Dollar Rally or BLS Conjuring Trick?

By Colin Twiggs

December 11, 2009 9:00 p.m. ET (1:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

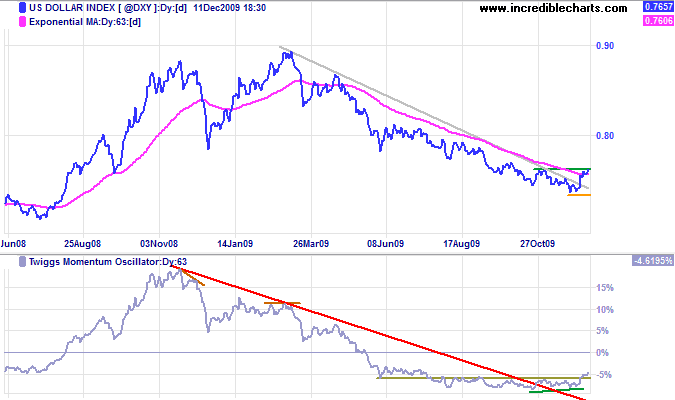

The US Dollar Index is testing resistance at 76.6. Twiggs Momentum Oscillator (21-day) breakout above recent highs (-1.5%) indicates a stronger correction than the brief retracements over the past few months suggested. Penetration of the declining trendline signals that the primary down-trend is weakening. And bullish divergence on Twiggs Momentum Oscillator (63-day) warns of a reversal.

* Target calculation: 76.5 + ( 76.5 - 74 ) = 79

The dollar rally was initially spurred by a Bureau of Labor Statistics report of surprisingly low job losses for November. Jeff Nielson, however, points out that their monthly figure of 10,000 job losses does not tally with weekly layoff stats. The market is in equilibrium (with zero job losses) when weekly layoffs are around the 300,000 mark, but November layoffs have been averaging close to 500,000 per week — which would indicate job losses of around 1 million for the month. Let us hope that this is not another BLS conjuring trick.

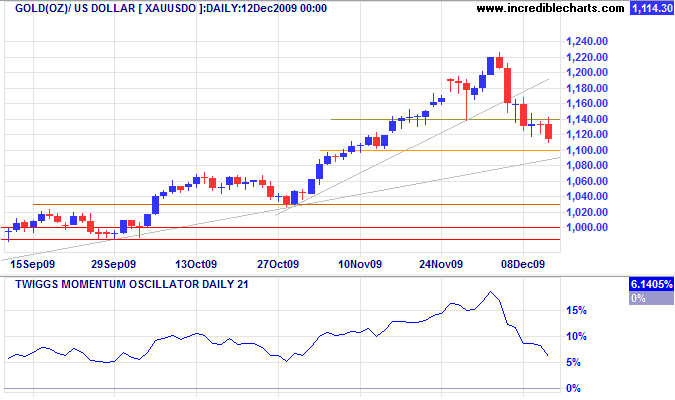

Gold

There is no reciprocal bearish divergence on spot gold, however, and we should wait for confirmation. Support at 1140 failed and the metal is now headed for a test of support and the rising trendline at $1100. Respect of support would signal a primary advance to $1300/ounce*. Failure would warn of a test of primary support at $1000.

* Target calculation: 1000 + ( 1000 - 700 ) = 1300

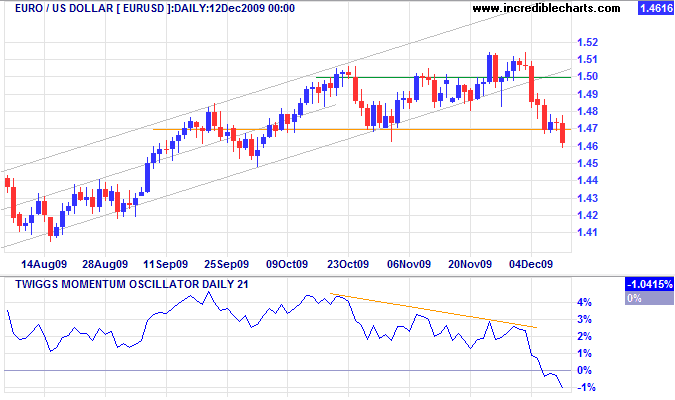

Euro

The euro reversed below support at $1.47, signaling a secondary correction. Momentum reversal below zero confirms the signal. The medium-term target is $1.43*.

* Target calculation: 1.47 - ( 1.51 - 1.47 ) = 1.43

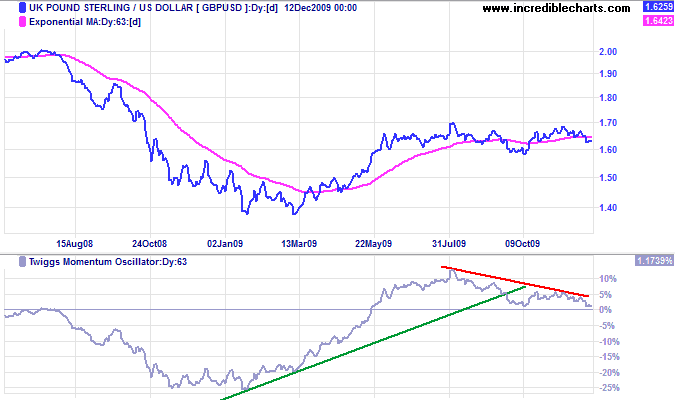

Pound Sterling

The pound is headed for a test of the band of support between $1.58 and $1.60. Failure of support would signal a (primary) trend reversal, confirming the large bearish divergence on Twiggs Momentum Oscillator (63-day).

* Target calculation: 1.66 + ( 1.67 - 1.58 ) = 1.75

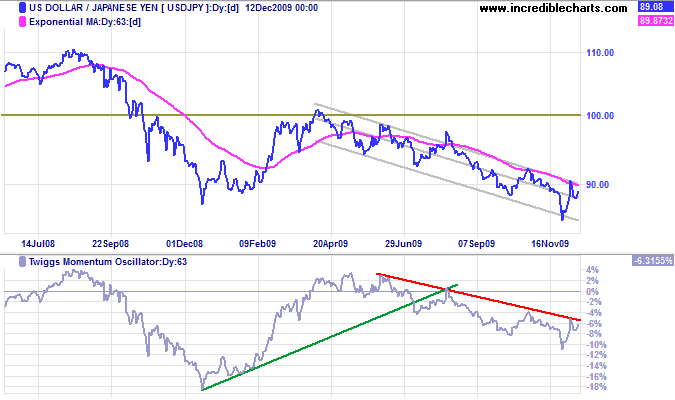

Japanese Yen

The dollar is testing the upper trend channel at ¥90. Breakout would warn that the primary down-trend is weakening. Respect of the upper trend channel, however, would indicate another test of support at ¥85.

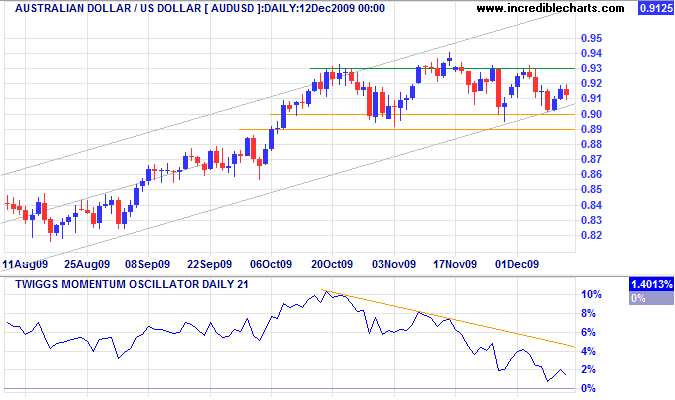

Australian Dollar

The Aussie dollar is testing the band of support between $0.89 and $0.90 against the greenback. Failure of support would indicate a secondary correction — with an initial target of 87*.

* Target calculation: 0.90 - ( 0.93 - 0.90 ) = 0.87

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

Practice does not make perfect.

Only perfect practice makes perfect.

~ Vince Lombardi.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.