Asian Markets Rally

By Colin Twiggs

November 9, 2:30 a.m. ET (6:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

The Dow Industrial Average recovered above 10000, but awaits confirmation from other indexes. Asia-Pacific markets responded positively on Monday, with strong gains on the ASX and Hang Seng indexes. Failure of the Dow to follow-through above 10100, however, will raise doubt about its ability to continue the advance.

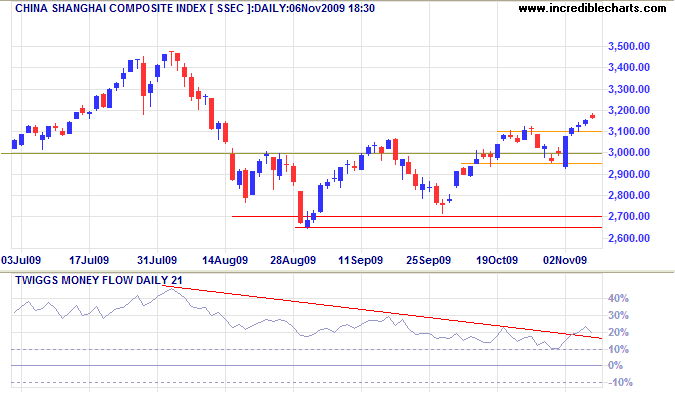

China

The Shanghai Composite Index spent most of Monday testing short-term support at 3150 before rallying to test resistance at 3180. Narrow consolidation signals continuation of the up-trend.

Source: Yahoo Finance

Rising Twiggs Money Flow (21-day) indicates a resurgence of buyers. Breakout above 3100 signals an advance to 3500; retracement that respects the new support level (at 3100) would confirm. Reversal below 2950 is unlikely, but would indicate another test of primary support at 2700.

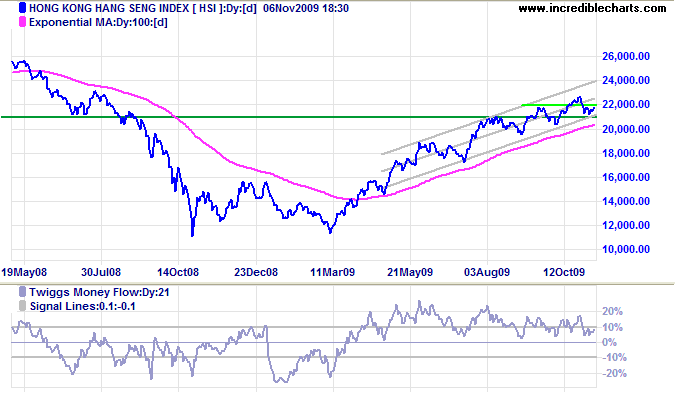

The Hang Seng Index recovered above 22000 on Monday, signaling an advance to the upper trend channel at 24000*. Twiggs Money Flow (21-day) holding above zero indicates buying support. Reversal below the lower trend channel is unlikely, but would warn that the up-trend is weakening.

* Target calculation: 22000 + ( 22000 - 20000 ) = 24000

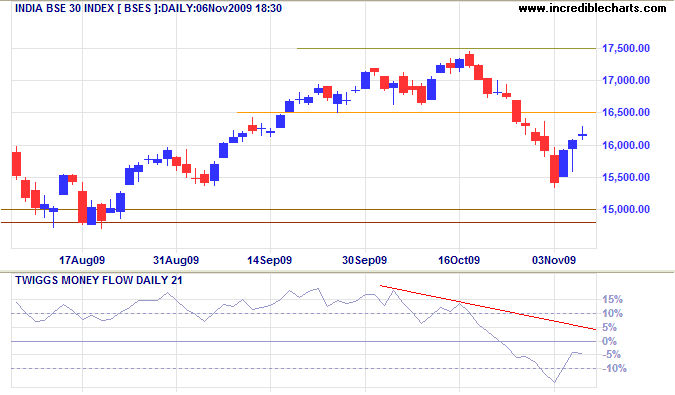

India: Sensex

The Sensex found short-term support at 15500 before rallying to test 16500. Respect of resistance would signal a decline to 14800/15000. Twiggs Money Flow (21-day) failure to recover above the zero line would indicate strong selling pressure.

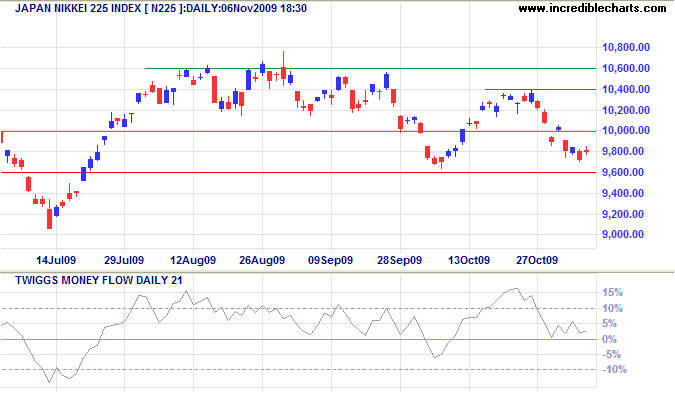

Japan: Nikkei

The Nikkei 225 consolidated below 9850 for most of Monday. Twiggs Money Flow (21-day) respecting the zero line indicates buying support. Reversal below 9600, however, would signal a primary down-trend.

* Target calculation: 10600 + ( 10600 - 9600 ) = 11600

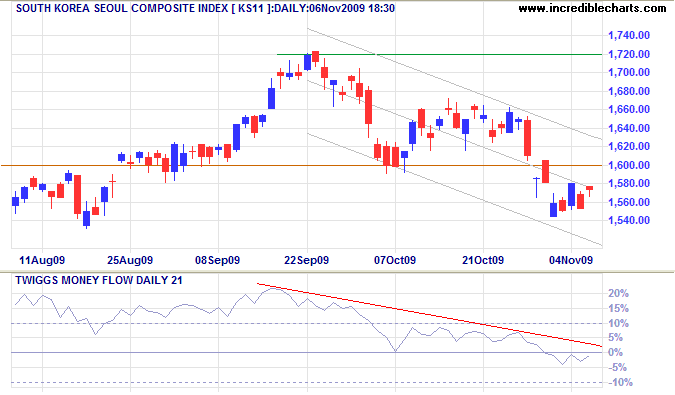

South Korea

The Seoul Composite is headed for a test of its upper trend channel, closing at 1580 on Monday. Twiggs Money Flow (21-day) below zero indicates continued selling pressure.

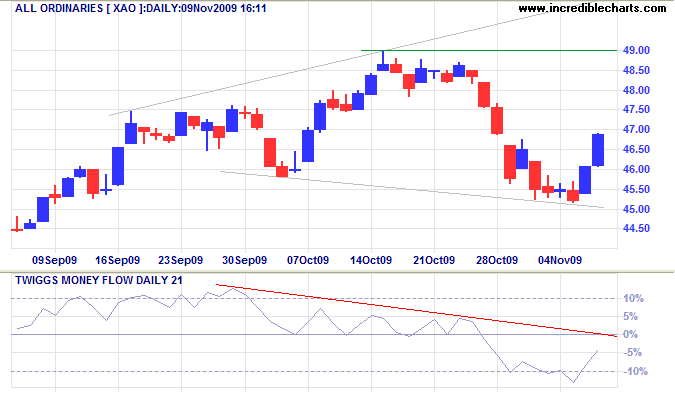

Australia: ASX

The All Ordinaries displays a broadening wedge consolidation. Monday follow-through from Friday's rally indicates a test of the upper border at 5000. Reversal below 4500, however, would signal a secondary correction with a target of 4000*. Twiggs Money Flow (21-day) respect of the zero line from below would warn of strong selling pressure.

* Target calculation: 4500 - ( 5000 - 4500 ) = 4000

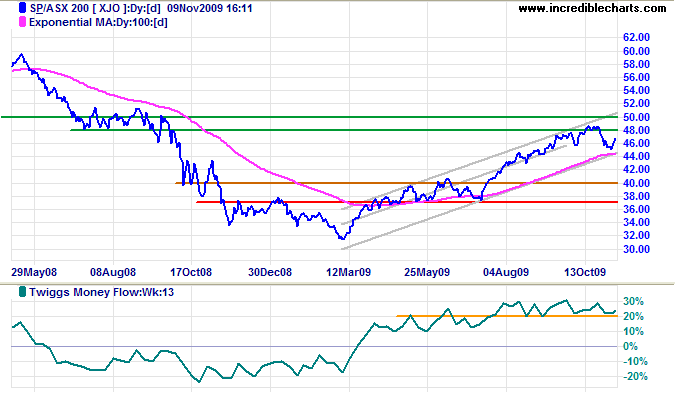

The ASX 200 also displays a broadening wedge. Expect a rally to test the upper trend channel at 5000. Twiggs Money Flow (13-week) holding above 20% indicates buying support.

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

The things that will destroy America are prosperity at any price, peace at any price,

safety first instead of duty first, the love of soft living and the get rich quick theory of life.

~ Theodore Roosevelt (1858 - 1919)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.