Gold Bounces Back

By Colin Twiggs

October 1, 2009 4:00 a.m. ET (6:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

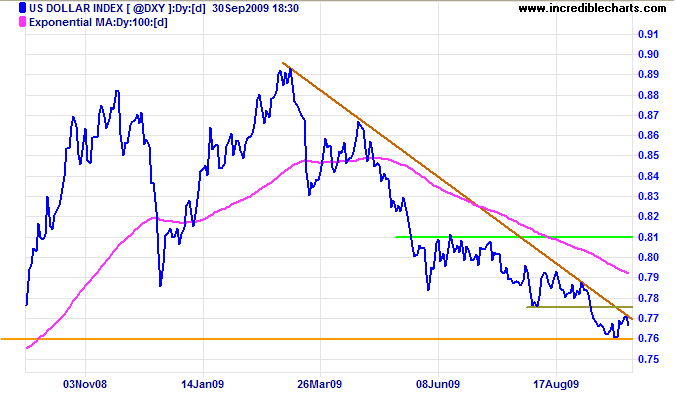

The US Dollar Index found short-term support at 76 before rallying to test resistance at 77.50. Breakout above resistance (and the declining trendline) is unlikely, but would indicate that the primary down-trend is weakening. Recovery above the August high of 79.50 would warn that the primary down-trend is reversing. The medium-term target, however, remains at 74*.

* Target calculation: 78.50 - ( 83 - 78.50) = 74

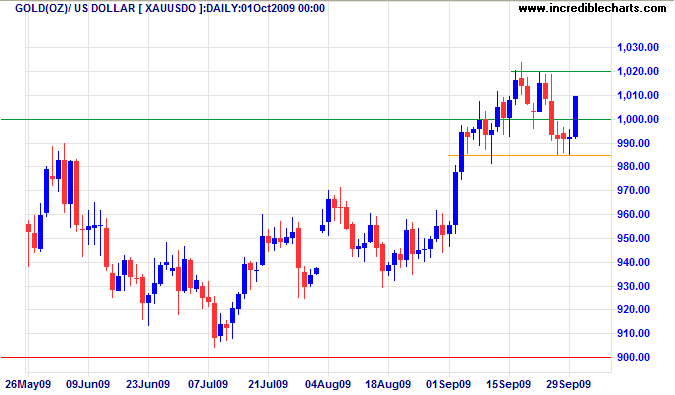

Gold

Spot gold retreated below the key $1000 level, but a strong blue candle to $1010 indicates solid buying support. Breakout above $1020 would signal a primary advance to $1100*. Failure of support at $985 is unlikely, but would warn of a potential bull trap. The long-term target for the breakout is $1300*.

* Target calculations: 1000 + ( 1000 - 900 ) = 1100 and 1000 + ( 1000 - 700 ) = 1300

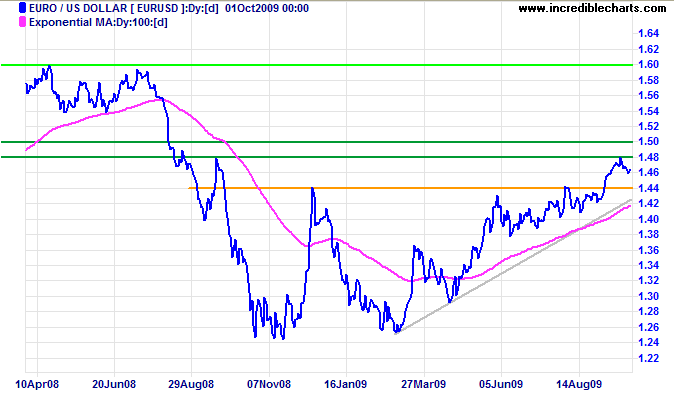

Euro

The euro is retracing from resistance at $1.48 to test support at $1.44. Recovery above $1.48, however, would signal an advance to $1.50*. Reversal below $1.44 is unlikely, but would warn of a weakening up-trend — as would penetration of the rising trendline. In the long term, breakout above $1.50 would signal an advance to the 2008 high of $1.60.

* Target calculation: 1.44 + ( 1.44 - 1.38 ) = 1.50

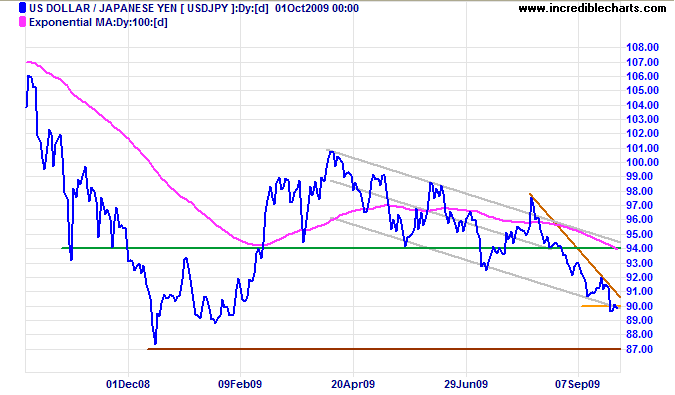

Japanese Yen

The dollar continues its primary down-trend against the yen, testing the lower border of its trend channel. Breakout above the declining trendline would warn of a rally to test the upper channel border — and resistance at ¥94. Failure of support at ¥90 would test the 2008 low of ¥87.

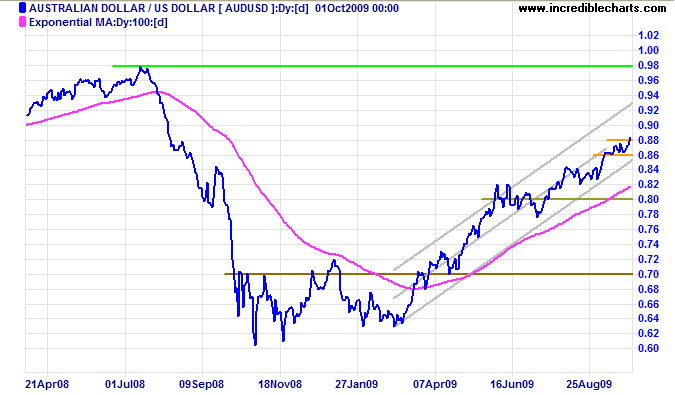

Australian Dollar

The Aussie dollar continues to edge upwards against the greenback — recovering commodity prices increasing momentum. Breakout above short-term resistance at $0.88 indicates a test of the upper channel border; while reversal below $0.86, though unlikely, would warn that the trend is weakening. In the long term, breakout above $0.90 would offer a target of parity*.

* Target calculation: 0.90 + ( 0.90 - 0.80 ) = 1.00

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

If you observe a really happy man you will find him building a boat, writing a symphony,

educating his child, growing double dahlias in his garden,

or looking for dinosaur eggs in the Gobi desert.

He will not be searching for happiness as if it were

a collar button that has rolled under the radiator.

He will not be striving for it as a goal in itself.

He will have become aware that he is happy in the course of

living life twenty-four crowded hours of the day.

~ W. Beran Wolfe

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.