Selling Pressure Increases

By Colin Twiggs

November 21, 2009 2:30 a.m. ET (6:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Major markets display a number of ascending broadening wedge reversal patterns and bearish divergences on Twiggs Money Flow, indicating increased selling pressure. While not conclusive until the patterns are completed by a breakout, they warn of a secondary correction.

USA

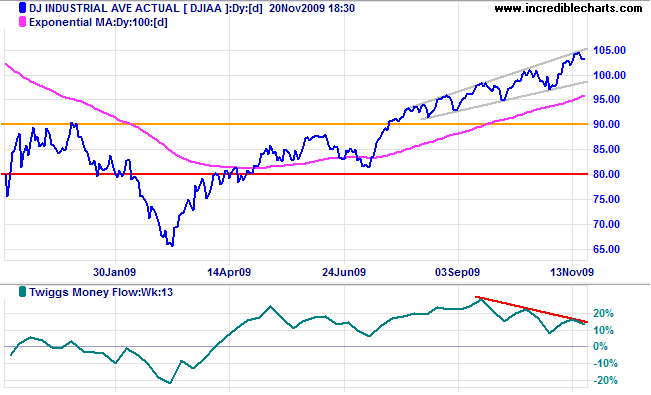

Dow Jones Industrial Average

The Dow encountered resistance at 10500 and is expected to test the lower border of the ascending broadening wedge formation. Broader wedges (with a megaphone appearance) are more reliable than narrower (telescope-style) wedges, but the formation nonetheless warns of a correction back to the base of the wedge at 9000. Bearish divergence on Twiggs Money Flow (13-week) reinforces the signal, warning of a secondary correction. Upward breakout from the formation is less likely, but would offer a target of 11000*

* Target calculation: 10000 + ( 10000 - 9000 ) = 11000

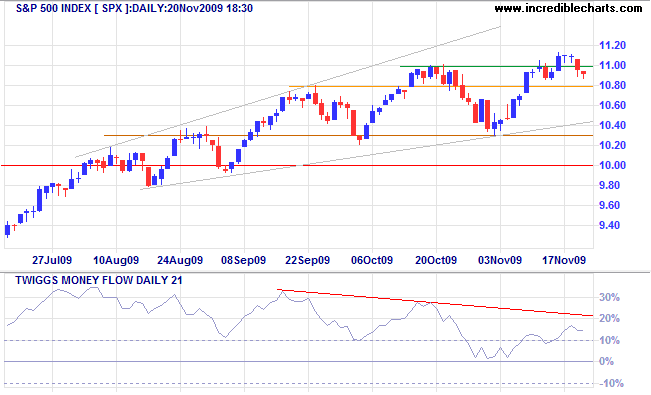

S&P 500

The S&P 500 retreated below support at 1100 after a marginal breakout, indicating trend weakness. Follow-through below 1080 would indicate a failed up-swing in the broadening ascending wedge pattern, warning of a correction to the base of the formation at 980. Bearish divergence on Twiggs Money Flow (13-week & 21-day) also warns of a correction.

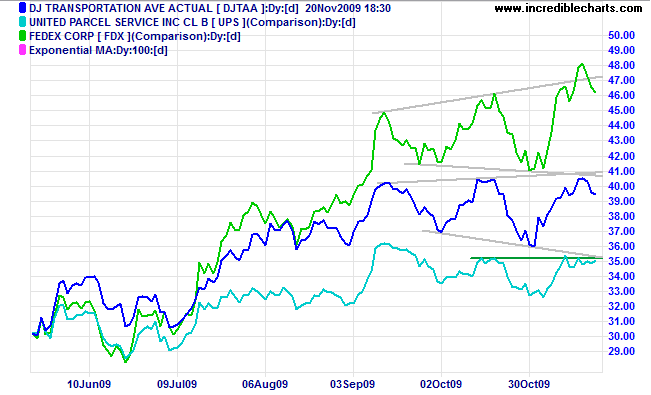

Transport

Broadening wedges on the Dow Transport Average and Fedex favor continuation of the primary up-trend. UPS recovery above its October high would also signal a primary advance.

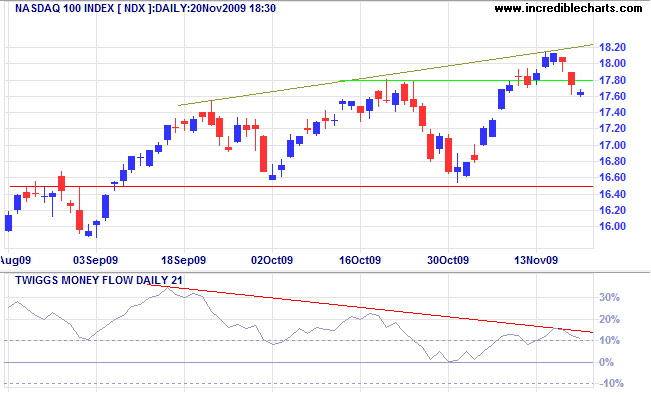

Technology

The Nasdaq 100 reversed at the upper border of its broadening wedge formation (right-angled ascending) and is headed for a test of support at 1650. Failure of support would offer a target of 1500*. Breakout above the upper border is less likely, but would indicate a primary advance to 1950*. Bearish divergence on Twiggs Money Flow (21-day) continues to warn of a correction; reversal below zero would strengthen the signal.

* Target calculation: 1650 - ( 1800 - 1650 ) = 1500 and 1800 + ( 1800 - 1650 ) = 1950

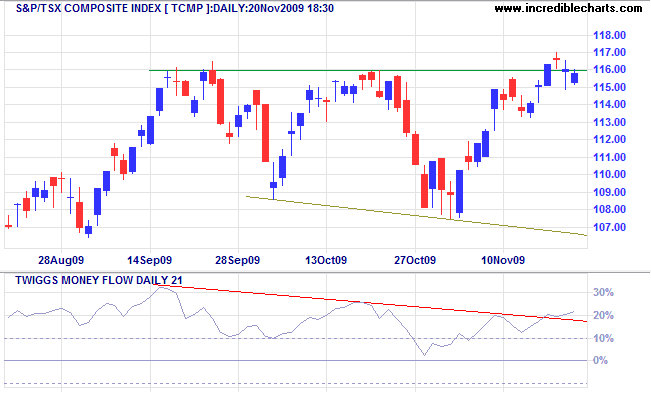

Canada: TSX

The TSX Composite failed in its attempt at a breakout above 11600, the upper border of a (right-angled descending) broadening wedge continuation pattern. Friday's blue candle indicates continued buying support and another breakout attempt is expected. Follow-through above 11700 would signal an advance to 12400*. Twiggs Money Flow (21-day) recovery above the declining trendline indicates rising buyer interest.

* Target calculation: 11600 + ( 11600 - 10800 ) = 12400

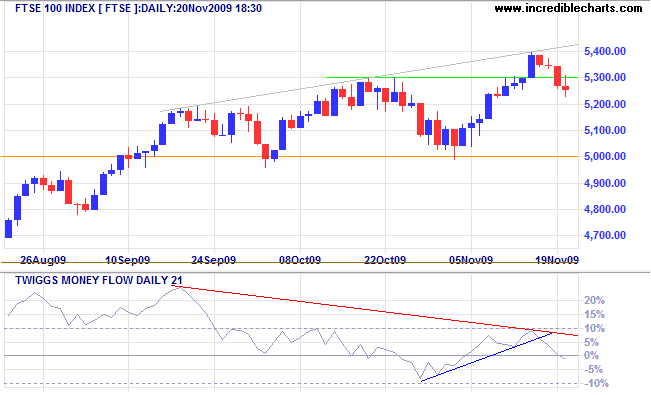

United Kingdom: FTSE

The FTSE 100 reversed at the upper border of the right-angled ascending broadening wedge reversal pattern — expect a test of the lower border at 5000. Twiggs Money Flow (21-day) reversal below zero and continued bearish divergence warn of selling pressure. Failure of support (5000) would signal a correction with a target of 4600*. Breakout above the upper border is less likely, but would signal an advance to 5800*.

* Target calculation: 5000 - ( 5400 - 5000 ) = 4600 and 5400 + ( 5400 - 5000 ) = 5800

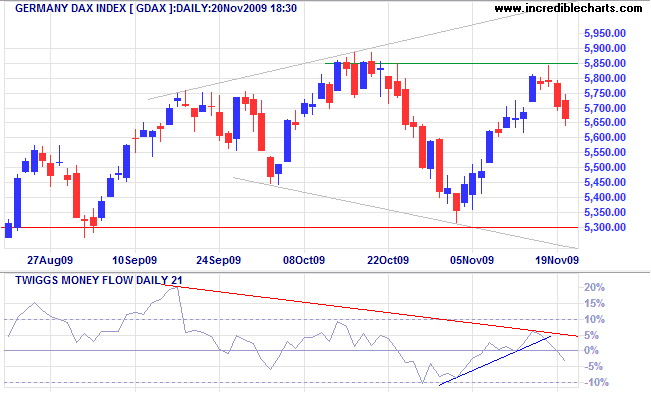

Germany: DAX

The failed up-swing on the DAX broadening wedge formation warns of a downward breakout and correction to 4700*. Twiggs Money Flow (21-day) reversal below zero and continued bearish divergence indicates selling pressure and increases the likelihood of a correction. Reversal below 5300 would confirm.

* Target calculation: 5300 -( 5900 - 5300 ) = 4700

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

Society in every state is a blessing, but government even in its best state is but a necessary evil; in its worst state an intolerable one; for when we suffer, or are exposed to the same miseries by a government, which we might expect in a country without government, our calamity is heightened by reflecting that we furnish the means by which we suffer.

~ Thomas Paine, Common Sense (1776)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.