Weak Dollar Boosts Commodity Prices

By Colin Twiggs

November 17, 2009 3:00 a.m. ET (7:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

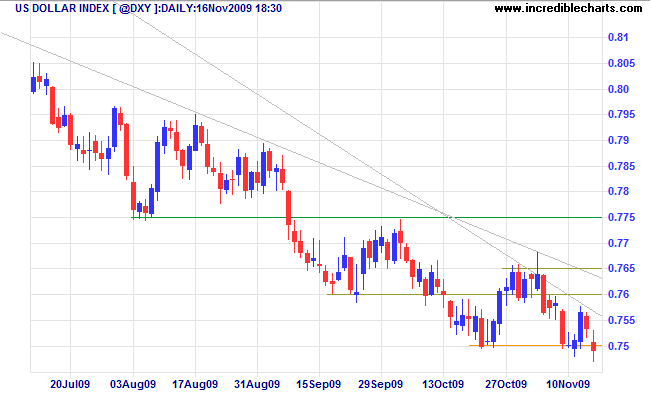

US Dollar Index

The US Dollar Index continues to test support at 75; breakout would signal a decline to 74*. In the long term, the dollar is headed for its 2008 low of 71. Breakout above 76.50 is unlikely, but would warn that the down-trend is ending. The weakening dollar continues to fuel rising commodity (especially crude oil and precious metals) prices.

* Target calculation: 75 - ( 76 - 75 ) = 74

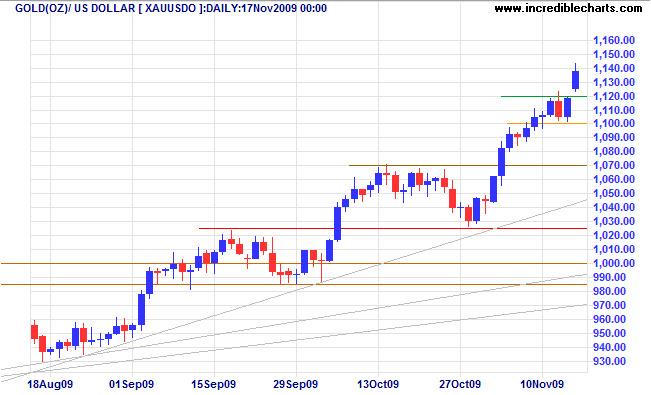

Gold

Spot gold is accelerating into a runaway trend, the short (1 day) retracement to $1100, followed by a gap through $1120, indicates strong buying pressure. The target of $1300* now looks achievable within two months. Look for further tall candles, gaps and/or short retracements to strengthen the signal. Reversal below the rising trendline remains most unlikely, but would warn of trend weakness.

* Target calculation: 1000 + ( 1000 - 700 ) = 1300

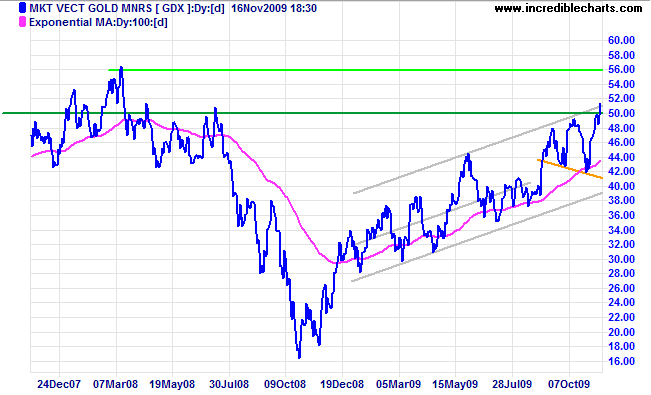

Gold miners responded, with the Market Vectors Gold Miners Index [GDX] completing a broadening wedge continuation with a target of the 2008 high at $56 (the calculated target is $58*).

* Target calculation: 50 + ( 50 - 42 ) = 58

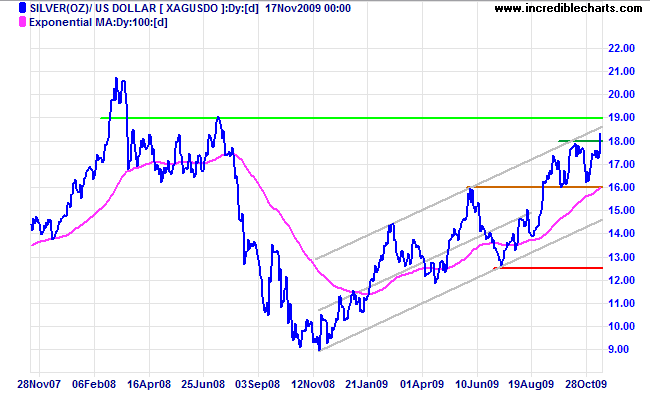

Silver

Spot silver broke through $18, headed for a test of the upper trend channel at $19. The target for a breakout would be the March 2008 high of $21*. Respect of the upper trend channel is less likely, but would warn of another test of support at $16.

* Target calculation: 18.50 + ( 18.50 - 16 ) = 21

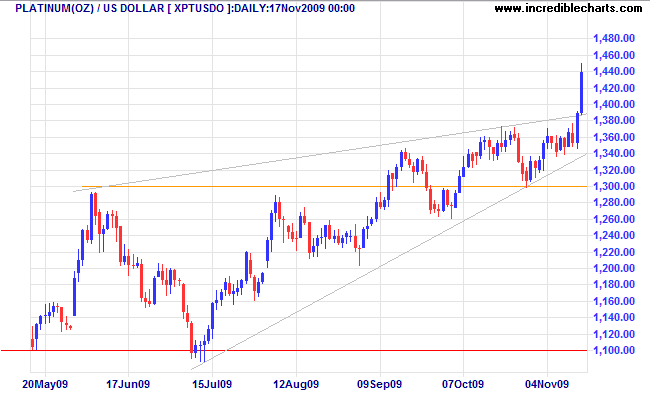

Platinum

Platinum followed gold with a strong breakout above $1400, completing a rising wedge pattern. The breakout is unusual, as rising wedges warn of reversal in an up-trend, but offers a conservative target of $1500*. Reversal below the lower trend channel is unlikely, but would warn of a test of support at $1100.

* Target calculation: 1300 + ( 1300 - 1100 ) = 1500

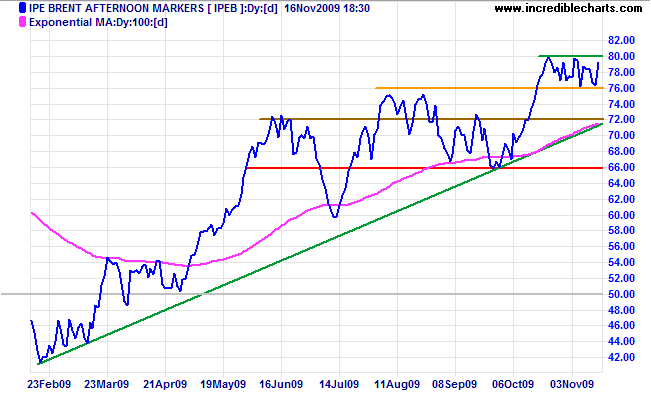

Crude Oil

Crude oil narrow consolidation between $76 and $80 signals continuation of the up-trend. The short-term target is 84*, while the medium-term (2 to 3 month) target is 90*. Reversal below $76 is unlikely, but would test the rising trendline at $72.

* Target calculation: 80 + ( 80 - 76 ) = 84 and 76 + ( 80 - 66 ) = 90

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

Most of the time common stocks are subject to irrational and excessive price fluctuations in both directions as the consequence of the ingrained tendency of most people to speculate or gamble... to give way to hope, fear and greed.

~ Benjamin Graham

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.