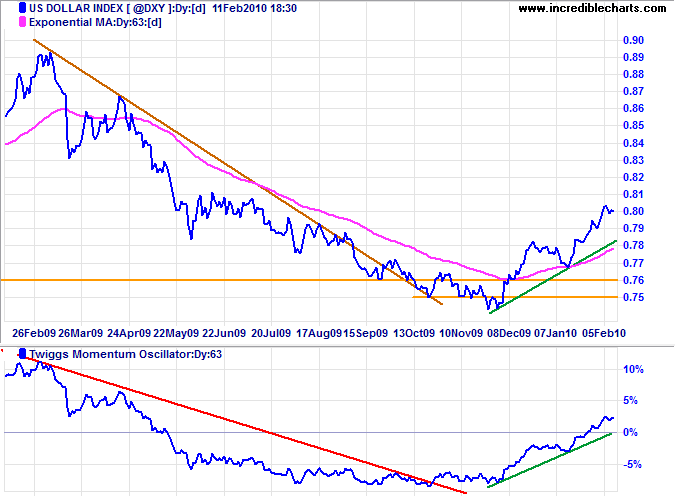

The US Dollar Index is in a primary up-trend, largely as a result of a weaker euro. Having reached its medium-term target of 80.5*, expect retracement to test the latest support level at 78.5 (the last peak). Reversal below the rising trendline is unlikely, but would warn of trend weakness.

* Target calculation: 78.5 + ( 78.5 - 76.5 ) = 80.5

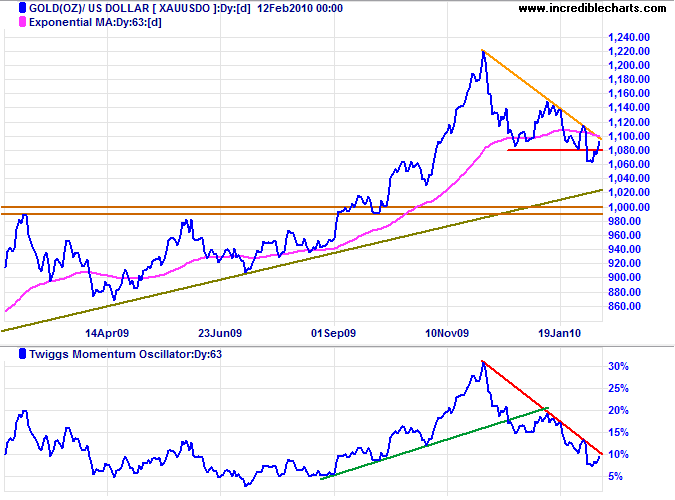

Gold

Gold broke through support at $1080 to signal a primary down-trend, but immediate recovery above the new resistance level warns of a bear trap. Breakout above the declining trendline would confirm the trap, while reversal below $1080 would ratify the down-trend. Twiggs Momentum (63-day) breakout above the declining trendline would re-inforce the bull signal.

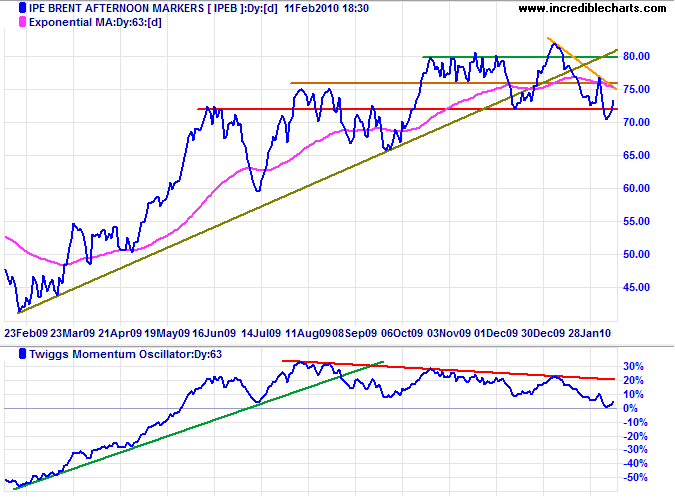

Crude Oil

Crude retreated below primary support at $72, warning of a primary down-trend. Immediate recovery above the new resistance level warns of a bear trap. Breakout above the declining trendline would confirm the trap, offering a target of $80, while reversal below $72 would establish the down-trend.

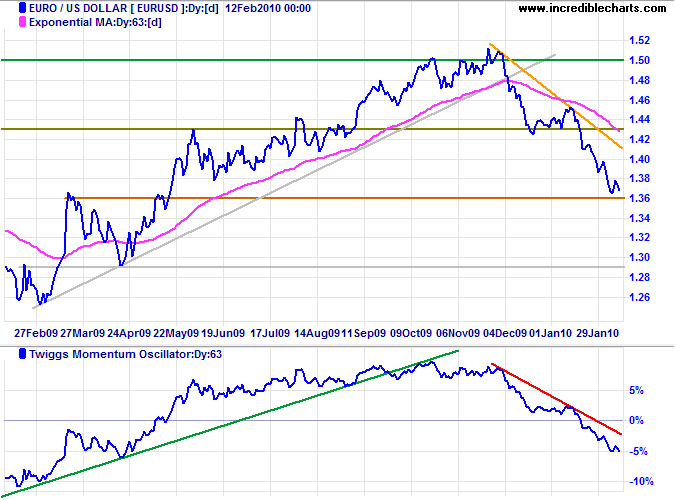

Euro

The euro is in a strong primary down-trend. Talk of Greece being rescued by France and Germany may help to stem the decline at the $1.36 support level. Expect a test of the declining (orange) trendline. Breakout above the declining trendline on Twiggs Momentum (63-day) may provide advance warning of a trend change.

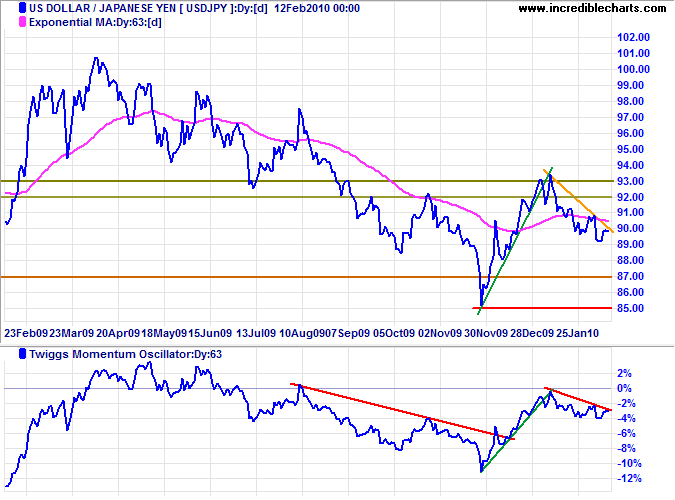

Japanese Yen

The greenback is undergoing a correction against the yen, after making a new high in early January. Recovery above ¥ 93 would confirm a primary up-trend. Look for early warning from Twiggs Momentum Oscillator (63-day) crossing above the declining (red) trendline.

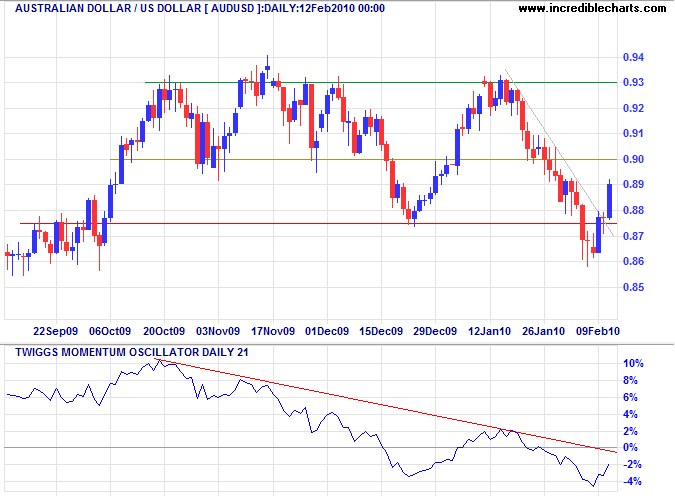

Australian Dollar

The Aussie dollar broke through primary support at $0.875, but rallied sharply above the new resistance level. Recovery above the declining trendline signals a bear trap, offering a target of $0.93. Twiggs Momentum Oscillator (21-day) recovery above its January high would indicate a primary up-trend, while respect of the zero line (from below) would favor continuation of the down-trend.

The spirit, the will to win and the will to excel are the things that endure. These qualities are so much more important than the events that occur.

~ Vince Lombardi (1913 - 1970).

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.