The Next Asian Crisis

By Colin Twiggs

January 22, 2010 9:30 p.m. ET (1:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

China: Red Star About To Implode?

China's reaction to the global financial crisis was to stimulate domestic demand in an attempt to make up for the sharp contraction in export orders, primarily from the US. The strategy was twofold: a $586 billion stimulus plan and to stimulate private demand by quantitative easing. At a staggering 20 percent of GDP, the stimulus plan boasts a massive infrastructure spending program including construction of new railways, environmental protection and investment in new technology. Aggressive quantitative easing aimed to boost private borrowing by lowering finance costs and easing credit standards.

The resurgence, with GDP growth reaching 10.7 percent in the fourth quarter (WSJ) appears to vindicate the strategy, but the true cost of the plan lies ahead. Bank loans grew by $1.4 trillion in 2009, or 29 percent percent of GDP. That is madness — and likely to cause a massive speculative bubble in real estate, the stock market, and to some extent commodities. Inflation is also starting to bite, with the consumer price index up by 1.9 percent in the last month.

A sharp cut-back in bank lending, however, will cause a contraction in private demand, sending the manufacturing industry back to where they started — with a large hole in their order books. Welcome to the real world.

Japan: How To Turn A Financial Crisis Into A Total Disaster

Japan is a lot farther down the track than China. In an attempt to avoid the collapse of its banking system after the implosion of an enormous real estate and stock market bubble in the early 1990s, Japan embarked on a similar strategy to the one now pursued by China. Massive infrastructure spending and aggressive quantitative easing, with the BOJ maintaining interest rates near zero for most of the last two decades, failed to restore the economy to its former growth path. The new government now finds itself painted into a corner, inheriting massive public debt as a result of the failed stimulus program. The IMF expects Japan's gross public debt to reach 218 percent of GDP this year and 246 percent by 2014 (Daily Telegraph). With savings rates falling, further stimulus spending is no longer an option and the pigeons of the 1990s will finally come home to roost. Except they now closer resemble pterodactyls.

USA: The Dow Retreats

The Dow retreated by more than 5 percent after the voters of Massachusetts sent a clear message to the White House: either p... or get off the pot. The cosy relationship between Washington and Wall Street will end as elected leaders scramble to preserve their seats. Expect more legislation to curb the excesses of Wall Street, restricting executive compensation and imposing taxes or levies to recover some of the cost of the financial collapse. Treasury needs to raise taxes in order to restrict the growing public debt — and the obvious target is Wall Street.

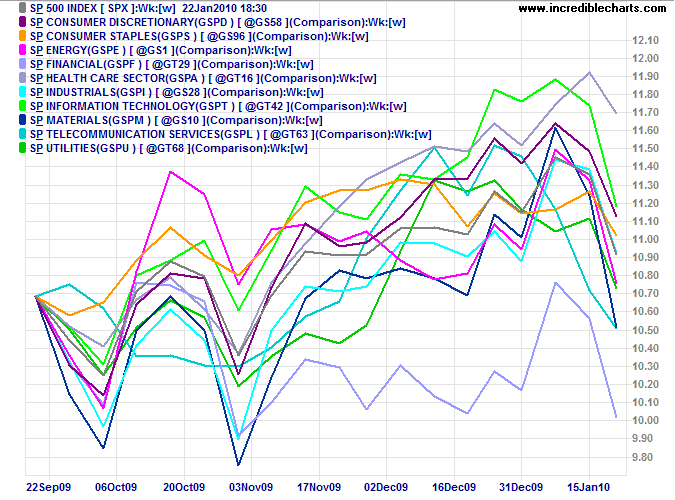

Financial stocks are worst affected by the decline, but sectors such as Energy and Materials also display a sharp fall — indicating that contraction of financial stocks is likely to impact on the broader economy.

Avoiding Japan II

The voter backlash will restrict the Fed's ability to pursue further quantitative easing. Re-election of Ben Bernanke as Fed Chairman is going to be a close-fought affair with even Democrat senators, like Barbara Boxer of California, whose seat is under threat, calling for a new candidate who represents "a clean break from the failed policies of the past". Also, expect growing reluctance from Congress to fund deficits with further public debt — curtailing spending and increasing pressure to raise taxes.

Conclusion

Japan is likely to be the first to fall, with China way behind. The US is also ahead of China, but disgruntled voters may yet prevent President Obama and Chairman Bernanke from continuing down the same path.

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

Watch your thoughts, for they become words.

Choose your words, for they become actions.

Understand your actions, for they become habits.

Study your habits, for they become your character.

Develop your character, for it becomes your destiny.

~

Tryon Edwards

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.