Wedge Consolidations

By Colin Twiggs

November 14, 2009 5:00 a.m. ET (9:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

A review of major markets reveals a rash of broadening wedge consolidations which continue to warn of a correction.

USA

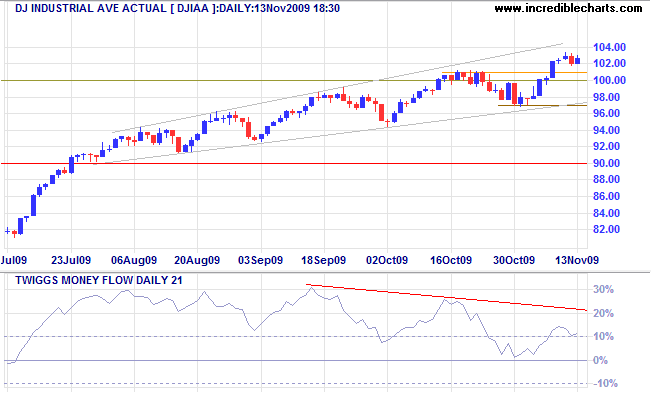

Dow Jones Industrial Average

The Dow broke through 10000 to signal continuation of the up-trend, but the ascending broadening wedge formation warns of a correction back to 9000, the base of the wedge. Bearish divergence on Twiggs Money Flow (13-week) also warns of a secondary correction; reversal below zero by the shorter-term (21-day) indicator would confirm the signal, while recovery above the trendline would be a bullish sign. Upward breakout from the formation is less likely (27% according to Thomas Bulkowski), but would offer a target of 11000*

* Target calculation: 10000 + ( 10000 - 9000 ) = 11000

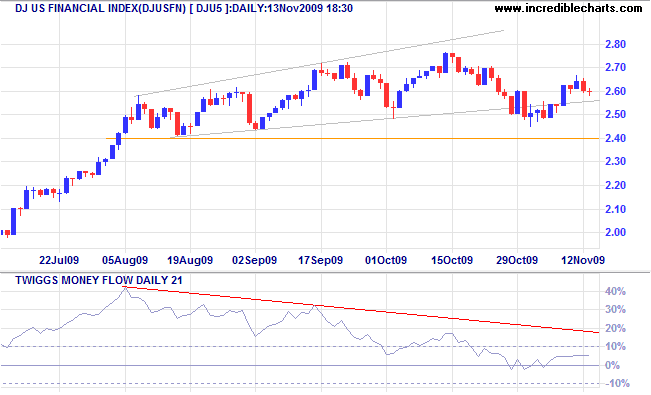

A reader (thank you Ed) drew my attention to the downward breakout on the Dow Financial Sector Index [DJU5]. The ascending broadening wedge target is only slightly lower at 240, but breakout below this level would indicate a far stronger correction* for the financial sector. It is too early, however, to extrapolate this to the entire market.

* Target calculation: 240 - ( 280 - 240 ) = 200

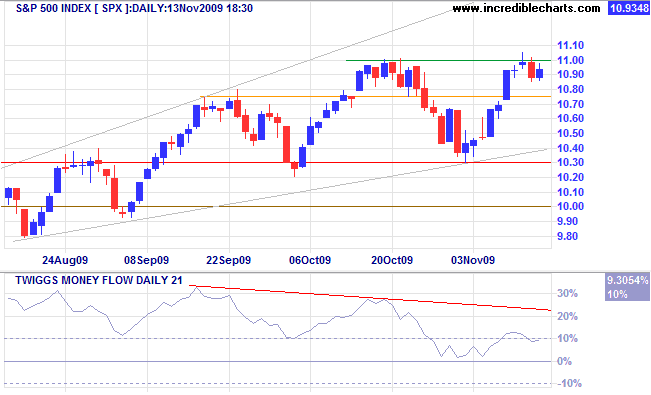

S&P 500

The S&P 500 displays a similar broadening ascending wedge; narrow consolidation makes breakout above 1100 likely — which would signal an advance to the upper wedge border. Failure to break through resistance at 11000, however, would increase the probability of a downward breakout. Bearish divergence on Twiggs Money Flow (13-week & 21-day) warns of a correction.

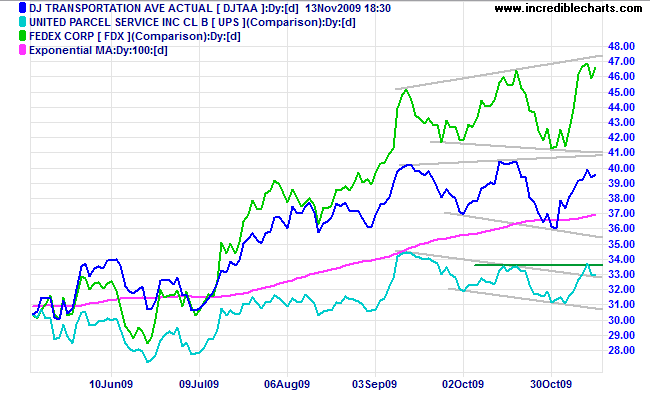

Transport

Broadening wedges on the Dow Transport Average and Fedex favor continuation of the primary up-trend. UPS recovery above its October high would also signal a primary advance.

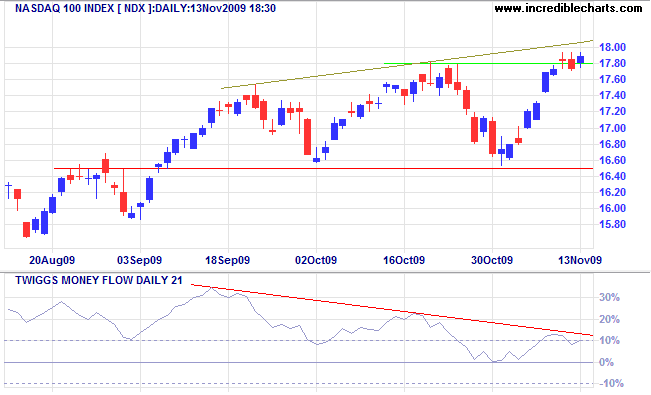

Technology

The Nasdaq 100 shows a broadening wedge consolidation (right-angled ascending); failure of support at 1650 would offer a target of 1500*. Breakout above the upper border is less likely, but would indicate a primary advance to 1950*. Twiggs Money Flow (21-day) falling below zero would warn of a correction, while recovery above the trendline would be a bullish sign.

* Target calculation: 1650 - ( 1800 - 1650 ) = 1500 and 1800 + ( 1800 - 1650 ) = 1950

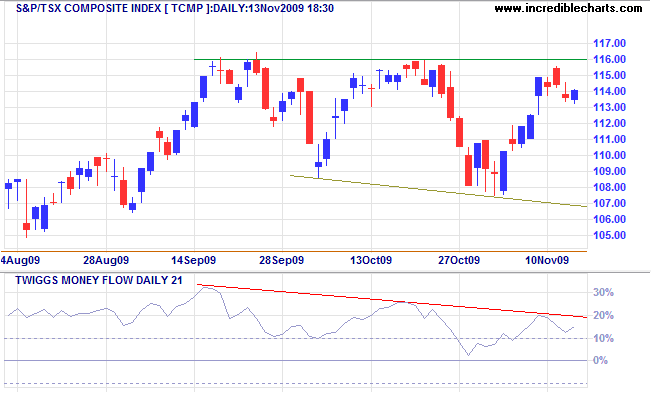

Canada: TSX

The TSX Composite shows a (right-angled descending) broadening wedge: a weak continuation pattern. Breakout above 11600 is likely after the short retracement and would signal an advance to 12400*. Bearish divergence on Twiggs Money Flow (21-day) warns of a secondary correction, but recovery above the trendline would be a bullish sign.

* Target calculation: 11600 + ( 11600 - 10800 ) = 12400

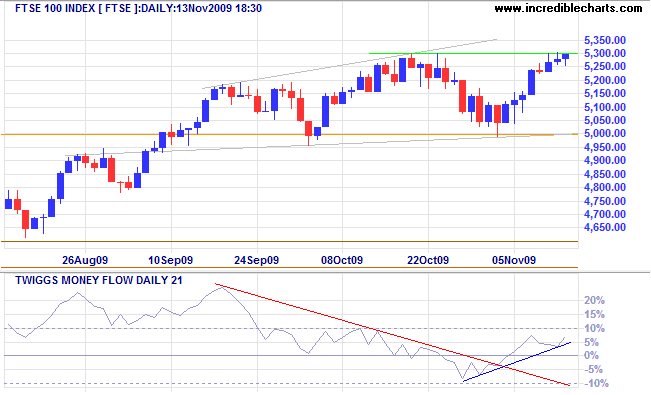

United Kingdom: FTSE

The FTSE 100 displays a right-angled ascending broadening wedge, warning of a reversal. Twiggs Money Flow (21-day) recovery above zero, however, indicates continued buying pressure — easing the possibility of a correction. Retreat below 5000 would offer a target of 4700*, while breakout above the upper border would signal an advance to 5600*.

* Target calculation: 5000 - ( 5300 - 5000 ) = 4700 and 5300 + ( 5300 - 5000 ) = 5600

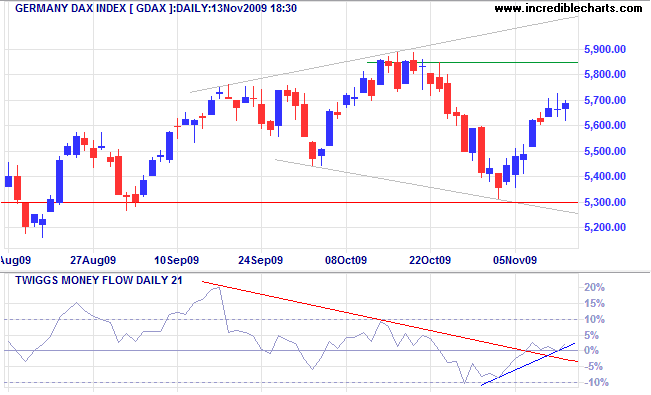

Germany: DAX

The DAX broadening wedge consolidation favors continuation of the primary up-trend, but reversal below 5300 would warn of a correction to 4700*. Twiggs Money Flow (21-day) recovery above zero indicates short-term buying pressure.

* Target calculation: 5300 -( 5900 - 5300 ) = 4700

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

Man is not the enemy of man but through the medium of a false system of government.

~ Thomas Paine, The Rights Of Man (1791)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.